The talk of the Street is the Fed,

While quiet this week, will soon shed

The higher for longer

Idea, with words stronger

That cuts are directly ahead

So, bonds are the new favorite toy

Of every hedge fund girl and boy

Since growth is now slowing

Investors are going

To buy bonds with fervor and joy

The amazing thing about markets is just how quickly they can shift their focus and reverse course if they find the right catalyst. Consider that just one week ago, 10-year Treasury yields were trading at 4.63%, having risen nearly 30 basis points in the prior two weeks on the strength of hawkish commentary from FOMC speakers, a much more hawkish than expected FOMC Minutes release, and economic data that indicated economic growth was still solid.

Source: tradingeconomics.com

And yet, in the past seven days, that entire move has been reversed and now the commentary is pointing to weakening economic activity, declining inflation, a looser jobs market and the inevitability of the Fed cutting rates before the election! So, what happened?

Well, first, a little perspective is in order. While a 30 basis point move in 10-year yields is a nice sized move, it is hardly unprecedented. Consider that if we look at a chart of yields over just the past year, rather than the past month as above, the most recent dip does not stand out as particularly impressive.

Source: tradingeconomics.com

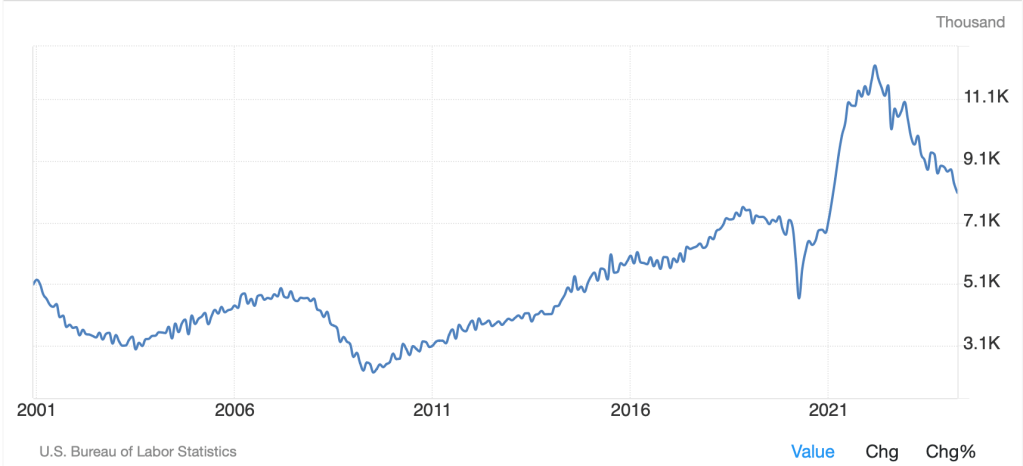

But second, the economic data in the US is starting to align more clearly in a negative fashion. Yesterday I showed the Citi Surprise economic indicator index, which demonstrated that data is failing to keep up with forecasts. Then yesterday, the JOLTS Job Openings data was released at a much diminished 8.059M, more than 300K jobs less than both anticipated and than last month. In fact, despite this data point really looking backward (yesterday’s print was for April data), the recent trend, as seen below is very clearly lower.

Source: tradingeconomics.com

This is an indication that the jobs market is much looser than the Fed had been worried about with regards to inflation, but of course is a problem for their maximum employment mandate. In any event, the weaker data continues to pile up and the natural response of investors is to start to price in a more traditional weak growth scenario. This includes declining bond yields on the assumption the Fed is going to ease policy, declining commodity prices on lessening demand, and a declining dollar on the back of those lower interest rates. And that is exactly what we have seen.

You will notice I left out the equity response to these events as I would contend it is far less clear. Initially, I expect that equity investors will be excited by the prospects of rate cuts, and we could see stocks rally, but if growth is really slowing, then that is going to negatively impact earnings which should undermine equity prices. Historically, when the Fed is cutting rates, it is in response to a slowing economy and equity prices have not fared well in this scenario. You can see in the chart below, that the Fed tends to cut rates (orange line) during recessions (grey areas), and those declines are coincident with equity market (S&P 500 – blue line) declines.

Source: macrotrends.net

So, has the economy turned down for real now? I would contend there are more indicators that are widely followed which indicate that is the case. Several months ago, one really needed to dig into the secondary parts of major releases to conclude things were rolling over. Today, it seems a bit clearer. But remember, too, Treasury Secretary Yellen has > $700 billion in the TGA to spend leading up to the election in an effort to prevent that outcome, and you can be certain she will do all in her power to do so. Will it be enough? I guess we will find out.

One last thought, though, is that my take is the current sticky inflation may well remain sticky despite an economic slowdown. Remember, there is a humongous amount of money around, and the response of every government will be to print even more if things slow, so the idea of stagflation remains very real and cannot be dismissed at this time.

Ok, let’s look at the overnight session to see how things have fared. After yesterday’s late equity rally resulted in very minor gains in the US, Asia had a mixed session with both Japan (-0.9%) and China (-0.6%) lower, although there were gains throughout the region led by India (+3.6%) rebounding from the initial election news there. PM Modi will continue ruling, but in a coalition, so with much reduced power. But Korea, Australia and Taiwan all performed well. In Europe this morning, equity markets are having a good day with gains on the continent around 0.9% across the board although UK stocks are only higher by a bit (0.3%). PMI Services data was released, and it was generally a touch better than forecasts (France excepted) but certainly not significant enough to change the view that the ECB is going to cut rates tomorrow. Meanwhile, US futures are picking up at this hour (8:00), rising 0.3% across the board.

We discussed bonds earlier but not the fact that Treasury yields fell 7bps yesterday after the softer data, dragging European yields down as well. This morning, Treasuries are another 1bp softer with Europe sliding by between 1bp and 4bps. Overnight, yields also fell, with JGB’s down 2bps and now right back at 1.00%, while other bonds in Asia saw yields fall more sharply. It seems pretty clear that the market is starting to price in a global slowdown in the economy.

In the commodity sector, after a week of routs, things have settled this morning with oil (+0.5%) bouncing slightly, although still lower by -7% in the past week. Gold (+0.25%) too, is a bit firmer, although that was not the metal that fell most sharply. Both silver and copper are unchanged this morning as the bullish long-term story mongers (present company included) are all licking their wounds, but absent more weak data, there is no incentive to sell things aggressively here right now. However, if the data keeps softening, so will these prices.

Finally, the dollar, which had fallen earlier in the week, has edged up a touch this morning. JPY (-0.6%) is giving back some of its recent haven inspired gains, and we have also seen both MXN (+0.9%) and INR (+0.25%) recoup a small amount of their election related losses. ZAR (-1.0%), however, is still under pressure as the weakened state of the government combined with the weakness in metals prices is clearly a major weight on the rand. All eyes today will be on CAD (unchanged) as the BOC meets and will be announcing their rate decision at 10:30. There is a 60% probability of a rate cut priced into the market, as recent data softness is getting traders excited that Governor Macklem will ignore his recent comments about needing “months of data” to confirm the situation. After all, inflation up there is within the BOC’s range, and I suspect a cut is coming.

On the data front, ADP Employment was just released at a slightly softer than forecast 152K (exp 170K) and then we see ISM Services (50.8) at 10:00am. As of yet, there has been no real response to the ADP data. At this point, the narrative is swinging quickly to the idea that softer economic activity will lead the Fed to cut sooner than previously expected. The Fed funds futures market has moved the probability of the September cut up to nearly two-thirds. For now, that is going to drive things, and as such, I believe the dollar will remain under pressure overall. Absent a very strong NFP report Friday, perhaps we have seen some near-term tops in yields and the dollar.

Good luck

Adf