The narrative writers have turned

Their focus, as markets they’ve spurned

It’s politics now

That they all endow

With ideas we need be concerned

And so, if the pricing is right

Come next week, the Fed will sit tight

The rest of the summer

Could well be a bummer

For traders, with volumes quite light

It is not uncommon for the summer months to lack interesting new information for market participants. While the regular monthly cycle of data continues to be released, the fact remains that there seems to be less interest overall. This is not to say there have never been summer surprises, but the very fact we call them surprises is indicative of their relative scarcity.

This year, especially, seems likely to have even fewer financial or economic discussions than usual given the ongoing drama in the US political cycle. And while this poet has opinions as to how things may work out (and of course what I would like to see) that is not what this morning missive is all about. Rather, I continue to try to find the stories that drive market activity and alert you to what is happening. But the ongoing political narrative is now so dominant, everything else pales in comparison. And as I wrote yesterday, while political narratives can have some market impact, it is not typically that significant.

I mention this because there were exactly zero stories of any market consequence overnight. Much was written about the US elections and there were some ‘thought’ pieces on issues like the long-term impacts of President Xi’s iron grip on China and what that means for the economy there, but there was no data to excite, there were no comments of note and basically, it was all quite dull. For instance, I’ll bet you were unaware that the G20 is meeting in Rio de Janeiro because it is almost impossible to find a story on the meeting. I suspect that Thursday’s GDP and Friday’s PCE data are going to be the most exciting things that occur this week.

Unless, of course, there is a real summer surprise. It is earnings season with the Mega-cap tech companies set to report this week and next, but those are generally not market wide movers. So, with that in mind, let’s take a look at the overnight market activity and call it a day.

After US equity markets showed their resilience yesterday, laughing off the concept of a rotation out of tech or the beginning of a serious correction, Asian markets mostly followed that same line of thinking if you ignore Japan (flat) and China (CSI 300 -2.1%, Hang Seng -1.0%) as the rest of the region was in the green, with some markets really enjoying a boost, notably Taiwan (+2.75%). The Chinese story seems to be ongoing disappointment that the Third Plenum did nothing to indicate support for the economy and the 10bp rate cuts were seen as insufficient. As to Japan, the tension between the rebound in tech shares and the strengthening in the yen led to no net movement. In Europe, though, bourses are all following the US lead and rising nicely, led by the DAX (+1.2%) as hints by some ECB members indicate that a cut is coming in September despite Madame Lagarde’s insistence that no decisions have been made. As to the US futures markets, at this hour (7:15) they are little changed overall.

Bond markets have seen yields decline this morning with Treasuries (-2bps) the laggard compared to Bunds (-4bps) and OATs (-3bps). Of course, this follows yesterday’s session where yields edged higher by a few basis points and basically shows that investors are unwilling to take any directional views until we at least see the PCE data, if not until the FOMC next Wednesday. Since the beginning of the month, Treasury yields have been choppy in a range of 4.15% – 4.30% and are currently sitting right in the middle. There continue to be two longer term views, with the recessionistas calling for a sharp decline in yields as it becomes clear the US economy is slowing and the Fed will cut rates to stimulate, while the fiscal policy bears keep pointing to the massive deficits and issuance that accompanies those deficits, and explains that at some point, demand will not meet supply and yields will rise sharply. My own view is that both of these outcomes will obtain, with the first recession signals helping to send yields lower before longer-term troubles emerge for the US fiscal picture. But right now, it’s hard to get excited in either direction.

In the commodity space, oil (-0.3%) remains under pressure although today’s decline is far less severe than we’ve seen in the past several sessions. Rumors of OPEC increasing production in Q4 seem to be one driver as well as forecasts for inventory builds in the US this week. Gold (+0.6%) continues to find buyers and remains above $2400/oz as Asian demand, from both central banks and individuals remains a key driver. Copper (-1.0%) on the other hand continues to suffer, down more than -6.0% this month, as the slowdown in China’s economy weighs on demand for the red metal.

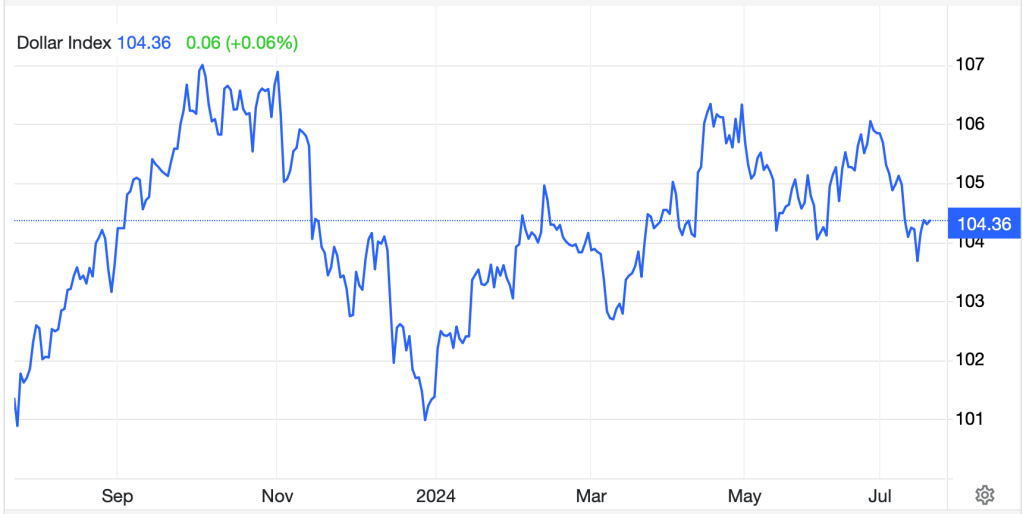

Finally, the dollar, which has been written off more times than I can count, is firmer again, back above 104.00 on the DXY. For all the discussion about how the dollar is set to decline, a quick look at the DXY over the past year tells me that there is no discernible downtrend at all (nor is there an uptrend).

Source: tradingeconomics.com

There has been an uptick in the long-term ‘dollar will die’ narrative, but certainly that has not had any impact on the ordinary activity that we watch regularly. As to today’s activity, NOK (-0.5%) is leading the G10 lower although we are seeing declines averaging -0.25% elsewhere with one exception, JPY (+0.5%) which is bucking the trend. From a currency perspective, one might think it is a risk off day, with investors flocking to havens, but given equity market strength, that is clearly not the case. As to the EMG bloc, ZAR (-0.9%) continues to demonstrate impressive volatility overall, suffering on weakness in commodity markets and the CE4 are also soft, tracking the euro’s decline.

On the data front, we see Existing Home Sales (exp 3.99M) at 10:00 this morning and that is all she wrote. It is difficult to get excited about today’s market and I suspect that absent some terrible earnings data that causes a real stock market decline, tomorrow when we wake up, things will be close to where they are now.

Good luck

Adf