The Chinese are starting to worry

That if they don’t act in a hurry

Their ‘conomy’s growth

Is destined for slowth

Explaining their rate cutting flurry

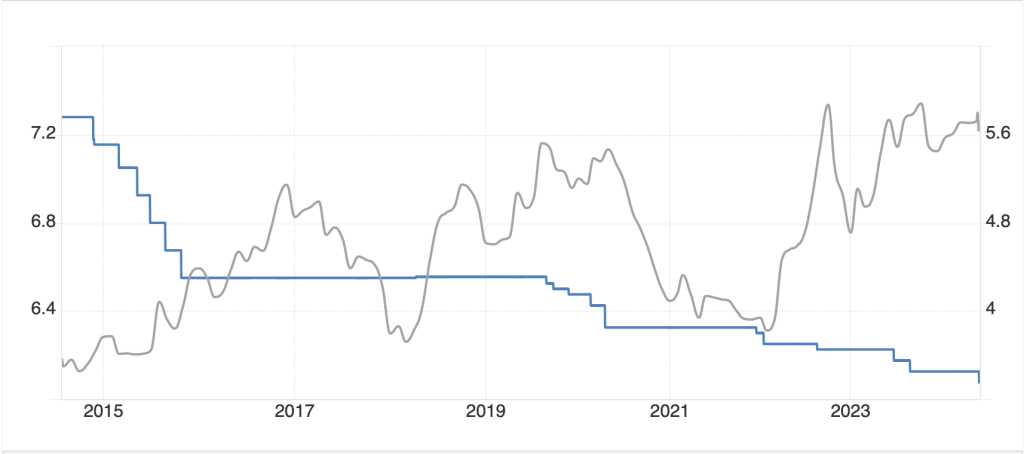

Sunday night, the PBOC surprised markets by cutting both their 1-year and 5-year Loan Prime Rates by 10 basis points each. As well, they cut the rate on their newly developed 7-day repo rate by 10bps as they endeavor to shorten the maturity of their money market operations. At the time, it was taken as a response to the Third Plenum and the only concrete action seen as new support for the economy. As its name suggests, those rates represent the cost to borrow for credit worthy companies. A quick look at the history of this rate (the blue line), which was first tracked toward the end of 2013, shows that over time, it has done nothing but decline. I have overlayed a chart of USDCNY in the chart (the grey line) to help appreciate the long-term trend in that as well which, not surprisingly, shows a steady weakening of the renminbi (rise in the dollar).

Source: tradingeconomics.com

But the reason I bring this up is that last night, the PBOC surprised markets yet again by cutting its One-Year Medium-Term Lending Facility by 20 basis points, to 2.30%. Not only was this the largest cut since the pandemic, but it was also done at an extraordinary meeting and combined with an injection of CNY235 billion (~$32B) into the economy. Arguably, this is the most aggressive monetary policy stance that has been effected by the PBOC since the summer of 2015 when they surprisingly devalued the renminbi 2%. Apparently, the PBOC is trying to adjust its policy actions to be more in line with the G7 where central banks use short term rates as their tools. One other thing this implies is that President Xi remains steadfastly against any fiscal stimulus of substance at this point. On the one hand, you must admire that effort, but I fear that the domestic Chinese economy remains so weighed down by the ongoing property sector problems, achieving their 5.0% GDP growth target is going to become that much more difficult as the year progresses.

For our purposes, though, the story is all about the CNY (+0.7%), which rallied sharply after the announcement, continuing its movement from the Monday rate cuts which totals 1.1%. Now, ordinarily one might think that a country cutting its rates would lead to a weaker currency, ceteris paribus, However, given the market outcome, there is much discussion about how the PBOC “requested” Chinese banks to more aggressively buy CNY to support the currency. Interestingly, the fixing rate on shore overnight (7.1321) continues to weaken ever so slightly overall, but now the spread between the fix and the market has fallen to just over 1%, well within the +/- 2% band and an indication there is less pressure on the currency. My take is this is just window dressing, but I would not fight it. I expect that we will see USDCNY slowly return to higher levels over time, with the key being it will take lots of time.

The ongoing rout

In tech stocks has another

Victim, dollar-yen

Under the guise, a picture is worth a thousand words, the below chart showing the NASDAQ 100 (blue line) and USDJPY (green line) overlaid is quite interesting.

Source: Tradingeconomics.com

While there is an ongoing argument amongst market practitioners as to whether it is the decline in the tech sector that is driving USDJPY’s decline or the other way round, what is clear is that there is a strong correlation between the two. If you think about what the USDJPY trade represents, it is the purest form of a carry trade, shorting the cheapest currency and using the funds to buy a much higher yielding currency with maximum liquidity. But another thing to do with those funds obtained from borrowing yen and buying dollars was to use the dollars to jump on the tech stock bandwagon. After all, that added another 30% to the trade since the beginning of the year.

However, over the past two weeks, nearly one-third of the NASDAQ gains have been erased and that has been made worse by the >6% rise in the yen. At this stage, it no longer matters which is driving which, the reality is that we are seeing significant short covering in the yen with sales in other assets required to unwind the trade. Arguably, this is why we are seeing virtually every risk asset lower this morning, although bonds are holding up as havens, as all have been funded with short yen. Given that relationship, I am coming down on the side of the yen being the driver, but as I said, I don’t think it matters.

The real question is can it continue? It is important to understand that when markets achieve excessive levels like we saw in USDJPY, they rarely simply unwind to some concept of fair value. Rather they typically overshoot dramatically in the other direction. As such, if we assume PPP is fair value, and PPP for USDJPY is currently around 110.00, it appears there is ample room for USDJPY to decline much further. Consider, this movement has happened, and the Fed has not even started to cut rates. If we do, indeed, fall into recession, the Fed will respond, and I expect that we could see a very sharp decline in USDJPY. Something to consider looking ahead.

While that was a lot about the currency markets, they seem to be the current drivers, so are quite important. But let’s look at everything else.

Equity market pain has been universal with Japan (-3.3%), Hong Kong (-1.8%) and China (-0.6%) all following the US lower overnight and in Europe, this morning, it is no better with the CAC (-2.2%) the worst performer, but all the major indices falling sharply. US futures are little changed at this hour (7:00), but remember, we are awaiting key GDP data and more earnings numbers, which have been the driver.

As mentioned above, bond markets are rallying with Treasury yields lower by 5bps and most European sovereigns seeing declines of -3bps or -4bps. Credit is an issue as Italian BTPs are the laggard this morning, with yields there only lower by 1bp. Equally of interest is the fact that the US yield curve inversion has been reduced to just 14bps and has been normalizing dramatically for the past several sessions. One thing to remember about the yield curve is that when it inverts, it indicates a recession is coming, but when it uninverts, it indicates the recession has arrived! This is all of a piece with softer economic data and expectations of Fed policy ease coming soon to a screen near you.

In the commodity markets, nobody wants to own anything. Oil (-1.3%) is continuing its recent poor performance despite EIA data showing significant inventory reductions. This is not a sign of strong demand. But we are also seeing weakness across the entire metals space with gold (-1.0%) breaking back below $2400/oz and silver and copper under severe pressure. Right now, nobody wants to hold these, although I suspect that the long-term supply/demand situation remains bullish.

Finally, the dollar is mixed overall. While we have seen strength in JPY and CNY, as discussed above, and CHF (+0.8%) is also showing its haven status and use as a funding currency, there are numerous currencies under pressure, notably AUD (-0.8%), NOK (-0.8%), MXN (-0.8%), ZAR (-0.7% and SEK (-0.6%) all of which are commodity linked to some extent. Yesterday, the BOC cut rates by 25bps, as expected, but the Loonie has been steadily weakening for the past two weeks, so yesterday’s decline and today’s is just of a piece with that. Ultimately, we are watching a serious risk-off event, and I expect the dollar will hold its own vs. most currencies, although JPY and CHF seem to have room to run yet.

On the data front, once again yesterday’s data was on the soft side with the Flash Manufacturing PMI falling to 49.5, well below expectations and New Home Sales slipping to 617K. In fact, it is difficult to find the last strong piece of data, perhaps the ex-autos Retail Sales number from last week. This morning, we see Initial (exp 238K) and Continuing (1860K) Claims, Q2 GDP (2.0%), and Durable Goods (0.3%, 0.2% ex transport). The Atlanta Fed’s GDPNow tool is indicating GDP in Q2 was 2.6%, well above the forecasts. However, I think of much more interest will be to see how it starts out for Q3. We have had a spate of weak data, and those recession calls are growing louder.

This is a tough market, but I expect we have not yet seen the last of the risk-off trade (just consider how long the risk-on trade has been going on) so further dollar strength against most currencies, except for JPY and CHF, and further weakness in commodities and equities seem the most likely direction.

Good luck

Adf