When looking ahead to this week

The noteworthy thing is Fedspeak

At least fifteen times

They’ll give us their dimes’

Worth of knowledge, though none be unique

For instance, we already know

Their confidence is rather low

So, absent new data

Do they have schemata

Designed to get ‘flation to slow?

Arguably, the biggest news this morning is the death of the Iranian President and Foreign Minister in a helicopter crash overnight as it opens a range of possibilities regarding the future stance of Iran in the Middle East. Will it remain the strict theocracy that it has been? Or will a new leadership recognize the people appear to be growing tired of that stance and want something different. While it would seem unlikely that there will be a major change, at least from this view thousands of miles away, if one were to come about, it would have a major impact on the Middle East and the ongoing conflict in Gaza. After all, if Iran stopped funding terrorist groups, that would de-escalate things dramatically and potentially see a significant decline in the price of oil. At this time, however, there is no information as to who will step into the role and what policies will be followed, so it is a wait-and-see period. As it happens, oil prices (-0.35%) have edged lower this morning, but this is hardly a sign of anything new. This will be quite critical to watch going forward.

However, beyond that, there has been vanishingly little new information about which to speak regarding the macroeconomic situation around the world. The Chinese left their policy rates unchanged, as universally expected, and there has literally not been any other data from any major nation since Friday. In fact, looking ahead at the calendar for the week, arguably the most significant piece of data to be released is Canadian CPI, or perhaps UK CPI and then on Friday we see the Flash PMI reports.

Which brings us back to the Fedspeak. It is staggering to think that the FOMC believes they need to be so visible at this time, especially after Chairman Powell explained that rate hikes were off the table and that while it may take a little longer than they had initially expected, they were still certain that inflation was going to head back to their 2% target.

Speaking of inflation, over the weekend I was reading some analysis (sad, I know) that highlighted if the US used the European HICP calculation the core reading would already be below their target with April’s data coming in at 1.9%. To me this is a similar stance to what we heard at the end of 2023 when numerous pundits were explaining that the 3-month trend or the 6-month trend was already at 2.0% so why wait to cut? Of course, the sticky inflation camp (this poet included) was quick to hoist them on their own petard as the recent 3-month and 6-month trends are pointing to 4+% CPI readings going forward.

In this particular instance the question I would ask is, other than the fact that the reading is lower, why would anyone think that the European HICP inflation reading is a more accurate representation than the BLS representation? The difference lies in the fact that HICP doesn’t incorporate housing price changes, which given they remain stubbornly high, have been supporting higher CPI readings. But don’t people pay for their housing? Certainly, it would be easy to create a lower CPI if you simply remove all the items that are going higher in price. Unfortunately, that process doesn’t really tell you anything about reality.

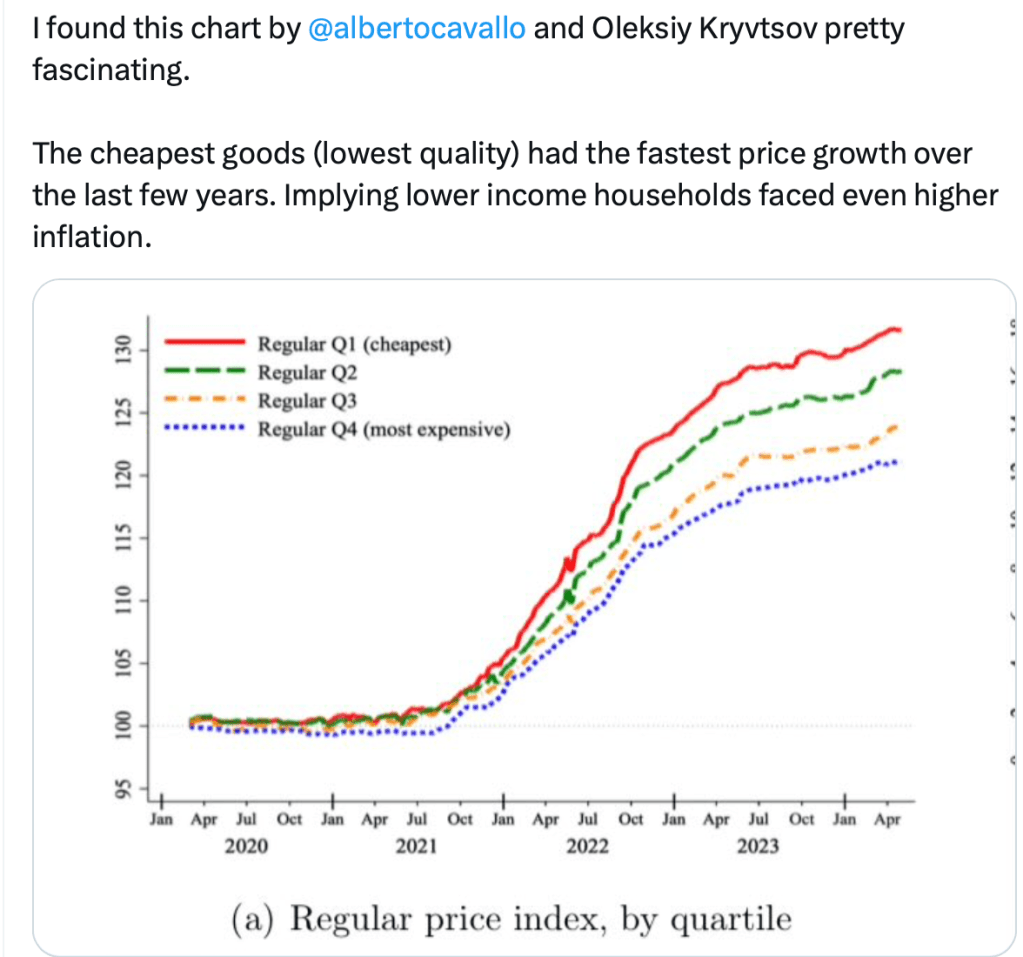

Below is a very interesting chart I found on X (nee Twitter) created by Professor Alberto Cavallo of Harvard and Oleksiy Kryvtsov, a Bank of Canada economist, which may be a better description of inflation as felt by the average person.

The fact that prices are rising fastest for the least expensive goods indicates that inflation is a major problem for Joe Sixpack, and no matter how pundits seek to adjust the measurement, so the numbers look better, reality is a harsh mistress. (If you want to know why President Biden’s numbers are so bad, you needn’t look further than this chart.)

Alas, there is no escaping the plethora of blather that will be coming from the Fed this week, although I sincerely doubt any of it will change anyone’s opinions about anything. Ok, it was another generally quiet session overnight with the exception being the ongoing blast higher in metals markets.

Equity markets have performed well across the board, although the gains have not been too dramatic. Japan (Nikkei +0.7%) was the best performer although the entire region was in the green to a lesser extent, about 0.35% or so. In Europe, all the bourses are higher as well, but here the gains are even smaller, on the order of +0.25% across the board while US futures are essentially unchanged at this hour (6:30).

In the bond market, Treasury yields, which backed up 2bps on Friday are unchanged this morning while European sovereigns are higher by roughly 1bp across the board. ECB speakers have conceded that a rate cut is coming in June, but many are pushing back hard against the idea that a July cut is a sure thing, preferring to wait until September. However, the really interesting thing is in Japan, where JGB yields have traded up to 0.98%, a new high yield for this move and a level not seen since March 2012. At this point, it would seem that 1.00% is a foregone conclusion so it will be interesting to see how the BOJ responds when that ‘magic’ number is finally traded.

But, as I mentioned above, it is a metals day with gold (+0.9%), silver (+1.1%) and copper (+0.9%) all continuing last week’s strong gains with gold making yet further new highs, copper pushing its historic highs and silver breaking above a key technical resistance level at $30/oz last week and now extending those gains. While there have been many explanations for this price movement, I think you need to consider precious and industrial metals separately. For precious, there continues to be a growing concern in the ongoing debasement of the fiat currency universe and both individuals and central banks are seeking to hold alternative assets. On the industrial side, though, especially copper and silver which are both critical to electronics, the ten-year hiatus in investment due to the ESG cult combined with the recent recognition that all the new-fangled tech wizardry like AI is going to require gobs of power and electrical capacity has simply skewed the supply/demand curve to much more demand than supply.

Finally, the dollar is little changed this morning, pretty much at the same level overall since Thursday. Given the lack of movement in the rates space, this ought not be a surprise. It also ought not be surprising that the best performing currencies of the past week have been CLP (+3.5%) as it has simply traveled alongside its major export, copper, and ZAR (+5.1%) as it rallies alongside the precious metals complex. Meanwhile, there has been no movement in the interest rate narrative with, perhaps, the exception of Japan, but what we have learned there lately is that higher JGB yields lead to a weaker yen. Go figure!

On the data front, as I said earlier, it is extremely light this week,

| Wednesday | Existing Home Sales | 4.22M |

| FOMC Minutes | ||

| Thursday | Initial Claims | 220K |

| Continuing Claims | 1799K | |

| New Home Sales | 680K | |

| Friday | Durable Goods | -0.7% |

| -ex Transport | 0.1% | |

| Michigan Sentiment | 67.6 |

It is not clear, given how much we have already heard from Fed speakers since the last FOMC meeting, that the Minutes will be very informative. Perhaps the discussion about QT will change some minds, but I doubt it. Otherwise, if stocks continue to rally, market players will be happy and not try to rock the boat. Meanwhile, the dollar will need a new impetus to break out of this narrow range, but that may not come until next month’s NFP data.

Good luck

Adf