On Tuesday, six Fed members spoke

And none of them, from the pack, broke

While May’s CPI

Caught everyone’s eye

No ideas of cuts did it stoke

But markets just simply don’t care

Instead, all is well, traders swear

Nvidia rose

And at Tuesday’s close

No other firm could quite compare

Another day, another new all-time high for the S&P 500 and the NASDAQ (boy, my call from two weeks ago didn’t age well!). And so it goes, the Fed imagines it is maintaining tight financial conditions and is trying to rein in spending and price pressures, and equity investors simply buy more NVDA every day. Yesterday, the chipmaker became the most valuable company in the world, or at least the one with the largest market capitalization, cresting Microsoft and Apple, although all three are now worth about $3.3 trillion each. I raise the point because it is such a perfect description of market sentiment. It seems that everyone has placed their hopes (and potentially future wealth) on the back of a single company. I’m sure it will work out well 😱.

In fact, as the investing community narrows its focus to an ever-smaller number of companies, and news elsewhere appears to show cracks in the façade of a solid economy, I suspect that problems may be coming our way. For instance, remember Battery Electric Vehicles, and how they were the future? Not just Tesla, but all these companies like Lucid, Polestar, Nikola, VinFast and Fisker? Well, every name on this list has either gone bankrupt or is on the edge with Fisker being the latest to file Chapter 11. The point is that in an environment where liquidity is abundant, or overly so, investment decisions tend to be less well thought out. While the Fed has certainly tightened policy dramatically and been resolute in its efforts to maintain that tighter policy while inflation still percolates, the federal government’s excessive largesse (the CBO just announced they now expect a budget deficit this fiscal year of $1.9 trillion, up from the $1.5 trillion estimate last quarter) is too much for the Fed to stop.

One other thing to note about Nvidia, and AI in general, is that in China, Ali Baba has reduced the charge for using its AI function and it appears that AI, rather than being a new revenue stream for companies may simply become increased overhead of doing business. In that world, as margins of the Apples and Microsofts and Googles compress, perhaps there will be more discernment before the next order of Nvidia chips. There are many imbalances in this market, and it appears most of them are a result of the mania for AI. When this passes, and it will pass, be prepared for some repricing of risk.

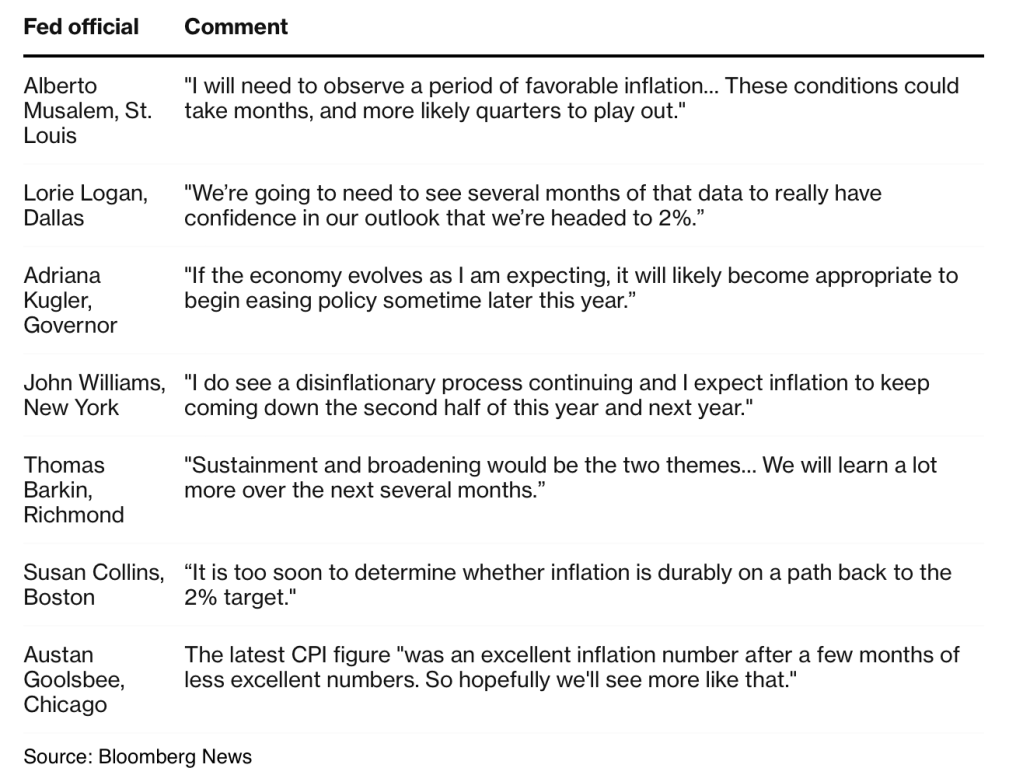

Ok, but back to the other stuff, namely the overwhelming amount of Fedspeak that keeps coming from all these FOMC members. Yesterday, we actually had seven members speak, NY’s John Williams was not on the calendar ahead of time, and to a (wo)man, they explained that patience remains a virtue. Happily, Bloomberg News put together the following list of key comments from the entire group:

Despite the modestly softer than expected CPI data last week, and even yesterday’s somewhat softer than expected Retail Sales data, it is hard to look at this grouping of comments and expect a rate cut is coming anytime soon. Now, the one thing we can never forget is that markets can move incredibly quickly when it comes to readjusting its views on a subject. In addition, history has shown that when the Fed figures out they are behind the curve and the economy is beginning to slow, they have the ability to cut rates very quickly as well. But right now, I just don’t see the roadmap for a rate cut before the end of the year. If this is the case, the one thing that seems most evident is that the dollar will maintain its overall bid. Despite all the talk that the dollar is losing its reserve status, and that too much debt is going to destroy it, the reality remains there is no viable alternative as a means to store wealth and for governments to store reserves. I don’t doubt the day will come when a substitute is found, but I do doubt I will be around to see it.

Ok, let’s see how the rest of the world celebrated the new leader in the market cap sweepstakes. In Asia, the Nikkei (+0.25%) edged higher but the Hang Seng (+2.9%) had a fantastic run as the tech stocks resident there seemed to follow Nvidia. Not surprisingly, Taiwan and Korea had good days, but elsewhere in the region, there was far more red than green as tech stocks are not the basis of those markets. As to Europe, it is a mixed picture there but probably more red than green. UK (+0.15%) stocks have edged higher after the UK inflation report showed that the headline number touched 2.0% for the first time in three years, but it doesn’t appear that will be enough to get the Tories re-elected next month. However, we have seen most of the continent bleed lower after the European Commission warned a series of nations (including France and Italy) that they needed to address their budget deficits which are far above the 3% “limit” that was embedded in the entire Eurozone project. Meanwhile, despite the fact that the US equity markets will be closed today for the Juneteenth holiday, futures are trading although they are little changed at this hour (7:45).

It is also a bank holiday here, so there will be no bond trading in the US, but in Europe, yields are a bit higher this morning, between 2bps and 4bps, bucking the trend from yesterday’s Treasury market and seeming to demonstrate a little concern over the ongoing political ructions on the continent. However, there is one place where yields are having difficulty finding a base, Japan. Despite all the talk that the BOJ was going to allow yields to rise more aggressively, or that there was no cap at 1.00%, JGBs fell 1bp overnight and have shown no inkling of moving higher in any substantial amount. With this in mind, look for the yen to remain under pressure.

In the commodity markets, the early part of the month, which saw oil prices slide is just a memory now as once again, WTI (+0.1%) is holding onto its gains from yesterday and is now firmly above $81/bbl. It appears that demand figures are starting to improve and inventory draws are being seen now. Watch at the pump. In the metals markets, after rallies yesterday, the precious set are holding the gains, up just 0.1% each, but copper has rebounded a further 1.5%, again an indication that economic activity seems better than feared.

Finally, the dollar is slightly softer this morning, slipping a touch against most of its G10 and EMG counterparts, but the noteworthy thing is that no currency has moved more than 0.25% in either direction. In other words, nobody seems to care this morning here.

There is no data and no Fed speakers given the holiday so not only will things slow quickly by 11:00am, it seems a safe bet that movement will be di minimus. Tomorrow brings a reawakening, but for today, enjoy the sunshine.

Good luck

Adf