There once was a US VP

Who pined for the presidency

Her views were well-known

But many had shown

The voters could well disagree

So last night, amidst great fanfare

She finally took to the air

Disclaimed all her views

And thought to accuse

The Right as the source of despair

The reason for pointing this out

Is many are starting to doubt

If she wins the race

That she won’t debase

The buck, which could head for a rout

While this poet is always reluctant to discuss politics in the morning, sometimes that is the story that is driving the discussion. Today, that is the case in the wake of VP Harris’s first interview of her presidential campaign. One of the major complaints about her campaign was she had ostensibly changed many long-held views by 180° without explanation. This was supposed to be rectified in the interview. It should be no surprise that her supporters claim she did just that swimmingly while her detractors feel they know nothing more this morning than they did before the interview aired.

For instance, a key question is about energy markets, specifically fracking. From a market perspective, if a President Harris were indeed to ban fracking, her long-standing view, oil prices would surge dramatically given that somewhere around 6mm-7mm barrels per day are pumped using this method. At the margin, removing 6% of supply in the oil market could easily double the price given the relative inelasticity of demand as per the chart below.

My take is that would be quite destructive to the economy, dramatically reducing growth while raising inflation substantially. My point is these policy pronouncements matter, and market participants know that. Now, based on the price behavior of oil (unchanged today) and still trading in the middle of its recent year-long trading range, it is clear the market is not too concerned about that outcome. Whether that is because the market is betting on a Trump victory or the market is betting that she will not be able to withstand the political pain of higher gasoline prices that would come with a dramatic reduction in US oil production, I have no idea.

I am merely highlighting that the consequences for the economy and markets are very large depending on the outcome of the upcoming presidential election here. And those consequences will be felt worldwide. Were the US to decide to cede its energy status, it would be quite easy to see the dollar fall substantially in value as capital seeks a safer home elsewhere or simply because there would be less demand for dollars to pay for oil. It would be quite easy to see bond yields rise as investors seek alternatives or demand higher yields to hold US paper. These outcomes are not guaranteed, they are merely one direction in which things could turn.

Remarkably, away from that story, there is precious little else of note ongoing as we await this morning’s PCE release. It’s not that there wasn’t other data, there was, but the outcomes were close enough to expectations to result in limited movement.

For instance, last night Japanese data showed a modest rise in the Unemployment Rate to 2.7% as well as a rise in Tokyo CPI (2.6%, 2.4% core, 1.6% super core) with all three readings higher than last month. Meanwhile, both Korean and Japanese IP were soft. But none of that fazed markets as we saw gains in both the Nikkei (+0.75%) and KOSPI (+0.45%) while the yen (-0.25%) and won (0.0%) really did very little nor did JGB yields move.

Meanwhile, this morning there was a raft of European data with inflation readings from both France (1.9%) and Italy (1.1%) helping to complete the Eurozone composite rate (2.2%). These readings follow Germany’s lower than expected 1.9% yesterday and seem to cement a 25bp cut by the ECB next month. Alas for the French, GDP continues to underperform with Q2 printing at 0.2% M/M, 1.0% Y/Y, helping to boost the case for a rate cut. The market response here has been more focused on the potential for cuts than the lackluster economic performance as equity markets are higher throughout Europe (DAX +0.2%, CAC +0.4%, IBEX +0.6%) and the UK (+0.3%).

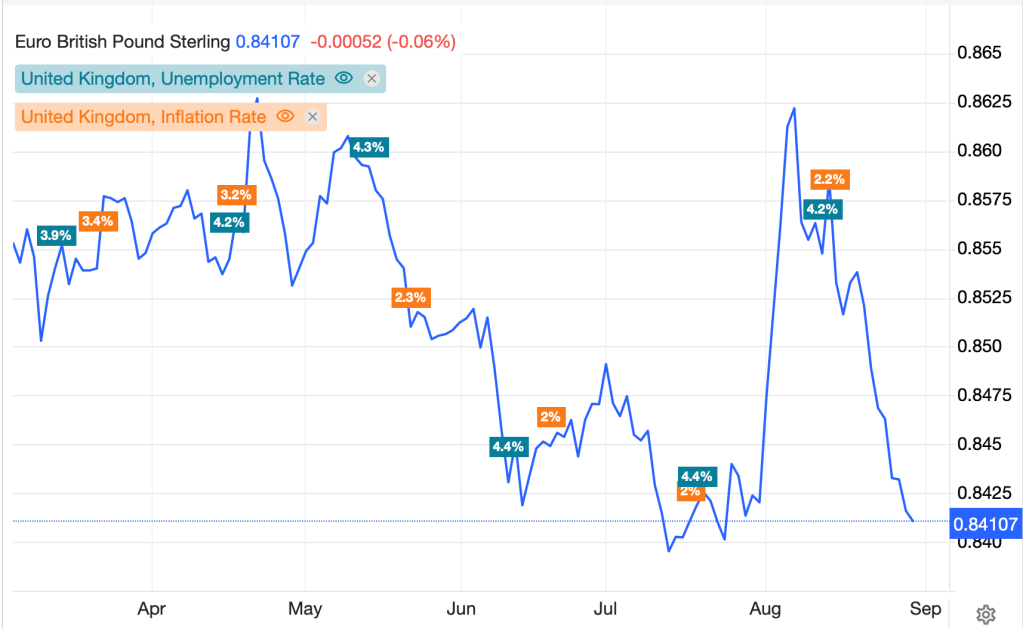

Perhaps more interesting is the fact that UK economic data continues to outperform the continent with the most recent data showing the housing market there remains solid, at least based on new mortgage approvals and mortgage lending data. This dichotomy is most evident in the EURGBP exchange rate which has moved sharply in the favor of the pound, more than 2.5%, over the past three weeks, after the BOE cut rates at their last meeting but in a very close 5/4 vote indicating that concerns over inflation remain, and future cuts are not baked in.

Source: tradingeconomics.com

And I feel that really sums up the overnight discussions. In other markets of note, Chinese shares (CSI 300 + 1.3%) finally got off the schneid and had their first up day in a week. Too, the Hang Seng (+1.1%) rallied alongside. As to US futures, ahead of the PCE all three major indices are seeing futures higher following yesterday’s gains.

In the bond market, Treasuries are unchanged this morning and European sovereign yields are lower by 1bp across the board. Clearly, there is little concern of either a collapse in Europe, nor a runaway higher in activity. And that 25bp cut is baked in at this point.

In the commodity markets, as mentioned above, oil prices are unchanged awaiting the next shoe to drop, which in the metals markets, gold (0.0%) is unchanged, holding its recent gains while both silver (+0.5%) and copper (+1.0%) rebound further from some weakness earlier in the week.

Finally, the dollar continues its mixed performance, with a number of the high yielding EMG currencies showing strength this morning (MXN +0.9%, ZAR +0.7%, BRL +0.6%) as the belief in the market is that the Fed will not only cut in September but will continue to do so going forward. However, in the G10 bloc, the movement has been far less significant with only the yen moving more than 0.2%. in my opinion, this is due to a combination of curiousity about the data this morning and the fact that it is the Friday of a holiday weekend in the US, hence most desks are lightly staffed.

As to that data, we see Personal Income (exp 0.2%), Personal Spending (0.5%) and PCE (0.2%, 2.6% Y/Y) along with Core PCE (0.2%, 2.7% Y/Y). Later this morning we get Chicago PMI (45.5) and Michigan Consumer Sentiment (68.0). Yesterday’s Claims data was on the button and the GDP data was actually revised higher to 3.0% in a surprise. Once again, it remains difficult for me to understand the idea that the Fed needs to cut rates aggressively given the economy seems to be working well, at least based on the data the Fed discusses with us. And yet, the market is still pricing in a one-third probability of a 50bp cut next month.

Putting it all together, while I believe the Fed is more focused on unemployment than inflation, as they have basically claimed victory over the latter, if we see a soft reading this morning, I suspect the market will price a greater probability of a 50bp cut and the dollar will suffer while stocks and bonds rally. But a strong reading will not have the opposite effect as the focus will be on next week’s unemployment data.

Good luck and good weekend

Adf