The world is apparently ending

‘Cause stocks just will not stop descending

So, calls have increased

For fifty, at least

And government to up its spending

The cause of this rout is unclear

Though data of late’s been quite drear

If growth is much slower

Then stocks can go lower

And that, my good friends, triggers fear

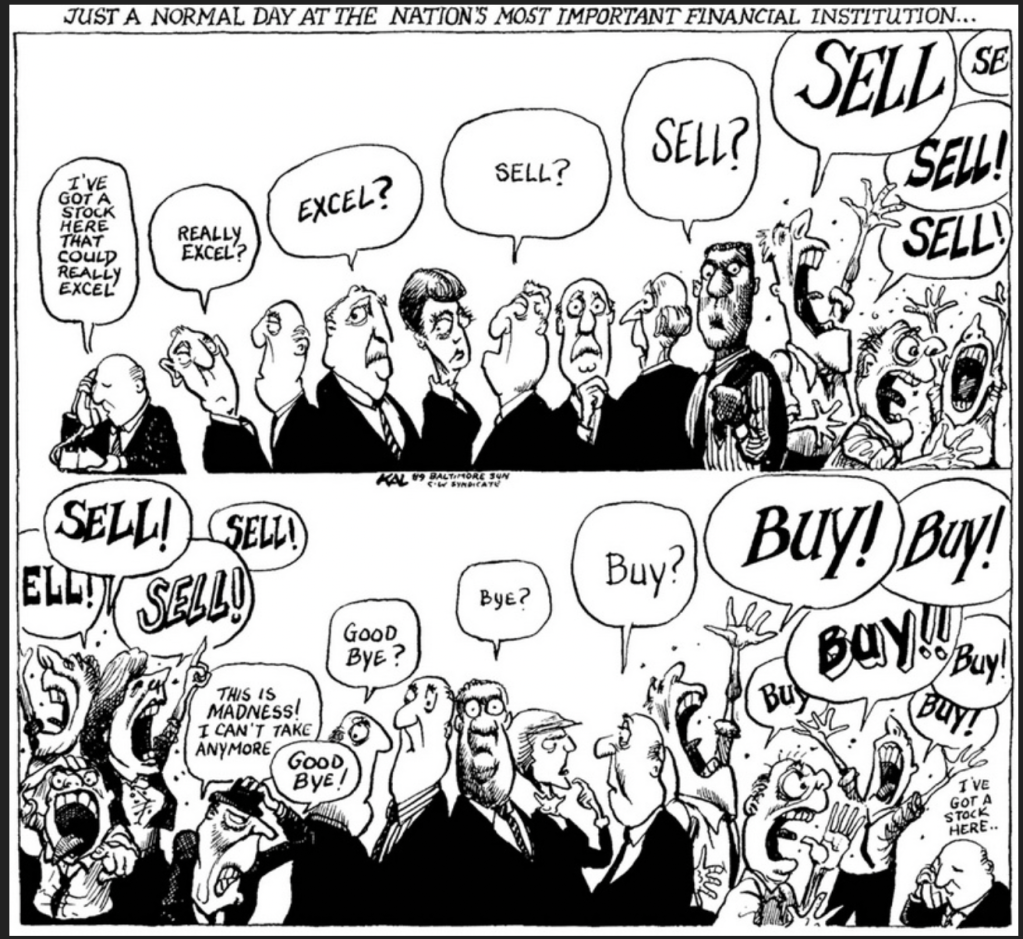

The only topic on market practitioners’ lips this morning is the ongoing sell-off in equity markets around the world. The US returned after the Labor Day holiday and sold equities aggressively with the NASDAQ falling more than 3.25% and the other major indices all declining at least -1.5%. This led to a disastrous opening in Asia with the Nikkei (-4.25%) leading the way down as fears of a repeat of the early August rout were rampant. While things never got to that point, we did see both Korea and Taiwan markets fall even more than Tokyo with declines between -4.5% and -5.0%. This negative sentiment is alive and well in Europe with every market lower there, although the declines are less pronounced, between -0.7% and -1.1%, and US futures are lower this morning as well, down anywhere between -0.3% and -0.6% at this hour (6:30).

So, what’s happening? Is there something new that was previously unknown? The first place to look is the data which saw ISM manufacturing rise less than expected to 47.2, a number that historically represents recession, with the added problem of the ISM Prices Paid reading at 54.0, higher than expected and a potential harbinger that inflation may not be declining as quickly the Fed expects. Add to that a weaker than expected Construction Spending result, -0.3%, and you have the makings of some potential dreariness on the economic front. The problem with this thesis is that the equity market opened prior to the releases and was already down -1.0% by the time they hit the tape.

Perhaps it is simply the end of summer blues as historically, September seems to be the worst month for equity performance, although I don’t put much credence in the idea that just because something has happened at a particular time before in markets, it will happen again. Seasonality is real, especially in things like commodities, but is technology really seasonal? And tech was leading the way lower.

Of course, markets have a long history of simply moving up and down over time without any specific catalyst. Positioning and changes in sentiment evolve over time and sometimes they combine to move markets more than would otherwise be expected.

From a macro perspective, I believe that this week will teach us a great deal as the ISM data along with the employment data will give further evidence of the potential for that widely hoped for soft-landing or whether things are declining more rapidly. Certainly, we continue to read of problems arising elsewhere in the world with the VW news about potential plant closings and weakness in Chinese PMI data overnight indicating that President Xi may need to do more to support his economy. The thing about sentiment is that it doesn’t necessarily need a clear catalyst to change.

Source: Horace.org

In the end, I’m hard-pressed to define anything that has changed since Friday afternoon. However, it appears that sentiment is clearly far more circumspect about the future of economic activity and how that will be able to support the current extremely high valuations of so many companies. As Ace Greenberg, then Chairman of Bear Stearns said when asked about what happened in the wake of Black Monday in 1987, “markets move, next question.”

To this poet’s eyes, the big picture remains that economic activity is continuing to slow down around the world, and that price pressures in the US are lagging that decline. It appears that China is flooding the global markets with manufactured goods as domestic consumption there remains lackluster, thus goods price inflation remains under control. However, there is no sign that central banks or governments are reducing the amount of available liquidity which is finding its way into services pricing, and that is a much larger part of the economy, hence likely to sustain inflation readings going forward. I’m confident the Fed will cut rates in 2 weeks’ time, but I’m also highly concerned that the result will be inflation remaining higher than ‘target’ going forward. The one thing on Powell’s side right now is the decline in oil, and by extension gasoline (see chart below where gasoline futures fell >15% in August), prices, which will help push headline numbers lower.

Source: tradingeconomics.com

So, how did other markets behave while stocks were getting hammered? Treasury yields fell 9bps yesterday after the data release and are lower by another 2bps this morning. Clear risk-off behavior. In Europe, sovereign bonds are all seeing declines this morning between -4bps and -5bps after declines yesterday as well and even JGB yields are lower by -4bps this morning. investors are running for the relative safety of fixed income right now.

In the commodity markets, oil (+1.3%) is bouncing off the lows seen yesterday, when WTI traded down to $69.15/bbl briefly, as the recent decline has OPEC rethinking their decision to start increasing supply next month. You may recall that when they cut production, they kept renewing that decision every few months but were set to slowly increase production again starting in October. However, the sharp decline in the price of oil has them backtracking now. The problem is that the evidence of slowing economic activity is weighing on the price here. I suspect that until there is clear evidence that economic activity is rebounding, oil could remain under pressure. In the metals markets, they were also sold off sharply yesterday, but have basically stopped declining for now, consolidating those losses. Gold continues to be the best performer as the combination of risk-off and ongoing central bank purchases are supporting it well enough. This is clearer if you look at the price of gold in other currencies, where it continues to make new highs. But the industrial metals will have a difficult road ahead with slowing growth.

Finally, the dollar, after a strong rally yesterday, is little changed this morning. In fact, most currencies are within a few basis points of their closing levels yesterday with only MXN (-0.35%) and SEK (-0.3%) showing any semblance of weakness while ZAR (+0.3%) and JPY (+0.3%) are the biggest gainers. The yen story is clearly the haven aspect with Japanese investors bringing funds home. Both the peso and krona are likely feeling a little pressure from the declines in commodity prices, while the rand has bucked that trend after reporting higher than expected GDP growth in Q2 and higher Business Confidence this morning.

Data today brings the Trade Balance (exp -$79.0B) at 8:30 and then the JOLTs Job Openings (8.10M) and Factory Orders (4.7$, -0.2% ex transport) at 10:00. We also will see the BOC cut rates 25bps this morning, although nobody is paying much attention to Canada with all eyes on the Fed and ECB.

While a lower opening seems baked in, I wouldn’t be surprised to see a bounce of some sort by this afternoon as market participants seem to have a hard time allowing prices to fall for too long. But there appears to be ample reason for further equity declines and further risk reduction, which historically has supported the dollar.

Good luck

Adf