In England they call it the pence

But now it just doesn’t make sense

While pennies will still

Live in the cash till

We’ll speak of them in the past tense

And as to the shutdown, Trump signed

The CR to leave it behind

While this is good news

It won’t change the views

Of those who are not Trump aligned

For 230 years, the penny was a staple of the US currency system with more than 300 billion currently in circulation. Of course, I don’t know that I would call them in circulation as they are generally sitting next to the cashier in a dish to be used since most folks don’t want to deal with them, or in a jar in the bedroom where they remain as people cannot throw out something valuable, but don’t want to bother with them either. Let’s say they are in existence. But given the rise in the price of copper, as well as the rise in general inflation, the Treasury estimates that it costs about 3.7 cents to mint each one, obviously a losing trade. While they will remain legal tender, be prepared for everything to be rounded to the nearest nickel soon. I guess there is no better description of inflation than the fact that the penny has outlived its useful life. An interesting tidbit, the last coin discontinued by the Mint was the half-penny, which ended in 1857.

On to more important things, last night, President Trump signed the CR and ended the government shutdown. It strikes me this was a whole lot of politics with no substantive changes to anything. But it, too, is now history and we move on. It was interesting to me that there was not a broad “sell the news” outcome as the equity rally early in the week appeared to be based on the prospects that this would occur. Perhaps that will be today’s trade, although the futures at this hour (7:00) are little changed. But no matter, there appear to be an increasing number of cracks in the façade of ever higher asset prices. While the DJIA did set another record yesterday, the NASDAQ slipped. I don’t foresee a smooth path ahead for risk assets, especially with havens continuing to perform well.

The last thing of note this morning was Chinese monetary data which was released last night. Remember yesterday’s story about the ‘phantom’ loans? Well, apparently, that has not been enough to keep the flywheel turning on the mainland as New Bank Loans fell to CNY220 billion, down more than CNY 1 trillion from September and well below last year’s October data of CNY 500 billion as per the chart below from tradingecomomics.com. There is huge seasonality in this data, with every January showing massive growth, but looking at the past three years of data, my eye tells me things are slowing regularly despite their alleged 5% GDP growth.

Despite the 4th Plenum declaring they would be focusing on increasing domestic economic activity, President Xi continues to have a difficult time growing the economy organically. The ongoing GDP targets warp investment decisions which result in overproduction of goods and massive infrastructure spending which drives up debt issuance. The problem with this cycle is the lack of domestic consumption means that the returns on that infrastructure are terrible, likely negative, and so while building the stuff increases GDP, having it sit there idle doesn’t do anything once its built. For now, investors continue to believe in the growth story, and I’m confident that Xi Jinping will never allow economic data to be released that would counter that narrative, but trouble is brewing there in my mind. Just not today!

And that’s really the news this morning, at least from what I’ve seen, so let’s look at markets overnight. The official end of the government shutdown was widely lauded in Asia with Tokyo (+0.4%), HK (+0.6%) and China (+1.2%) all closing higher in the session. Korea (+0.5%) also rallied but elsewhere in Asia, things were less satisfactory with Australia, New Zealand and Taiwan all under modest pressure while India was unchanged.

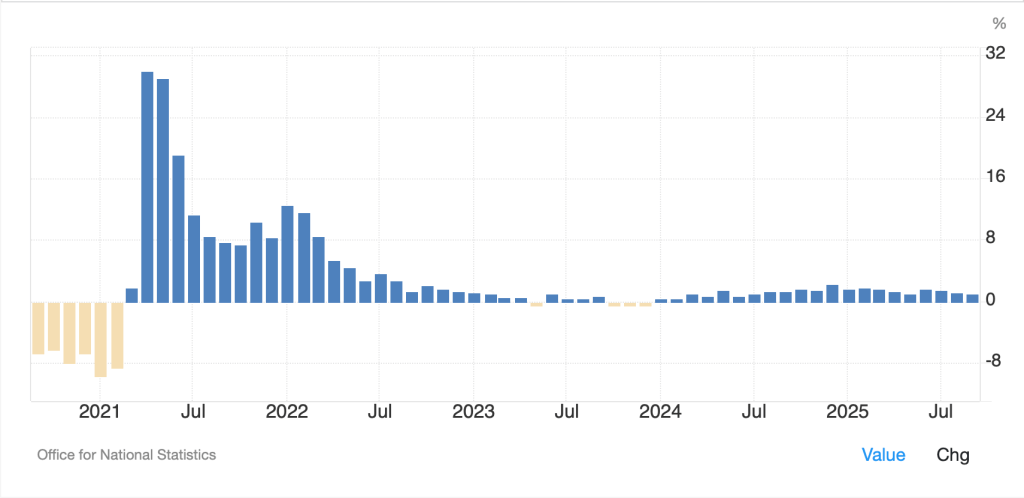

In Europe, the FTSE 100 (-0.6%) is slipping after weaker than expected GDP data with the Y/Y number slipping to 1.1% while IP fell -2.5%. It is difficult to look at the chart of GDP below and get the sense that the UK economy is in very good shape.

Source: tradingeconomics.com

All this is with the backdrop of the Starmer government getting set to release its latest budget in just under two weeks and expectations they are going to be raising income taxes yet again as revenues cannot keep up with their welfare state promises. The problem they have is the pound is not the global reserve currency nor are Gilts the global reserve asset, so it appears the Gilt vigilantes are alive and well although the bond vigilantes remain in hibernation. As to the continent, the DAX (-0.6%) is also suffering despite no data releases while the CAC (+0.4%) is managing to rally. The rest of the bourses are generally little changed with all eyes focused on the UK to see how they handle their problems. Of course, virtually every country on the continent has the same problems!

In the bond market, after sliding -4bps yesterday, 10-year Treasury yields have backed up 2bps this morning. we are seeing similar price action on the continent with virtually all sovereign debt showing rises of between 1bp (France) and 3bps (Germany, Netherlands), once again mostly tracking the Treasury market.

In the commodity space, oil (+0.7%) is bouncing after a disastrous session yesterday where it fell nearly $2/bbl on news that the IEA increased its supply forecasts (2.5 MM bbl/day) significantly more than its demand forecasts (780K bbl/day). Certainly, this is aligned with my longer-term bearish view on oil and a look at the chart below shows the trend over the past year remains firmly downward. Do not be surprised if we get to $50/bbl next year.

Source: tradingeconomics.com

Turning to the metals markets, the rally continues across base and precious this morning and this steady climb after a sharp pullback a few weeks ago seems to have real legs. This morning, we see gold (+1.0%), silver (+1.3% and pushing its recent ATH), copper (+0.9% despite the loss of penny demand) and platinum (+1.2%). When governments run it hot, precious metals benefit.

Finally, the dollar is softer this morning with the DXY (-0.25%) slipping back to the middle of its narrowing trading range as per the below chart.

Source: tradingeconomics.com

The weakness is universal, though with G10 and EMG currencies stronger across the board. ZAR (+0.6%) is the leader today as the dollar has fallen back below 17.00 for the first time since January 2023 as it continues to benefit from the rally in gold and platinum.

Source: tradingeconomics.com

It strikes me that if one were so inclined to play a long-term trend in currencies, long ZAR vs. short NOK might be a very interesting way to play the dichotomy between oil’s ongoing decline and gold’s ongoing rally. But everything is firmer vs. the dollar with the pound (+0.3%), euro (+0.2%) and AUD (+0.3%) highlighting the G10. In the EMG bloc, CLP (+0.5%) is benefitting from copper’s rally while the CE4 are all higher by 0.3% to 0.4%, mirroring the euro’s rise. Even CNY (+0.25%) is higher despite the weak monetary data. Not to be outdone, both MXN (+0.2%) and BRL (+0.3%) are in thrall to a weaker dollar.

While the government is open now, given the closure, no data has been collected so it is not yet clear when we will be seeing the next set of numbers. Yesterday’s Fedspeak showed caution the watchword regarding more cuts which has led the futures market to reduce the probability of a December cut to just 54% this morning and a definite change in flavor for the curve overall. It is somewhat surprising that the dollar is not performing better given this adjustment in views.

Equity prices feel extended and the fear and greed index continues to sit in extreme fear despite the seemingly daily record highs. I am uncomfortable with stocks overall here and believe they are due for a reckoning, or at least a correction. But metals have nowhere to go but up.

Good luck

Adf

“If you have no ha-penny then God bless you.”