The data, on Friday, revealed

The job market’s mostly been healed

As such, any thought

The Fed really ought

Cut rates, simply must be repealed

In fact, two Fed speakers explained

That rate cuts were not yet ordained

Should prices keep rising

It won’t be surprising

If higher rates soon are unchained

Wow! Once again, the NFP report was significantly hotter than any analysts forecast, with a top line number of 303K while the previous 2 months were revised higher as well. The Unemployment Rate fell back a tick, to 3.8%, while wages continue to grow above 4%. In other words, it seems quite difficult to make the case that the economy is in a state that requires rate cuts. After all, if the Fed’s focus has turned from inflation specifically to employment now, and employment continues to rock, why cut?

However, the impression from the cacophony of Fedspeak we heard last week is that many members are still of a mind to cut the Fed funds rate, likely in June. Just not all of them. We heard from two more speakers Friday, Governor Michelle Bowman and Dallas Fed President Lorie Logan, and neither seemed in a cutting frame of mind. [Emphasis added]

Bowman: “While it is not my baseline outlook, I continue to see the risk that at a future meeting we may need to increase the policy rate further should progress on inflation stall or even reverse.”

Logan: “In light of these risks, I believe it’s much too soon to think about cutting interest rates. I will need to see more of the uncertainty resolved about which economic path we’re on.” She followed that with, “To be clear, the key risk is not that inflation might rise — though monetary policymakers must always remain on guard against that outcome — but rather that inflation will stall out and fail to follow the forecast path all the way back to 2 percent in a timely way.”

Now, it is very difficult for me to read these comments and think, damn, rate cuts are coming soon! By now, you are all aware that I have been in the sticky inflation camp from the get-go and certainly Friday’s data did nothing to change my mind. But my views don’t really matter. However, if we start seeing a majority of FOMC members talking about fewer cuts than expected/assumed in March, and even hikes, we need to pay attention. I don’t think it is yet a majority, and clearly Chair Powell is very keen to cut, but there is a long time between now and the June meeting, with much data to come. Unless that data starts to really back off and hint at a substantial slowing of the economy, my sense is that June will morph into November or December, with the median dot pointing at just one cut this year.

A quick look at the Fed funds futures shows that traders are growing even less confident in those rate cuts being implemented. As of this morning, the June probability has fallen slightly below 50% and there are a total of 61bps priced in by the December meeting, just over two cuts. This is quite a contrast to the Eurozone, where the market has fully priced in a June cut and is beginning to consider a 50bp reduction to get things going there. On the surface, this makes a great deal of sense as the Eurozone economy’s growth continues to lag that of the US and inflation has been ebbing more rapidly there than in the States. And don’t forget, the ECB meets this Thursday, so at the very least we should have a better sense of what will happen in June, and we cannot rule out a cut this week, regardless of market pricing.

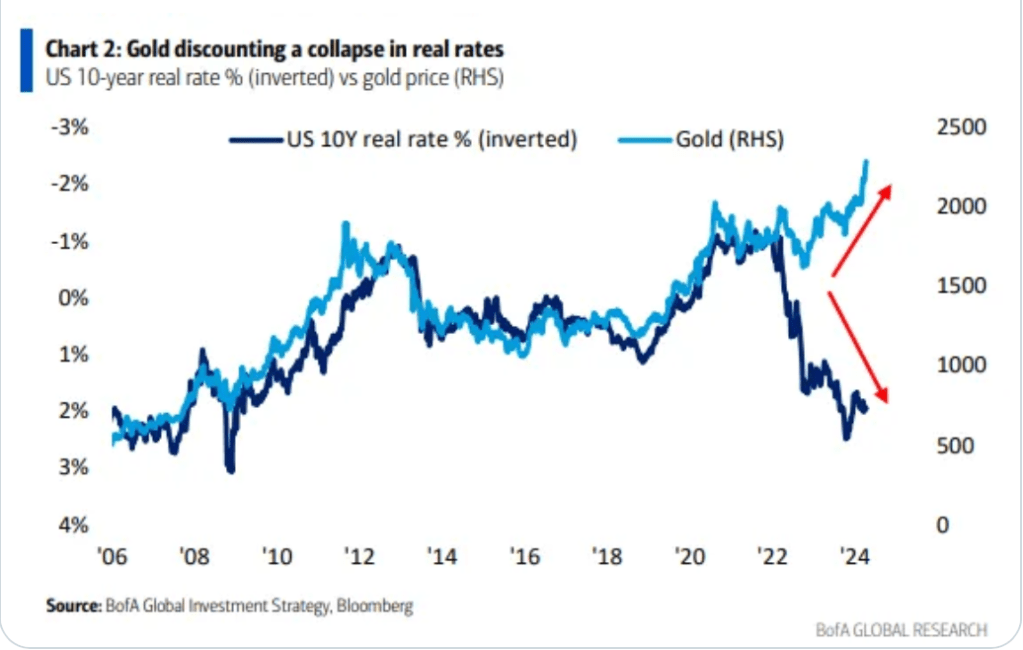

Trying to step back for a broader perspective on the economy and the future of policy rates as well as market movements, there continue to be several conundrums in markets compared to historical trends. For instance, what is the meaning of the price of gold rising consistently alongside a rise in interest rates, both nominal and real? Historically, there has been a strong negative correlation between the two, but something has changed in the past two years as evidenced by the BofA Research chart below.

Is this a signal that the market is getting indigestion over the amount of sovereign debt that is outstanding, led by Treasuries? Is this an indication that investors are losing faith in fiat currencies and the current global monetary structure? Or is this simply a temporary anomaly that will correct over the course of the next several years? Unfortunately, there is no way for anyone to know the answer to these questions at this point in time. Anyone who says otherwise is not being honest.

However, my suspicion is that the consequences of monetary and fiscal policies around the world during the Pandemic and since has more and more people, and institutions, starting to hedge their bets on the future and its outcomes. From a more benign view that the authorities will be able to kick the can down the road, this relationship seems to indicate more than a few folks think that the fiscal and monetary authorities are about to stub their collective toe on the next kick. Ouch!

In many ways, I think that the change in this relationship is an excellent encapsulation of the problems currently faced by monetary and fiscal authorities. As such, I will be watching it closely as a key indicator of market sentiment overall.

Ok, let’s look at the overnight session. After Friday’s solid US equity performance, the picture elsewhere has been slightly less positive, although positive overall. In Asia, the Nikkei (+0.9%) followed the US price action although Chinese shares had a less positive session, falling on the mainland with the HK market staying flat. Treasury Secretary Yellen was in China trying to smooth things over, but the following two statements, I think, are a great description of how confused things are:

Talk about mixed messages! Meanwhile, in Europe, most bourses are a bit higher this morning, but on the order of 0.5%, half what we saw in the US on Friday. It seems that some traders are betting that the ECB, when it meets this Thursday, is going to cut rates. Lastly, at this hour (7:20), US futures are essentially flat.

The bond market, though, has seen far more activity lately as it appears the bond vigilantes, last seen in the 1990’s are reawakening. This morning, 10-year Treasury yields are back to 4.45%, their highest level since November when yields were falling in the wake of the Fed’s perceived pivot and the reduced amount of coupon issuance just announced at that time. This is 13bps higher than the yield just before the NFP data was released, 8bps on Friday and another 5bps this morning. Similarly, European sovereign yields hare higher by between 3bps and 5bps this morning, being dragged higher by Treasuries, but lagging as bets get made that the ECB acts sooner than the Fed.

In the commodity space, oil (-0.8%) is backing off its recent highs this morning as there appears to be an easing in some concerns over the Middle East, at least that is the story making the rounds. Meanwhile, metals prices continue to flourish despite the rise in interest rates with both precious (Au +0.4%, Ag +0.9%) and base (Cu +0.7%, Al +0.3%) all continuing their recent climbs. Another conundrum here is the fact that these metals prices are rising despite the dollar remaining reasonably well bid.

Turning to the dollar, it is little changed, on net, this morning although we have seen some strength against the CHF (-0.5%) and KRW (-0.4%). The former is the only currency seemingly following the interest rate story as the recent SNB rate cut plus low inflation readings indicates that the policy divergence between Switzerland and the US is set to widen further. The won, on the other hand, looks to be a proxy for China, which the PBOC refuses to allow to weaken despite many economic reasons it should. On the flipside, ZAR (+0.4%) is rallying on the back of those metals’ prices. One of the things that is confusing is the fact that the euro remains reasonably well bid despite the changing tone of the interest rate policies between the Fed and ECB. While the single currency has generally been declining over the past month, in truth, since the beginning of April, it has rebounded about 1% and held strong since then. Given the changing market perceptions, I would have anticipated the euro to continue its declining ways, but right now, that is not the case.

On the data front, the week starts out slowly, but we get the critical US CPI data on Wednesday.

| Tuesday | NFIB Small Biz Optimism | 89.5 |

| Wednesday | CPI | 0.3% (3.4% Y/Y) |

| -ex food & energy | 0.3% (3.7% Y/Y) | |

| Bank of Canada Rate Decision | 5.0% (unchanged) | |

| FOMC Minutes | ||

| Thursday | Initial Claims | 215K |

| Continuing Claims | 1792K | |

| PPI | 0.3% (2.3% Y/Y) | |

| -ex food & energy | 0.2% (2.3% Y/Y) | |

| ECB Rate Decision | 4.5% (unchanged) | |

| Friday | Michigan Sentiment | 79.0 |

In addition to the data and other central bank decisions, we hear from seven more Fed speakers this week, which given the recent more hawkish commentary, could well be quite interesting. If Wednesday’s CPI data is hotter than expected again, I suspect it will become increasingly difficult for the doves to spread their wings. As it happens, six of the seven speak after the CPI, so we could well see things evolve further. In the meantime, relative to other currencies, I continue to look at the rate picture and believe the dollar should remain firm. However, versus ‘stuff’ not so much.

Good luck

Adf