For Jay and his friends at the Fed What they’ve overwhelmingly said Is weakened employment Will give them enjoyment While helping inflation get dead So, yesterday’s JOLTS data news Which fell more than ‘conomists’ views Was warmly received, Though bears were aggrieved, By bulls who’d been singing the blues

In fairness, Chairman Powell never actually said he would revel in a weaker employment picture, but he did discuss it regularly as a critical part of the Fed’s effort to drive inflation back to their 2% target. And, in this case, more importantly, he had specifically mentioned the JOLTS data as a key indicator as an indication of the still very tight labor market. With this in mind, it should be no surprise that when yesterday’s number came in much lower than expected, at ~8.8 million, down from a revised 9.2 million (the original print last month had been ~9.6 million), risk assets embraced the news as evidence that the Fed is, in fact, done raising rates. Now, tomorrow and Friday’s data releases are still critical with both PCE and NFP on the calendar, so there is still plenty of opportunity for changes in opinions. However, there is no question that the risk bulls have made up their minds and decided the Fed is done.

There is, however, a seeming inconsistency in this bullish thesis. If the US economy is set to weaken, or perhaps is already weakening, with the jobs data starting to roll over, exactly what is there to be bullish about? After all, China is clearly in the dumps, as is most of Europe. While short-term interest rates are certainly likely to fall amid a recession, so too are earnings. And if earnings are falling, explain to me again why one needs to be bullish on stocks. I assume that the goldilocks scenario of the soft landing is the current driving force in markets, but that still remains a very low probability in my mind.

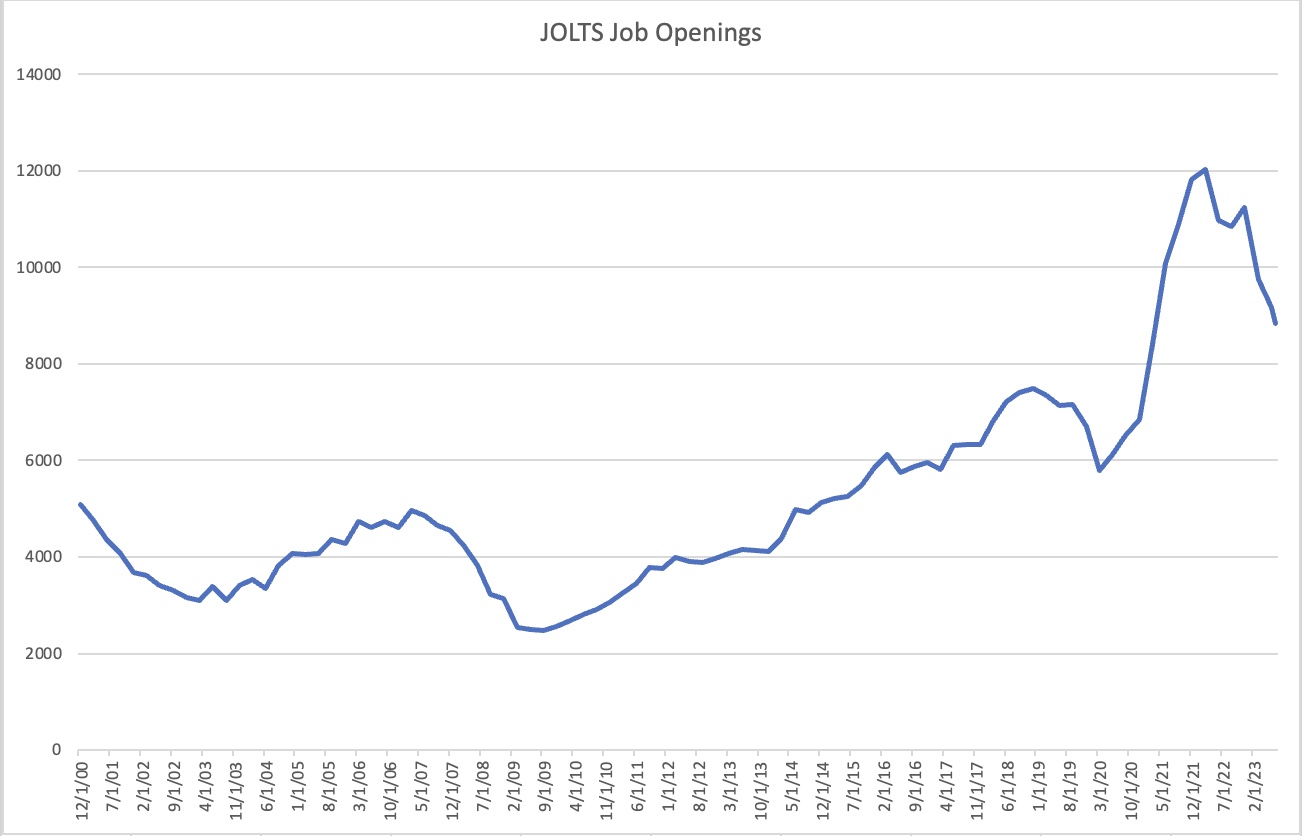

History has shown that since they started compiling this particular labor market indicator in December 2000, peak-to-trough decline, has occurred leading directly to a recession. This was true in 2001-02 (39% decline), 2008-09 (49% decline), 2020 (23% decline) as can be seen in the chart below, and now we are at the next sharp decline. Thus far, the decline from the peak in March 2022 has been 27%, so there is ample room for it to fall further. I merely suggest that if that is the case, things are probably not that great in the US economy, and therefore, are likely to have a negative impact on risk assets. Keep that in mind as you consider potential future outcomes.

Source data: Bloomberg

The other data yesterday, Case Shiller House Prices and Consumer Confidence did little to enhance a bullish view. Confidence fell sharply, by nearly 11 points and is not showing any trend higher. Meanwhile, house prices fell less than expected, only about -1.2%, which has implications for the inflation picture. After all, housing remains more than one-third of the CPI calculation, and if the widely assumed decline in house prices has ended, that doesn’t bode well for the idea inflation is going to fall further.

Remember, Chairman Powell was quite clear that one data point would not be enough to change the Fed’s views, and while he is no doubt relieved that some of the job market pressure seems to be receding, he was also quite clear in his belief that rates needed to remain at least at current levels for quite some time to ensure success in their goal to reduce inflation. The futures markets have reduced the probability of a September rate hike to 13% this morning, from nearly 25% before the data. There is about a 50% chance of a hike at the November meeting. It seems premature to determine that inflation is dead, and the Fed is getting set to cut soon, at least to my eyes. Beware the hype.

As to the overnight session, after a strong US equity day, which saw the NASDAQ rally nearly 2% and the Dow nearly 1%, Asia had trouble following through. At least China had trouble, with virtually no movement there. Australia rallied nicely, 1.2%, but otherwise, not much action in APAC. In Europe this morning, there are far more losers than gainers, but the losses are on the order of -0.2%, so not substantial, but certainly not bullish. The data out of Europe today showed inflation in Germany remains higher than desired, and confidence across the continent, whether consumer, economic or industrial, is sliding. Not exactly bullish news. As to US futures, they are ever so slightly softer this morning, down about -0.1% across the board.

In the bond market, it should be no surprise that bonds rallied and yields fell yesterday after the JOLTS data, with the 10yr yield falling 8bps. However, this morning, it has bounced 3bps and European sovereign yields are higher by between 6bps and 7bps on the back of that higher than expected German inflation data. The market is still pricing about a 50% probability of an ECB hike in September, but whether it happens in September or October, it is seen as the last one coming.

In the commodity space, oil (+0.5%) continues to hold its own, perhaps seeing support after OPEC member Gabon saw a coup yesterday, potentially reducing supply. At the same time, we have seen several large drawdowns in inventories as well, so there seem to be some fundamentals at play. Now, a recession is likely to dampen demand, but right now, the technicals seem to be winning out. As to the metals markets, gold had a big rally yesterday on the back of declining real interest rates and is retaining those gains this morning. The base metals are mixed this morning, but essentially unchanged over the past two sessions as the questions about growth vs. supply continue to be probed.

Finally, the dollar is modestly stronger this morning, but that is after a sharp decline yesterday. With yields falling in the US it was no surprise to see the dollar under pressure. With yields backing up, so is the dollar. USDJPY is back above 146 again, having fallen below yesterday, but today’s movements are far more muted than yesterday’s. As to the EMG bloc, the picture today is mixed with some gainers and some laggards, but aside from TRY and RUB, which are hyper volatile and illiquid, the gains and losses have been smaller. One exception is ZAR (-0.5%), which fell after news the government ran a record budget deficit in July was released.

ADP Employment (exp 195K) headlines the data today, although we also see a revision of Q2 GDP (2.4%, unchanged) and the Advanced Goods Trade Balance (-$90.0B). There are no Fed speakers on the calendar, so that ADP data will likely be the key for the day. A weak print there will reinvigorate the Fed has finished debate, while a stronger than expected print may well see much of yesterday’s movement reversed. With that in mind, remember that the past two months have seen very strong ADP numbers that were not matched by the NFP data, so this is likely to be taken with a little dash of salt.

We are clearly in a data dependent market right now as all eyes focus on this week’s news. I need to see consistently weak data to alter my view that the Fed is going to step off the brakes, and it just has not yet appeared. Until then, I still like the dollar.

***Flash, ADP just released at 177K, with revision higher to last month’s number. Initial move in equity futures is +0.2%, but there is a long time between now and the close.

Good luck

Adf