While yesterday’s markets were tough

Today starts the really good stuff

It’s ADP first

Then Jay’s well-rehearsed

Defense the Fed’s doing enough

As I suggested in yesterday’s note, markets had a little further to fall prior to the beginning of the information onslaught that is coming today and continues for the rest of the week. Apparently, this was the worst session since sometime in October, but in the broad scheme of things, a 1.0% – 1.5% decline doesn’t seem that dramatic. After all, even after yesterday’s declines, the NASDAQ 100 is higher by 8.1%, the S&P 500 by 7.1% and the Dow Jones by 2.3% so far this year.

This morning, however, I think we need to look ahead to what is on the near horizon as I believe today’s information may be the most important of the week. Before we get into the US story, a quick note on Europe and the UK. Many of you will recall that during the Brexit drama in 2016, the Remainers claimed that the UK economy would collapse if they left the EU. I cannot help but notice how it is the continent which is suffering the worst effects of the current economic situation with the UK faring quite a bit better.

One need only look at the PMI data as evidence that while things in the UK may not be great, the Eurozone is in much worse condition. Today’s Construction PMIs are a perfect encapsulation with the UK printing 49.7, not great, but miles ahead of Germany (39.1), France (41.9), and the Eurozone as a whole (42.9). And this has been the pattern of data we have seen consistently for the past several years. While the UK may have suffered somewhat, Europe is in far worse shape. Looking at the data, it is easy to see why expectations for the ECB to cut rates first are rising. They need to do something to support the Eurozone economy.

But anyway, let’s turn to this morning’s activity which starts with the ADP Employment number (exp 150K). The relationship between this and the NFP data seems to have broken down a bit lately, but it remains a key early look at the US employment situation. While 150K does not indicate remarkable strength, it would be the second highest print in the past six months, a time when the economy has grown at a > 3.0% clip. I feel like the market will pay attention to a big miss in either direction, especially a weak number as that will be seen as a harbinger of rate cuts coming sooner.

The next thing we get is the Bank of Canada rate decision, where the universal expectation is for no adjustment in the current 5.0% rate. Here, the issue will be much more about the tone of the statement and commentary. Recent inflation data in Canada has been softer than expected, slipping below 3.0%, but growth data continues to motor along well. There are many in the markets who believe that the BOC will lead the way in policy changes, and if they indicate a cut is coming soon, the Fed will follow. Personally, I don’t buy that, but then, I remain unconvinced the Fed is going to cut at all.

Which takes us to Chairman Powell’s Senate testimony starting at 10:00am. If I were to guess on the nature of his opening statement it will be something along the lines of; things are going well as growth is solid, unemployment remains low and inflation seems to be trending lower, however, inflation remains job #1 and we are not yet convinced it will sustainably reach our goal of 2%. He will then get a series of bizarre and idiotic questions from Senators who have virtually no understanding of the economy, and only care about grandstanding on TV for their constituents.

But this is where the most opportunity for a market moving event will take place. If Powell offers anything other than the above recap, look for markets to react quickly. Any hint that they are closer to a cut, and we will see equities fly and the Fed funds futures markets rally sharply (remember the December pivot?). Any hint that cuts seem unnecessary given the overall economic strength and continued low unemployment rate and look out below.

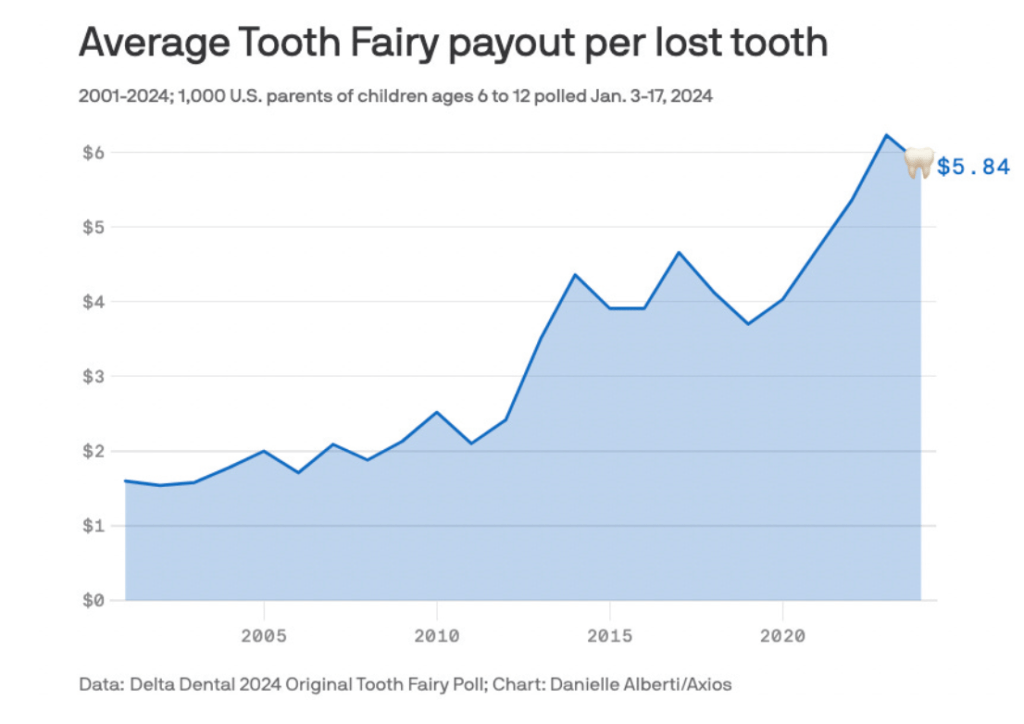

And that’s how the day is shaping up. However, it would not be complete if I didn’t mention perhaps the most important inflation indicator I have seen to date, and perhaps a harbinger of the future. Of course, I am referring to the Average Tooth Fairy payout as seen below.

I found this on the Morning Hark, a terrific Substack that does a great job of aggregating information published all around the world every day, and one I cannot recommend highly enough. But let’s face it, if the tooth fairy is cutting back her (his? Its?) payout, inflation must be dead!

Ok, it’s time to review the overnight activity. Following yesterday’s declines in the US, Asia had a mixes session with the big winner being the Hang Seng (+1.7%) on the strength of a strong earnings report from JD.com as well as a rebound from the prior session’s sharp declines. But elsewhere, things were mixed with limited movement overall. In Europe, the screen is green, but only Spain’s IBEX (+1.15%) is showing any real life, with the other bourses just barely above flat. You will be happy to know, though, that US futures are all pointing higher at this hour (7:30) by between 0.25% and 0.75%.

In the bond market, things are stable although yields have drifted a bit lower over the past several sessions. This morning, Treasury yields are down just 1bp while we are seeing a mixed view in Europe with different nations seeing moves of + or – 1 bp. But in general, not much to note here. As to Asia, yields fell overnight, following the US lead of late, with JGB’s the lone exception, creeping higher 1bp. Arguably, the fact that the bulk of the movement has been 1 basis point tells us nothing is going on!

In the commodity market, oil is rebounding slightly this morning, up 0.9%, which reverses earlier losses this week. The star here continues to be gold (+0.3%) which has risen 5% to new all-time highs this week and looks like it is not going to stop in the near future. Alongside the sharp rally in Bitcoin, a case can be made that investors are seeking out non-monetary alternatives given the massive debt issuance that is ongoing in the US, as well as elsewhere in the world. For instance, yesterday China mentioned they were going to be issuing an additional CNY 1 trillion of ultra-long-term bonds to finance some stimulus. It is not unreasonable for investors to seek non-monetary stores of value when concerns arise over non-stop issuance of paper.

Finally, this morning the dollar is a bit softer against virtually all its counterparts. While the movement has not been large, the breadth of the decline could be indicative of a view that Chairman Powell is going to be cooing like a dove today. This is especially so if one has a political view as after yesterday’s Super Tuesday primary results, the presidential race has been cemented as a rematch of 2020. Many make the case that Powell does not like Trump, especially given Trump has said he will not reappoint Powell. But I don’t think that Powell cares about that as much as about trying to get things right. He is independently wealthy and can retire with his head held high if he can get inflation back to target.

We’ve already discussed the data although I left out the JOLTS Job Openings (exp 8.9M) at 10:00, and then the Beige Book is released at 2:00. We also hear from Minneapolis Fed president Kashkari, but will anybody really care what he says having just heard from Powell himself? I think not.

So, today is all about early data and more importantly Powell’s comments. I continue to believe that the Fed does not need to cut rates at all given the economic backdrop and despite the Tooth Fairy, inflation will remain sticky and above the Fed’s target. As the market prices out Fed rate cuts, the dollar should benefit, but that will take more time.

Good luck

Adf