The FOMC’s out in force

Explaining the still likely course

Of rates is to stay

Where they are today

Unless there’s some hidden dark horse

Investors, though, don’t give a whit

As Spooz seem quite likely to hit

Five thousand quite soon

Then onto the moon

Take care lest this view turns to sh*t

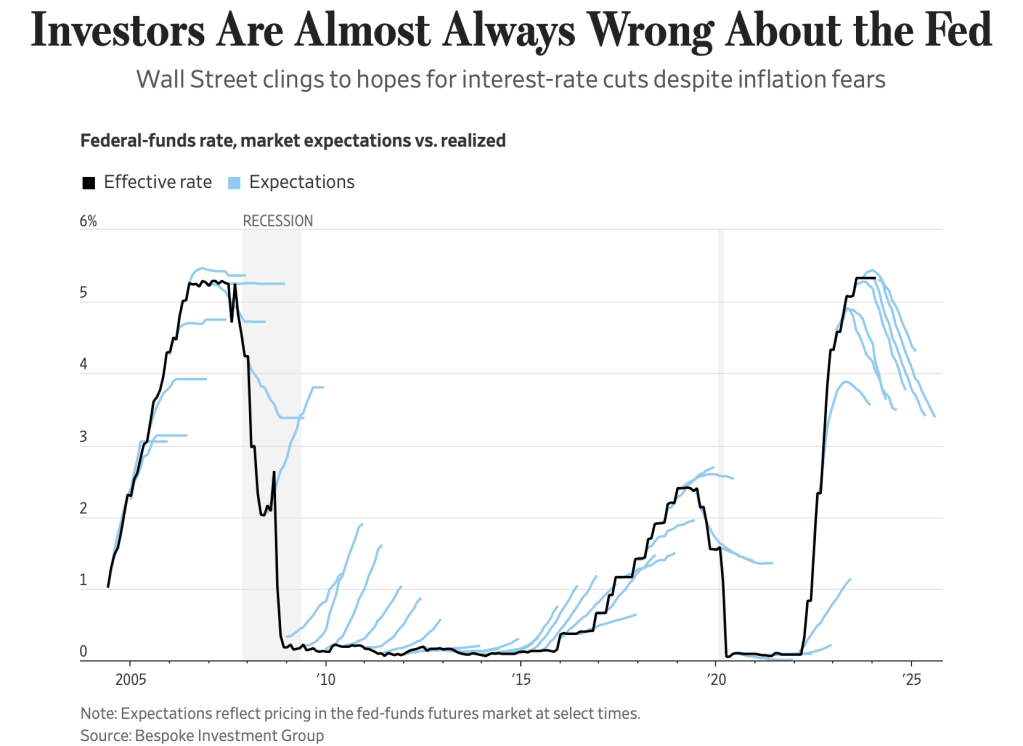

The WSJ led with an interesting article today with the below graphic as the teaser. This is called a hair chart, for obvious reasons, with those light blue lines describing Fed funds futures curves and comparing them to the subsequent actual Fed funds rate over time. The article’s point, which is important to understand, is that the futures market tends not to get things right very often. In other words, just because the market is pricing in 5 or 6 rate cuts today does not mean that is what will occur over time. In fact, looking at the chart, it almost seems that 5 or 6 cuts is the least likely outcome. One need only look at the past several years to see that while they were pricing cuts, the Fed was still hiking.

Of course, this fits with my thesis that the Fed funds futures market is actually reflecting a bimodal outcome of either zero cuts or 10. But regardless of my view, the equity market is all-in on the idea that the Fed is going to be cutting rates soon as evidenced by the fact that the S&P 500 is now trading just a hair below 5000 after yesterday’s 0.8% gain.

In the meantime, yesterday we heard from four more Fed speakers and to a wo(man) they all said effectively the same thing; progress has been made on the inflation front but they still don’t have confidence that 2% inflation on a sustainable basis has been achieved. In fact, several mentioned that the recent hot GDP and NFP data indicated more caution is warranted. By the way, if we look at the Atlanta Fed’s GDPNow forecast, it currently sits at 3.4%, hardly a level of concern, while their Wage Growth Tracker remains at 5.0%. Again, that is not data that indicates inflation is collapsing. It remains very difficult for me to expect inflation to fall given the recent totality of the data. In other words, nothing has changed my view that inflation will remain stickier than currently priced and very likely start to creep higher again, and that will ultimately have a negative impact on risk assets. But not today!

The other news overnight was that Chinese CPI rose less than expected in January, just 0.3%, which took the annual change to -0.8%. As China heads into their two-week Lunar New Year holiday, welcoming the Year of the Dragon, the question for investors around the world is, will Xi do anything to halt the decline? Thus far, his efforts have been weak and insufficient as evidenced by the equity markets in Hong Kong and on the mainland both having fallen sharply over the past year with little net movement this year despite several efforts at support and stimulus. Now, Xi has nearly two weeks to come up with a new plan to get things going when markets return on February 20th, but for the past several years he has been unwilling to fire a big fiscal bazooka. Will it be different this time? Remember, they still have a catastrophic mess in the property market there which will impinge on anything they do. I expect there will be some more half-hearted measures, but nothing sufficient to turn things around. Ultimately, while they don’t want to see the renminbi fall sharply, I suspect it may have a bit more weakness in it before things are done, especially if the Fed really does stay higher for longer.

Ok, let’s look at markets elsewhere overnight. The Nikkei (+2.0%) rallied sharply after comments by a BOJ member indicating that even when rates get back above zero, they will not move very much higher, and it will take time. This saw the yen weaken further while stocks benefitted. Meanwhile, the only loser in Asia overnight was India, where investors were disappointed that the RBI left rates on hold rather than cutting them (see a pattern here?). Otherwise, everything followed the US rally yesterday. The same is broadly true in Europe with decent gains, about 0.5%, almost everywhere except the UK, which is flat on the day after comments by a BOE official that cuts may not come as soon as hoped. As to the US, at this hour (7:30) futures are basically unchanged.

In the bond market, after a generally quiet session yesterday, yields are starting to creep higher again with Treasuries +2bps and European sovereign yields rising a similar amount across the board. Once again, the global bond markets revolve around Treasury yields with the only exception being JGB’s which saw the yield decline 1bp after those BOJ comments.

In the commodity markets, oil (+0.9%) is higher once again with Brent trading back above $80/bbl, as Secretary of State Blinken returned to the US with no real improvement in the Israeli-Hamas war and no prospects for a cease-fire. Meanwhile, the US was able to kill the Iranian commander who allegedly led the attack on a US base that killed three soldiers, certainly not the type of thing to cool down tensions in the region. Between the rise in cost of shipping oil from the Mideast to the rest of the world because of the Red Sea situation, and the lack of hope for an end to the fighting, it seems oil may have some legs here. As to the metals markets, there is a split with both gold and copper under some pressure but aluminum seeing a bid this morning. Quite frankly, I understand the former two rather than the gains in aluminum, but in the end, none of these metals has moved very much over the past months and remain trendless for now.

Finally, the dollar is starting to assert itself this morning as though the yen (-0.75%) is leading the way lower, pretty much every G10 and EMG currency is weaker vs. the greenback at this time. Again, I would contend this is all about the ongoing Fed message of caution and confidence regarding inflation’s disposition, and the prospects of higher for longer. FWIW, the current probability of a March cut is 18.5%. barring a collapse in the CPI data next week, I expect that to head toward zero over time.

As to the data situation, we only see the weekly Initial (exp 220K) and Continuing (1878K) Claims data first thing and then it is Fedspeak for the rest of the day. I expect that traders are going to push the S&P 500 over 5000 early this morning, if for no other reason than to say it was done, but what happens after is far less certain. Earnings data has been generally ok, but some pretty bad misses have had quite negative impacts on individual names. As to the dollar, the more I hear Fed speakers urge caution in the idea for rate cuts soon, the better its prospects.

Good luck

Adf