Soaring like eagles

Japanese growth beats forecasts

Are rate hikes coming?

On this President’s Day holiday, when US markets are closed, arguably the most interesting financial story around is in the Land of the Rising Sun where Q4 GDP was released last night at 0.7%, significantly higher than forecast (0.2%) and Q3’s outcome (0.4%). Japanese markets responded about as might be expected with the yen (+0.6%) rising alongside JGB yields (+3bps) with the 10yr now at 1.38%, its highest level since March 2010. As to equity markets, the Nikkei (+0.1%) was caught between the positive GDP news and the stronger JPY. Of course, much has been made of the BOJ’s overnight rate, which now sits at 0.50% after several hikes during the past year. As well, expectations are for further hikes this year, with several analysts calling for a rate over 1.00% before the end of 2025.

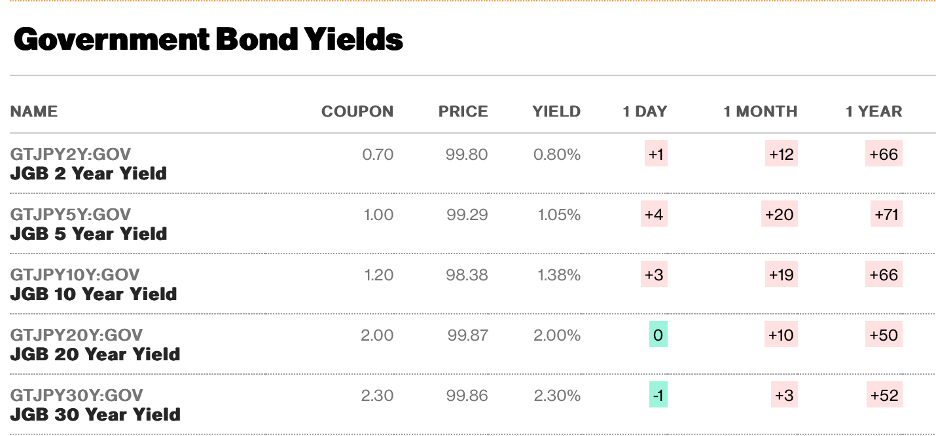

But let us consider, for a moment, what the Japanese rate structure looks like in the context of the current inflation story in Japan. As can be seen below, this is the current shape of the Japanese government bond yield curve, with 2yr yields at 0.80% while 30yr yields are up to 2.30%.

Source: Bloomberg.com

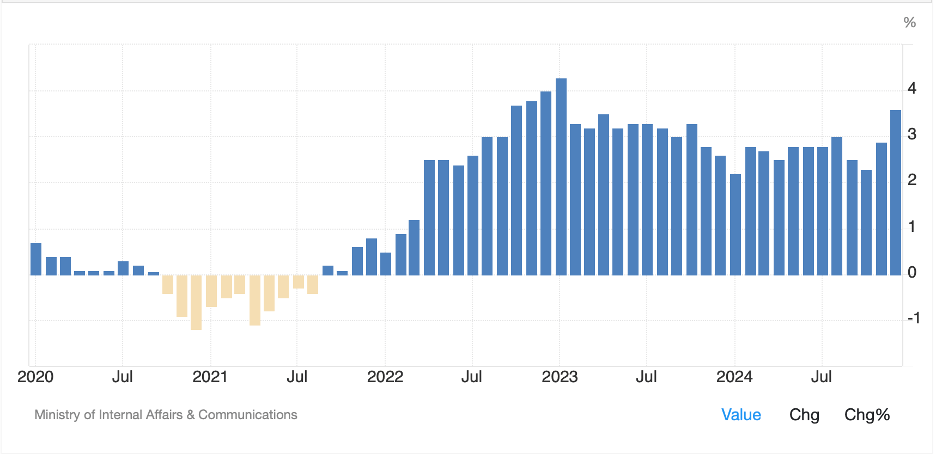

However, when looking at these yields, which as you can see from the column furthest to the right have risen substantially in the past 12 months, we must also remember the pace of inflation in Japan. Since April 2022, every monthly CPI print in Japan has been above the target of 2.0%, with all but two of them above 2.5%. In fact, as you can see from the chart below, the most recent data, as of December 2024 with the January data to be released Thursday night, shows the headline at 3.6%. That is nearly three years of inflation data running above their target, yet the BOJ is unwilling to say inflation is stably at 2.0%. I guess they are correct, it is stably at about 3.0%!

Source: tradingeconomics.com

But let’s add up this conundrum and perhaps we will better understand why GDP is growing so robustly in Japan. If 10yr JGB yields are 1.38% and inflation is 3.60%, then real yields are running at… -2.22%. That is a pretty loose monetary policy and one in which it is no surprise that economic activity is humming along. In fact, unless we see a substantial decline in inflation, with no indication that is on the horizon, the BOJ has ample room to raise interest rates while maintaining accommodative monetary policy.

I know that there is much discussion regarding President Trump’s tariffs and whether Japan will be affected like other nations thus increasing uncertainty. But the economic reality is that the BOJ remains highly stimulative to the economy which has been a driver of both economic growth and inflation. I also know that this poet has been negative on the yen for a long time, in fact calling for USDJPY to reach 170 by the end of the year. But as I observe the current situation, take into account the fact that President Trump very clearly wants the dollar to decline, and see more hints that the Japanese government is becoming more concerned over rising inflation in Japan, I am changing my tune here. Add to these indications the fact that the yen, on any accounting, remains significantly undervalued, with estimates of as much as 50% (Big Mac Index claims it is 44% undervalued) and the case for yen strength is growing on me.

While over the past year, the yen has, net, done very little, the more recent trend is for yen strength as per the 1-month chart below. My take is that we need to see a break below 150 before the fireworks start, but if that is the case, do not be surprised if we trade back to 130 before the year is over.

Source tradingeconomics.com

And really, that is the story of the evening. The Chinese NPC will be meeting next week to discuss their economic plans and policies for the upcoming year, so that will be important. As well, Europe has been put on notice by recent speeches from VP JD Vance and Secretary of State Marco Rubio that the relationship with the US is changing. However, at this time, it is very difficult to discern if that means the euro will weaken further or rebound on increased internal activity.

Ok, let’s look at markets overnight. It appears that with the US on holiday, many markets were reluctant to demonstrate leadership in any direction with not only Tokyo virtually unchanged, but the same being true throughout Asia (Hong Kong, 0.0%, China +0.2%, Australia -0.2%) and most of Europe with only the German DAX (+0.8%) showing any life at all. It seems that several German defense contractors are benefitting from the idea that Europe may be increasing its defense expenditures locally. US futures are little changed, although of course the market will not be open today.

Treasury bonds are also unchanged this morning with no trading but in Europe, yields are higher by between 3bps and 5bps, also on the rising defense expenditure story as there is an idea now floating around that there will be pan-European debt issuance to help fund that expenditure, thus adding supply to the market. Certainly, despite the ECB maintaining a somewhat dovish stance, if European yields climb higher, that will likely support the single currency.

In the commodity markets, after Friday’s rout in the metals, where both precious and industrial metals sold off sharply, seemingly on no news, but more likely on position adjustments, this morning we are seeing a rebound, at least in gold (+0.5%) and silver (+0.6%) although copper (-1.3%) remains under pressure. As to energy prices, oil (-0.35%) is continuing to hover closer to the bottom than top of its recent trading range as there is no clarity at all regarding how a potential Ukrainian peace will impact Russian production. The one consistency is that European NatGas continues to decline on hopes that Russian gas deliveries will resume going forward.

Finally, the dollar is doing mixed this morning with the yen the outlier showing strength against the greenback, but ZAR (-0.5%) and MXN (-0.4%) showing weakness. The rest of the G10 has seen only modest movement and that is generally true for the rest of the EMG bloc. Traders remain highly uncertain over the future that President Trump will usher in.

On the data front, it is a pretty light calendar overall.

| Tuesday | Empire State Manufacturing | 0.0 |

| Wednesday | Housing Starts | 1.4M |

| Building Permits | 1.46M | |

| FOMC Minutes | ||

| Thursday | Initial Claims | 215K |

| Continuing Claims | 1860K | |

| Philly Fed | 16.3 | |

| Leading Indicators | -0.1% | |

| Friday | Flash Manufcturing PMI | 51.2 |

| Flash Services PMI | 53.2 | |

| Existing Home Sales | 4.13M | |

| Michigan Sentiment | 67.8 |

Source: tradingeconomics.com

As well as this data, we see the EIA oil inventories and hear from 11 more Fed speakers. But again, after Powell made clear they are on hold for now, and there has been no data to change that perception, and President Trump continues to dominate the spotlight, I don’t anticipate any new information here.

With the holiday today, I anticipate things will be quite slow. Traders will take advantage of the time off to rest given the rising volatility we have seen. Going forward, I will be reevaluating my longer-term views based potential changes in fiscal policies around the world. But for now, other than the yen, I don’t see any clear changes yet.

Good luck

Adf