The data continues to show

The US is able to grow

If this is the case

Seems foolish to chase

The idea rate cuts are a go

Instead, I expect Powell’s way

Is higher for longer will stay

If rates, thus, stay high

Can risk assets fly?

Or will those high rates cause dismay?

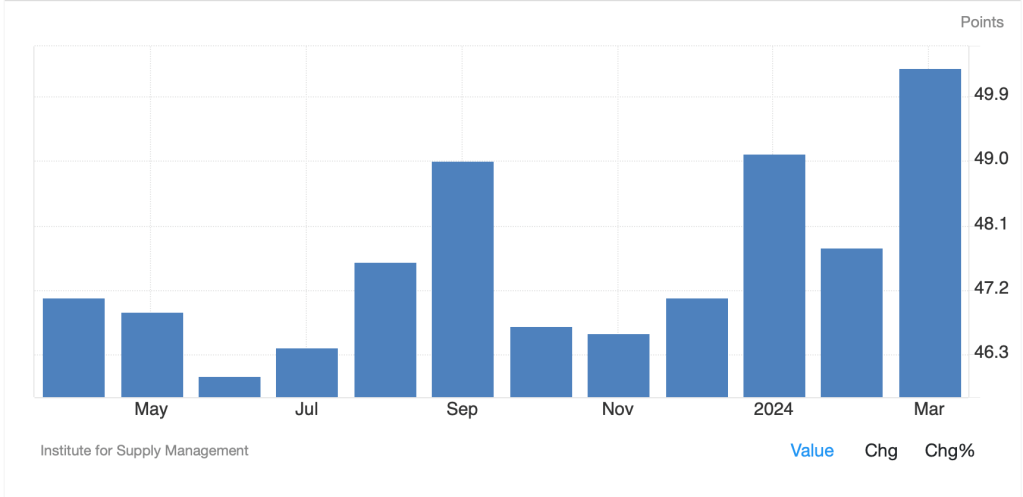

The case for the Fed to cut rates continues to fade as not only have Powell and his team been cautioning patience, the data continue to show that economic activity is not slowing down. The latest exhibit comes from yesterday’s ISM Manufacturing data which printed at a much better-than-expected 50.3, its first print above 50 in 16 months. Not only that, but the New Orders and Prices Paid sub-indices both printed much higher than last month indicating business is picking up and so are prices. Certainly, the chart below from tradingeconomics.com indicates that a clear trend is forming for better growth ahead.

The Prices Paid chart looks almost identical. It strikes me that the recession call continues to get harder to make. Certainly, things can change, but as of right now, I cannot look at the menu of data and conclude growth is set to slow rapidly. Given this as background, it becomes increasingly difficult to make the case that the Fed is going to cut rates at all, at least based on the data. This is a big problem for Powell if he remains insistent on making those cuts because it will call into question the rationale and really push the politics front and center.

As it happens, I am not the only one concluding that rate cuts are less likely, the CME’s Fed funds futures contract is slowly pricing cuts out of the mix as well. This morning not only has the probability of a June cut fallen slightly to 58.8%, but the market is now pricing in just 66bps of cuts by the December meeting, less than the three full 25bp moves that the median dot indicated. There is a ton of Fedspeak this week, starting with 4 speeches today from Bowman, Williams Mester, and Daly. Chairman Powell speaks tomorrow and there are a dozen more after that, so it will be very interesting to see if the tone has changed to even more caution and patience. With this as a backdrop, perhaps longer duration assets, like bonds and high growth companies (i.e., tech) could well feel some pressure. We shall see how things play out.

Cooperation

Is not what the market gives

Instead look for pain

While the US story continues to be about stronger economic activity and a reduced probability of lower rates, in Japan, the story remains entirely focused on the yen’s weakness and whether the MOF/BOJ are going to respond. First, remember that in Japan, like here in the US, the MOF is responsible for the currency, not the BOJ, meaning any intervention is directed by the MOF although it is executed by the BOJ. This is why we need to focus on the FinMin and his minions regarding any actions. In this vein, last night as USDJPY once again approached 152.00, FinMin Suzuki was back in front of reporters explaining, “Language aside, we’re now watching markets with a strong sense of urgency. We are carefully watching daily market moves.” He added, “All we can say is that we will take appropriate action against excessive volatility, without ruling out any options.”

So, the MOF continues to threaten intervention with their urgent watching of markets (I feel like that is a very poor translation of whatever he is actually saying, although I suppose it gets the message across.). In one way, it was surprising they didn’t take advantage of illiquid markets yesterday to push the dollar lower as every dollar spent would have been far more effective, but a look at the recent price activity shows that while the yen has weakened appreciably since the beginning of the year, thus far their words have been sufficient to prevent further damage as the currency hasn’t budged in two weeks.

The problem they have is that the US seems less and less likely to begin easing monetary policy and so the underlying fundamental driver of the exchange rate, interest rate differentials, is going to continue to weigh on the yen (and every other currency). I also see no reason for Secretary Yellen to consider that a weaker dollar is a help for the US right now, so concerted intervention, a redux of the Plaza Accord of 1985 seems highly unlikely. While at some point I do expect the MOF to act on their own, as is always the case, it will only have a short-lived impact on markets and likely be used as an entry point for speculators to extend their short yen trade. The only solution is a change in policies and the BOJ blew that last month.

Ok, now that markets are back open again, let’s see what’s happening. In Asia, the big mover was the Hang Seng (+2.35%) which was catching up to the news that China seemed ready to implement further stimulus that we heard on Friday. But there was no consistency throughout the rest of Asia with both gainers and losers around the continent. Europe is a similar mixed bag, with some markets higher and others lower despite what I would characterize as mildly better than expected PMI data released this morning across the entire continent. While it wasn’t showing growth, the data improved on the flash numbers of last week. US futures, however, are softer this morning by about -0.5% after yesterday’s lackluster session. Certainly, continued hopes for rate cuts are diminishing and that seems to be weighing on stocks at least a bit.

In the bond market, yesterday’s US data set the tone as Treasury yields jumped 12bps yesterday after the strong ISM data and are up another 5bps this morning. This has dragged European yields higher across the board with gains between 9bps (Germany) and 14bps (Italy). Of course, the mildly better PMI data in Europe is adding to that mix. Even JGB yields managed to edge higher by 1bp overnight, although they remain below 0.75%.

Oil prices have been flying, up another 1.1% this morning and now nearly 9% in the past month. It seems that the escalation of events in the Middle East is having an impact at the same time that OPEC+ is holding firm on their production cuts. There are rumors of some big Middle East settlement deal to end the war as well as get Saudi Arabia to recognize Israel, but the market does not yet believe that, clearly. Considering that growth is making a comeback, that China seems ready to stimulate further and that production is not growing, it seems there is a pretty good chance that oil prices continue to rally. Meanwhile, metals remain the flavor of the day with gold (+0.3%), silver (+1.7%), copper (+0.6%) and aluminum (+1.6%) all in demand. The industrial metals are responding to the growth story, while the precious set are simply on a roll with fears that fiat currencies are going to continue to be debased top of mind.

Speaking of fiat currencies, the dollar, which rallied nicely over the long weekend, is settling back a bit this morning, but with no consistency. For instance, CHF (-0.5%) is lagging sharply while NOK (+0.5%) and SEK (+0.5%) are both powering ahead. The rest of the G10 is modestly firmer, but the movements are within 10bps of yesterday’s closing levels. In the EMG bloc, ZAR (+0.5%) continues to benefit from the metals rally while PLN (-0.4%) is under pressure after its PMI data disappointed relative to its peers. My view continues to be that as long as the Fed remains the most hawkish central bank, the dollar will find support.

On the data front today we see JOLTS Job Openings (exp 8.75M) and Factory Orders (1.0%) and we have all those Fed speakers mentioned above. German CPI fell to 2.2%, as expected, which implies to me that the chances remain greater the ECB will cut before the Fed. And that is really the big question now, which major central bank acts first. With all the Fed speakers on this week’s docket, I suspect by Friday we will have a much better idea as to whether a June cut is still on the table. We will be watching closely.

Good luck

Adf