Though CPI’s print was benign

It’s clear that it didn’t enshrine

The impact of war

That caused crude to soar

Thus, yields round the world rise and shine

But other than yields heading higher

And prospects for peace looking dire

Most markets lack motion

Which leads to the notion

That not very much may transpire

It seems incongruous but despite the war, and a remarkable cacophony from the press, markets are not really doing very much at all. Certainly, at the margin, there is some movement, and, of course, this does not include oil prices which have been all over the map, but generally, if you look at the charts below, it is hard to get too excited.

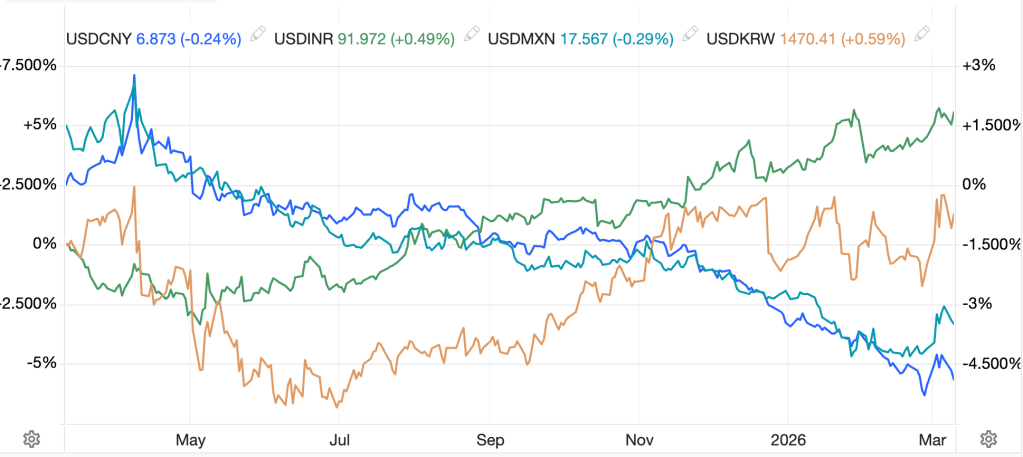

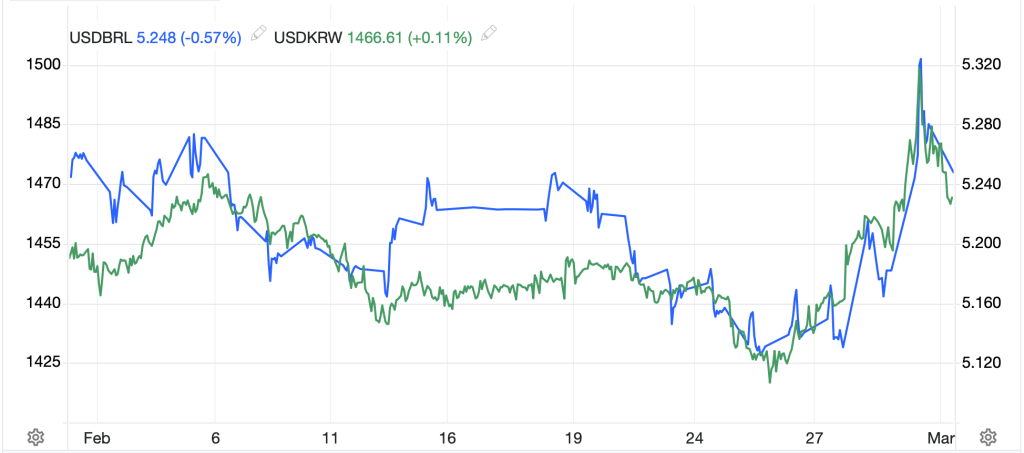

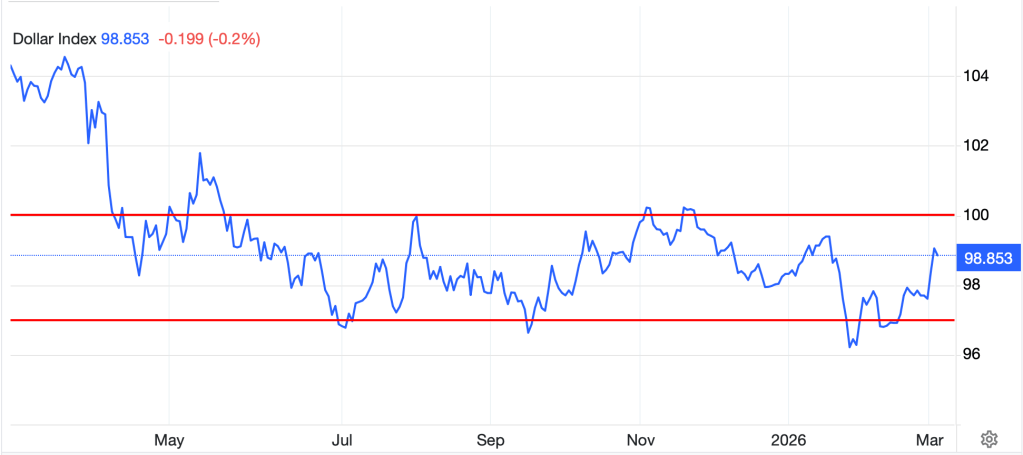

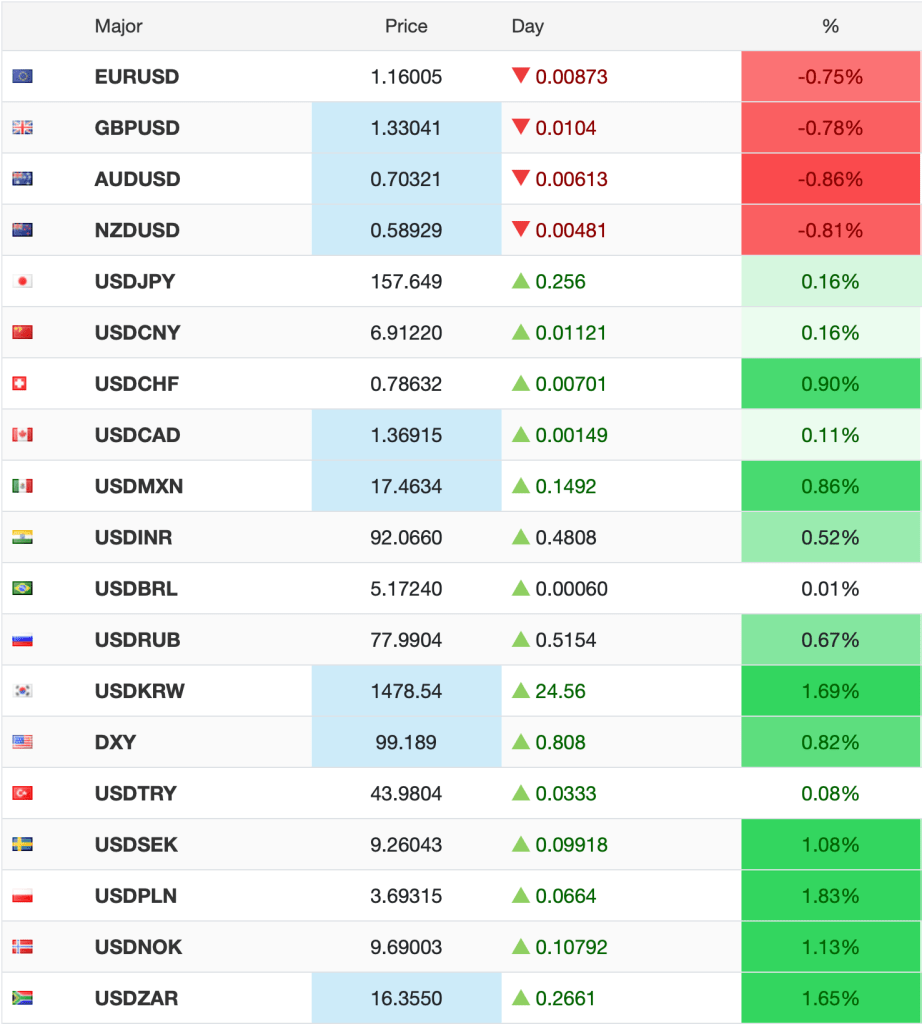

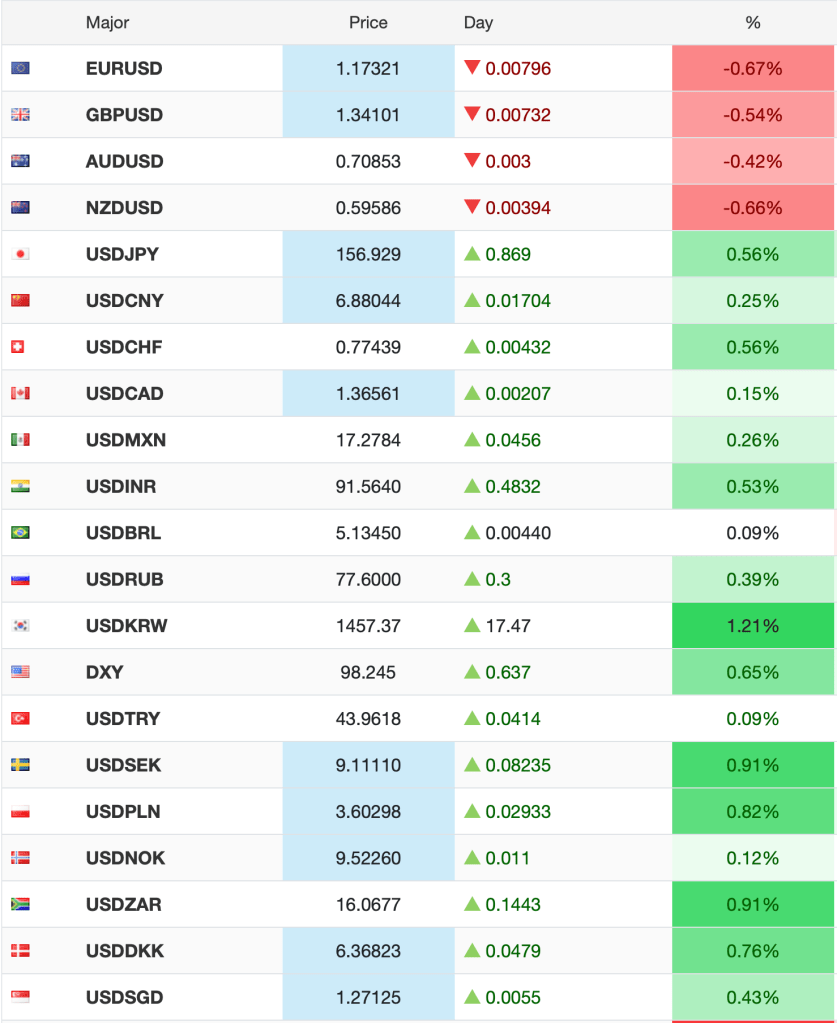

Starting with the dollar, as per the DXY, it has traded in a 4% range for basically the past year, touching both top and bottom three times each. The current rebound looks almost identical to the October rally. But 4% is just not that much of a move, certainly not one that implies a regime change. Overnight, the largest move was PLN (-0.4%) with virtually every other counterpart, whether G10 or EMG, +/-0.25% or less.

Source: trading economics.com

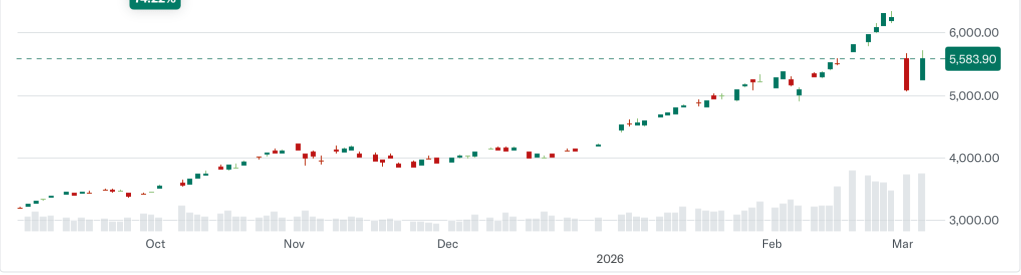

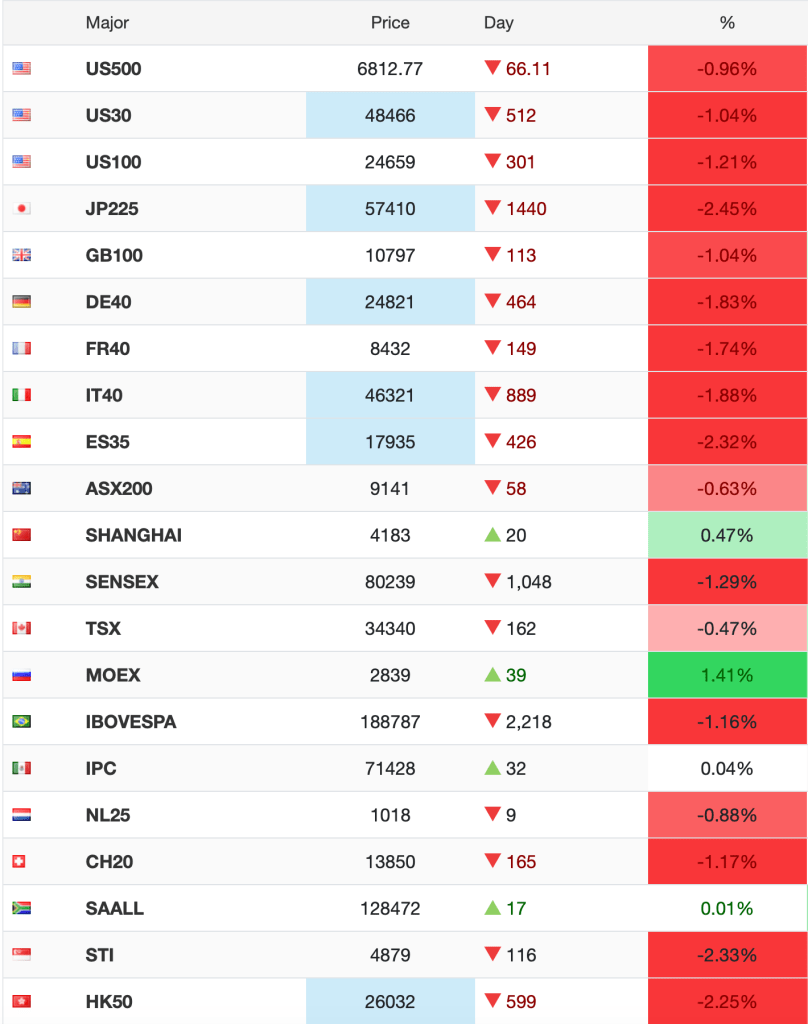

Turning to stocks, it is difficult to look at the below chart of the S&P 500 and come away with the conclusion that it is either rallying or declining in any meaningful measure. For the past 6 months, the range has been about 450 S&P points, which, given the level, works out to less than 7%. It is no surprise that equity volatility is a bit higher than currency volatility, but this chart does not instill fear of either collapse or breakout to my eyes.

Source: tradingeconomics.com

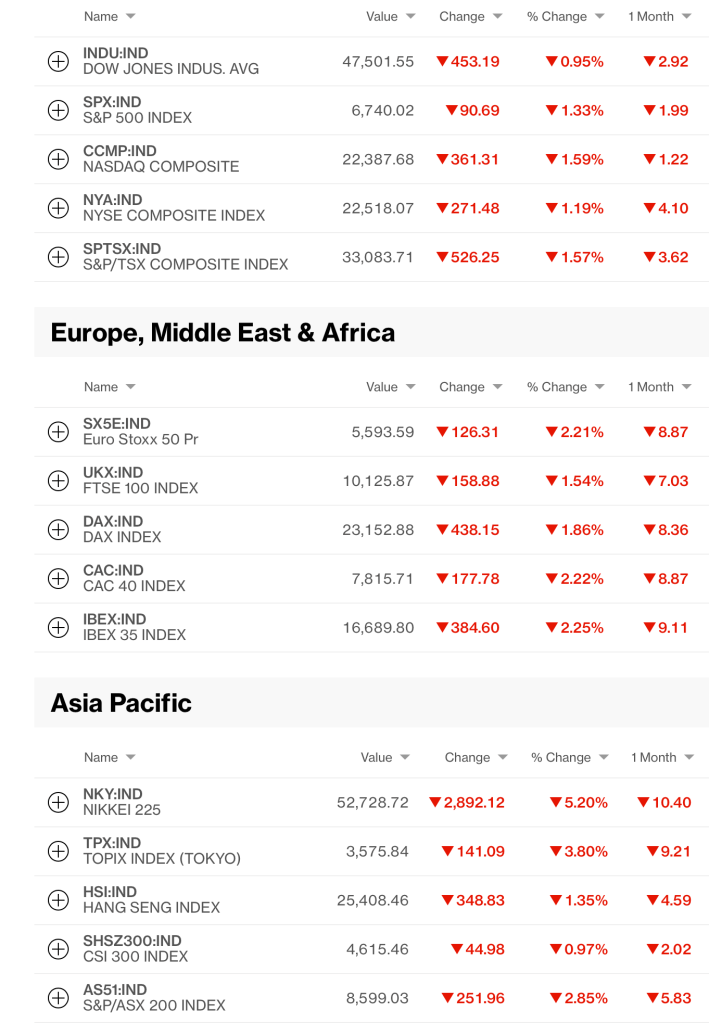

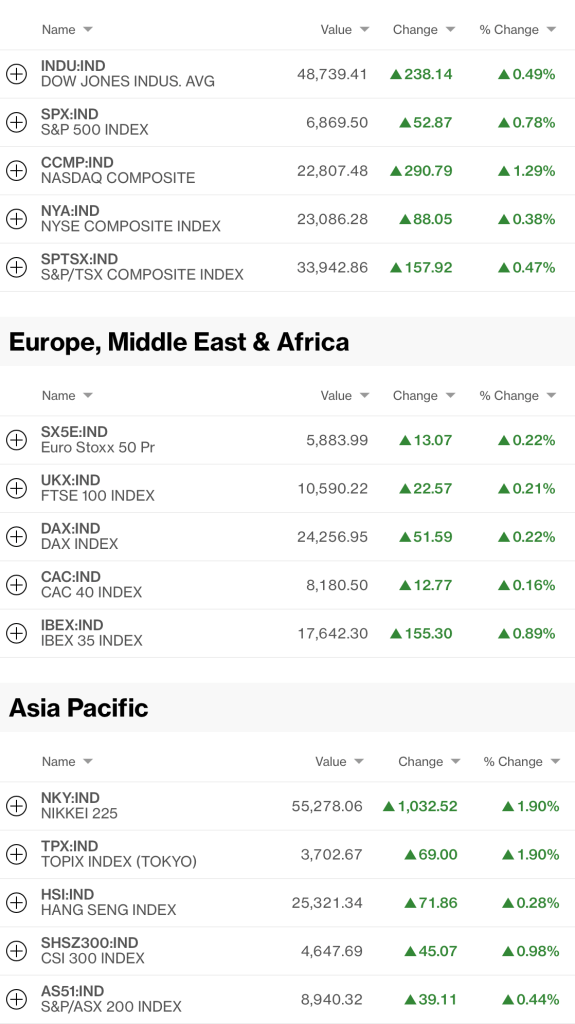

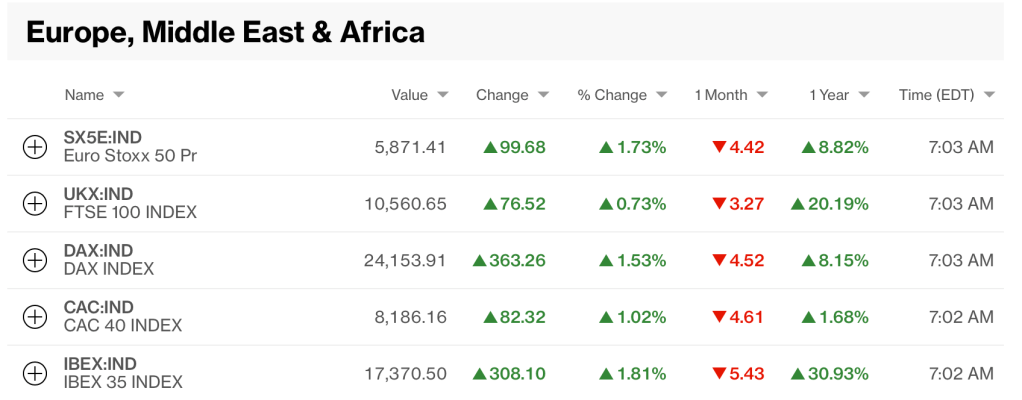

Yes, this morning there is rising concern and equity markets around the world had a weak session overall, but nothing indicating a collapse. Consider in Asia we saw the following movement:

- Tokyo -1.0%

- Hong Kong -0.7%

- China -0.4%

- Korea -0.5%

- Taiwan -1.6%

- India -1.0%

- Australia -1.3%

A weak performance? Absolutely. Unprecedented declines? Not even close. The same is true in Europe, but even less so, with Spain (-0.7%) the worst offender by far while France (-0.3%), the UK (-0.3%) and Germany (0.0%) all tread water. Again, where is the fear? US futures, at this hour (6:50) are lower by just -0.4%, again, soft but not catastrophic.

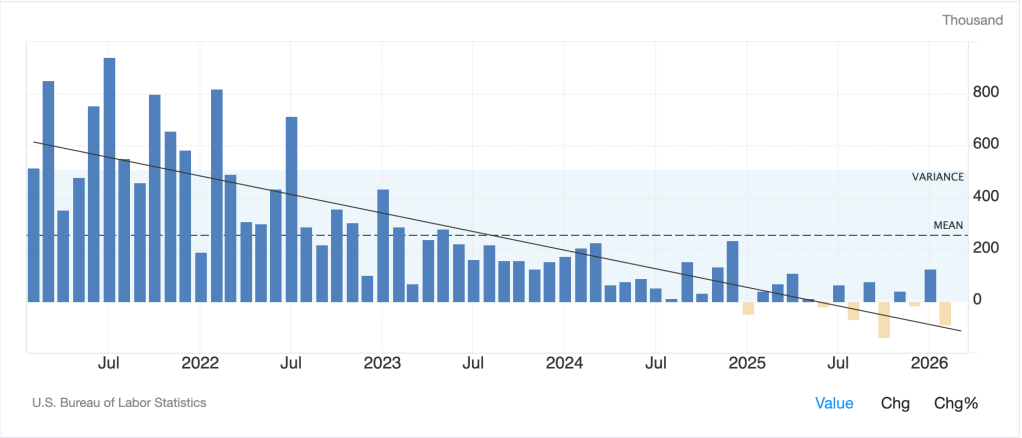

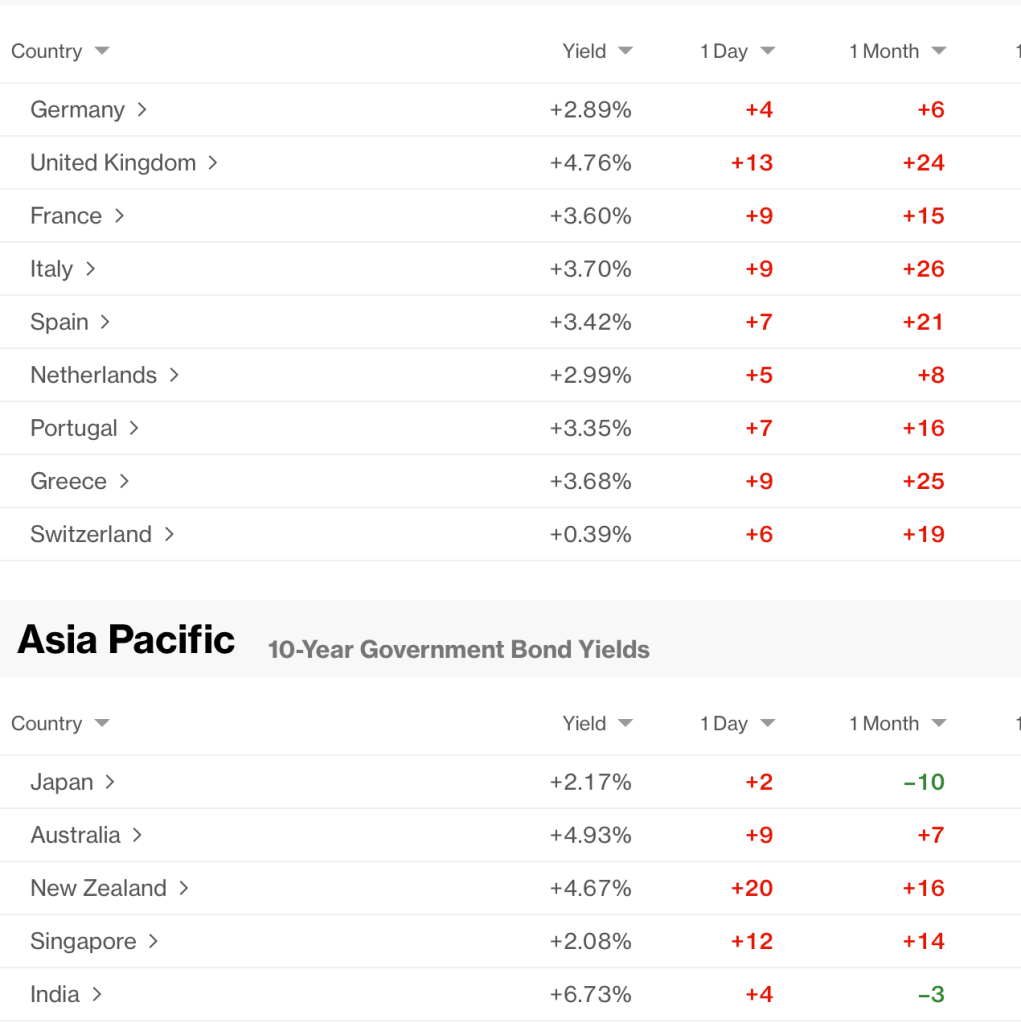

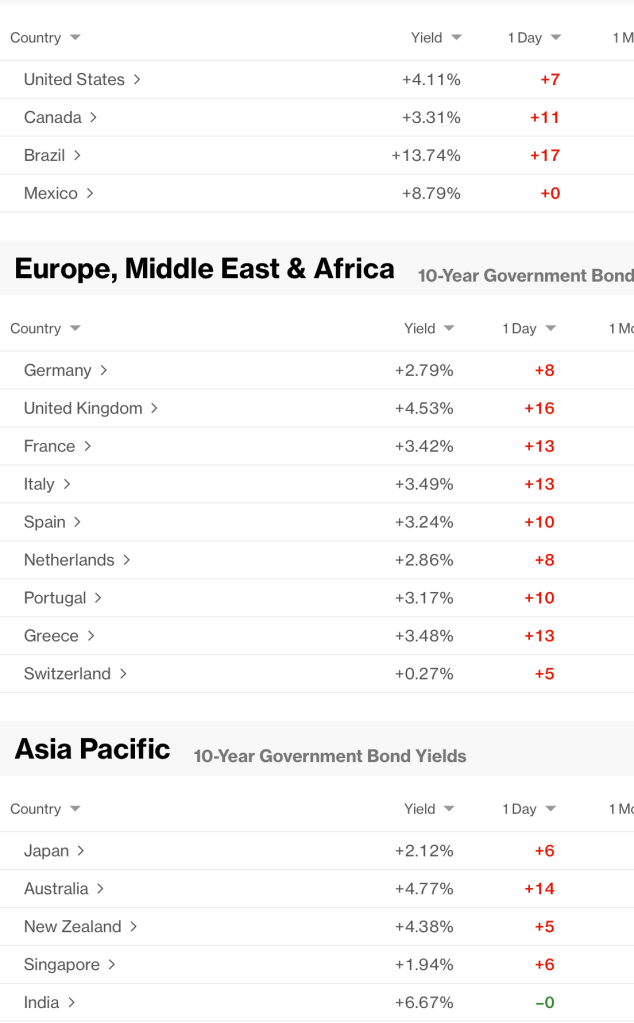

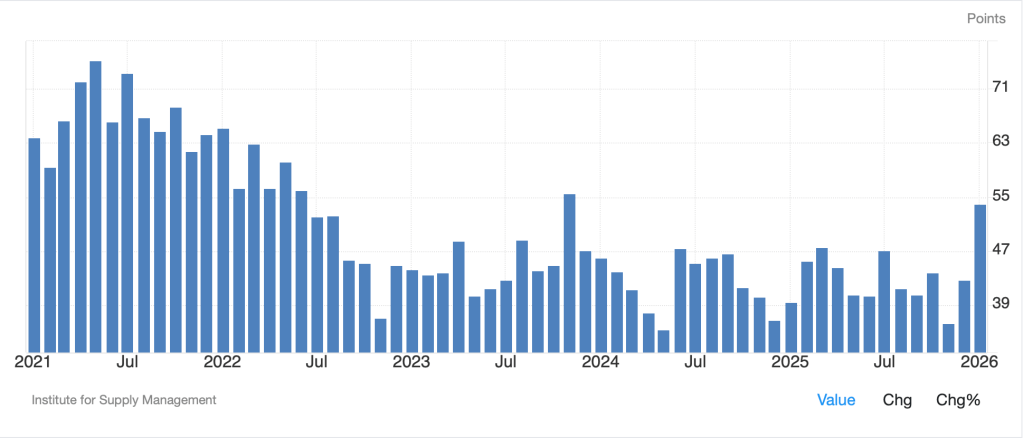

Turning to bonds, while Treasury yields climbed 7bps yesterday, and have been rising since the beginning of the month, they are just now at the top (and slightly through) the range of the past 6 months. Now, the recent rise is understandable as we all know that yesterday’s benign CPI reading didn’t include any of the oil price movement since the Iran war began. My understanding is that the rule of thumb for headline CPI is that every $10/bbl rise translates to 0.2% higher CPI. So, with this morning’s WTI price at $91.50/bbl, compared with $65/bbl prior to the first attacks, that is about 0.5% higher CPI ceteris paribus. Now, ceteris is never paribus, so we don’t know how things will actually play out, but it seems a fair bet headline inflation will be higher next month. (This is the point where I will highlight the best way to take advantage of the rising CPI is through USDi, the fully-backed CPI tracking currency. We already know that CPI next month is going to be higher because of the catch up from the October government shut down. Add to that the oil price moves and we are looking at annualized returns in the coin of 4.5+% over the next quarter, well above T-bills!)

Back to the bond market, a look at the chart shows the chopping action described above, just like the dollar’s price action.

Source: tradingeconomics.com

This is the Treasury story. Elsewhere around the world, things have not been quite as benign. For instance, German bund yields have, this morning, traded to their highest level since October 2023 as per the below chart, although, in fairness, the rise has been gradual.

Source: tradingeconomics.com

UK gilts, on the other hand, have been somewhat more volatile, although I suspect that has a great deal to do with UK domestic economic policy as the nation continues its effort at suicide by insisting that Net Zero CO2 output is the way of the future, thus crushing economic output while suffering through remarkably higher energy prices, and the corresponding inflation that comes with that. But even here, while the price action has been choppier, the result so far has been similar, a sharp rise in the post Covid recovery reaching a plateau.

Source: tradingeconomics.com

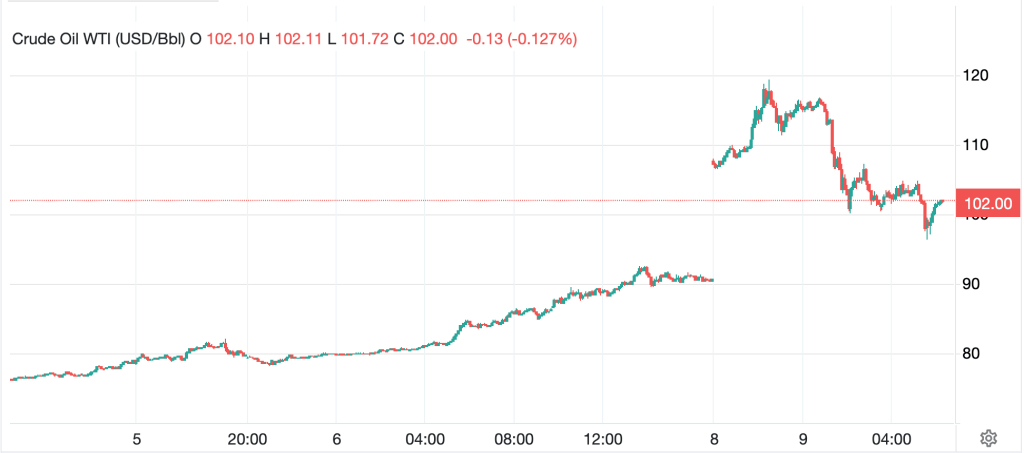

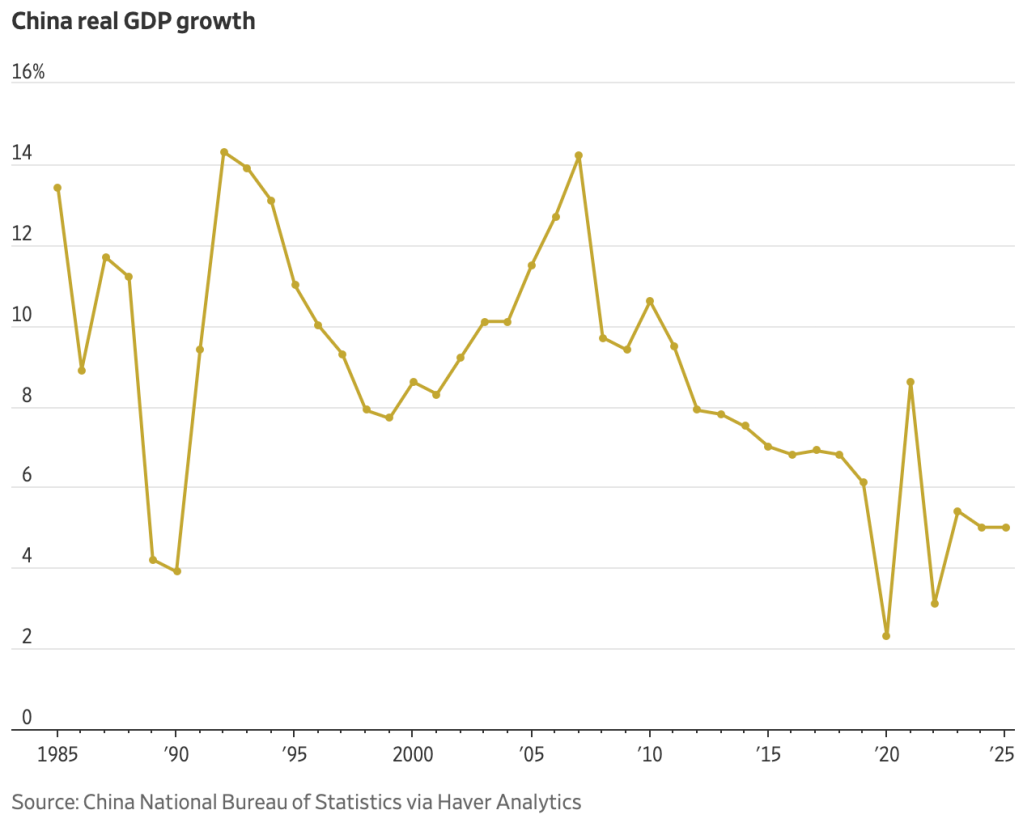

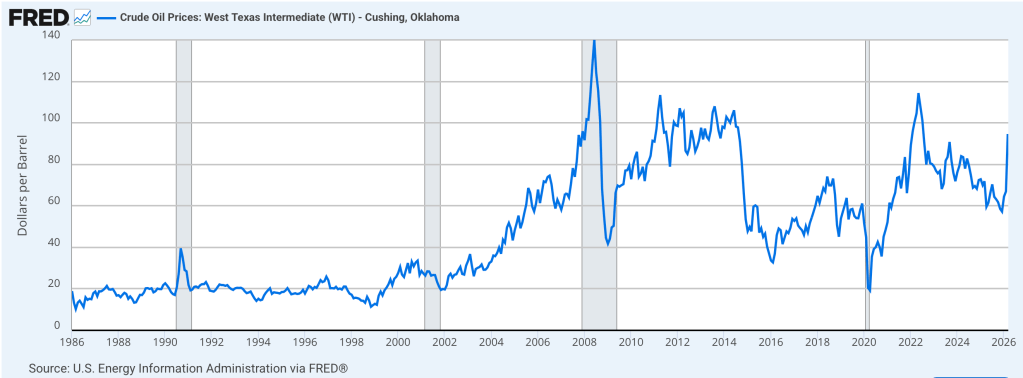

The fear here, and across all bond markets, is that the Iran war lasts much longer, that oil prices continue to rise, perhaps back to the post Ukraine invasion levels of $120 or higher, and that inflation reignites. History has shown that every time oil prices rise swiftly and remain there for any length of time, it leads to a recession or at least coincides with one as per the below chart from the FRED database.

Remember, recessions are called after the fact, so my take is the NBER goes back to include the spike. But it is not a hopeful chart.

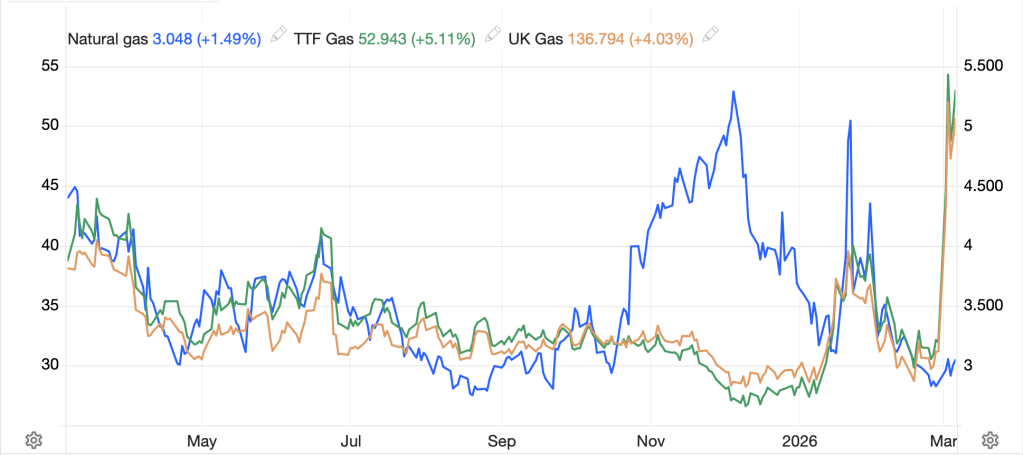

On the subject of oil, this morning it is higher by 4.2% as news that Iran has begun to mine the Strait of Hormuz has the narrative updating to explain that the Strait will be closed for an extended length of time and so some 20% of global oil supplies will be off the market. Now, this is not strictly true as Iran is still transiting the Strait and sending those cargos to China, and I read that India is trying to negotiate for oil heading there to get through as well. Nonetheless, there is a significant backup there and production is starting to get shut in, which is never a good sign. While we remain far below the Sunday night panic peak, there is nothing to say we cannot climb back there if things deteriorate in Iran.

Source: tradingeconomics.com

Which takes us to the metals markets. After a remarkable run over the past two years, gold (0.0%) appears to be settling into a new trading range, as does silver (+1.75%).

Source: tradingeconomics.com

The funny thing about this is that gold has historically been seen as an inflation hedge, so with inflation almost guaranteed to be higher for the next several months, at least, one might expect gold to rally more aggressively. One consideration is that with inflation rising, expectations are for rising interest rates which, correspondingly, are negative for gold, so there is no buying. (H/T Alyosha for that narrative.). But perhaps the explanation is that gold has historically been a hedge for monetary inflation, meaning the printing of more currency. If inflation is caused by a spike in energy prices, gold typically sits on the sidelines.

Which takes us to the Fed. If Powell and friends look at inflation and decide that they need to raise rates to address it, that would be a double negative for gold in my view as not only would interest rates be higher, but it would almost certainly trigger a recession. Initially, that would not be a gold positive, although their response to the ensuing recession, which would be significant policy ease, would definitely send the barbarous relic soaring again.

So, that’s how I see things this morning. some market chop, but nothing really changing. I suppose that we will need to see a conclusion of some sort in Iran to change opinions because, if things drag on, just like they did in Ukraine, investors forget about it after a while. For instance, how many of you remember Venezuela, which was just 2 months ago. Attention spans these days are very short.

On the data front, Initial (exp 215K) and Continuing (1850K) Claims lead this morning alongside the Trade Balance (-$66.6B) and Housing Starts (1.35M) and Building Permits (1.41M). There is also a 30-year auction today, although nobody has been discussing auctions at all lately.

You will not be surprised that I am not excited by the current market situation, and in fact, my take is the bigger risk for a large move is a sudden end to the Iran conflict, rather than anything else. In the meantime, I am hunkering down.

Good luck

Adf