One percent is now A loose upper bound, rather Than a key level Yen participants Saw a signal to sell. Is Intervention next?

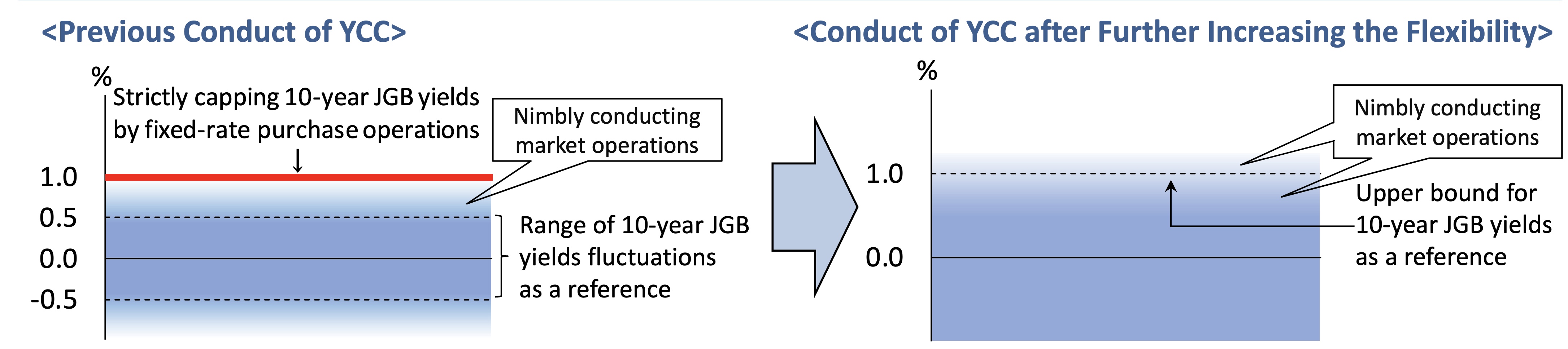

Below is what appears, to me at least, to be the critical comment from the BOJ after last night’s policy meeting. As well, that graphic comes straight from the BOJ presentation.

“It is appropriate for the Bank to increase the flexibility in the conduct of yield-curve control, so that long-term interest rates will be formed smoothly in financial markets in response to future developments.”

The essence of this is that YCC as we knew it, where the control part was the key, is now dead. Instead, Ueda-san is going to allow a great deal more leeway for the market to determine the yield on the 10-year JGB, and the entire yield curve there. While they have not yet adjusted the policy rate, which remains at -0.10%, I imagine that change is only a matter of time. Remember, though, the BOJ currently owns somewhere around 56% of the outstanding JGBs in the market. It is very clear they are not going to sell any. To me the question, which I did not see answered last night, is whether they will replace the bonds in their portfolio when old ones mature. There was no mention of QT, but I guess we will have to see. Based on their history, however, I would expect that the current balance of JGB’s they own will remain pretty constant going forward, at least on a nominal basis. Given the Japanese government continues to run deficits, that will eventually reduce the percentage of holdings. Of course, I suspect that this is subject to change if things get politically uncomfortable, but we shall see.

The market response was somewhat counter to what might have been expected. Arguably, many were looking for a yen rally as higher yields in Japan would create a greater incentive for Japanese institutional investors to bring their money home. But that is not what happened at all. This morning, USDJPY is firmly above 150.00 with no hint that there is intervention coming anytime soon. It seems, at least for now, that the MOF and BOJ are going to allow markets to find a new level by themselves. If that is the case, I expect that USDJPY is going to revert to form and follow USD interest rates. In fact, that is really the key, and something about which I have written in the past. When the Fed turns their policy toward easier money, at that time the dollar will come under significant pressure. However, until then, the dollar remains the place to be.

In China, the data has shown The ‘conomy’s not really grown Will Xi add more cash To try for a splash Or will he leave things on their own?

The other news overnight was from China where their PMI data proved weaker than expected for both manufacturing and services with the former falling back below the key 50.0 level at 49.5 and the latter falling to its lowest print since last December during the zero-Covid policy Xi had implemented. It seems that slowing growth around most of the world plus a limited domestic economic impulse combined with the ongoing collapse of the Chinese property market is just too much to overcome right now. Expectations are that Xi will agree to yet more stimulus (remember earlier this month they put forth a CNY 1 trillion (~$137 billion) plan, but that has not seemed to have had the desired impact. At least not yet. While Japanese equities rallied on the back of the BOJ activity, Chinese equities came under pressure, especially the Hang Seng (-1.6%) although mainland shares fell as well. As to the renminbi, it continues to grind lower (dollar higher) and remains pegged at the 2% boundary vs. the PBOC’s daily fixing rate. Nothing has changed my view of further weakness in the renminbi going forward, at least as long as the Fed retains its current policy stance.

If I were to sum up the situation in Asia at this time, I would suggest that the two major economies there are both very busy dealing with substantial domestic economic questions, although those questions are different in nature. Japan is trying to come to grips with rising inflation absent substantial economic growth while China has a problem defined by weakening growth with inflation not a current issue. But lack of growth is the common denominator here and as we have seen countless times around the world, I suspect we will see further fiscal stimulus in both nations before long.

Of course, when it comes to fiscal stimulus, China and Japan are mere pikers compared to the US which has completely rewritten the record books on this matter. And there is nothing that indicates the US is going to back off, at least while the current administration is in place, and likely the next regardless of the letter after the president’s name.

On this subject, though, while yesterday I described the QRA as critical, the first part of the Treasury story was revealed yesterday morning when they announced that the funding requirement for Q4 would be $776 billion, some $75 billion less than the consensus estimates before the announcement. But the key difference was that Secretary Yellen is aiming for an average TGA balance of “only” $750 billion, far less than some estimates of $1 trillion, and less than the current balance of $835 billion. In fact, the difference between the current balance and the target is what makes up for the difference in the issuance estimates. Under no circumstances should anyone believe that fiscal prudence is coming soon.

But this lower number has relieved some pressure in the bond market where we have seen yields slide a few more basis points this morning with the 10-year now trading at 4.83%. This movement has been followed by the European sovereign market, where yields have fallen by between 4bps and 6bps across the board in sympathy. In fact, the only major market that saw yields rise was the JGB market, where the 10yr yield is now at 0.93%, up 5 more bps from yesterday’s closing levels. I suspect that we will be trading at 1.00% soon enough, and it will be quite interesting to see just how ‘nimble’ the BOJ will be if yields start to run higher more quickly.

As to equity markets, yesterday’s US rally has been followed by the European bourses, all up between 0.6% and 1.2% despite somewhat soft economic growth data released this morning. However, Eurozone inflation data was also slightly softer than forecast and it seems traders are looking for the ECB to reverse to rate cuts sooner rather than later. US futures, meanwhile, are very marginally firmer this morning as all eyes now turn toward tomorrow afternoon’s FOMC outcome.

Oil prices have bounced a bit, up 0.9%, but this seems to be a trading move rather than anything either fundamental or geopolitical. Regarding the latter, the fact that the beginnings of the Israeli ground invasion of Gaza have not produced nearly the pyrotechnics feared, nor that the conflict has spread throughout the Middle East, at least not yet, has resulted in traders returning their attention to inventories and demand. Slowing growth in most places around the world is likely the key driver right now. As to gold, it has maintained its recent gains and is trading right at the $2000/oz level. Clearly, there is a fear factor there, but remember, if the equity bulls are correct and the Fed is going to tell us they are done, that will be seen as dovish and we should see a reversal in the dollar, a rally in commodities, including gold, and an initial rally in stocks and bonds. That is not my base case, but you cannot ignore the possibilities.

Finally, the dollar is best described as mixed today as the strength in USDJPY (+1.1%) has been offset by weakness in the greenback vs the euro (+0.4%) and the pound (+0.2%), as well as a number of EMG currencies (MXN +0.4%, PLN +0.5%, ZAR +0.6%). If one considers the DXY, that is virtually unchanged on the day.

On the data front, this morning brings the Employment Cost Index (exp 1.0%), Case Shiller Home Prices (1.6%), Chicago PMI (45.0) and Consumer Confidence (100.0). obviously, there are no Fed speakers as their meeting starts this morning and runs through tomorrow afternoon when we will see the statement and Powell will meet the press at 2:30.

It seems to me like traders will be cautious ahead of the FOMC tomorrow. I would think they would want more confirmation that the Fed has finished before running back into bonds as well as reversing the recent stock declines. While the Fed is unlikely to do anything tomorrow, it will be all about the statement and press conference. Til then, I suspect a quiet time.

Good luck

Adf