The calendar’s now turned the page

So, summer has moved to backstage

Thus, risk is retreating

And people are treating

The autumn as though it’s a phage

Meanwhile, German voters have spoken

And fears are a new trend’s awoken

Political leaning

Is rightward, thus meaning

A longstanding taboo’s been broken

Arguably, the biggest story from the long weekend was the voting in two German states, Thuringia and Saxony, where the Alternative for Germany (AfD) won one-third of the vote in each state thus destroying the traditional political calculus. AfD is the right-wing party that has been described as neo-nazi and fascist regularly by the media (of course, the Republican party in the US has also been described in those same words), but more importantly, represents a complete rejection of the current status quo in Germany. But perhaps the bigger concern for the German political elite is that an entirely new party, the Sarah Wagenknecht Alliance (BSW) won 15.5% and 11.5% of the votes in those two states respectively. The BSW is a far-left party that espouses some of the same opinions, notably on immigration, as the AfD. In other words, nearly half the electorate voted against the traditional parties as apparently people in Germany are not very happy.

To complete this story, the issue is that AfD, with which all parties have sworn against working in the parliament, has enough votes for a blocking minority, meaning they can (and almost certainly will) prevent the appointment of new judges and any constitutional changes that they don’t like. As I said, the political calculus in Germany has changed significantly. In fact, the parties in the current federal coalition (SPD, FDP and the Greens) saw their share of the vote fall to just 10.3% and 12.4%, respectively, in the two states.

I highlight this issue because it is indicative of the ongoing changes in Europe that may well undermine the single currency’s potential, and assumed, future strength based on the dollar’s assumed future weakness. After all, whether or not the Fed embarks on a long period of rate cutting, or simply implements a token cut or two, given the political upheaval in Europe, is that going to be a good place for industry to invest? Their energy policies have been hugely counterproductive, and Europe has about the most expensive energy in the Western world. In fact, Volkswagen AG, has indicated it may be closing plants in Germany for the first time in the company’s long history. It has simply become too expensive a place to do business.

This is not to imply that the euro (-0.25%) is going to collapse imminently. Germany is only one of twenty nations in the Eurozone, albeit the largest economy by far. But the story in Germany is not isolated to that nation. We have seen similarly poor energy decisions and similar voter responses in other nations (notably the Netherlands, France and Austria). Whatever you think about the dollar, it is very difficult to get excited about the euro in my view.

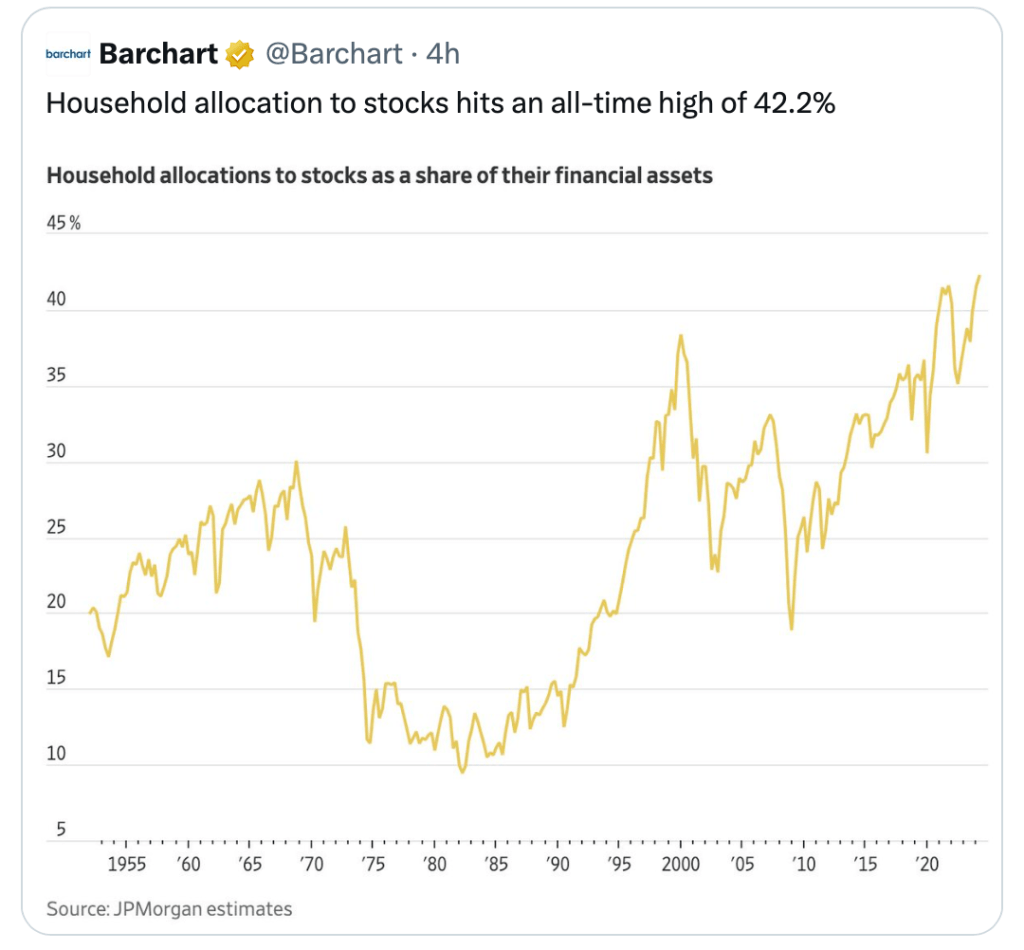

But let’s turn our attention to risk writ large. I keep reading that September is historically the weakest month in the US equity markets and given the number of sources of strong repute that have written such, am willing to take that at face value. As well, apparently, US households are the most bullish equities, or at least have the largest equity positions as a portion of their assets, in history (see chart below from @InvariantPersp1 on X).

It strikes me that the combination of extreme long positioning and a historical tendency for weakness may open up some downside in the equity markets, at least for a period. Of course, if you are old enough to remember the yen carry trade debacle all the way back at the beginning of August, you know that even if we see a big downdraft, it can be reversed quite quickly. And given both the Fed and ECB (and BOE) all meet later this month, it is not hard to believe that if equities were to decline sharply before their meetings, we could see larger than expected rate cuts across the board. For now, the market continues to price a one-third probability of a 50bp cut by the Fed while expectations are for the ECB to cut in September and a 50% probability of an October cut.

Net, do not be surprised if September has nearly as much volatility as August as the idea of max-long equity exposure into a slowing economy with still high inflation feels like a tenuous position. We shall see.

Ok, let’s try to catch up to overnight activity, which has generally been of the risk-off variety. Since Friday’s close, the story has been more negative than positive with Japanese (-1.1%) and Chinese (-1.5%) markets falling amid slightly softer than expected data and a more general malaise. In Europe, too, things have been soft with today’s declines ranging from -0.2% (CAC) to -0.8% (Spain’s IBEX) and everything in between. This is completely in sync with US futures markets which are all lower by at least -0.6% at this hour (7:20).

Interestingly, while risk is under pressure, the traditional havens of government bonds are not seeing much benefit with Treasury yields edging higher by 1bp and similar moves throughout much of Europe although both Gilts and Bunds have seen yields edge lower by 1bp. JGB yields have also edged higher by 1bp and are creeping, ever so slowly, back toward 1.00%. This follows comments by BOJ Governor Ueda that he really means it when he says they BOJ will normalize policy. The caveat is that will occur only if the economy meets their expectations with growth rising and inflation remaining high. However, inflation continues to be fairly stable with services inflation actually declining there, thus undermining his message somewhat.

In the commodity markets, oil (-2.3%) has been taking it on the chin for the past week as the combination of the weaker demand story on a slowing global economy combines with growing confirmation that OPEC+ is going to end their production cuts starting next month, thus adding to supply, has weighed heavily on prices. Back in January, I wrote a piece discussing my change of view on the long-term prospects for oil prices, which I flipped from bullish to bearish. The essence of the piece was that there is plenty of oil around, it is political decisions that prevent its extraction. As the politics of everything around the world continues to quickly change, I think this is an important baseline to keep in mind, although that doesn’t mean we won’t see short term spikes in oil’s price. However, right now, it looks awful on the charts.

As to the metals markets, they have been under some pressure lately as well, notably copper and silver, with each of those falling more than 5% in the past week. Gold, however, continues to find buyers as the bigger picture concerns of monetary debasement combine with still active central bank purchasers to support the barbarous relic.

Finally, the dollar is quite strong this morning, rallying against almost all its counterparts. The commodity bloc are the laggards with AUD (-0.8%), NOK (-0.75%), NZD (-0.7%) and SEK (-0.5%) all suffering in the G10 with only JPY (+0.5%) rallying, arguably playing its haven role. In the EMG bloc, ZAR (-0.8%), and the CE4 (-0.5% each) are under pressure along with KRW (-0.4%) and even CNY (-0.2%). LATAM is the surprise with MXN (-0.1%) little changed at this hour.

On the data front, this is a big week that culminates in the payroll report on Friday.

| Today | ISM Manufacturing | 47.5 |

| Construction Spending | 0.0% | |

| Wednesday | Trade Balance | -$78.9B |

| JOLTs Job Openings | 8.10M | |

| Factory Orders | 4.6% | |

| -ex Transport | -0.2% | |

| Thursday | ADP Employment | 145K |

| Initial Claims | 230K | |

| Continuing Claims | 1870K | |

| Nonfarm Productivity | 2.4% | |

| Unit Labor Costs | 0.9% | |

| ISM Services | 51.1 | |

| Friday | Nonfarm Payrolls | 165K |

| Private Payrolls | 138K | |

| Manufacturing Payrolls | 0K | |

| Unemployment Rate | 4.2% | |

| Average Hourly Earnings | 0.3% (3.7% Y/Y) | |

| Average Weekly Hours | 34.3 | |

| Participation Rate | 62.6% |

Source: tradingeconomics.com

Obviously, all eyes will be on NFP as the Fed has clearly turned its primary attention to the employment side of its mandate. However, don’t fall asleep on the JOLTs data tomorrow, as that has also been part of Powell’s calculus. (seems there was a lot of calculus today, I hope you all managed to get through that in college 😂). Remember, too, that CPI comes next week and then the FOMC meeting is the following week, so there is no respite.

This morning, risk feels unwanted. With equity markets still within spitting distance of their all-time highs, it appears there is ample room for some down days ahead. Of course, Friday will be key. Regarding the dollar, for now, I believe the bounce continues. But Friday will dictate the medium term, at least until the FOMC meeting.

Good luck

Adf