We will take action Threatened Vice FinMin Kanda If you speculate

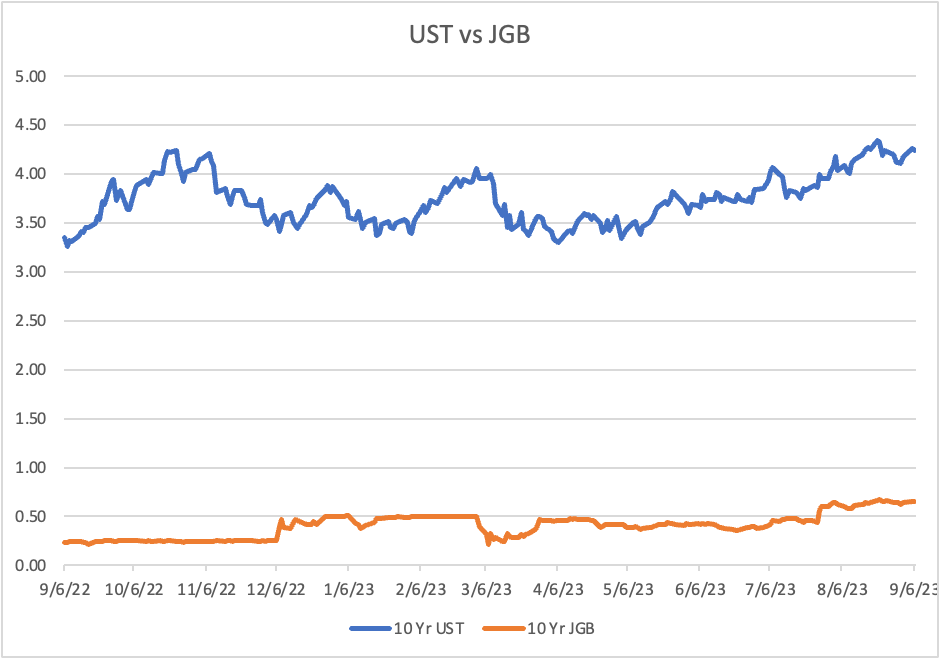

“If these moves continue, the government will deal with them appropriately without ruling out any options.” So said Vice FinMin Masato Kanda, the current Mr Yen. Based on these comments, one might conclude that ‘evil’ speculators were taking over the FX market and distorting the true value of the yen. One would be wrong. The below chart shows the yields for 10yr JGBs vs 10yr Treasuries. You may be able to see that the most recent readings show a widening in that yield spread in the Treasury’s favor. It cannot be a surprise that investors continue to seek the highest return and the yen most certainly does not offer that opportunity.

While I don’t doubt there is a place where the BOJ/MOF will intervene, they know full well that the yen’s weakness is a policy choice, not a speculative outcome. They simply don’t want to admit it. The upshot is that the yen edged a bit higher overnight, just 0.2%, as market realities are simply too much for words to overcome. The yen has further to fall unless/until the BOJ changes its monetary policy and ends YCC while allowing yields in Japan to rise. Until then, nothing they can say will prevent this move.

While ECB hawks keep on screeching More rate hikes are not overreaching The data keeps showing That growth’s quickly slowing So, comments from Knot are just preaching

“I continue to think that hitting our inflation target of 2% at the end of 2025 is the bare minimum we have to deliver. I would clearly be uncomfortable with any development that would shift that deadline even further out. And I wouldn’t mind so much if it shifted forward a little bit.” These are the words of Dutch central bank chief and ECB Governing Council member Klaas Knot. As well, he intimated that the market might be underestimating the chance of a rate hike next week, which at the current time is showing a 33% probability. Another hawk, Slovak central bank chief Peter Kazimir also called for “one more step” next week on rates.

The thing about these comments is they came in the wake of a German Factory Orders number that was the second worst of all time, -11.7%, which was only superseded by the Covid period in March 2020. Otherwise, back to 1989, Factory Orders have never fallen so quickly in a month. This is hardly indicative of an economy that is going to grow anytime soon. Rather, it is indicative of an economy that has inflicted extraordinary harm to itself through terrible energy policies which have forced producers to leave the country.

The key unknown is whether the slowing economic growth will also slow price growth. Given oil’s continued recent strength, with no reason to think that process is going to change given the supply restrictions we have seen from the Saudis and Russia, I fear that Germany is setting up for a very long, cold winter in both meteorological and economic terms. With the largest economy in the Eurozone set to decline further, it is very difficult to be excited at the prospect of a stronger euro at any point in time. It feels to me like the late summer downtrend in the single currency has much further to go.

This is especially true if the US economy is actually as resilient in Q3 as some economists are starting to say. Yesterday, I mentioned the Atlanta Fed GDPNow number at 5.6%, but we are seeing mainstream economists start to raise their Q3 forecasts substantially at this point given the strength that was seen in July and August. Not only will this weigh on the single currency, and support the dollar overall, but it may also put a crimp in the view that the Fed is done hiking rates. Consider, if GDP in Q3 is 3.5% even, it will not encourage the Fed that inflation is going to slow naturally. And while they may pause again this month, it seems highly likely they would hike again in November with that type of data.

Which takes us to the markets’ collective response to all this news. Risk is definitely under some pressure as the combination of stickier inflation and slowing growth around the world is weighing on investors’ minds. The only market to manage a gain overnight was the Nikkei (+0.6%) which continues to benefit from the weaker yen, ironically. But China, which is also growing increasingly concerned over the renminbi’s slide, remains under pressure as do all the European bourses and US futures. Good news is hard to find right now.

Meanwhile, bond investors are in a tough spot. High inflation continues to weigh on prices, but softening growth, everywhere but in the US it seems, implies that yields should be softening with bond buyers more evident. This morning, 10yr Treasury yields are lower by 2bp, but that is after rallying 16bps in the past 3 sessions, so it looks like a trading pullback, not a fundamental discussion. But in Europe, sovereign yields are edging higher as concern grows the ECB will not be able to rein in inflation successfully. As to JGB yields, they seem to have found a new home around 0.65%, certainly not high enough to encourage yen buying.

Oil prices (-0.1%) while consolidating this morning, continue to rally on the supply reduction story and WTI is back to its highest level since last November. Truthfully, there is nothing that indicates oil prices are going to decline anytime soon, so keep that in mind for all needs. At the same time, metals prices are mixed this morning with copper a bit softer and aluminum a bit firmer while gold is unchanged. It seems like the base metals are torn between weak global economic activity and excess demand from the EV mandates that are proliferating around the world. Lastly a word on uranium, which continues to trend higher as more and more countries recognize that if zero carbon emissions is the goal, nuclear power is the best, if not only, long term solution. The price remains below the marginal cost of most production but is quickly climbing to a point where we may see new mining projects announced. For now, though, it seems this price is going to continue to rise.

Finally, the dollar is mixed this morning, having fallen slightly vs. most G10 currencies, but rallied slightly vs. most EMG currencies. This morning we will hear from the Bank of Canada, with expectations for another pause in their hiking cycle, but promises to hike again if needed. Meanwhile, the outlier in the EMG bloc is MXN (-0.7%) which seems to be a victim of the overall risk situation as well as the belief that its remarkable strength over the past year might be a bit overdone. In truth, this movement, five consecutive down days, looks corrective at this stage.

On the data front, we see the Trade Balance (exp -$68.0B) and ISM Services (52.5) ahead of the Beige Book this afternoon. We also hear from two FOMC members, Boston’s Susan Collins and Dallas’s Lorrie Logan. Yesterday, Fed Governor Waller indicated that while right now, the data doesn’t point to a compelling need to hike, he is also unwilling to say they have finished their task. However, that is a far cry from the Harker comments about cutting in 2024 seems appropriate. I suspect Harker is the outlier for now, at least until the data truly turns down.

Net, the big picture remains that the US economy is outperforming the rest of the world and the Fed is likely to retain the tightest monetary policy around, hence, the dollar still has legs in my view.

Good luck

Adf