Ueda explained

Buying bonds is still our bag

But buying yen ain’t

The last of the major central banks met last night as the BOJ held their policy meeting. As expected, they left the policy rate unchanged between 0.00% and 0.10%. However, based on the April meeting comments, as well as a “leak” in the Nikkei news, the market was also anticipating guidance on the BOJ’s efforts to begin reducing its balance sheet. Remember, they still buy a lot of JGBs every month, so as part of the overall normalization process, expectations were high they would indicate how much they would be reducing that quantity.

Oops! Here is their statement on their continuing QQE program [emphasis added]:

Regarding purchases of Japanese government bonds (JGBs), CP, and corporate bonds for the intermeeting period, the Bank will conduct the purchases in accordance with the decisions made at the March 2024 MPM. The Bank decided, by an 8-1 majority vote, that it would reduce its purchase amount of JGBs thereafter to ensure that long-term interest rates would be formed more freely in financial markets. It will collect views from market participants and, at the next MPM, will decide on a detailed plan for the reduction of its purchase amount during the next one to two years or so.

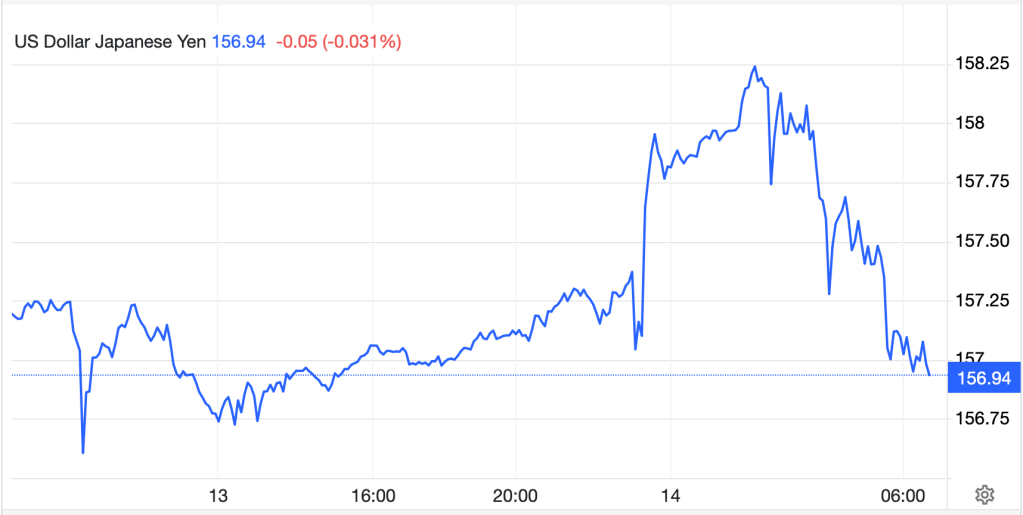

In other words, they have delayed the onset of their version of QT by another month and based on the nature of their process, where they pre-announce the bond buying schedule on a quarterly basis, it is entirely possible that the delay could be a bit longer. You will not be surprised to know the yen fell sharply on the news, as per the below chart.

Source: tradingeconomics.com

In fact, it traded to its weakest (dollar’s highest) level since just prior to the intervention events in April. However, as you can also see, that move was reversed during the press conference as it became clear to Ueda-san that his delay did not result in a desired outcome. The issue was the belief that the BOJ cannot make decisions on interest rates and QT simultaneously (although for the life of me, I cannot figure out why that was the belief), and so Ueda addressed it directly, “We will present a concrete plan for long-term JGB buying operations in July. Of course, it’s possible for us to raise the short-term interest rate and adjust the degree of monetary easing at the same time depending on the information available then on the economy and prices.”

In the end, the only beneficiary of this was the Japanese stock market, which managed a modest rally of 0.25%. Certainly, this did not help either Ueda’s or the BOJ’s credibility that they are prepared to normalize policy, and it also left the entirety of currency policy in the lap of the MOF. The problem for Ueda-san is that until the Fed decides it is time to start cutting interest rates, a prospect which seems further and further distant, the yen is very likely to remain under pressure. I am beginning to suspect that despite Ueda’s stated goal of normalizing monetary policy, the reality is that, just like every other central banker today, his bias is toward dovishness, and he cannot let go. I fear the risk is that the yen could weaken further from here rather than it will strengthen dramatically, at least until there are real policy changes. FYI, JGB yields closed 3bps lower after the drama.

Away from that, the overnight session informed us that Chinese economic activity appears to be slowing, at least based on their loan growth, or lack thereof. Loans fell, as did the pace of M2 Money Supply and Vehicle Sales. While none of these are typically seen as major data releases, when combined, it seems to point to slowing domestic activity. The upshot is a growing belief that the PBOC will ease policy further thus supporting Chinese equities (+0.45%) and maintaining pressure on the renminbi which continues to trade at the limit of its 2% band vs. the daily CFETS fixing.

As to Europe, it is becoming clearer by the day that investors around the world have begun to grow concerned over what the future of Europe is going to look like. Despite the ECB having cut their interest rates last week, the results of the European Parliament elections continue to be the hot topic and we are seeing European equity markets slide across the board, with France (-2.5% today, -5.8% this week) leading the way lower as President Macron’s Renaissance Party looks set to be decimated in the snap elections at the end of the month. But the entire continent is under pressure with Italy (-2.8% today, -5.7% this week) showing similar losses and the other major nations coming in only slightly better (Germany -2.75% this week, Spain -3.9% this week). You will not be surprised to know that the euro (-0.4%) is also under pressure this morning, extending its losses to -1.0% this week with thoughts it can now test the lows seen last October.

There is a great irony that the G7 is meeting this week as so many of the leaders there, Italy’s Giorgia Meloni and Japan’s Kishida-san excepted, looks highly likely to be out of office within a year. Macron, Olaf Sholz, Justin Trudeau, President Biden and Rishi Sunak are all far behind in the polls. One theory is that the blowback from the draconian policies put in place during the pandemic restricting freedom of movement and speech within these nations, as well as the ongoing immigration crisis, which is just as acute in Europe and the UK as it is in the US, has turned the tide on the belief that globalization is the best way forward.

Earlier this year I forecast that there would be very severe repercussions during the multitude of elections that have already taken place and are yet to come. Certainly, nothing has occurred that has changed that opinion, and in fact, I have a feeling the changes are going to be larger than I thought.

The reason this matters is made clear by today’s market price action. If the world is turning away from globalization, with a corresponding reduction in trade, equity markets which have been a huge beneficiary of this process (or at least large companies have directly) are very likely to come under further pressure. As well, fiscal policies are going to put more pressure on central banks as the natural response of politicians is to spend more money when times are tough, and we could see some major realignments in market behaviors. This will lead to ongoing inflationary pressures, thus weaker bond prices and higher yields, weaker equity prices, much strong commodity prices and the dollar, ironically, likely to do well as it retains its haven status. Certainly, the euro is going to be under pressure, but very likely so will many other currencies. This is a medium to long-term concept, certainly not something that is going to play out day-to-day right now, but I remain firmly in the camp that many changes are coming.

As to the rest of the markets overnight, yields are falling everywhere (Treasuries -5bps, Gilts -9bps, Bunds -12bps, OATs -6bps, Italian BTPs -1bp) as investors are seeking havens and for now, bonds seem better than stocks. You will also notice that the spread between Bunds and other European sovereigns is widening as there is clear discernment about individual nation risk. This is not a sign that everything is well.

Maintaining the risk-off thesis, gold (+1.25%) and silver (+1.00%) are rallying despite a much stronger dollar this morning and we are also seeing some strength in oil (+0.2%).

As to the dollar, it is stronger vs. almost every one of its counterparts this morning, most by 0.3% or more with CE4 currencies really under pressure (PLN -1.0%, HUF -0.8%). However, there are two currencies that are bucking this trend, CHF (+0.25%) which is showing its haven characteristics and ZAR (+0.5%) where the market is responding to the news that the ANC has put together a coalition and that President Ramaphosa is going to remain in office.

Yesterday’s PPI data showed softness similar to the CPI on Wednesday but more surprisingly, the Initial Claims number jumped to 242K, its highest print since August 12, 2023, and a big surprise to one and all. The combination of data certainly added to yesterday’s feel that growth and inflation were ebbing. This morning, we get the Michigan Sentiment (exp 72.0) and then a couple of Fed speakers (Goolsbee and Cook) later on during the day.

I should note that equity futures are all in the red this morning, with the Dow continuing to lag the other markets, probably not a great signal of future strength. Arguably, part of today’s price movement is some profit taking given US equity markets have rallied this week and month. But do not discount the bigger issues discussed above as I believe they will be with us for quite a while to come and put increasing pressure on risk assets with support for havens. As such, I think you have to like the dollar given both the geopolitical issues and the positive carry.

Good luck and good weekend

Adf