The punditry’s dominant theme

Is whether Chair Powell’s dream team

Will cut twenty-five

And try to contrive

A reason a half’s a pipe dream

But there’s something getting no press

The balance sheet shrinking process

They’re still in QT

But what if QE

Is something they’ll now reassess?

With all the data of note now passed (PPI was largely in line although tending a bit higher than forecast) and the ECB having cut their deposit facility rate by 25bps, as widely expected, the market discussion is now on whether the Fed will cut by one-quarter or one-half percent next week. The Fed funds futures market, which you may recall had been pricing as little as a 15% probability for that 50bp cut earlier this week, is currently a coin toss between the two outcomes. In addition, the Fed whisperer, Nick Timiraos of the WSJ, had a front page article on the subject this morning, although he drew no conclusions.

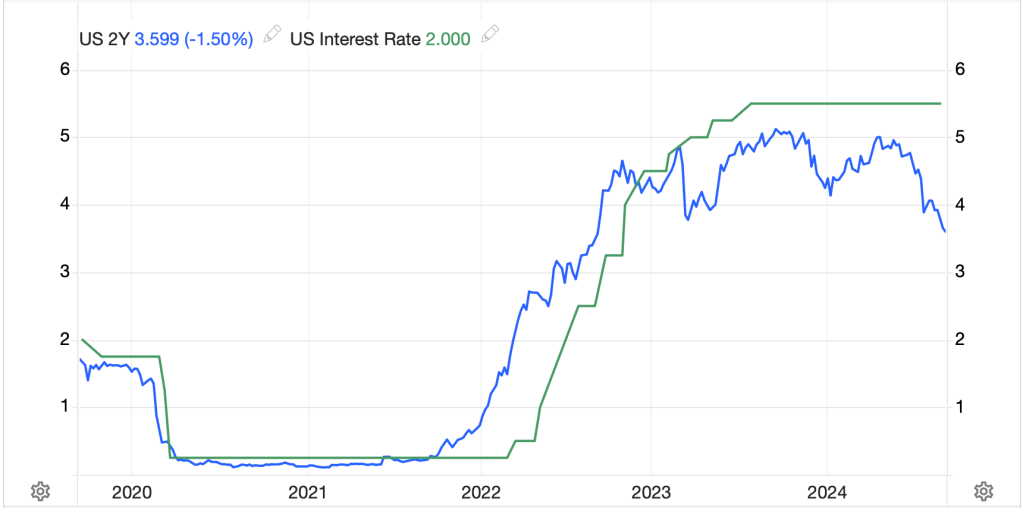

But something that is getting virtually no airtime is the Fed’s balance sheet and its ongoing shrinkage. You may recall that the current level of QT is $25 billion/month, which was reduced from the original amount of $60 billion/month back in June as the FOMC started to grow cautious regarding the appropriate amount of reserves and liquidity in the system.

The issue is nobody knows what number constitutes the right amount of reserves. Fed research is of the belief that somewhere between 10% and 12% of GDP (currently about $2.7 trillion to $3.3 trillion) should be sufficient to ensure that economic activity does not grind lower due to a lack of liquidity. This has been the rationale behind the slow reduction in balance sheet assets. But that research may not be accurate, and the underlying assumption was that the economy continued to grow at its trend rate. In the event of a slowdown or recession, you can be sure that the Fed will add liquidity back as well as cut rates.

Now, working against my thesis is the Fed has not discussed this idea at all, at least publicly, and so a complete surprise is not their typical MO. However, they have found themselves in a place where the market is pricing in more than 100 basis points of cuts over the next three meetings, including next week’s, which if they stick to their 25bp increments, means that one of these meetings needs a 50bp cut. As I have written before, the bond market is pricing nearly 200bps of cuts in the next two years (see chart below), which would indicate that the likelihood of an economic slowdown is high.

Source: tradingeconomics.com

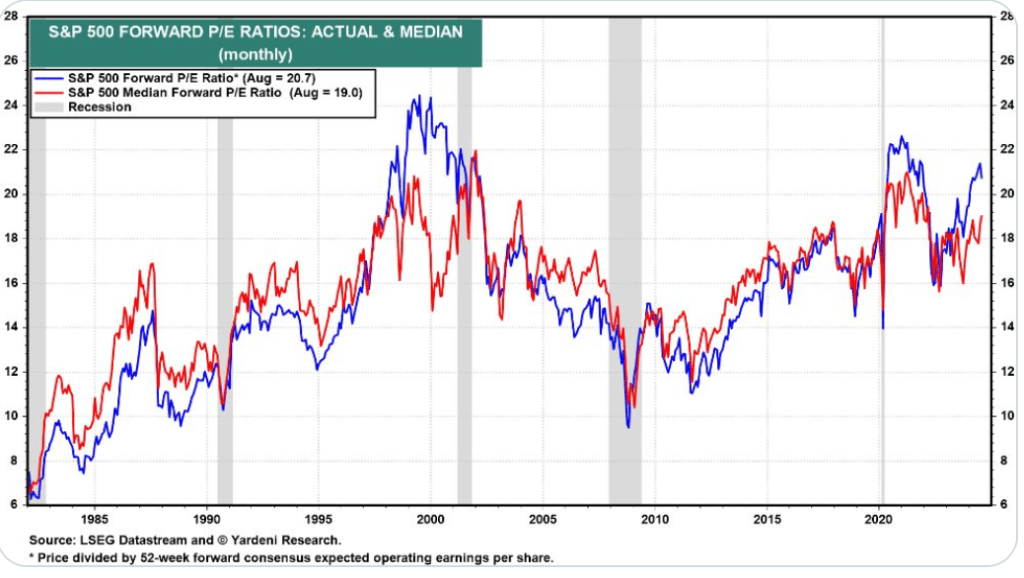

At the same time, equity markets are trading near all-time highs with earnings estimates indicating that economic growth expectations remain quite robust. Both of those scenarios cannot be true at the same time.

Source: LSEG

This is the landscape through which Chairman Powell must navigate the Fed’s policies as well as his communication of those policies. In Jackson Hole, he virtually promised a rate cut was coming next week, and one is certainly on its way. The magnitude of that cut, though, will offer the best clues as to the Fed’s thinking with respect to the future trajectory of the economy and which market, stocks or bonds, is right.

There is one other thing to consider, though, as an investor. Given the bond market is pricing a significant slowdown, if that is your view, bonds will not offer much return if you are correct. And if you are wrong, and growth is strong, it will be ugly. Similarly, if you are of the view that there is no recession, but rather a soft- or no-landing is the likely outcome, then being long stocks, which have already priced for that outcome will likely have only a modest benefit. However, in the event that the economy does fold and recession arrives, stocks are likely to sell-off sharply. Arguably, the best positioning for a trader is to be short both stocks and bonds, as whichever outcome prevails, one asset will fall substantially while the other has limited upside, at least for a while. For a hedger, this is the time that options make a lot of sense as the asymmetry they provide is what allows a hedger to prevent locking in the worst outcomes.

Ok, with that behind us, let’s look at the overnight session to see how things followed yesterday’s risk rally in the US. In Asia, the Nikkei (-0.7%) has been struggling lately on the back of continued JPY strength. As you can see from the below chart, that relationship has been pretty strong for a while, and last night, USDJPY traded to new lows for the year, erasing the entire gain (yen decline) that peaked at the end of June.

Source: tradingeconomics.com

As to the rest of Asia, mainland Chinese shares (CSI 300 -0.4%) continue to underperform although HK shares managed a rally (+0.75%) while most of the rest of the region showed very modest strength, certainly nothing like the US performance, but at least in the green. In Europe, equity markets are all higher this morning with Spain’s IBEX (+0.8%) leading the way although solid gains of 0.3% – 0.5% prevalent elsewhere. As to US futures, at this hour (7:45) they are creeping higher by about 0.1%.

In the bond market, Treasury yields are lower by 2bps this morning and European sovereign yields are generally little changed to lower by 2bps across the continent. Yesterday’s ECB outcome was universally expected, and Madame Lagarde explained they remain data dependent and promised no timeline for potential further rate cuts, if they are even to come (they will). As to JGB yields, they too fell 2bps last night, once again confusing those who are looking for policy tightening in Tokyo.

In the commodity markets, oil (+1.4%) is rallying for the third consecutive day as Hurricane Francine shut in about 40% of gulf production and the timing of its return is still uncertain. Despite the US equity markets’ clear economic bullishness, the weak growth/demand story is still a major part of this discussion. In the metals markets, gold (+0.3% overnight, +3.2% in the past week) continues to set new price records daily with a story making the rounds that SAMA, Saudi Arabia’s central bank, secretly bought 160 tons of gold last quarter, soaking up much supply. This has helped drag silver back above $30/oz although copper (-0.5%) is stumbling a bit this morning.

Finally, it should be no surprise that the dollar is under some pressure this morning as the talk of more aggressive Fed easing grows. While the euro and pound are little changed, JPY (+0.5%) is leading the way in the G10 with AUD (+0.45%), NZD (+0.4%), NOK (+0.2%) and SEK (+0.3%) all firmer on the back of commodity strength. In the EMG bloc, the story is a bit more nuanced with ZAR (-0.15%) bucking the trend on domestic political concerns, although we saw strength in KRW (+0.5%) overnight and MXN (+0.35%) as the Fed rate cut story plays out across most currencies.

On the data front, only Michigan Sentiment (exp 68.0) is on the docket so once again, the dollar will be subject to the equity market behavior and the strength of narrative regarding just how dovish the Fed will wind up behaving next week. I will say that a 50bp cut is likely to see some short-term dollar weakness, probably enough for it to fall to multi-year lows vs. its major counterparts. But remember, if the Fed starts getting aggressive, other central banks will feel comfortable following that lead, so the dollar’s weakness may not be that long-lived.

Good luck and good weekend

Adf