In Washington, something's amiss As hardliners say with a hiss Let government close As we don’t oppose A tumble into the abyss The reason that markets might care Is data will then become rare Thus, how will the Fed Keep looking ahead If rear-facing data’s not there?

As this is not a political commentary, I generally try not to focus on these issues. However, periodically, they impact the economics and the markets so I must. As we approach the fiscal year-end for the US this Saturday, there are still a number of appropriation bills that have not passed Congress and been signed into law. Some of the hardliners in the Republican majority in the House seem to be willing to die on this particular hill, although as we are talking politics, and there are still two days left before it becomes a fait accompli, things are subject to change.

But the issue for markets has far less to do with the actuality of the government shutting down and entirely to do with the fact that the Bureau of Labor Statistics and Commerce Department, the source of most government data, will be shut down and so not be able to publish the monthly numbers. Given that the Fed has repeatedly told us that they are data dependent, on what will they base their decisions if there is no fresh data to help guide them?

The inherent problem with data dependence is that all the data published by the government is backward looking, reporting what happened in the past week/month/quarter, and the Fed uses its numerous econometric models to extrapolate how that will play out in the future. History shows us, though, that the Fed’s models, especially lately, have not been terribly accurate. Does anyone remember transitory inflation? (Every time I go to the grocery store and see the price of staple items it crosses my mind. How about you?) Thus, if I were to analogize their process, it is like driving a car forward while looking only in the rearview mirror and the steering mechanism doesn’t work properly.

At any rate, this story is going to dominate for a while. Chairman Powell speaks this afternoon at a townhall with educators and he will be taking questions from the audience. You can be sure that reporters will be there and there will be a question about how the Fed will handle the lack of data in the event of a shutdown. This is unlikely to dominate the market narrative quite yet, but if the shutdown does happen, Monday could see some impact. We shall see.

In the meantime, risk remains under pressure around the world as there are three current market features that are dissuading investors from jumping in, and in many cases pushing them to the sidelines.

First is the price of oil, which rose 4% yesterday and is basically unchanged this morning, retaining all of this gains. We are now back to levels not seen since July 2022 when oil was falling from the post Ukraine invasion spike while the Biden administration was flooding the market with SPR reserves. Given the SPR is back to levels last seen in 1983, shortly after it was initiated, it seems there is less room for the Administration to repeat this performance. At the same time, there has been no indication that OPEC+, and the Saudis specifically, are getting set to open the taps again. Rising oil prices impact everything as they are an excellent proxy for the price of energy writ large. And everything requires energy to keep going. If it costs more to keep the lights on or ship products, it is going to work its way into the price of retail items.

Second is US yields, which we proxy with the 10-year Treasury bond. This morning it is trading at 4.65%, continuing its recent move and, in truth, looking like it is accelerating it. Since the beginning of September, the 10-year yield is higher by 55bps, a very large move, and that is dragging yields higher around the world. For instance, German bunds, French OATs, and UK gilts are all trading at decade-plus high yields, and even worse for the ECB, Italian BTPs, are seeing their spread to bunds widen back toward 200bps. You may recall that in July 2022 the ECB created a program called the Transmission Protection Instrument (TPI) which was designed to essentially roll maturing bund positions from the ECB’s balance sheet into Italian BTPs to support that market and prevent the euro from exploding. Once that got going it was quite effective at moderating that spread, and things seemed fine. But recently, the Italian fiscal situation has become increasingly weakened and the market is pushing on this issue again. The point is the market is focusing on more risks and thus risk appetite is waning.

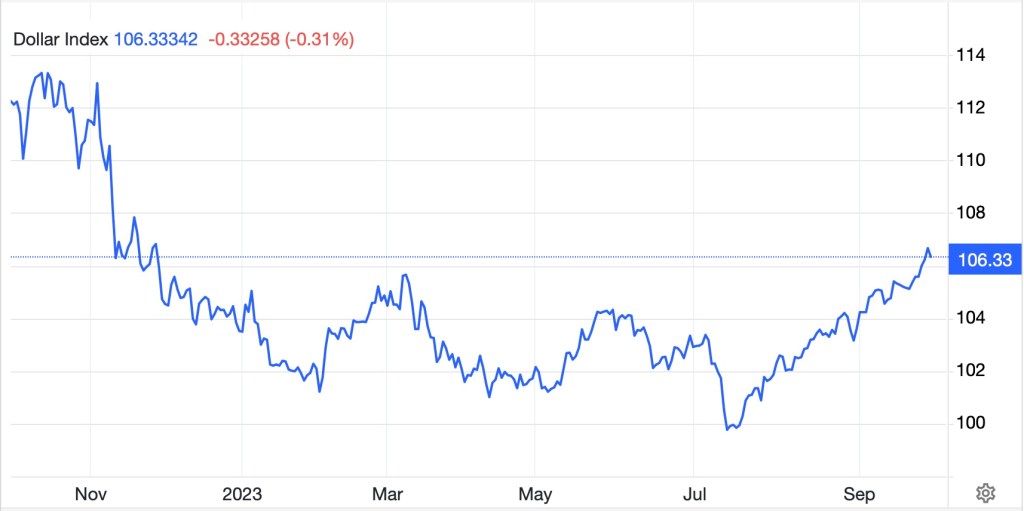

Finally, the dollar continues to rise. Using the Dollar Index (DXY) as a proxy, it is currently trading well above 106 and taken out much technical resistance. While it is a bit softer this morning, with the euro (+0.4%) and pound (+0.5%) both bouncing a bit along with the yen (+0.2%), this trend remains very clear. (see graph courtesy tradingeconomics.com)

In fact, last night USDJPY touched 149.70, a new high for the move and that triggered some further comments from Japanese FinMin Suzuki that indicated he was close to the next stage of intervention known as “checking rates”. This is the process by which the BOJ calls out to the big banks in Tokyo asking for a price in USDJPY but does not deal. However, the simple fact of asking for the price gets these banks to sell dollars for their own accounts and they then spread the word that the BOJ is “checking rates” which all in the market know is a sell signal. So, last night, when the dollar hit that high level, Suzuki was on the tape saying that might be the next step and the dollar fell back a bit.

Remember, though, intervention will only matter if it is concerted, with all the central banks, especially the Fed involved, and really only if monetary policies change. And it is the latter that seems the least likely right now. So, if when the dollar trades above 150 expect some fireworks, but unless there are other changes, it will be temporary. Hedgers, be prepared.

And that is the situation as we head into today’s session. There is a bunch of data coming this morning starting with Initial (exp 215K) and Continuing (1675K) Claims, as well as our third look at Q2 GDP (2.1%). In addition to Chair Powell this afternoon, we hear from Chicago Fed president Goolsbee this morning and Governor Cook early this afternoon. The most recent comments from both of them indicate that more rate hikes may well be necessary, and neither is in a hurry to cut rates.

Yesterday saw a pretty flat day in the equity markets in the US and futures this morning are also little changed. however, there is growing concern, as I outlined above, that risk is becoming riskier and that the safety of short-dated US paper, which currently yields 5.5% or more, is a very good place to be invested for the time being. To my eye, the trends outlined above, higher oil, yields and a stronger dollar, remain intact. As long as that is the case, equity markets are going to struggle. As to the dollar, we will need substantial policy changes to turn that ship around, and right now, there is no sign that is on the horizon.

Good luck

Adf