Apparently President Xi Is keen to continue to be The story du jour While finding a cure For China and its ‘conomy But elsewhere, the market’s fixation Is central bank communication Tomorrow, Chair Jay Seems likely to say They’ve not yet defeated inflation

The story in China continues to be one of weakening economic activity and a government that is increasingly desperate to address the situation while maintaining their iron grip on everything that occurs in the country. Of course, the problem with this thesis is that economic activity works far better without government interference, but that is the bed they have made. At any rate, the word out of the CCP’s Politburo is that more support is coming with expectations now for lower interest rates as well as still looser property investment policies. While it seems they don’t want to make direct cash injections into the economy yet, that appears to be the next step.

However, the announcements last night were sufficient for a bullish slant on everything China along with positive knock-on effects for those nations that are heavily reliant on a strong China for their own economic progress. The result is that we saw dramatic strength in Chinese equity markets with the Hang Seng (+4.1%) and CSI (+2.9%) both having their best days in months. Even with these moves, though, the Hang Seng remains more than 37% below its 2021 highs while the CSI is about 34% off those levels. The point is that while last night’s session was quite positive, belief in the Chinese economic story remains a bit suspect yet.

Elsewhere, however, the PBOC is doing its level best to prevent the renminbi from declining sharply as they set the fix nearly 1% stronger than expected based on analysts’ models, and ultimately, the currency closed 0.6% stronger on the session. Now, it remains well above the 7.00 level, but it seems quite clear that Pan Gongsheng, the freshly appointed PBOC governor, is making a statement that the renminbi should not fall dramatically. I suspect that if the Chinese economy continues to flounder, that attitude may change, but for now, that is the party line. As such, it should be no surprise that the rest of the APAC currency bloc performed well last night, along with AUD (+0.3%) the best G10 performer.

But away from that story, the market’s attention is turning almost entirely to the trio of central bank meetings that are starting with announcements due tomorrow afternoon (Fed), Thursday morning (ECB), and Thursday night late (BOJ). Let us begin with the Fed, where the meeting commences shortly, and they are set to discuss the current situation in the economy as well as how things have changed since their June meeting and what their forecasts for the future look like.

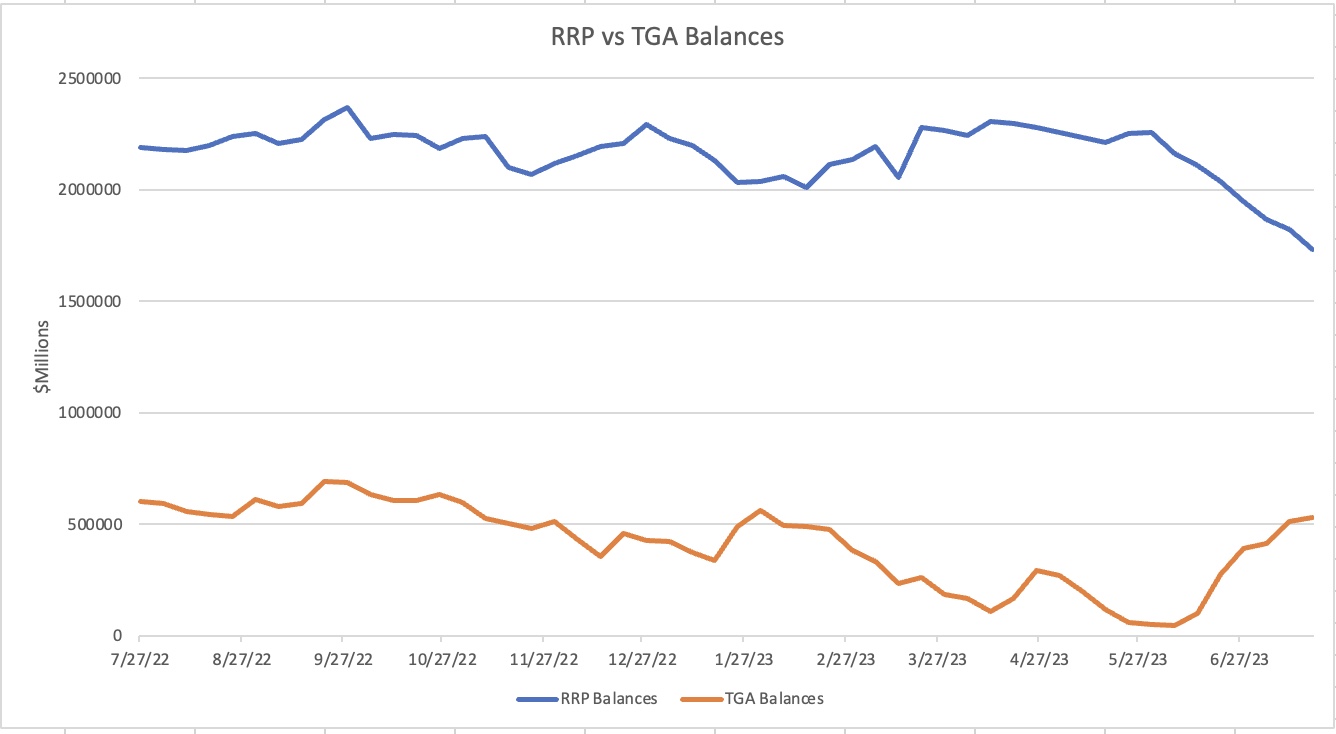

One area that is worth discussing is the Fed’s Reverse Repurchase Program (RRP or reverse repo) which serves as a low-risk investment outlet for excess funds in the system. Prior to the debt ceiling crisis, there was a great deal of concern that when the Treasury started to issue T-bills to refill the Treasury General Account, the government’s checking account, the liquidity to buy those bills might come out of the stock market and undermine the stock market rally. But there was another potential source, the RRP program, which prior to the debt deal had more than $2.3 trillion parked, mostly cash held by Money market funds. However, since the TGA bottomed at the end of May, and the Treasury has been issuing T-bills at a record rate, it turns out that the entire TGA balance has been filled by a reduction in RRP. In other words, there has been no liquidity drain from the markets, writ large, hence the equity markets continued ability to rally. That amount has been approximately $500 Billion. (See chart below with data from Bloomberg and the poet’s calculations)

Of course, there is a cost to this, and that is that the Treasury has been paying a higher yield on T-bills than those money market funds could get in the RRP market, and that, my friends, is adding to the already gargantuan budget deficit. Since the start of this process, 3mo T-bill yields have risen 50bps, right alongside the Fed funds rate. In essence, the Treasury is paying to keep the stock market higher.

There is another short-dated money issue and that is Interest on Reserves, the rate the Fed pays banks for excess reserves that are held at the Fed. That is currently set at 5.15%, between the Fed’s 5.00% to 5.25% band for Fed funds. One subtle tweak the Fed could make is to alter that relative level when they raise rates tomorrow in an attempt to adjust the amount that is held there. After all, other uses for those funds could be satisfying loan demand assuming that existed. Arguably, a lowering of that rate would imply the Fed is seeking fewer excess reserves in the system, somewhat of a tightening exercise.

At this stage, the 25bp rate hike is baked in the cake and is assumed by virtually every analyst with just 5 of the 108 analysts surveyed by Bloomberg calling for no hike. Futures markets are pricing a 97% probability as well, so the reality is that all the action will be in the press conference as well as any new tweaks to the statement. In my view, there has not yet been enough evidence of a considered slowing in inflation for the Fed to change its tune, but by the September meeting, we will have seen a lot more data and depending on how that plays out, things could be different. But not this month.

Heading into this morning’s session, that Chinese stock rally was not really widely followed elsewhere as the Nikkei was unchanged and most of Europe is higher by just basis points. That minimal movement is true in US futures as well.

Bond yields are a touch firmer, about 2bps across Treasuries and virtually the entire European space with only Italy (+4bps) an outlier. The only data of note was the German IFO report, which was on the soft side, but not dramatically so. I suspect that the yield move is in anticipation of the coming central bank activities.

In the commodity space, after another rally yesterday, oil is essentially unchanged and consolidating its recent gains. However, the base metals have rallied sharply on the back of the China news with copper higher by almost 2% and aluminum by 1%. Meanwhile, gold continues to trade in a very narrow range just below $2000/oz.

Finally, the dollar is slightly firmer this morning overall as the China story did not bleed over into any other areas and traders seem to be adjusting positions ahead of the Fed meeting. Surprisingly, NOK (-0.6%) is the worst performer despite oil’s recent gains, but elsewhere, in both the G10 and EMG, it is modest dollar strength around.

This morning we see Case Shiller Home Prices (exp -2.35%) and then the Consumer Confidence reading (112.0) although typically, these do not move markets. With no Fed speakers, the ongoing earnings calendar is likely to be the key driver of markets, although it is not until later this week when we hear from some of the Megacap names that people are getting excited. I suspect there will be little net movement today ahead of tomorrow’s FOMC announcements.

Good luck

Adf