The doldrums of summer are here

And just like occurs every year

Most markets compress

As pundits profess

The future, for them’s, crystal clear

But truthfully, nobody knows

The things, the next week will disclose

While there is no doubt

Big change is about

T’will likely be months (years?) til it shows

I wish there was something interesting to discuss this morning in any market, but the reality is some days the news feed has nothing of note. Surveying the headlines shows that despite the tariff uncertainty, equity markets (as per the MSCI All-Country World Index) traded to new all-time highs.

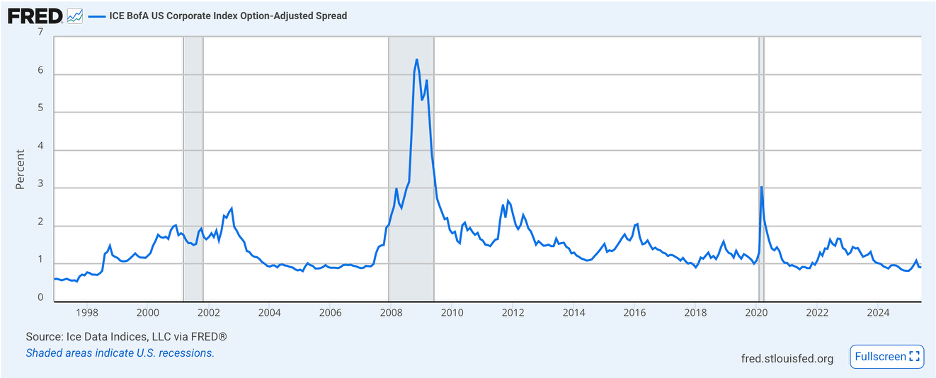

Maybe tariffs are not going to be the end of the world after all. Adding to this story is the fact that corporate credit spreads continue to compress, a clear signal that concerns over future economic activity are not that significant. A look at the chart below shows that the current level, below 100bps, is the exception, not the rule when it comes to perceptions of debt risk. In fact, the current reading of 0.91% is in the 13th percentile, well below the long-term average of 1.49% and median of 1.29%. My point is, although the political lens through which so much news is presented continues to scream that everything the Trump administration is doing is an existential threat to the global economy, it appears a majority of investors have taken a different view.

So, I guess it’s good times for all. In other markets, the dollar’s recent modest weakness continues to be highlighted as the beginning of the end of its reserve currency status and another existential threat to the US. But again, one cannot look at a long-term chart of the euro and believe that we are on the edge of the precipice. The EUR/USD exchange rate has been both much higher and much lower during the euro’s lifetime which began back in 1999.

It’s summer, folks, and oftentimes throughout my career, that signaled a significant reduction in market activity, liquidity and overall movement. This is not to say that something untoward cannot occur before Labor Day, but perhaps this year will see a summer lull. If pressed, I would say that the key risks to the idea of a true summer of doldrums would be a significant increase in the probability of a global conflagration, where both the Russia/Ukraine and Iran talks go off the rails with more kinetic activity in either or both places. Certainly, if China were to invade Taiwan, that would change things. And perhaps, if the Big Beautiful Bill fails to be enacted, prospects for the US economy would decline as tax rates would rise dramatically. My take is that would not be good for either stocks or bonds, and probably not for the dollar either.

History, however, tells us that assuming little or no change is the best bet for the immediate future, so I don’t see any of those things happening. In fact, my take is financial markets are becoming inured to most of President Trump’s pronouncements at this stage. Given the movement we have seen in equities and credit spreads, it appears to me there is already a strong assumption of some trade deals to be announced in the near future. Maybe that will be a ‘sell the news’ event. But for now, there is precious little about which to get excited.

So, let’s see how things behaved overnight. It oughtn’t be surprising that equity markets around the world are higher since the MSCI Index, as mentioned above, is setting records. So, solid gains in the US yesterday were followed by similar type gains in Asia (Japan +0.8%, HK +0.6%, China +0.4%, Australia +0.9%) with the latter rising despite weaker than expected GDP growth in Q1 of 1.3%. In Europe, too, gains are the general order of the day with Germany (+0.5%) and France (+0.5%) both in fine fettle although Spain (-0.3%) is today’s aberration as PMI data there was weaker than expected (perhaps the blackout had a negative impact!). I guess we oughtn’t be surprised that US futures are pointing slightly higher at this hour as well.

In the bond market, apparently everybody took Ambien today as yields are within 1bp of yesterday’s closing levels in the US, Europe and Asia. I will take this as no news is good news.

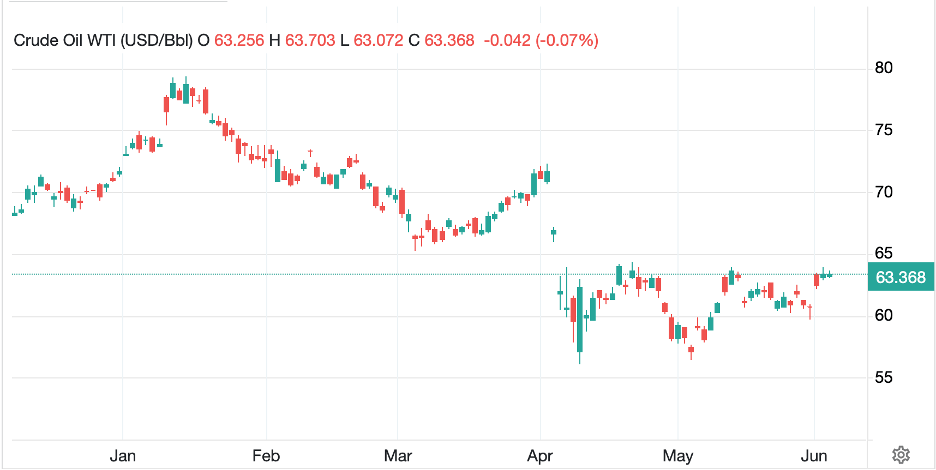

In the commodity complex, oil is stuck near its recent highs and unchanged on the day. Some might argue this is a triple top as per the chart below, where a break higher would target something on the order of $70/bbl and closing that huge gap from April. However, given the general lack of activity, there doesn’t seem an obvious catalyst for that type of move.

Source: tradingeconomics.com

As to the metals markets, the extra bond market Ambien was distributed to those traders.

Finally, the dollar is mixed with the overall situation, at least as defined by the DXY, unchanged. So, AUD (+0.4%) has rallied a bit while JPY (-0.2%) is sliding a bit. In fact, most currencies are within 0.2% of yesterday’s closing levels although NOK (+0.5%) is today’s big winner as continued support in the oil market helps the krone. But there is nothing to get excited about here either.

On the data front, ADP Employment (exp 115K) is probably the most interesting number although we also get ISM Services (52.0) and then the EIA oil inventory data with a modest build expected across products. The BOC meets and nobody expects any policy rate change there and Atlanta Fed president Bostic speaks, but again, who cares at this point?

Quiet is the name of today’s game. It wouldn’t surprise me if that is the rest of the week’s MO as well, although at some point, we will definitely see a break in one market that is likely to be contagious. Until then…,

Good luck

adf