The market, on Wednesday, was JOLTed

By data, and traders revolted

The jobs situation

Has changed the narration

And helped Jay, his door be unbolted

What door you may ask? Why, the door that leads to a 50bp rate cut at the FOMC meeting in two weeks. Already, the Fed funds futures market is pricing in a 43% probability of a 50bp cut, up from a one-third probability on Tuesday morning. Remember, everything now revolves around the labor market, and yesterday’s JOLTs data was not only worse than forecast, at 7.67M (forecast 8.1M), but last month’s was revised lower by nearly 200K jobs as well. Remember, too, that tomorrow the NFP report is released with current forecasts centering on 160K, higher than last month but well down on what we have been seeing all year prior to the August report.

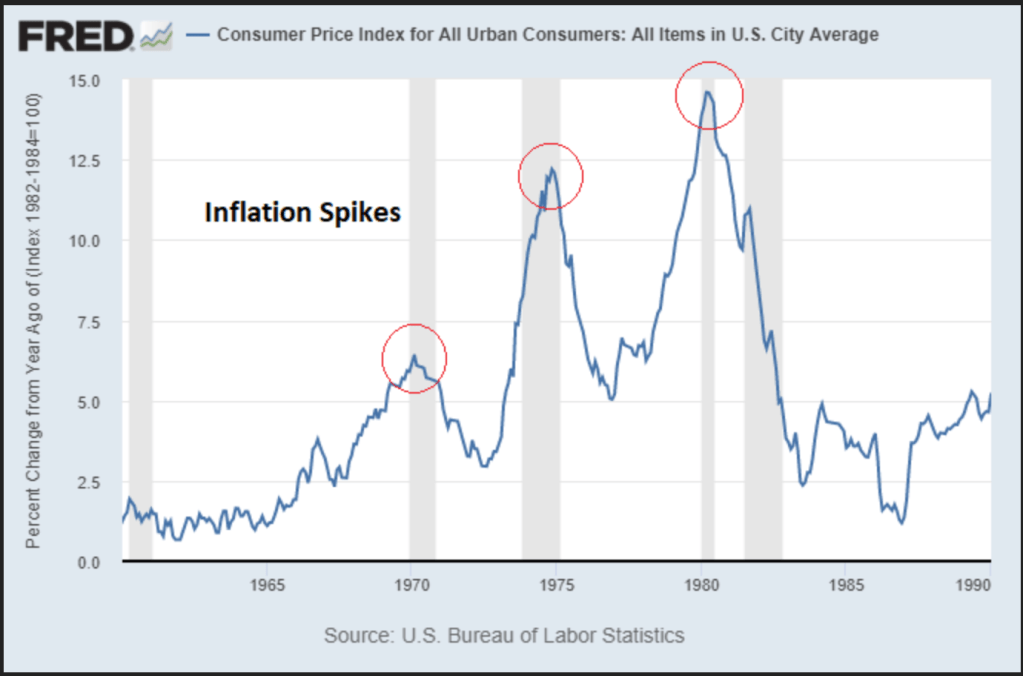

There are many analysts who have been calling out Powell and the Fed for making a policy error and holding rates too high for too long. Perhaps they are correct. But so much of the decision to cut rates relies on the idea that inflation is well and truly dead, or at least terminal, and if that assumption is incorrect, there will be hell to pay. The last time the US saw inflation of the same magnitude that we have seen in the past two years, then Fed Chair, Arthur Burns, cut rates too early and inflation exploded higher, peaking at a higher rate than the first rise. In fact, he did that twice, with inflation spiking three times throughout the 1970’s and early 1980’s.

Source: FRED database

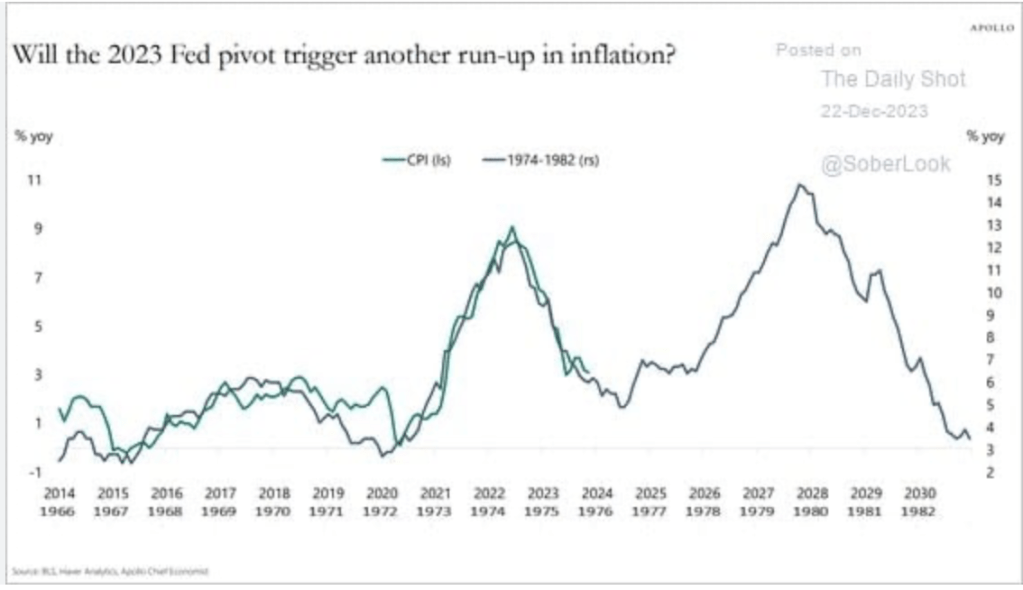

Powell has been very clear that he is trying to channel Paul Volcker and not Arthur Burns, but if he cuts rates, he opens himself up to a much less satisfactory outcome. There have been many charts of the following nature showing the parallels of the 1970’s to recent price levels and it is entirely possible we see another wave higher if the Fed cuts.

Source: Real Investment Advice

As things currently stand, I would contend that the Fed’s focus is almost entirely on employment, hence the market response to yesterday’s weaker than forecast JOLTs data. This implies that this morning’s ADP and Initial Claims data have the chance to really move things. It also means that tomorrow’s NFP data remains a critical focus for all markets.

In the meantime, market activity overall could well be described as choppy. While US equity markets opened lower yesterday, following the sharp declines on Tuesday, they closed mixed with limited overall movement. The fears in the semiconductor sector, which were fanned by a, since denied, report that Nvidia had been subpoenaed in an anti-trust investigation, has stopped falling and there are still numerous stories about how much Capex the big 4 tech companies are going to invest this year in all things AI. Traders and investors are looking for the next big clue which is why I expect limited activity until tomorrow morning’s data release.

Asian equity markets were similarly mixed overnight with some gainers (Australia +0.4%, Taiwan +0.45%, CSI 300 +0.2%) and some laggards (Nikkei -1.05%, KOSPI -0.2%, Hang Seng -0.1%), as no clear direction presently exists. Late last week, BOJ Governor Ueda sent a letter to the Diet explaining he still expected to raise interest rates if the economy progressed as expected, and that has a number of analysts calling for another leg down in USDJPY and further Nikkei weakness. But it seems that is a big IF. With economic activity clearly slowing around the world, it is not hard to believe that the same will be true in Japan and conditions for further rate hikes may not develop. As to European bourses, the picture here is mixed as well with the CAC (-0.5%) lagging while Spain’s IBEX (+0.7%) is having a pretty good day. Both the DAX (+0.2%) and FTSE 100 (+0.1%) are modestly higher despite weak Construction PMI data, perhaps both anticipating further policy ease.

In the bond markets, though, the direction of travel is clear for now with yields everywhere having fallen sharply yesterday and simply consolidating today. After the JOLTs data, Treasury yields fell 9bps (2yr yields fell 12bps and the 2yr-10yr spread is now flat), although this morning it has bounced by a single basis point. European sovereign yields slipped yesterday as well, between -3bps and -5bps, after the JOLTs data and this morning have backed up by 1bp across the board. As to JGB yields, they edged lower by -1bp last night and remain a good distance from the 1.00% level despite the recirculated Ueda comments.

In the commodity markets, oil (+0.2%) which had bounced a bit yesterday morning, ceded those gains as the session wore on and is currently below $70/bbl. While talk of OPEC+ starting up more production has faded, the weak economy / slowing demand story, especially the weak Chinese economy story, remains front and center and continues to weigh on the price. Meanwhile, in the metals markets, gold (+0.7%) continues to shine overall as the growing sentiment for a 50bp Fed funds cut helps all commodities, but especially this one as concerns over the dollar’s ability to maintain its purchasing power remain rife. But this morning we are seeing silver (+1.4%) and copper (+0.2%) higher as well, although the latter seem more trading than fundamentally based.

Finally, the dollar is under some modest pressure this morning, which given the movement in yields and rate cut expectations, should be no surprise. In the G10, virtually all the movement has been less than 0.2% with CAD (-0.1%) the laggard after the BOC cut rates by 25bps yesterday as widely expected. This morning the yen is also a touch softer, but that is after a sharp rally yesterday of more than 1%, so this morning feels like a trading bounce. In the EMG bloc, the picture is a bit more mixed with ZAR (+0.5%) the leader this morning on both the gold price as well as economic data showing the Current Account deficit shrank dramatically in Q2 in a pleasant surprise. On the flipside, MXN (-0.3%) is lagging as the market absorbs recent modestly weaker than expected economic data on Unemployment and Fixed Investment.

Which brings us to today’s data releases. We start with ADP Employment (exp 145K), then Initial (229K) and Continuing (1870K) Claims. As well, at 8:30 we see Nonfarm Productivity (2.4%) and Unit Labor Costs (0.8%). Then, at 10:00 comes ISM Services (51.1) with the final set of data the EIA oil inventories at 11:00 with net further drawdowns forecast. There are no Fed speakers on the docket today, but we are supposed to hear from two tomorrow after the NFP data.

Absent a big surprise in either ADP or Initial Claims, with the former more likely than the latter, I suspect that it will be another choppy day as all eyes focus on NFP tomorrow. However, the one thing that seems likely is the dollar has further to decline within the current market narrative of more rate cuts sooner by Powell and the Fed.

Good luck

Adf