The OECD has released Its forecasts for West and for East Alas what they’ve said Is looking ahead The growth story’s somewhat decreased

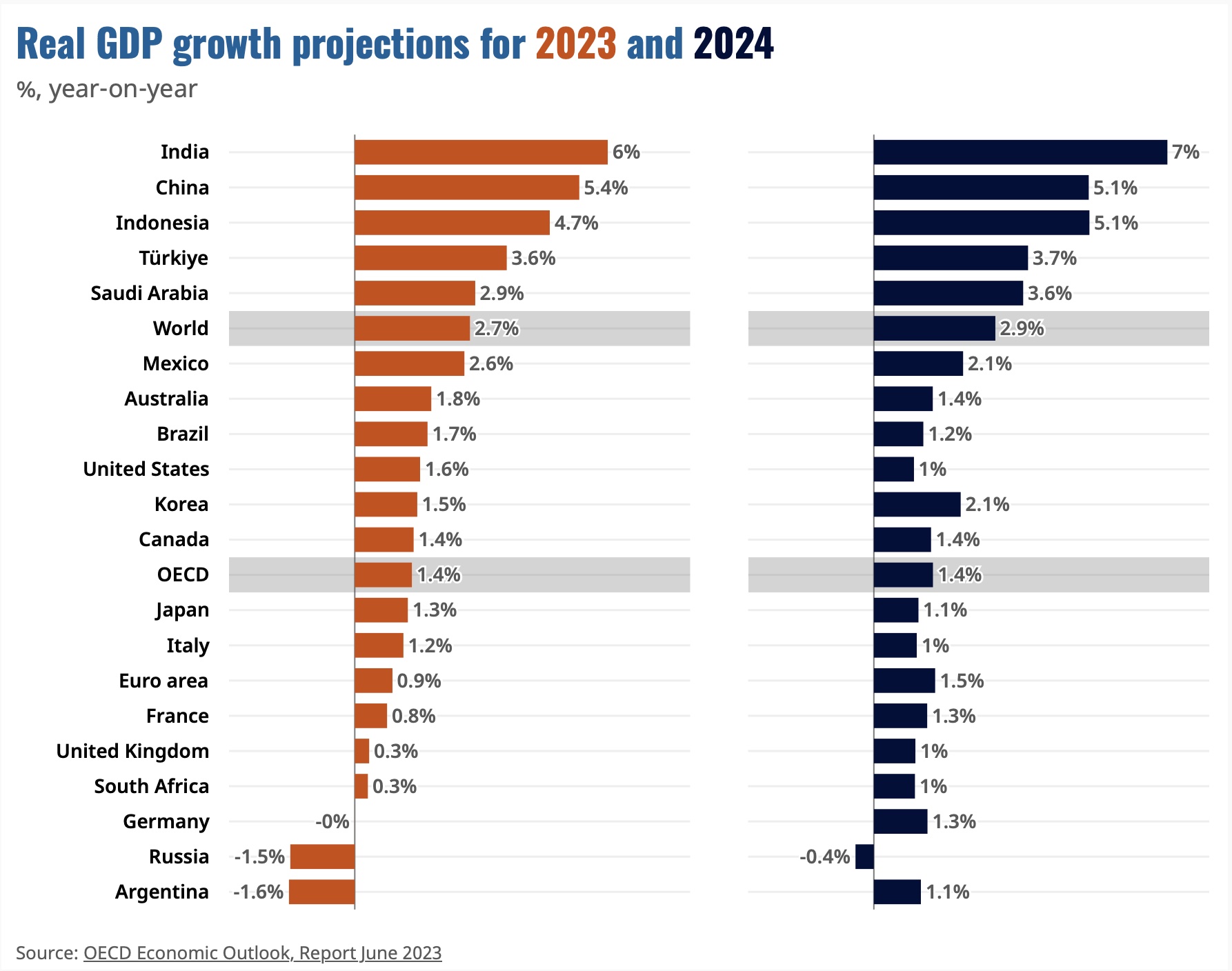

It’s another extremely dull day in markets as the passing of the debt ceiling crisis has left traders and investors looking for anything new at all to help catalyze trading ideas. Granted, all market participants are anxiously awaiting next Wednesday’s FOMC meeting, but there is a lot of time between now and then to fill. As there was a dearth of new data of importance overnight, the talk of the market is the OECD’s release of their June 2023 Report on global GDP growth as per the below:

In truth, it does not make for great reading as the estimates point to continued subdued growth, well below the pre-pandemic average of 3.4% globally. As well, they highlight that this slower growth trajectory will be matched with higher inflation (exp 6.6% in 2023 and 4.3% in 2024), a truly unenviable situation. Of course, just like every forecast, these must be taken with a grain of salt as the one thing we know about forecasting is…it’s really hard, especially about the future. It is not clear that anybody altered their views on anything after the release of the report, but it has been the talk of the town.

Aside from that, I must follow up on a comment from yesterday’s note regarding the interest rate adjustments made in China, as it seems there is even more nuance involved. The big 4 Chinese banks have reduced their onshore deposit rates for USD by about 30bps to try to discourage dollar hoarding and incremental additions to the carry trade. With US rates now above 5%, the carry opportunity to hold dollars relative to renminbi has been quite significant and has been a key driver of the renminbi’s weakness this year. In fact, from the renminbi’s high point this year in mid-January, it has weakened nearly 6.6%, which is quite far for a currency that traditionally runs with about a 4% annualized volatility.

One other thing to consider here is that the fact that Chinese banks had to lower their USD deposit rates in order to discourage the owning of dollars seems at odds with the idea that the Chinese are getting out of their dollar holdings. Rather, it might be a signal that the Chinese people, regardless of what their government may want, seem pretty comfortable holding the greenback.

And, my goodness, there is virtually nothing else marketwise to discuss from the overnight session. Equity markets have been generally quiet overall, with modest gains or losses following yesterday’s very modest US rally. Major European bourses are +/- 0.1% on the day although we did see the Nikkei fall -1.8% overnight, arguably on the back of the latest Policy proposal by PM Kishida which calls for more spending and debt.

Bond markets are also quite subdued with yields edging slightly higher in most places, but just on the order of 1bp-2bps, hardly a worry. The one noteworthy thing here is now that the debt ceiling has been suspended, the Treasury issued just under $400 billion in T-bills yesterday and is likely to continue on that pace for the rest of the month as they refill the TGA. The market impact is that the curve’s inversion is increasing with 2yr-10yr now back to -83bps and seemingly heading far lower again. A test of -100bps seems entirely likely here. Meanwhile, the 3m-10yr spread is -163bps, which is far below the levels seen even in the 1970’s and 1980’s during Volcker’s time in office. Given the amount of issuance likely still forthcoming, I suspect this can fall further still. It is not clear to me that this is a positive for the market.

Turning to commodities, oil (+1.1%) is rebounding slightly as it retraces yesterday’s losses while metals markets are a bit more positive today with copper (+0.5%) and aluminum (+0.75%) both rebounding although gold is little changed on the day. I sense that part of this is related to the dollar softening a bit, as the growth story just does not seem that positive.

Speaking of the dollar, other than vs. the Turkish lira, which has collapsed nearly 7% this morning after President Erdogan’s new government took office, it is generally a bit softer on the day. With oil’s rebound, NOK (+0.8%) is leading the G10 higher followed by SEK (+0.6%) and AUD (+0.4%) on broader commodity strength, but the whole bloc is firmer. In the EMG bloc, ZAR (+1.0%) is the leader, also on better commodity pricing as well as an increasingly positive outlook on the power situation there, followed by the rest of the bloc (save TRY) edging up between 0.1% and 0.3%. There really aren’t any other good stories there.

And that’s all she wrote. This morning we see the Trade Balance (exp -$75.8B) and this afternoon, Consumer Credit ($22.0B), but these days, neither of those is likely to matter to the trading community. I expect another dull day, and potentially a whole week of dull until the CPI data next Tuesday and then the FOMC meeting on Wednesday. At this stage, the medium-term trend is for modest dollar strength, but on a given day, there doesn’t seem to be much directional impetus in either direction.

Good luck

Adf