The weekend saw fighting expand

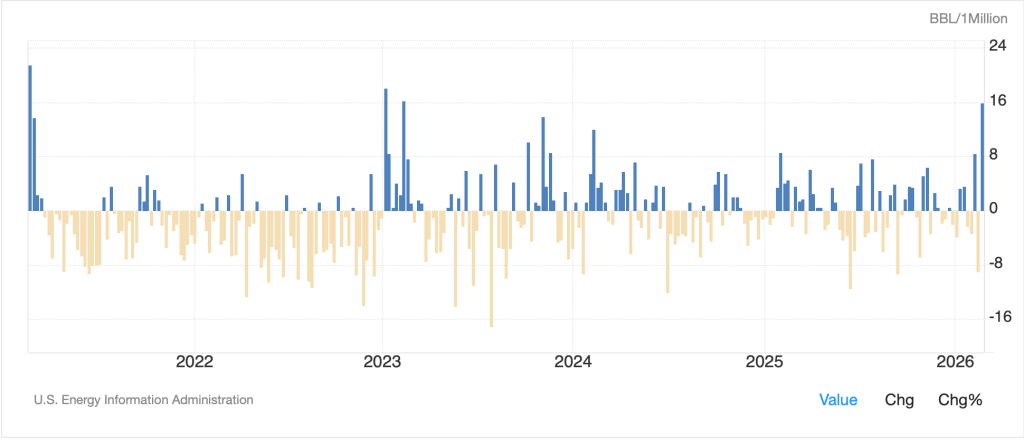

And so, it’s supply, not demand

That’s driving up prices

In this oil crisis

The question, how long can this stand?

As such the G7 has mooted

An idea that, if executed

Could help reduce nerves

By drawing reserves

Thus, price pressures could be diluted

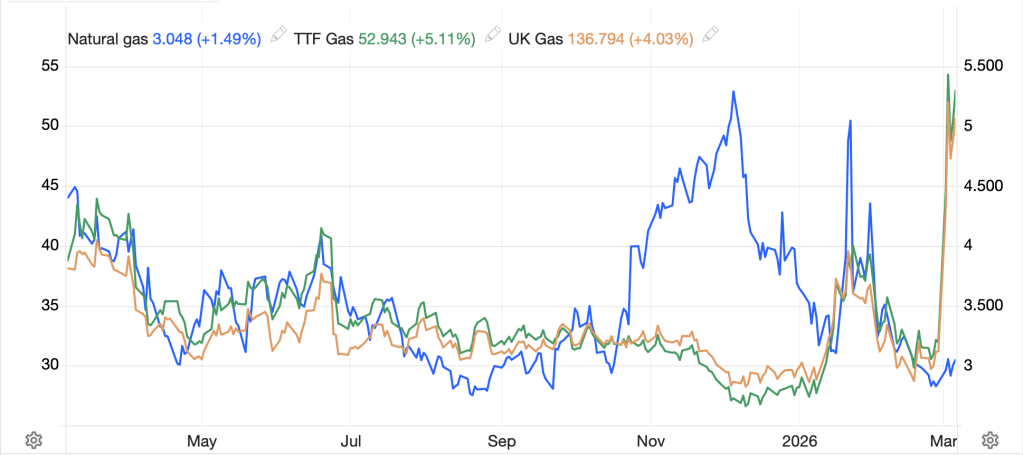

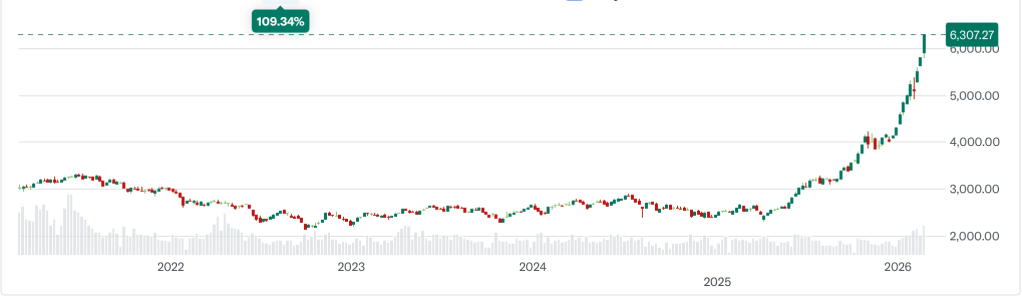

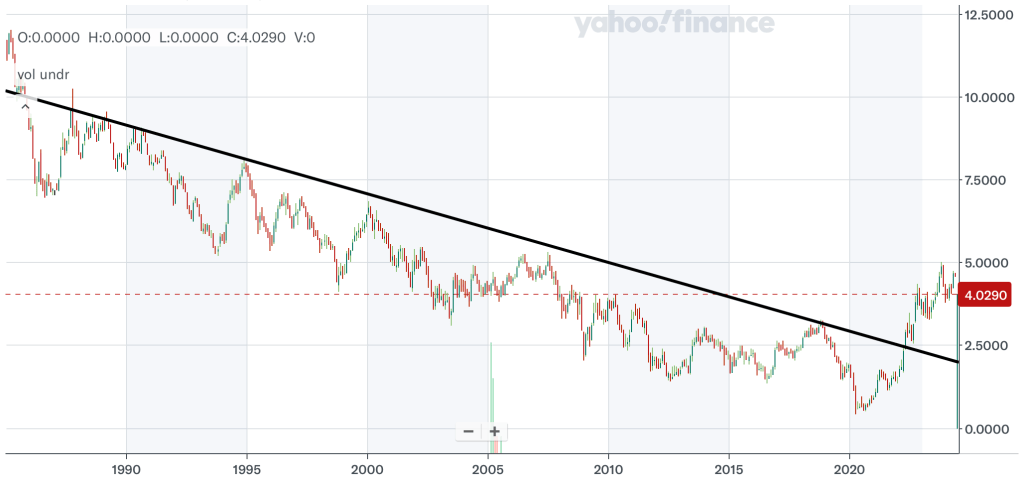

Oil gapped higher last night when futures markets opened as the war in Iran widened its scope. There were more attacks on refineries in Iran, and there has still been limited transit through the Strait of Hormuz (although I read of a ship that turned off its locator beacon and made it through safely). As you can see from the chart below, though, the initial panic has subsided somewhat.

Source: tradingeconomics.com

It seems that the key decline came after French President Macron, the current head of the G7, suggested a joint release of oil reserves across the group in an effort to stabilize prices. It seems to me that while the G7 may have difficulty reaching some decisions, this one is pretty easy, and I expect that we will hear of this joint release shortly.

At the same time, Iran announced that the former Ayatollah’s son, Mojtaba, has been named the new Supreme Leader, and many assume this means they are hunkering down for a long fight.

I am no military strategist, so take this for what it’s worth, but from what I have gleaned across numerous commentators, the Iranian strategy is to outlast the US and Israeli munitions which many have said are limited. As well, they believe that by closing the Strait of Hormuz, they can inflict so much economic pain that the US will have to stop the fight. Funnily enough, I have seen no commentary on the fact that by closing the Strait, Iran has essentially cut off all its own revenues as >90% of its oil sales transit the Strait. The one thing we know is that the US will not run out of money.

The other thing at which I marvel is the incredibly low number of casualties on both sides of this war. While there has been significant destruction of physical assets, even the Iranian propaganda has only claimed 1000-1500 dead, and in the US and Israel, the number is 20 total, I believe.

This feels to me like it is going to be pushed as hard as it can for a while longer and then one side is going to completely capitulate. Whether that is the new Iranian regime crumbling or the US stopping the bombardment, I have no idea.

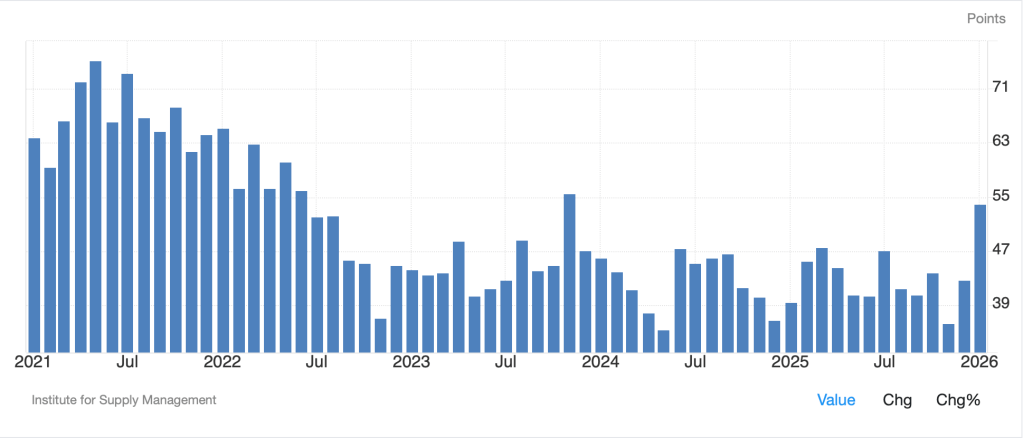

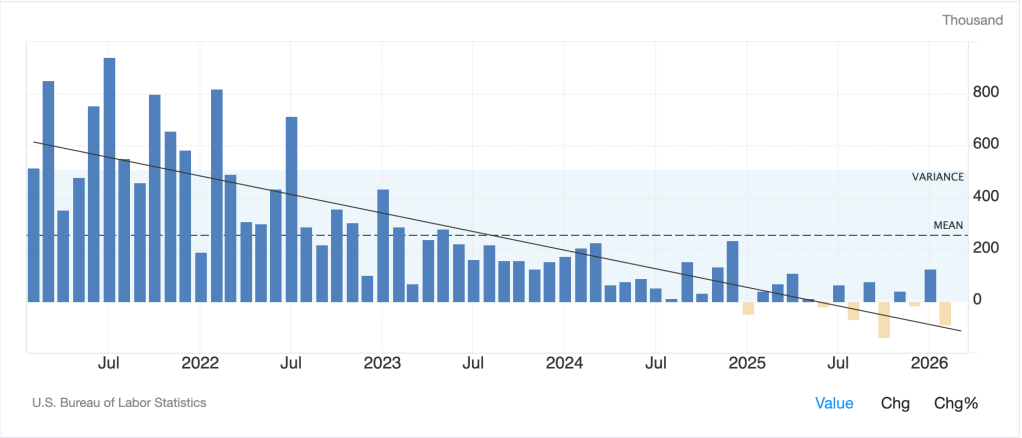

In the meantime, let’s briefly discuss Friday’s payroll report, which was pretty awful, and then see how markets are behaving this morning. By now, I am sure you have either heard or read about the NFP report which showed a headline loss of -92K, the largely offsetting January’s surprising gains. As you can see from the chart below, no matter the details of any particular report, the trend over the past five years has been clear.

Source: tradingeconomics.com

If memory serves, the previous job losses shown here are the result of revisions to the original release and it has been more than six years (covid) since the headline number was negative in its own right. Obviously, this is not the type of outcome the administration wants to see, but it is also important to remember the two significant changes we have seen over the past year: net outmigration along with deportations and a significant reduction in Federal government jobs. Certainly, the latter is a net benefit in my eyes. As to the former, it is exactly what President Trump promised in his campaign, so it cannot be a surprise. Regarding its impact on the economy, I guess we will need to compare per capita outcomes to the total gross numbers to determine if the population is comfortable with the new reality.

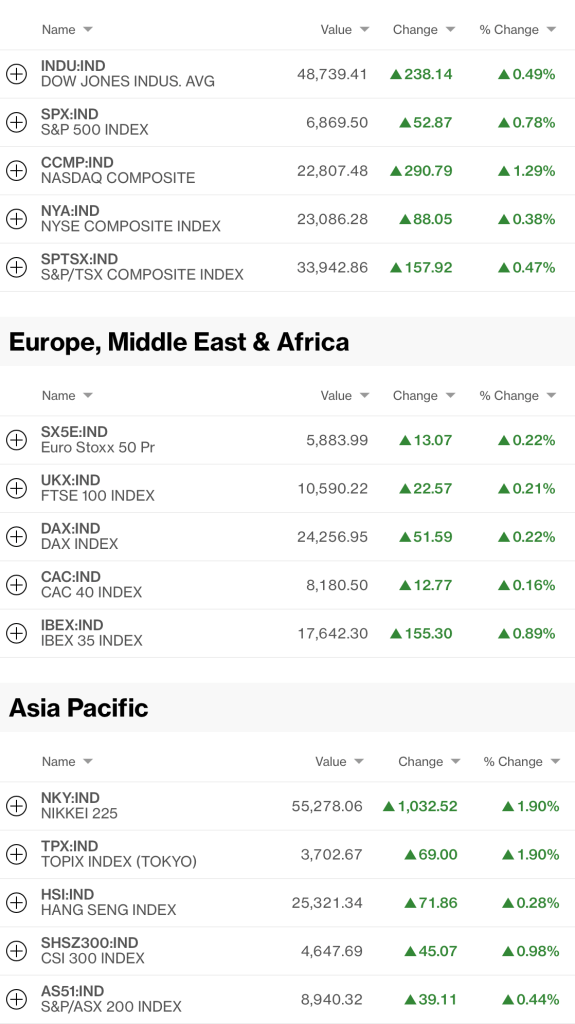

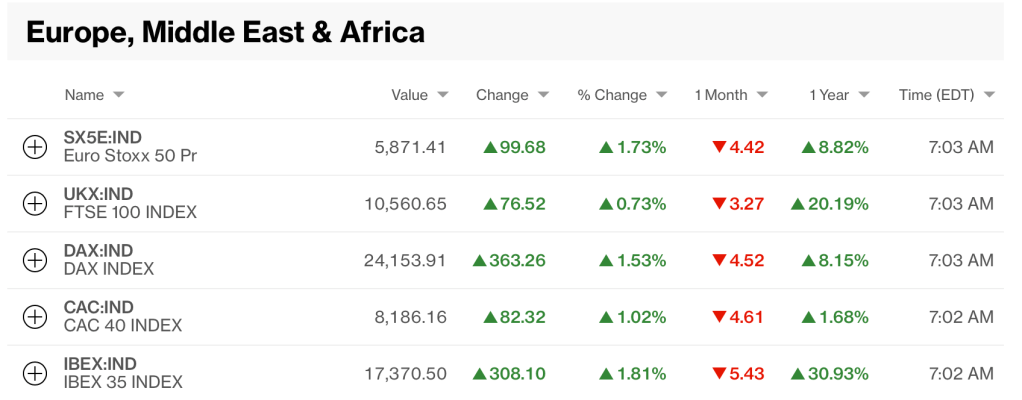

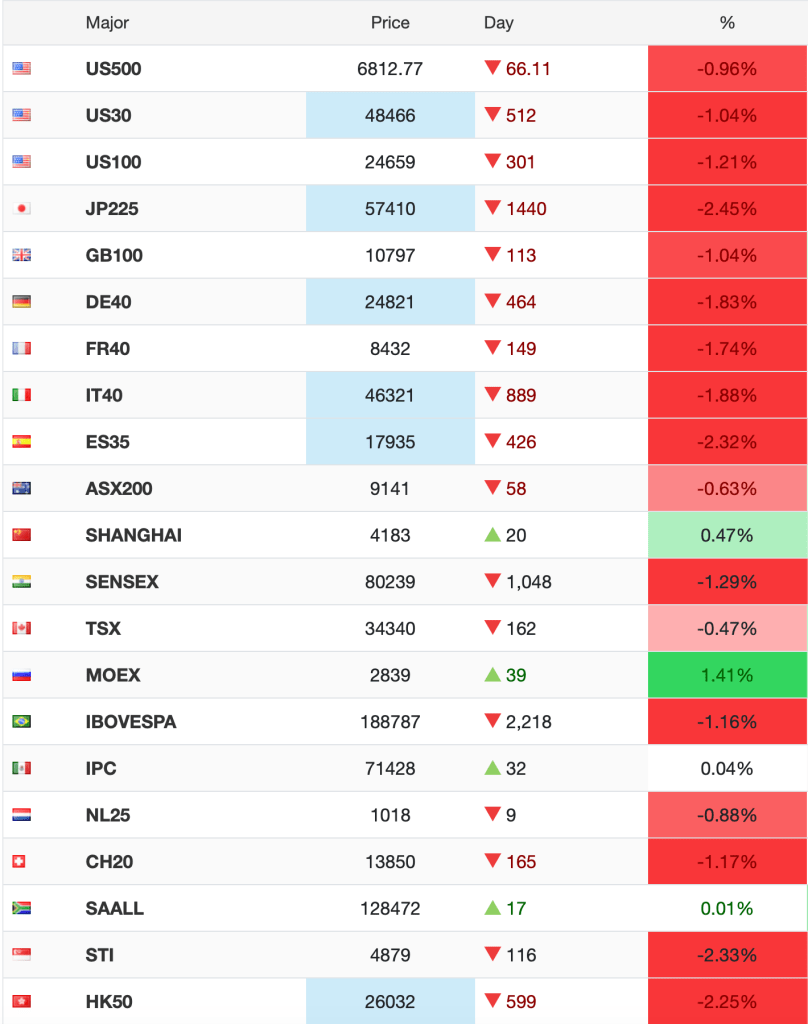

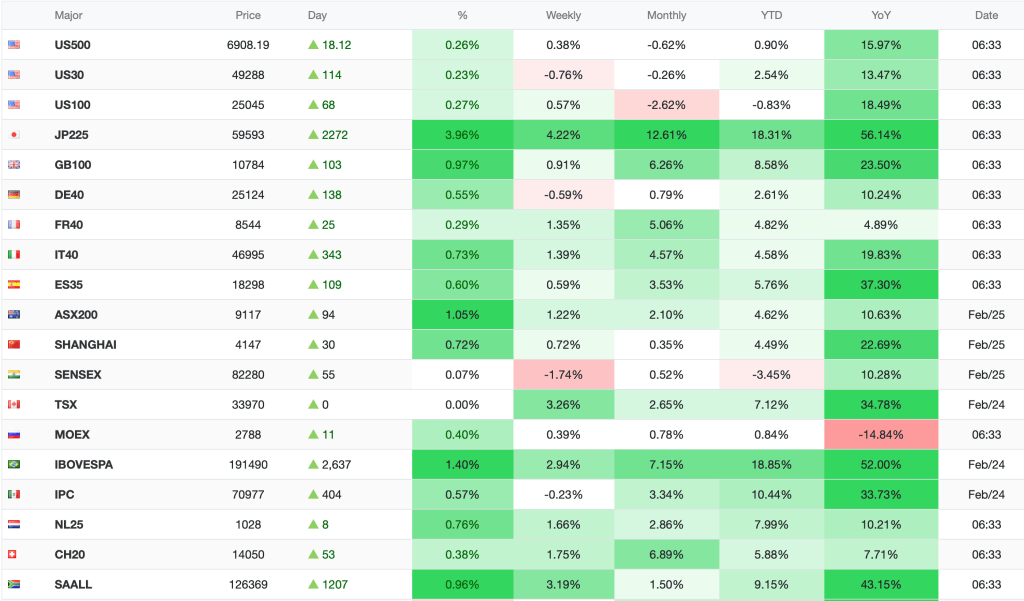

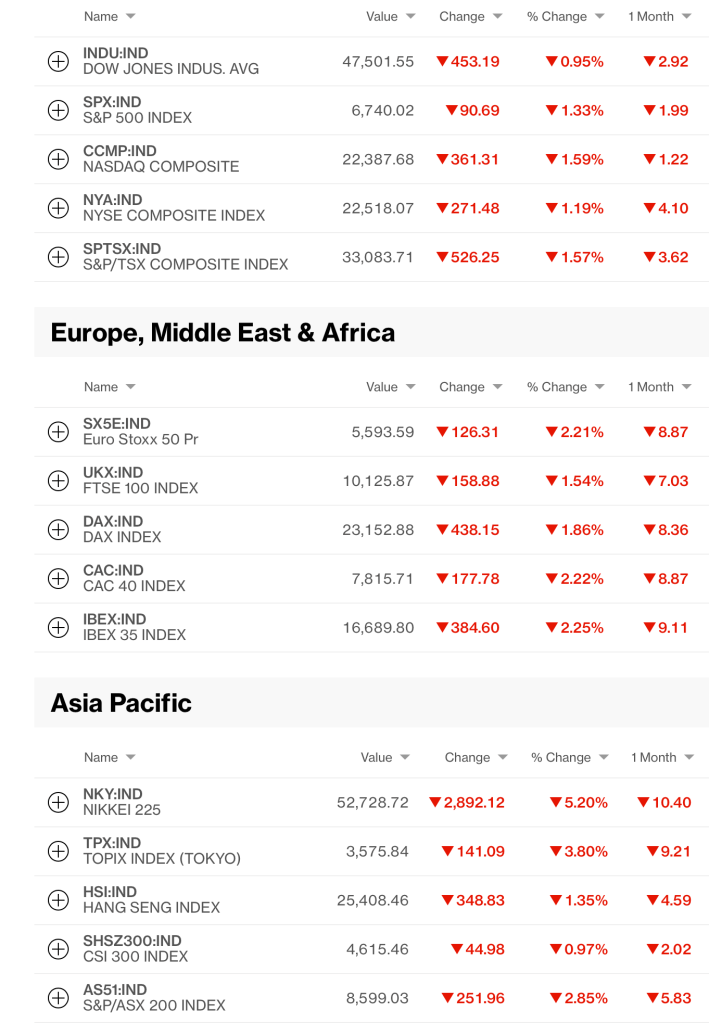

But ultimately, financial markets did not like the data Friday, as we also saw fairly weak Retail Sales data. Adding weak data to the war situation and rising oil prices led to weak equity markets in the US, and then the escalation over the weekend, saw equity markets around the world under pressure. Once again, I believe a screen shot of things this morning is self-explanatory. Those US prices are Friday’s closes.

Source: Bloomberg.com

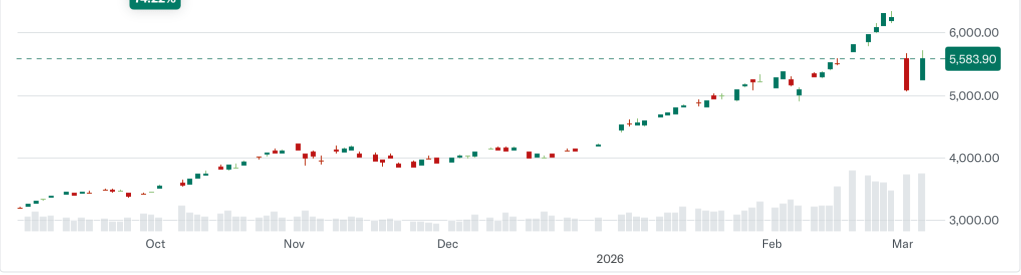

As to US futures, at this hour (7:00), they are all lower by -1.25% or so, but as you can see from the chart below of the S&P 500 futures, they are well off the worst levels of the evening, essentially showing the same response to the G7 story as oil.

Source: tradingeconomics.com

While those Asian markets showed just Japan, China and Australia, the smaller regional exchanges had a very rough time, with declines between -2.0% (India) and -6.0% (Korea) and everywhere in between.

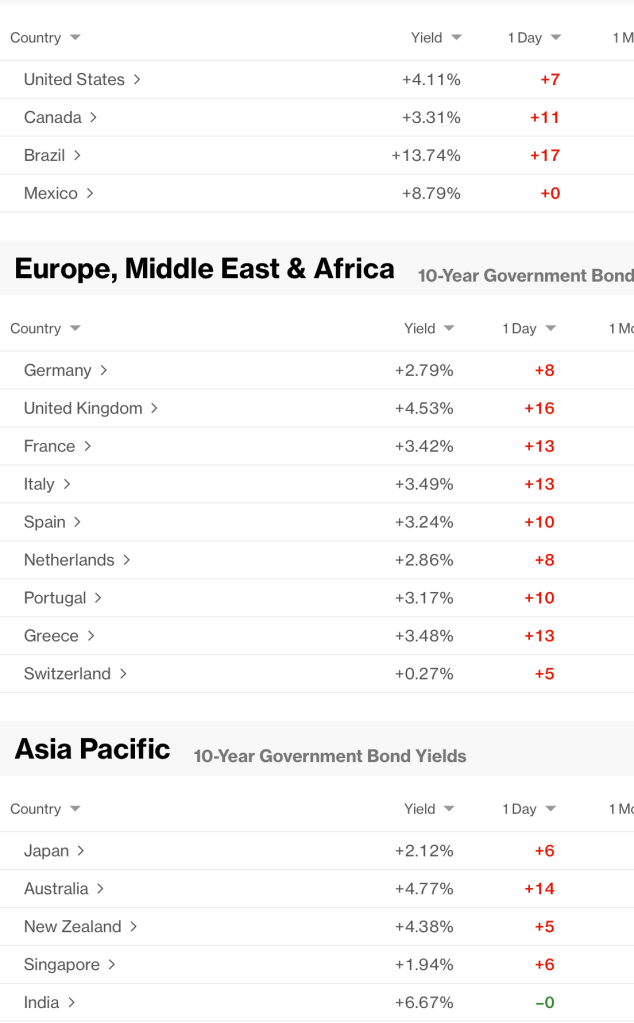

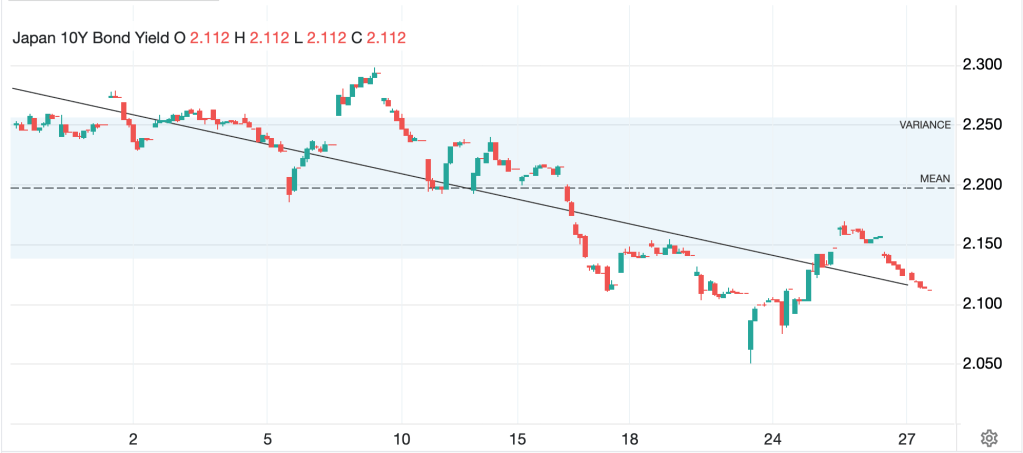

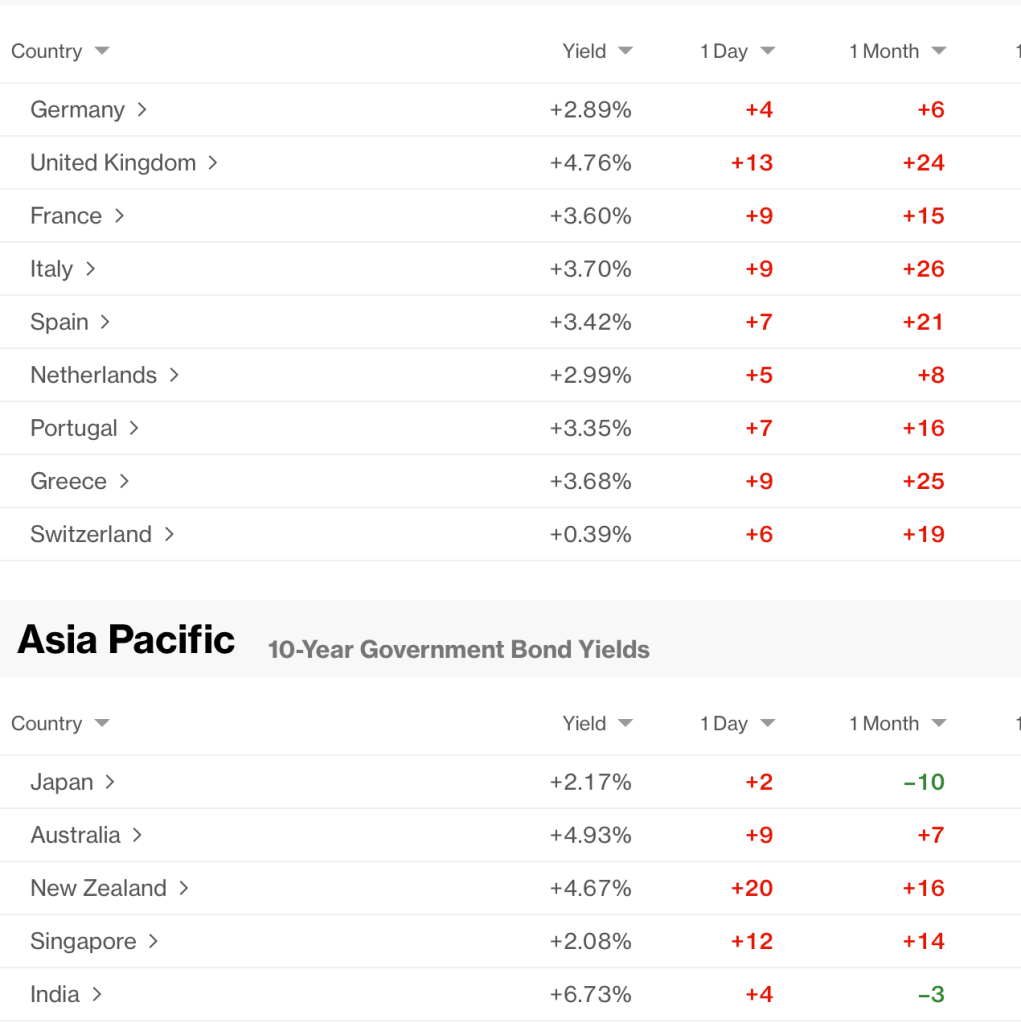

In the bond market, the oil price move has inflation back on everybody’s mind and that can be seen as yields around the world are higher across the board. While Treasury yields are higher by 4bps this morning, you can see much worse outcomes elsewhere in the world in the Bloomberg screenshot below:

I think this is directly related to Natural Gas prices as while they are higher in the US this morning, by 5.75%, that is nothing compared to the gains in Europe (+17.5%) and the UK (+16.75%), which has simply widened the gap between US and European prices further. In addition, the US remains an exporter of LNG, so there will be no supply questions at all, while Europe, with the Strait of Hormuz shut down and Qatar offline, has real problems sourcing gas, especially because they are trying to end supplies from Russia. Good thing they shut down their nuclear plants as well, that will certainly help their energy situation!

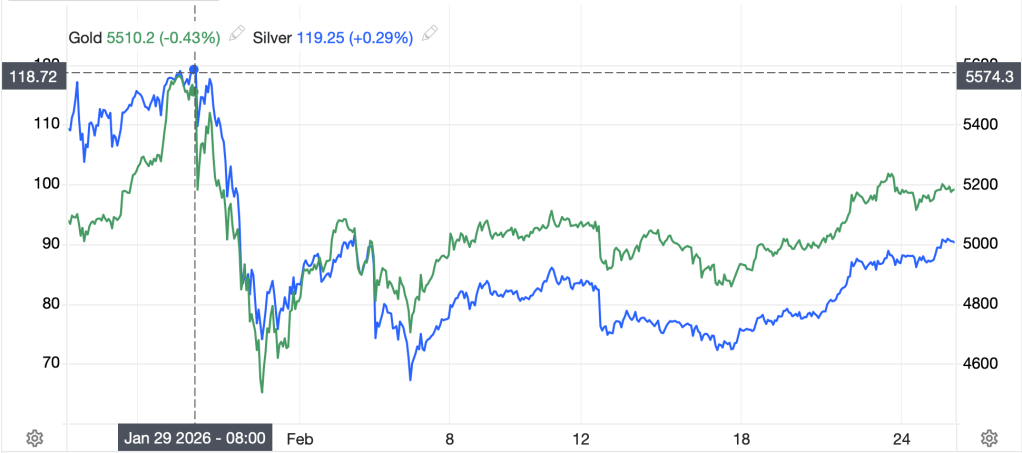

Meanwhile, the metals markets are under some pressure this morning (Au -1.25%, Ag -0.95%, Cu -0.7%), with the former continuing to underperform in a risk-off scenario as I believe that margin calls are resulting in sales of the one thing that investors had with gains. Copper, though, is probably starting to feel some strain regarding future economic activity as if oil prices do remain at these levels, global economic growth is going to be sharply impacted. We will need to watch this carefully.

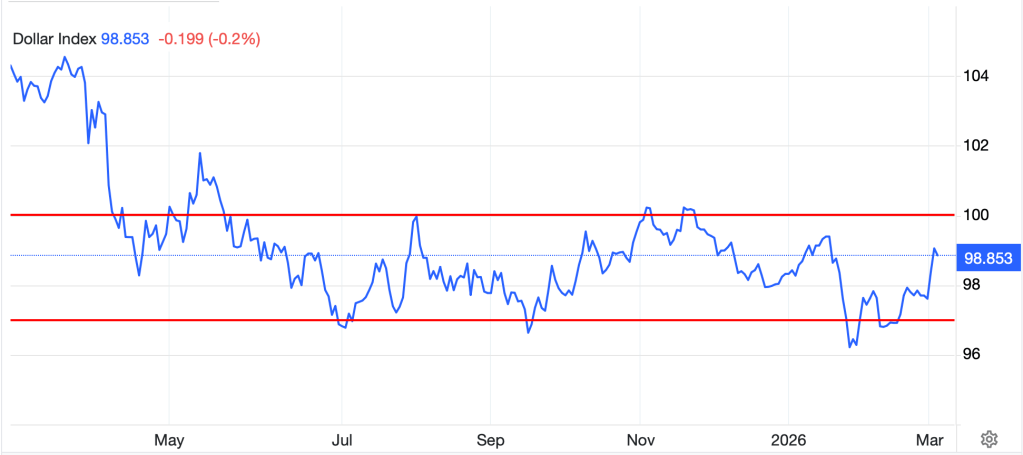

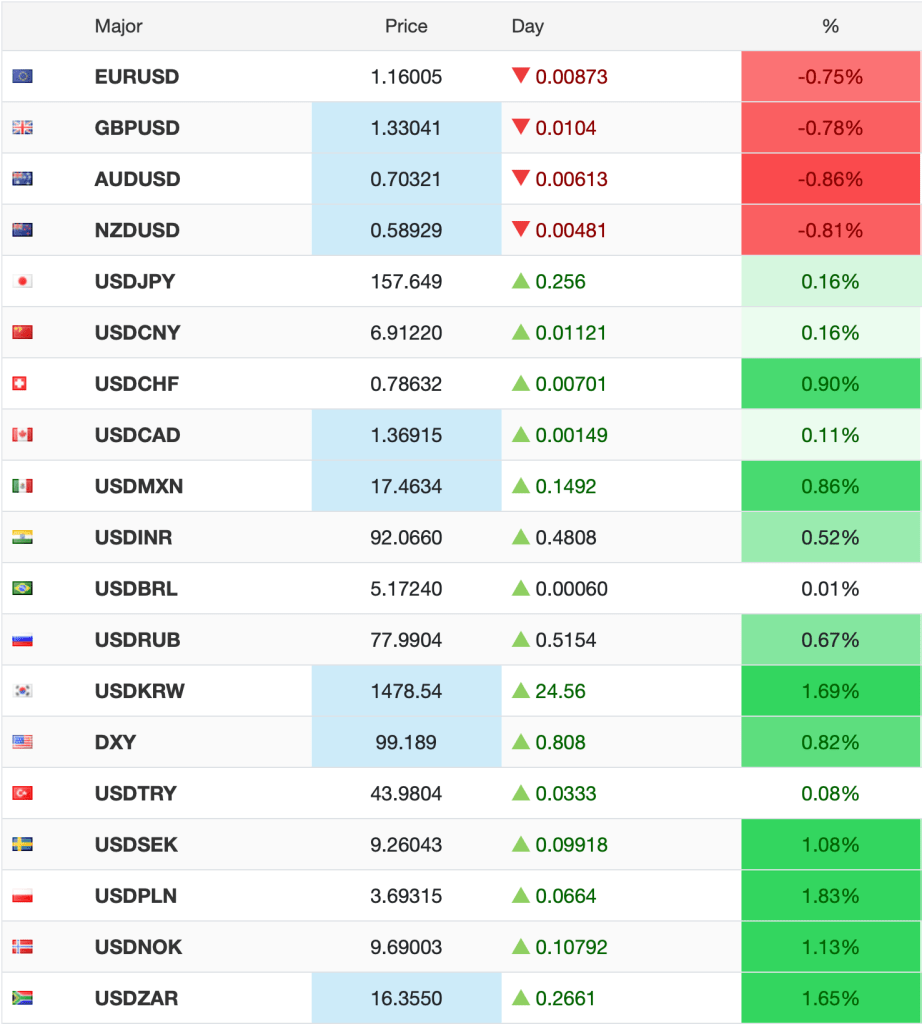

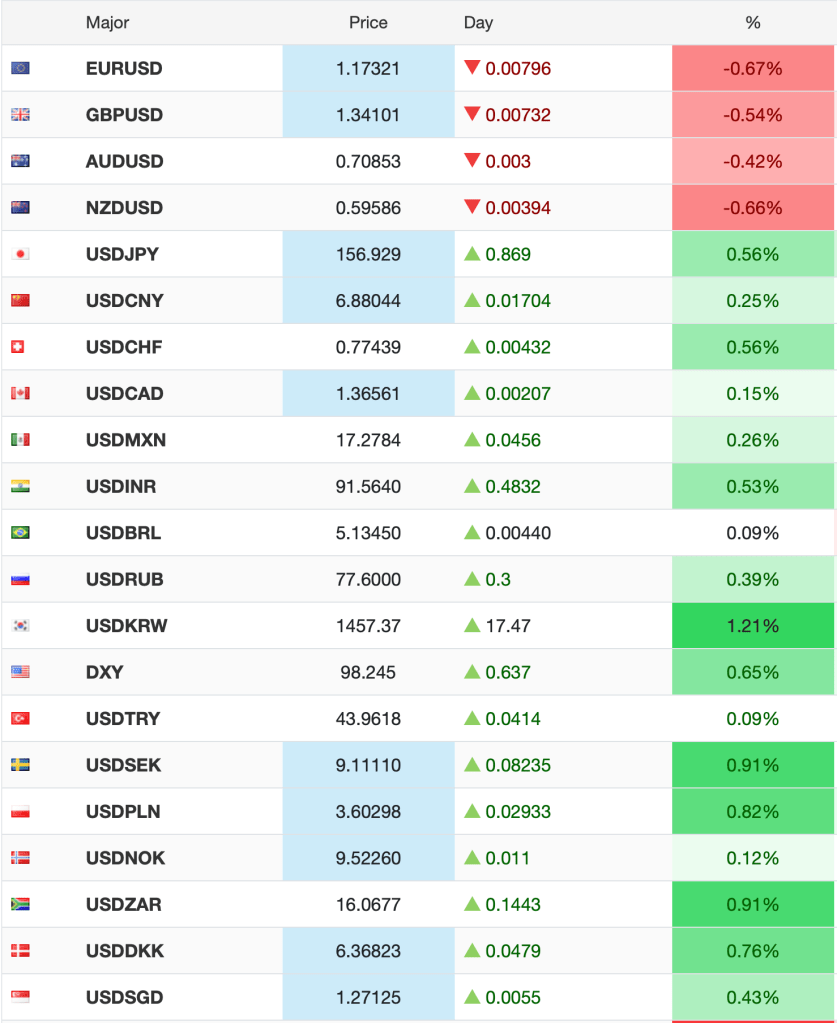

Finally, the dollar remains king. CAD (+0.2%) is the only currency that is showing any support and that is, naturally, because they are a major oil exporter. Interestingly, NOK (-0.7%) is under pressure this morning despite oil’s massive jump. As to the rest of the G10, EUR (-0.5%) and GBP (-0.4%) are suffering as are JPY (-0.35%) and CHF (-0.3%) the erstwhile havens. I imagine both of those are suffering given their entire reliance on imported energy. In the EMG bloc, ZAR (-1.2%) and HUF (-1.3%) are the laggards, although CLP (-1.0%) is falling on copper’s decline as well. ZAR clearly suffering from gold’s underperformance while HUF seems to be feeling some extra strain from expectations of central bank policy ease. Remember, Hungary gets about 80% of its energy, both oil and gas, from Russia, which has been a key political issue in the EU. Elsewhere, both APAC (KRW -0.5%, INR -0.6%, CNY -0.2%) and LATAM (BRL -0.65%, MXN -0.4%) currencies are suffering along with the rest of the world. However, I would have thought both those last two should do better as both are oil producers and far from the action. But right now, emerging markets are persona non grata to investors, so I expect that is the driver.

On the data front, there is nothing today, but we do get a few things this week:

| Tuesday | NFIB Small Business Optimism | 99.7 |

| Existing Home Sales | 3.90M | |

| Wednesday | CPI | 0.3% (2.4% Y/Y) |

| -ex food & energy | 0.2% (2.5% Y/Y) | |

| Thursday | Initial Claims | 215K |

| Continuing Claims | 1850K | |

| Housing Starts | 1.35M | |

| Building Permits | 1.41M | |

| Trade Balance | -$68.0B | |

| Friday | Personal Income | 0.4% |

| Personal Spending | 0.3% | |

| PCE | 0.3% (2.8%) | |

| -ex food & energy | 0.4% (3.0%) | |

| Q4 GDP (2nd est) | 1.4% | |

| Durable Goods | 0.8% | |

| -ex Transport | 0.5% | |

| JOLTs Job Openings | 6.70M | |

| Michigan Confidence | 55.0 |

Source: tradingeconomics.com

In a very rare outcome, we get both CPI and PCE in the same week as the hangover from the government shutdown continues to wreak havoc with the schedule. It remains an open question as to whether the data will matter as the war continues to hog the headlines. But if nothing changes there, then watch the inflation data. After the weak employment report, if we see calm inflation data, tongues will start to wag about a Fed cut, although if oil is still above $100/bbl, that will be tough optics.

Net, things are still quite confusing. My take is that there were many underlying aspects of the economy that were under pressure before the war and they may become more evident with oil putting pressure on everything, well, everything except the dollar, which probably will continue to track higher for now.

Good luck

Adf