There once was a Treasury note Whose yield every trader could quote Of late, its price dive To yields above five Has tongues wagging while bond bears gloat Now, looking ahead I expect This rise in yields could architect More problems worldwide As risk assets slide And equity markets get wrecked

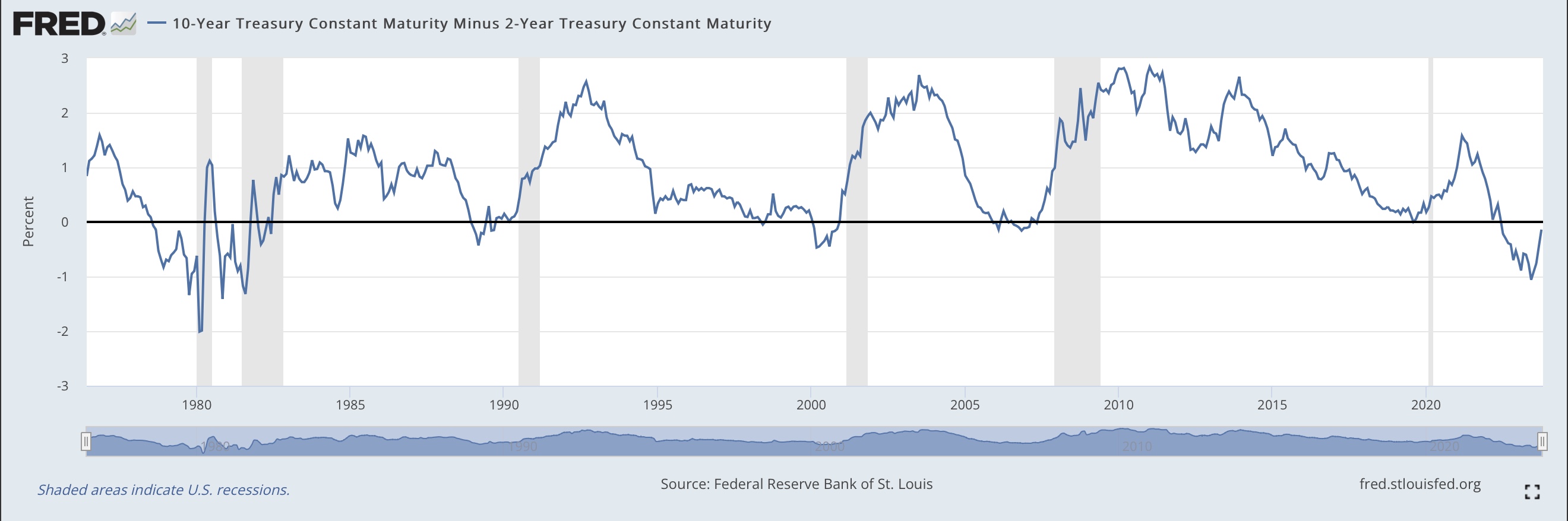

There is only one story in financial markets today, and that is the fact that the 10-year US Treasury note is now yielding above 5.0%. We briefly touched that level last Thursday, and then saw a pullback in yields on Friday, but today there is no question about a breach of that key psychological level. As a corollary to that price action, the 2yr-10yr spread is down to -12bps and looks quite clearly as though it is going to complete the normalization process this week. The real question is, how much further will it steepen? A quick look at the chart below from the St Louis Fed’s FRED database shows that the average steepness of this spread is somewhere around +100bps. The implication is that if the Fed continues to hold Fed funds at their current level, and higher for longer is the way forward, then 10-year Treasury yields could easily head to 6.00% and simply be back to their long-term relationship with the 2-year Treasury.

The other thing to note is why there is so much focus on the shape of the yield curve. As you can see from the shaded gray areas on this chart, every recession was preceded by a curve inversion (negative 2yr-10yr spread) but then when the recession was in process, the curve was steepening dramatically. It is this history that has economists and analysts concerned given the speed with which the curve is steepening of late.

And yet…two headlines in the WSJ this morning show a completely opposite expectation. “A Recession is no Longer the Consensus” is one of them, explaining a survey of economists now shows that fewer than half anticipate a recession will arrive at all, let alone soon. In addition, we have “The Economy was Supposed to Slow by Now. Instead it’s Revving Up” which describes the fact that recent data has been firmer than expected (see Retail Sales and NFP earlier this month) and now the proverbial soft landing is the new consensus call.

Now, maybe this time really will be different, but that is always a hard pill to swallow. There are many things that continue to haunt the economy with respect to things like bank lending standards tightening and consumer debt and delinquencies rising, neither a sign of economic strength. In fact, there was a terrific note published this weekend on Substack by GrahamsBenjamins going into more detail. The point is that there is a significant amount of economic stress in the economy and that combined with the rapid steepening of the yield curve has always been a sign of a looming recession. And folks, if (when?) that recession arrives, you can be confident that risk assets are going to decline sharply in value. Just sayin!

Ok, with that cheery opening, let’s see how markets have behaved overnight. Following last week’s lousy price action in the US, Asian shares were lower across the board, somewhere between -0.75% and -1.0% while European bourses are also lower, perhaps a little less dramatically, with an average decline on the order of -0.5%. US futures, too, are in the red, -0.6% or so at this hour (7:15), and not feeling very good.

Meanwhile, we already know the Treasury story, but it is important to understand that European sovereign yields are also rising rapidly, with most of them higher between 4bps and 6bps this morning. That critical Bund-BTP spread continues to trade just north of 200bps and holds the potential to be quite destabilizing if it widens much further. As well, we saw JGB yields creep up 2bps and are now at 0.85%. Inflation in Japan has been above 3.0% for the past 14 months, and more and more analysts are concluding the BOJ is going to have to tweak their policy yet again. There is far more to the bond market than just Treasuries, although Treasuries are clearly still story number one.

On the commodity front, oil (-0.6%) is a bit softer this morning although this seems a consolidation of last week’s strength. The biggest question in this market is the tension between the possible recession and a corresponding reduction in demand, and the structural supply shortages that are currently being exacerbated by the Saudi and Russian production cuts. My money is still on higher prices over time. Meanwhile, gold is little changed this morning, holding up quite well in the face of rising yields and seeming to be showcasing its haven status of late. As to the base metals, both copper and aluminum continue to grind lower with copper having fallen to its lowest level in a year and seemingly an indication of economic weakness to come.

Finally, the dollar is mixed to slightly softer this morning although slightly is the operative word. Looking across the G10 currencies, the Skandies are under a bit of pressure, but the majors are essentially unchanged. The real news is that the correlation between the dollar and Treasury yields seems to be disintegrating. If that is changing, then there are certainly many reasons to believe the dollar can decline given the US fiscal situation and the continuous growth in the US debt portfolio. As is often said, nothing matters until it matters. Throughout my entire career, spanning > 40 years, there has been a constant drumbeat of how the dollar should decline because of the massive budget and trade deficits that the US has run consistently. And that drumbeat has been studiously ignored for all that time. But perhaps, it will soon matter. While that is not my base forecast, one has to assign that outcome some real probability.

On the data front this week, this is what we see:

| Today | Chicago Fed National Activity | -0.16 |

| Tuesday | Flash PMI Manufacturing | 49.5 |

| Flash PMI Services | 49.9 | |

| Wednesday | New Home Sales | 680K |

| Thursday | Initial Claims | 209K |

| Continuing Claims | 1720K | |

| Durable Goods | 1.5% | |

| -ex Transport | 0.2% | |

| GDP Q3 | 4.2% | |

| Friday | Personal income | 0.4% |

| Personal Spending | 0.5% | |

| Core PCE | 0.3% (3.7% Y/Y) | |

| Michigan Sentiment | 63.0 |

Source: Tradingeconomics.com

Weirdly, while the Fed is supposed to be in its quiet period, I see three speeches scheduled, with Chairman Powell ostensibly speaking Wednesday afternoon. I will need to confirm that as it would be highly unusual at this time.

It seems to me the big question is whether the dollar – rates correlation is breaking down. If that is the case, then I will need to rethink, and likely adjust, my views of a stronger dollar over time, at least vs. the majors. But tick by tick price action is not necessary for the relationship to generally hold. I still like the dollar over time but am certainly going to review the situation more closely to see if something truly has changed.

Good luck

Adf