The efforts from Xi haven’t yet For locals, their appetites whet So, more were announced And equities bounced But still there is just too much debt Meanwhile, elsewhere things are subdued As traders have no certitude ‘Bout data this week And if it will wreak More havoc on everyone’s mood

As the week progresses, we will get a raft of data culminating in Friday’s payroll report. But for now, the market is looking elsewhere for its catalysts and China continues to provide fodder for the trading community. Last night, the news hit that Chinese banks were going to be reducing their mortgage rates for mortgages on first homes by up to 60 basis points in order to help support domestic consumption. At the same time, they are also likely to reduce deposit rates by between 5bps and 20bps as they try to maintain their lending margins, but net, it appears the move should free up some cash for the Chinese consumer.

This should certainly be a positive for the nation’s economy and the equity market in China responded accordingly, with the CSI 300 rallying 1.0% while the Hang Seng jumped nearly 2.0%. However, Xi’s actions continue to be small beer, tweaking policies at the margin, while he apparently remains adamantly opposed to any broad fiscal stimulus. Now, in the long-term, this is probably a pretty sensible move for China as they already have a massive amount of debt outstanding, especially in the property market, and if national debt were piled on top, it could lead to much worse long-term outcomes. However, in the short run, a 50bp cut in mortgage rates is unlikely to change consumption patterns by very much, and more domestic consumption is what they need. This is especially true given the ongoing economic weakness in Europe, which has become their largest trading partner.

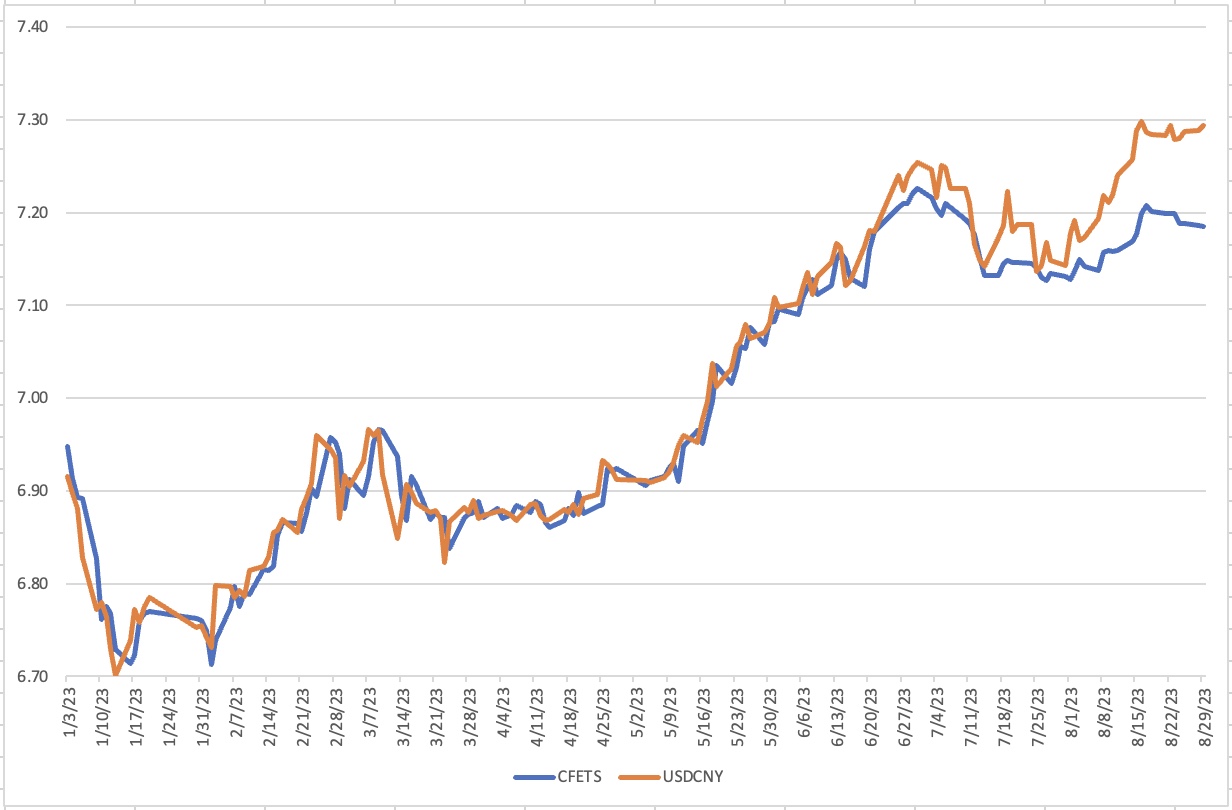

While Xi continues to fiddle with minor policy adjustments, the PBOC is desperately trying to prevent more severe weakness in the renminbi. Last night, for instance, they fixed USDCNY at 7.1851, far below the market’s calculated expectations and 1.65% lower than the market is actually trading. Remember, the onshore rules are that spot can only trade within a +/- 2.0% band compared to that CFETS fix, and it has been pushing that boundary for a while now as can be seen in the chart below (source Bloomberg):

The spread between the blue and orange lines continues to increase, but more importantly, the trends are moving in opposite directions. Given how close the spread already is to the 2% limit, it appears that there is the potential for some fireworks in the future. At this point, I cannot see how the PBOC will not ultimately allow a weaker CNY. This is especially true if (when?) the Fed raises the Fed funds rate again. Nothing has changed my view of 7.50 and beyond.

But, away from the ongoing recalibrations in the Chinese financial systems, there is precious little else on which to focus. Generally, markets seem to have absorbed the idea that the Fed may continue to tighten further and remain resolutely bullish on risk. It seems that the no-landing scenario is the current market fave. And so, last night aside from the Chinese share gains, we saw green everywhere else as well, just not nearly as excited with rises on the order of 0.2% to 0.5%. In Europe, it is also a positive morning with most gains relatively modest, of the 0.3% variety, with only the FTSE 100 (+1.45%) showing more substantial gains as the UK catches up with yesterday’s rally after their bank holiday. Alas, US futures are actually leaning slightly negative this morning, but only just, as traders await the first pieces of data this week. I would contend that the JOLTS data (exp 9.5M) is the most important as a key jobs indicator frequently mentioned by Powell, but we also see Case Shiller Home Prices (-1.60%) and Consumer Confidence (116.0). Things pick up a bit tomorrow with ADP and then GDP on Thursday ahead of NFP on Friday.

In the bond market, lackluster describes things quite well with Treasury yields higher by 1 basis point and even lesser moves across the European sovereign space. JGB’s, meanwhile are starting to drive a bit lower, but continue to hang around near 0.6%. Traders and investors are awaiting this week’s data now that they have absorbed the Fed commentary. If we see a surprisingly strong NFP print, do not be surprised to see yields back up toward their recent highs of 4.35% as many will assume at least one more hike is coming soon. Correspondingly, a soft print will likely see a test of 4.00%, at least initially.

Oil prices continue to hold their own, perhaps getting a boost from the China story as any stimulus there is welcome and seen as a fillip for demand. Metals prices, which had been a touch firmer earlier in the session, have given up those modest gains and at this hour (8:00), are basically flat on the day.

Finally, the dollar is mixed to slightly stronger this morning, but overall movement has been muted, like all the other markets. While NOK (+0.15%) is managing some gains on oil’s strength, the rest of the G10 bloc is a touch softer, although other than JPY (-0.3%), which has managed to trade above 147 this morning, the movement is tiny. In the EMG bloc, there is a more mixed view, but none of the movement is very large in either direction, with the biggest gainers and losers at +/- 0.3% on the day, effectively nothing in this space. Here, too, all eyes are on the data this week.

The only Fed speaker today is Michael Barr, and he is talking about banking services, with no policy discussions expected. Adding it all up leads to a conclusion of a pretty quiet session overall unless today’s data is dramatically surprising. Remember, though, quiet sessions are good days to hedge.

Good luck

Adf