We have now a president, Biden

Who lately, has taken much chidin’

Last night he debated

A man who he hated

Alas, polls against him did widen

The market response, though, was muted

With not many trades prosecuted

Instead, we await-a

The PCE data

To learn if inflation’s deep-rooted

While it was painful to watch, I did last through most of the debate. Unfortunately, it didn’t help me sleep any better! Clearly the top story around the Western world today is the performance of President Biden and the concerns it raised over his abilities to not merely execute the responsibilities of the President if he is re-elected, but to complete his current term. There have been numerous calls by high profile Democratic strategists and pundits for him to step down from the ticket. We shall see what happens, but my personal take is he will not willingly step aside regardless of the situation and that those closest to him will not force him to do so.

The upshot is that in the betting markets, Mr Trump is now a 60% favorite with Mr Biden at 22% and a host of other Democrats making up the difference, at least according to electionbettingodds.com. Arguably, though, the question that most concerns all of us is how will this outcome impact markets going forward. And remember, there is a very big election this weekend in France that is also going to have a major impact, not just in France, but in all of Europe.

Perhaps the most surprising thing to me is the non-plussed manner that markets have behaved in the wake of the debate. Equity markets around the world have traded higher as have US futures. Bond yields have traded modestly higher and so has oil, metals markets and the dollar. Clearly, investors do not appear to be concerned that the leader of the free world is in such dire physical condition. While I would not have expected a collapse, it doesn’t seem hard to foresee a chain of events that results in less positive economic outcomes.

Or…perhaps the market has absorbed this outcome and determined that central banks, and especially the Fed, are going to be starting to err on the side of easy money to ensure that economies don’t fall into disarray, so all that rate cutting that has been discussed, hypothesized and, frankly, dreamed about may be coming sooner than the hawkish central bankers themselves had considered previously. I understand that political events typically don’t have a big market response, but the depth and breadth of the damage that last night’s debate had on ideas about President Biden’s mental competence and acuity are stunningly large. That cannot inspire confidence in investors.

Of course, of far more importance to the market, obviously, is today’s PCE data release and the corresponding Personal Income and Spending figures. So, let’s take a look at expectations there.

| PCE | 0.0% (2.6% Y/Y) |

| Core PCE | 0.1% (2.6% Y/Y) |

| Personal Income | 0.4% |

| Personal Spending | 0.3% |

| Chicago PMI | 40.0 |

| Michigan Final Sentiment | 65.8 |

Source: tradingeconomics.com

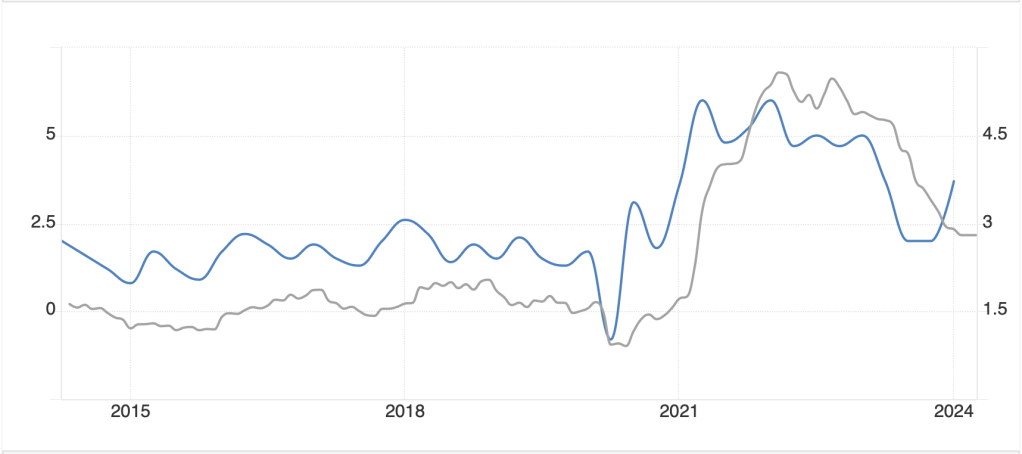

Of this grouping of data, the Core PCE reading is the most important as it represents the Fed’s North Star on inflation. (While we all live in a CPI world, the Fed apparently found out that their models worked better with core PCE and so that became the benchmark.) At any rate, forecasts are that prices, ex food & energy, did not rise in May. That was not my lived experience, and I will wager not many of yours either, but we don’t really matter in this context. However, the Bureau of Economic Analysis, when they are calculating GDP also calculate their own PCE figure for the quarter. That was released yesterday with the Core PCE printing at 3.7% while GDP was raised to 1.4%. In total, that implies nominal GDP was at 5.1% in Q1, a slight decline from Q4’s reading of 5.4%. It should not be surprising that both these PCE measures track one another well, and as per the chart below, that seems to be the case.

Source: tradingeconomics.com

However, I cannot help but look at this chart and see that the blue line (the quarterly BEA data, RHS numbers) is not trending lower at all. Perhaps it turns around, but perhaps the forecasts for this morning’s numbers are a bit too optimistic. After all, we saw higher inflation in Canada and Australia this month. As well, we have seen a continuation in the rise in the price of housing and energy. None of those are perfect analogs for the PCE data this morning, but I sense that we may have found the lows in inflation.

Ahead of the data, as I discussed briefly above, markets are in fine fettle. After a modestly positive session in the US yesterday, virtually every market in Asia was in the green as well, with the Nikkei (+0.6%) leading the way and smaller gains, on the order of 0.1% – 0.2% across the rest of the major markets in the region. In Europe, the CAC (-0.3%) is bucking the trend as investors continue to leave the market ahead of the elections this weekend, but the rest of the bourses are all decently firmer, on the order of 0.35% – 0.55%. I suppose the reason French investors are concerned is the possibility of a hung Parliament, where no party has a majority and therefore no new legislation will be able to be enacted under a caretaker government for at least a year. Of course, there are also those who are concerned that a ‘cohabitation’ between President Macron and the RN might have trouble governing as well. As to US markets, they continue to rally with futures higher across all three major indices this morning, roughly by 0.35%.

In the bond market, yields are higher across the board after they traded up yesterday as well. This morning, Treasury yields are +2bps while European yields have risen between 3bps (Germany, Netherlands) and 9bps (Spain) with French and Italian yields 6bps higher. This is the most straightforward explanation as investors demonstrate their concern with a further split between Germany and the rest of Europe regarding fiscal policies. As to JGB’s they have slipped 2bps lower overnight, despite Tokyo CPI data printing a tick higher than expected at 2.3% headline, 2.1% core.

Oil prices (+0.75%) continue to rally as summer driving demand is now the story of the market despite the large inventory builds seen this week. In a bit of a conundrum, metals markets are also firmer across the board despite the higher yields, although in the past hour or so, the dollar has reversed some of its earlier gains, so that is giving some support. However, I suspect that these markets will be subject to a dislocation in the event that we see a surprising PCE report.

Finally, the dollar has edged a bit lower this morning with modest declines vs. the G10 bloc, on the order of 0.1% – 0.2%, and a few outliers vs. EMG currencies like ZAR (+1.4%) and KRW (+0.6%). The won has benefitted from the upcoming increase in onshore trading hours as the country attempts to increase trading volumes and get more activity and more market participants to help the currency’s international standing. As to the rand, it appears that the sharp rally today in the Johannesburg stock exchange has drawn in outside investors and supported the currency.

In addition to the data, we hear from both Governor Bowman, again, and SF Fed president Daly this afternoon. Bowman has already explained, twice, that she would be amenable to raising rates if inflation rebounded, while you may recall Daly exhibited concern over the labor market and what to do if it deteriorates. Well, labor is a discussion for next week when the NFP report is released. Today is all about PCE. My sense is it will be higher than forecast which will probably undermine equities to some extent and keep pressure on bonds while supporting the dollar. In that situation, I see commodities suffering as well.

Good luck and good weekend

Adf