Both headline and core PCE

Were softer, with both below three

But under the hood

It’s not quite as good

As housing and transport are key

The narrative, though, will not quit

Assuring us all this is it

Rate cuts will come soon

And stocks to the moon

But so far, for proof, not one whit.

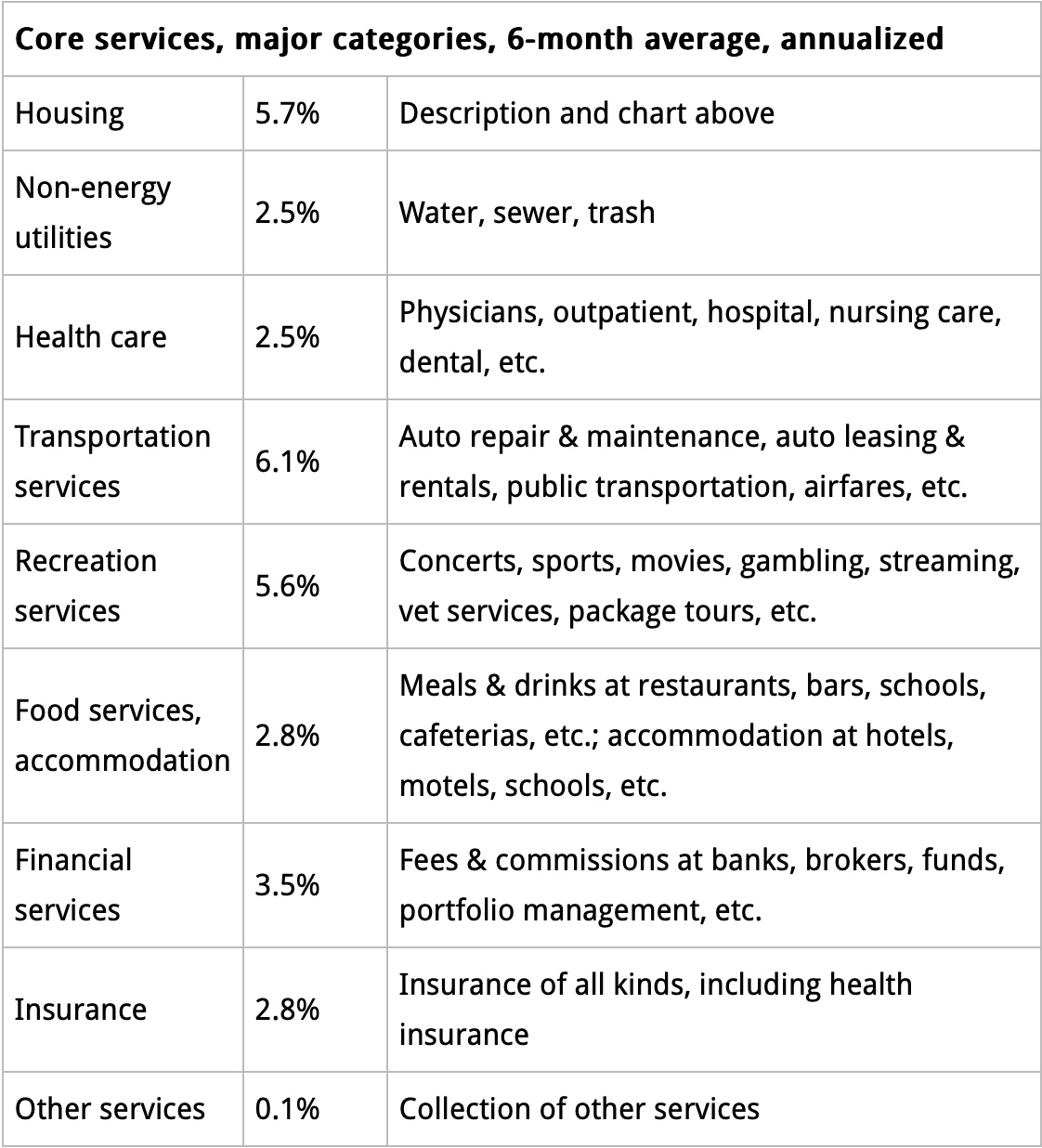

There is a very good analyst who writes regularly on the macroeconomic story named Wolf Richter. In the wake of Friday’s PCE data release, he published an article that had the following table:

It is not hard to look at this table and see a bit of the reality we all face, rather than the widely touted headline numbers regarding inflation. Housing continues to be sticky at much higher inflation rates than target, as well as transportation services, recreation services and financial services. But even the other stuff, seems to be running above the elusive 2.0% level. Now, this is the annualized rate of the past 6 months’ average readings. But as I highlighted last week regarding CPI, this seems to be the new benchmark. My point is that while the narrative is really working hard to convince us all that inflation is collapsing and the Fed is massively over-tight in its policy and needs to CUT RATES NOW, this breakdown doesn’t look quite the same. My belief is the Fed remains on hold much longer than the market is expecting/hoping for, and that at some point, equity markets and risk assets are going to come to grips with that reality. Just not quite yet.

Of course, maybe the narrative is spot on, and inflation is going to smoothly decline back to the 2% level while economic growth continues its recent above-trend course. But personally, I have to fade that bet. Based on the amount of continued fiscal stimulus, as well as the Fed’s discussion of slowing QT and their indication of rate cuts later this year, I believe that while the growth story is viable, it will be accompanied with much hotter inflation than is currently priced. The fact that breakeven inflation rates are priced at 2.50% in the 10-year does not mean that is what is going to happen. Just like the fact that the Fed funds futures market is currently pricing between 5 and 6 rate cuts in 2024 does not mean that is what is going to happen. Let’s face it, nobody knows how the rest of the year is going to play out. The one thing, however, of which we can be sure is that Treasury Secretary Yellen will spend as much money as possible in her effort to get President Biden re-elected. That alone tells me that inflation is set to rebound.

And there is one other thing to remember, as things heat up in the Red Sea, and shipping avoids the area completely, the cost of transiting stuff from point A to point B continues to rise. The cost is measured both in the dollars charged for the service and the extra 10-14 days it takes to complete the trip around the Cape of Good Hope in South Africa. It seems that the Biden Administration’s foreign policy has unwittingly had a negative impact on its economic policy plans.

In sum, when I look at both the data and the activities around the world, it remains very difficult to accept the narrative that inflation is collapsing so quickly that the Fed MUST cut rates and cut them soon. The combination of still robust US growth on the back of excessive fiscal stimulus and the increased tensions in the oil market lead me to a very different conclusion.

With that in mind, let’s see what happened overnight. Equity markets in Asia were mixed as Japan (Nikkei +0.8%) and Hong Kong (Hang Seng +0.8%) both rallied but mainland Chinese shares (CSI -0.9%) fell. This was somewhat surprising as China, in their continuing efforts to prop up their stock markets, have restricted the lending of any securities for short sales while a HK court ruled Evergrande (remember them?) should be liquidated completely. Perhaps the Chinese real estate situation is not quite fixed yet after all. I suspect that we will see other liquidations as well before it is all over. In the meantime, European bourses are mixed with the DAX (-0.4%) lagging while the FTSE 100 (+0.25%) is top dog today. There’s been no news of which to speak so this seems like position adjustments ahead of the Fed’s activities later this week. US futures, too, are mixed and little changed at this hour (7:15).

Bond markets, though, are really loving all the rate cut talk and are growing more confident that they will be coming soon as inflation collapses. Treasury yields are lower by 3bps this morning and the entire European sovereign market has rallied with yields down an impressive 5bps-7bps today. The only outlier is the JGB market, which saw the 10-year benchmark yield edge up 1bp. It is much easier for me to believe that the ECB is going to cut as inflation in the Eurozone slows alongside the faltering growth story than to believe that the Fed is going to cut into an economy growing 3+%. But that’s just me.

In the commodity markets, oil (+0.3%) continues to find support as the tensions in the Middle East expand after an attack in Jordan killed three US servicemen there. Oil is higher by 5% in the past week and more than 11% in the past month. It seems to me that will not help the inflation story. At the same time, we are seeing demand for precious metals as gold (+0.5%) and sliver (+1.0%) are both rallying on the increased nervousness around the world. Perhaps more interestingly is that copper is marginally higher this morning, something that would seem contra to the escalating tensions.

Finally, the dollar has rallied a bit this morning on net, although it is not a universal move by any stretch. For instance, while European currencies are broadly weaker, in Asia and Oceania, we are seeing strength with AUD and NZD (both +0.4%) and JPY (+0.2%) fimer. As to the rest of the world, it is a mixed session with minimal movement. Feels like a wait and see situation given all the data and info coming this week.

Speaking of the data this week, there is much to absorb.

| Today | Treasury Funding Amount | $816B |

| Dallas Fed Manufacturing | -23 | |

| Tuesday | Case Shiller Home Prices | 5.8% |

| JOLTS Job Openings | 8.75M | |

| Consumer Confidence | 115 | |

| Wednesday | ADP Employment | 135K |

| Treasury QRA | ||

| Employment Cost Index | 1.1% | |

| Chicago PMI | 48 | |

| FOMC Meeting | 5.5% (unchanged) | |

| Thursday | Initial Claims | 210K |

| Continuing Claims | 1835K | |

| Nonfarm Productivity | 2.5% | |

| Unit Labor Costs | 1.7% | |

| ISM Manufacturing | 47.3 | |

| Construction Spending | 0.5% | |

| Friday | Nonfarm Payrolls | 173K |

| Private Payrolls | 145K | |

| Manufacturing Payrolls | 2K | |

| Unemployment Rate | 3.8% | |

| Average Hourly Earnings | 0.3% (4.1% Y/Y) | |

| Average Weekly Hours | 34.3 | |

| Participation Rate | 62.4% | |

| Factory Orders | 0.2% | |

| Michigan Confidence | 78.8 |

Source tradingeconomics.com

The first thing to understand is that this morning, the Treasury will be releasing how much funding they expect to need in Q1 of this year, currently expected at $816 billion, but Wednesday’s QRA will describe the mix of the borrowings. Recall that last quarter, Secretary Yellen changed the mix of short-dated paper to long-dated coupons substantially and completely reversed the bond market rout that was ongoing at the time. If she continues to issue far more bills than coupons, it should support the bond market and help continue to juice risk assets. Any substantial increase in coupon issuance is likely to be met with a significant stock and bond market sell-off. So, which do you think she will do?

Otherwise, looking at the other data, certainly there is no indication that housing prices are moderating. The Fed will not change rates on Wednesday, but everyone is waiting to see if they will remove the line in their statement about potentially needing to raise rates going forward. Perhaps there will be a little two-step where the QRA points to more bond issuance, but the Fed sounds more dovish to offset that news. And of course, Friday’s NFP data will be keenly watched by all observers as any signs that the labor market is cracking will get the rate cut juices flowing even faster.

All in all, we have a lot of new information coming to our screens this week. At this point, it is a mug’s game to try to guess how things will play out. However, if we see dovishness from the Fed or the QRA (more bill issuance) then I expect risk assets to perform well and the dollar not so much. The opposite should be true as well, a surprisingly hawkish Fed or more coupon issuance will not be welcomed by the bulls, at least not the equity bulls. The dollar bulls will be happy.

Good luck

Adf