Will they or won’t they?

The intervention question

Is now top of mind

As we approach Japanese Fiscal Year end, and while we all await Friday’s PCE data, the FX markets have taken on more importance, at least for now. The big question is, will there be intervention by the Japanese? Late last night, USDJPY traded to a new thirty-four year high of 151.96, one pip higher than the level touched in September 2022 which catalyzed the last intervention by the BOJ/MOF. Recall, last week the BOJ “tightened” monetary policy by exiting their 8-year experiment with negative interest rates and ‘promised’ that they were just getting started. Granted, they didn’t indicate things would move quickly in this direction and they also explained they would remain accommodative, but they did seem confident that this would change a lot of opinions. Remember, too, that the market response to that policy shift was to weaken the currency further while JGB yields actually drifted lower.

So, here we are a bit more than a week later and the yen has fallen to new lows. What’s a country to do? In the timeless fashion of governments everywhere with respect to currency moves, they immediately started jawboning. Last night we heard from BOJ Board member Naoki Tamura as follows, “The handling of monetary policy is extremely important from here on for slow but steady progress in normalization to fold back the extraordinarily large-scale monetary easing. The continuation of an easy financial environment doesn’t mean there won’t be any more rate hikes at all.” Traders did not exactly quake in fear that the BOJ was suddenly going to tighten aggressively, let’s put it that way, and so nothing has really changed. One other thing to note is that Tamura-san is seen as the most hawkish member of the current BOJ, at least per Bloomberg Intelligence’s analysts. Take a look at their views below.

But wait, there’s more! We also heard from Japanese FinMin, Shunichi Suzuki, that the government would take “decisive steps” if they deemed it necessary to respond to recent currency movement. And the, the coup de grace, an emergency meeting between the MOF, the BOJ and the Financial Services Agency (FSA) is ongoing as I type (6:30) to help come up with a plan.

Does this mean intervention is coming soon to a screen near you? While it is certainly possible, the ultimate issue remains that the relative monetary policy settings between the US (higher for longer) and Japan (still at ZIRP with a hike expected in…October) remain such that the yen is very likely to remain under pressure. Remember, too, that Japan is in the midst of a technical recession, so tightening monetary policy is not likely to be appreciated by Mr and Mrs Watanabe. At the end of the day, the politics of inflation are very different in the US and Japan, and I would contend that in Japan, it is still not the type of existential problem for the government that it appears to be in the US.

FWIW, which is probably not much, I expect the MOF to follow their playbook, talk tougher, check rates and ultimately intervene over the next several days. They will take advantage of the upcoming Easter holiday weekend and the reduced liquidity in markets to seek an outsized impact for the least amount of money possible. But I do not see them changing their monetary policy before the autumn and so I look for continued yen weakness over time. Be careful in the short run, but the direction of travel is still the same, USDJPY will rise.

For China, the fact the yen’s weak

Has Xi and his staff set to freak

They’re all quite dismayed

‘Cause Japanese trade

Has lately been on a hot streak

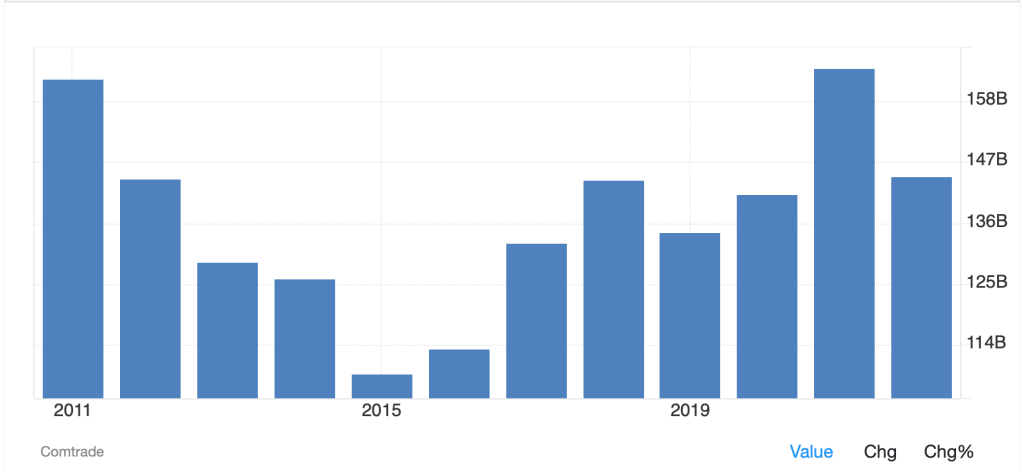

The other story in markets has been the ongoing ructions in the Chinese renminbi market. It is key to understand that this is directly related to the yen story above as China and Japan are fierce competitors in many of their export activities. But of even more concern to Xi and his gang is that Japanese exports to China are growing so rapidly and Japan ran a trade surplus with China in December (the last month with data released). When you are a mercantilist nation like China, having a key competitor, like Japan, allow its currency to weaken dramatically against your own is a major problem. Last week I highlighted the dramatic decline of the yen vs. the renminbi, and that has not changed. Below is a chart from tradingeconomics.com showing Japanese exports to China ($billions) showing just how much this trend has changed and continues to do so.

Ultimately, both of these countries rely on exports as a critical part of their economic growth and activity, and in both cases, exports to the US and Europe are crucial markets. If the Japanese continue to allow the yen to weaken, China has a problem. Remember, Japan does not have capital controls, so while they don’t want the yen to collapse, they are perfectly comfortable with capital outflows in general. China, on the other hand, is terrified of massive outflows if they were to even consider relaxing capital controls. The fact is both companies and individuals work very hard to get their money out of the country. This is one reason that gold is favored there by the population, and the reason that the government banned bitcoin as it was an open channel for funds to leave the country.

This battle has just begun and seems likely to last for quite a while going forward. The Chinese are caught between wanting to devalue the renminbi to compete more effectively and maintaining a stable exchange rate to demonstrate there are no fiscal or economic problems in the country. Alas for Xi and the PBOC, never the twain shall meet. I would look for a continuation of the recent market volatility here as they will use that uncertainty to discourage large position taking by speculators. But, as I have maintained for a long time, I expect that USDCNY will trade to 7.50 and beyond as time progresses.

And that’s really it for today. Ultimately, very little happened in markets overnight, certainly there were no changes in the recent data trajectory nor in any commentary from speakers (other than that mentioned above). It is a holiday week and a key piece of data, PCE, is set to be released on a broad market holiday this Friday. Do not look for large moves before then.

There is no US data due today but we do hear from Fed Governor Christopher Waller this afternoon so there is an opportunity for some market movement then. But for now, consolidation seems the most likely outcome.

Good luck

Adf