Like an avalanche

The Nikkei collapsed last night

Is there more to come?

The thing about markets is that they have an extraordinary ability to confound everyone. For instance, last night, the Nikkei (-5.8%) essentially collapsed, falling more than 3% on the opening and continuing lower from there. This takes the “correction” in this index to more than -16% in the past three weeks as you can see from the chart below.

Source: tradingeconomics.com

I have seen several explanations for the move but the one thing I have learned over time is that the biggest moves often lack a specific catalyst. Rather, an accurate post-mortem of the situation would indicate that prior to the collapse, the market was in a ‘critical state’, a state where there are many inherent flaws beneath the surface that can combine to drive a single significant move. (If you have not already read Ubiquity by Mark Buchanan, I cannot recommend it highly enough as it is both extremely well written and discusses this exact situation and how it plays out across all systems, including financial ones.) At any rate, the essence of the idea is that systems develop ‘fingers of instability’ within their structure over time. These can be things like the extreme concentration in the Mag 7 stocks compared to the rest of the S&P 500, or the fact that earnings for a majority of the S&P have been declining despite the index making new highs.

I will be the first to admit I do not know the inner workings of the Nikkei at all. However, I am confident that there were numerous fingers of instability beneath the surface that led to this move. Arguably, some of those were the recent appreciation in the yen, which has rallied ~8% in the past month with a negative impact on Japanese exporter earnings. And of course, just Wednesday night the BOJ tightened policy in a surprising move, but as importantly, explained they would be reducing their QQE, and that further tightening was likely going forward. Finally, the US market, especially the tech sector, has been under some pressure as well given some lackluster earnings reports by key Mag 7 players. Combine all that and you have a situation ripe for a major correction. It’s just that it is rare to put it all together ahead of time.

With payrolls the topic today

The pundits don’t know what to say

Is good news still bad?

Or will bears be glad

If payrolls, real weakness, betray?

Cause yesterday’s markets were rough

For holders of risk-laden stuff

The data was weak

And havens were chic

Investors have had ‘bout enough

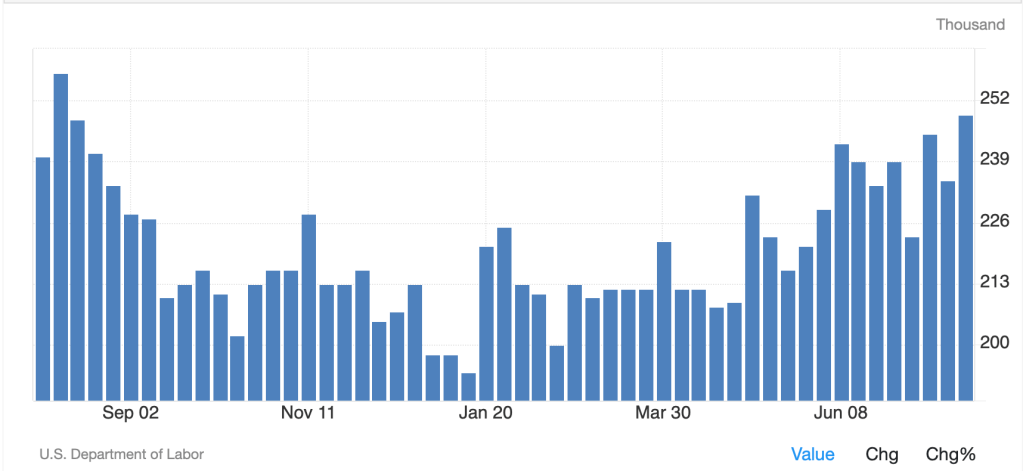

Which takes us to this morning’s payroll report. Before that discussion though, it is important to touch on what yesterday’s data revealed. It started with the highest Initial Claims data in almost a year, far higher than forecast and as you can see in the chart below, there certainly seems to be a developing trend.

Source: tradingeconomics.com

Continuing Claims were also much higher, their highest in nearly three years, and an indication that getting jobs is a lot harder these days. While the Productivity data was solid, the ISM data was anything but, printing at 46.8, the 22nd time in the past 23 months that it has printed below the 50.0 level of growth/contraction. And Construction Spending was also weak. The point is that yesterday had the feel of a much weaker economy than what we have been seeing previously. And more importantly, the market response seems to have changed from bad news = good, to bad news = bad. Previously, weak economic data encouraged the idea that the Fed would cut, and risk assets rallied. But now that the Fed passed on their opportunity to cut this week and will not meet again until September, bad news implies the Fed is falling further behind the curve, and risk assets are suffering accordingly. Now, with that is intro, here are today’s expectations:

| Nonfarm Payrolls | 175K |

| Private Payurolls | 148K |

| Manufacturing Payrolls | -1K |

| Unemployment Rate | 4.1% |

| Average Hourly Earnings | 0.3% (3.7% y/Y) |

| Average Weekly Hours | 34.3 |

| Participation Rate | 62.5% |

| Factory Orders | -2.9% |

Source: tradingeconomics.com

Certainly, the tone of the recent data has been soft, and the ADP Employment number was much lower than expected at 122K. This might lead one to believe that today’s number will be soft as well, with a headline print of 125K – 150K. If that happened, I don’t think anyone would be surprised. But here’s the thing about markets, they seem to exist to cause the most pain possible before heading where they are supposed to go. As such, there is a small part of me that believes we could see a better-than-expected outcome, perhaps over 200K again, just to confuse people.

However, if the report is soft, I expect that will weigh further on risk assets, and based on the US futures market at this hour (7:00), that is the general expectation with all three major US indices having fallen by more than -1.0% following yesterday’s rout. So, let’s look at how the rest of the world is handling this collapse in Japan. Every major market in Asia fell, mostly by more than -2% with notable declines in Taiwan (-4.4%), Korea (-3.6%) and Hong Kong (-2.1%) although the CSI 300 on the mainland fell only -1.0%. In Europe, the picture is all red, but the magnitude of the declines is not nearly so dramatic, DAX (-1.5%), CAC (-0.7%), FTSE 100 (-0.3%). Of course, given this seems to be related to a tech stock decline, this should be no surprise as there is no real tech in Europe.

Bond yields are lower everywhere after a sharp decline yesterday as well. Treasury yields are below 4.0% for the first time since their brief foray below that line at the beginning of the year, back when markets were pricing in 6 rate cuts this year. Net, 10-year Treasury yields have decline 13bps since yesterday morning. European sovereign yields are also declining in a similar manner, down between 8bps and 10bps from yesterday morning but the real surprise is in Japan where 10yr JGB yields have tumbled 9bps. It seems that there is more to the decline in USDJPY than simply unwinding the carry trade and covering JPY shorts. It looks as though some institutional money is heading home.

In the commodity markets, traders don’t know what to think. Will a war in the Middle East cause significant supply disruptions? Or is the evidence of a weak economy now too great to overcome and set to drive oil prices lower again. This morning, WTI is slightly softer (-0.2%) but I would come in on the side of weaker growth being a drag. Remember, there is much spare capacity in Saudi Arabia if supplies tighten. But the real story is gold (+0.5%) which has rallied to yet another new all-time high this morning and is dragging the rest of the metals complex along with it. In the end, I think in many eyes around the world, if not in the US, gold remains the ultimate safe haven, and when the fan gets hit, people want it in their portfolios.

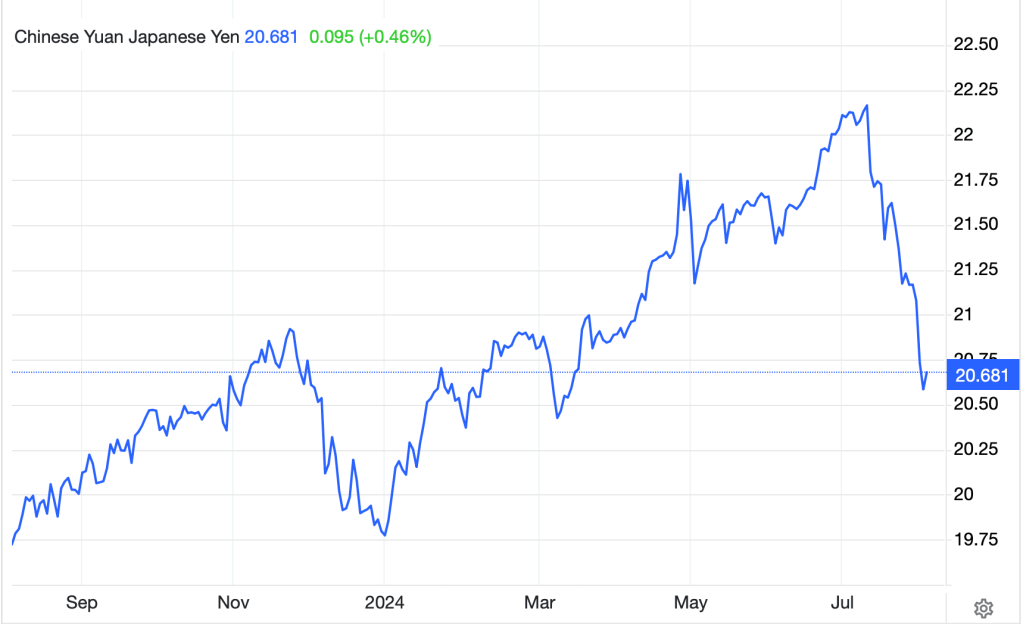

Lastly, the dollar is under real pressure this morning, opposite its haven characteristics but for a good reason. A quick look at the CME futures shows the market is now pricing a 24% chance of a 50bp cut in September, and if the data continues to weaken, especially this morning’s NFP, I expect there will be pressure growing for an inter-meeting cut. So, the euro (+0.4%) looks healthy by comparison and USDJPY continues to trickle lower, but the big surprise is CNY (+0.55%) which has had its largest daily rally since early May. I maintain that the PBOC will be happy to allow the renminbi to strength as long as it lags the yen. And lately, every currency has been lagging the yen with the big carry trades amongst the worst performers. But the chart of CNYJPY below demonstrates that the PBOC is likely not that concerned about a little strength vs. the dollar right now.

Source: tradingeconomics.com

And that’s really all for the day. I don’t see any Fed speakers on the calendar, but given the market movements lately, I expect we will hear from at least one FOMC member. Ahead of the NFP, things will remain quiet, but that will set the tone. To my eye, this correction has further to go, and if all those analysts who have been digging into the data and claiming we are already in a recession prove to be correct, watch for the Fed to be far more aggressive than currently priced. That means the dollar has a lot of room to decline in that situation.

Good luck and good weekend

Adf