The markets just said, never mind

Though yesterday’s moves were unkind

Twas all just a game

With punters to blame

It’s they who must need be maligned

Today is a whole other story

And one that is somewhat less gory

Now though it seems strange

Things just didn’t change

Believe us, it’s all hunky-dory

As much fear as was felt throughout global markets yesterday, that is how much relief is evident this morning. In the midst of a panic sell-off, it is impossible to determine both the causes and how far things might run. In fact, that is why stock exchanges around the world introduced circuit-breakers after the 1987 crash, to try to prevent any extended move lower. As it happens, the only circuit breakers that triggered were in Asia (Japan, South Korea and Taiwan) as the rest of the world’s markets, though sharply lower, did not see the same magnitude of losses.

But that was so yesterday! To their credit, no central bank reacted rashly to the movement, and there were precious few comments by any central bankers of note. SF Fed President Daly spoke at a scheduled event and maintained the party line that they did not yet have enough confidence that inflation was going to sustainably decline to their target, although she is closely watching the labor market after last Friday’s NFP report. “We’ve now confirmed that the labor market is slowing, and it’s extremely important that we not let it slow so much that it tips into a downturn. It’s too early to tell if it is slowing to a sustainable pace which allows the economy to continue to grow or if it’s getting to a point where there’s real weakness there,” she explained.

Those comments certainly did not sound like someone who was concerned about the market’s dramatic movement yesterday. And we should all be happy that is the case. In fact, the central bank that should have been most concerned, the BOJ, said nothing at all. As well, the RBA met last night and left policy on hold, as expected. So, kudos to the central bank community for not overreacting to a stock market move.

Market participants, though, continue to clamor for support as they are confused by numbers that don’t go up. Now, Tuesday has earned the name ‘turnaround Tuesday’ for a good reason, in that historically, after a large decline on Monday, especially if there was weakness at the end of the prior week, on average, there is a rebound in equity markets. In fact, there was a very nice article in Bloomberg this morning giving details on that phenomenon.

But the real question is, was yesterday an aberration or was it a harbinger of things to come? On the one hand, the only data released yesterday was the ISM Services, which rose 2.6 points to 51.4, a much better than expected outcome, and certainly not seeming to be a signal that the US economy is heading into recession. Ironically, if there is no recession coming, and the Fed remains sanguine about the economy, there is really no reason for them to worry about the interest rate structure. I have asked this question many times, why would the Fed need to cut rates if the economy continues to grow at trend and equity markets continue to make new highs?

But we cannot ignore the signals we have seen from other parts of the economy, notably the still weak manufacturing sector (as evidenced by the weak ISM Manufacturing and other regional Fed manufacturing indices) and the evident slowing in the payroll report. Many of you will have heard of the Sahm Rule, which describes the relationship between movement in the Unemployment Rate and recessions.

Briefly, the rule explains that if the three-month average of the Unemployment Rate rises 0.5% from its low point in the past 12 months, that signals the economy is already in a recession. Last Friday’s rise in the UR ostensibly triggered that “rule”. However, it is important to understand that the rule is merely the observation that since 1980, that situation has obtained each time a recession has occurred. It is not a causal factor, just a coincidental indicator, so the fact that it has been triggered does not actually mean we are in a recession, just that historically that has been the case.

I have described numerous times that there are two broad camps of economists with some very smart people continuing to believe that we are already in a recession, even prior to Friday’s NFP report, and that the Fed is far behind the curve. However, there is also a camp that believes in the no-landing scenario where the economy will be able to maintain its pace of growth given the combination of massive fiscal stimulus that continues to enter the economy, and the fact that the interest rate sensitivity of the US economy has declined dramatically since 2020 because so many borrowers, both individuals with mortgages and companies, termed out their debt during the ZIRP policy period.

However, there are several things to remember:

- The stock market is not the economy. Markets are forward looking indicators of indeterminate length, and while they may presage strength or weakness, they also get things wrong. So, this market movement could merely be a trading correction amid ongoing economic growth, or it could be the beginning of the end.

- The US economy’s reduced sensitivity to interest rates means that even if the Fed were to cut rates tomorrow, the impact on the economy is likely to take at least 12 months, if not much more before it is felt. After all, the Fed started hiking rates two years ago and in Q2, GDP was still growing at 2.8% with inflation continuing above their target.

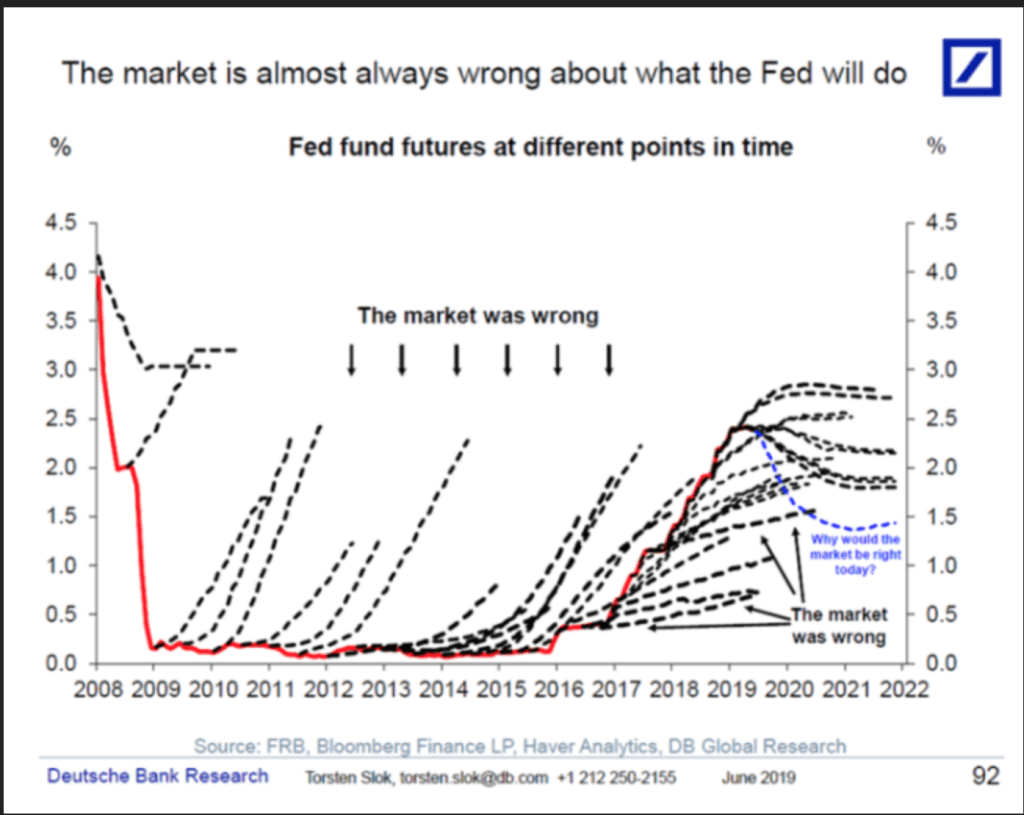

- Interest rate markets often, if not almost always, are incorrect in their pricing of future Fed policy moves. The below chart from Deutsche Bank Research shows the actual Fed funds rate (red line) and the way the futures market was pricing things at various points in time (black dashed lines). As you can see, there are a lot more bad outcomes than correct ones.

I know I regularly discuss the Fed funds futures market, but I do so as an indicator of market sentiment, not an expectation of what the Fed will actually do. And FWIW, this morning the futures market is pricing a 75% chance of a 50bp cut in September, up from Friday’s level of 25%, but down from the peak of 95% yesterday morning.

Ok, let’s tour markets very quickly now. The Nikkei rebounded by 10.2% last night, its largest rise ever in a single session. The other big decliners yesterday, South Korea (+3.3%) and Taiwan (+3.4%) also rebounded, although not nearly as impressively. Chinese shares have basically sat this movement out, little changed last night after modest declines on Monday. In Europe, the picture is mixed with the DAX (+0.1%) managing a gain while the CAC (-0.25%) and IBEX (-0.4%) both still lag. The only data of note was Eurozone Retail Sales which disappointed at -0.3%. US futures are rebounding as well, up about 1.0% at this hour (7:30).

In the bond market, Treasury yields bottomed yesterday morning at about 8:30 printing at 3.68% but have risen since then by a total of 20bps, with 7 of those occurring this morning. Meanwhile, European sovereign yields are generally a touch softer, down between 1bp and 3bps as the European markets have ultimately seen limited impact from the big moves. I guess, nobody was buying European stocks or bonds with their short yen funded positions. As to JGB’s they also rebounded last night, closing higher by 11bps, although still well below the 1.0% level.

In the commodity markets, oil (-0.2%) spent most of yesterday rebounding alongside Treasury yields, and likely showing a little concern over the imminent (?) retaliation by Iran on Israel. However, in the big scheme of things, it remains in its 70/90 range and obviously needs a bigger catalyst than we saw yesterday to break it. Gold (+0.4%), which sold off yesterday, was the least impacted of risk assets and it is no surprise it is rebounding this morning. The rest of the metals markets, though, remain under modest pressure after sharp declines yesterday.

Finally, the dollar has reversed some of yesterday’s moves, but there continues to be a wide range of movement. Starting with the yen, during the NY session yesterday, the dollar rebounded sharply, more than 1.5% and though that move continued into the early Asian hours, right now, the yen is stronger (dollar lower) by 0.5%. Elsewhere, though, the dollar is showing its haven status as it rallies vs. the rest of the G10, in some cases pretty substantially (GBP -0.75%, AUD -0.6%) and it is rallying against virtually all of the EMG bloc with the worst performers the MXN (-1.1%) and CE4 currencies, mostly lower by about -0.5%.

On the data front, today’s only release is the Trade Balance (exp -$72.5B) and I do not see any Fed speakers listed on the calendar. Perhaps yesterday was a one-off, a type of warning shot across the bow of the economy that things are out of balance and subject to some jarring impacts. Or perhaps it was just one of those things that markets periodically do irrespective of the economic fundamentals. This poet remains in the camp that economic activity is slowing, and a recession is coming soon, although that will not necessarily help inflation decline. But right now, it is anybody’s guess. As to the dollar, nothing has changed its haven status I believe, so if fear continues to drive things, it should hold its own.

Good luck

Adf