For those who believe a recession

Is coming, the data’s digression

From strength’s getting clearer

And rate cuts are nearer

Though maybe that begs a new question

Can equity markets go higher

If profits fall in a quagmire?

Though many agree

Rate cuts will bring glee

The past has shown they can be dire

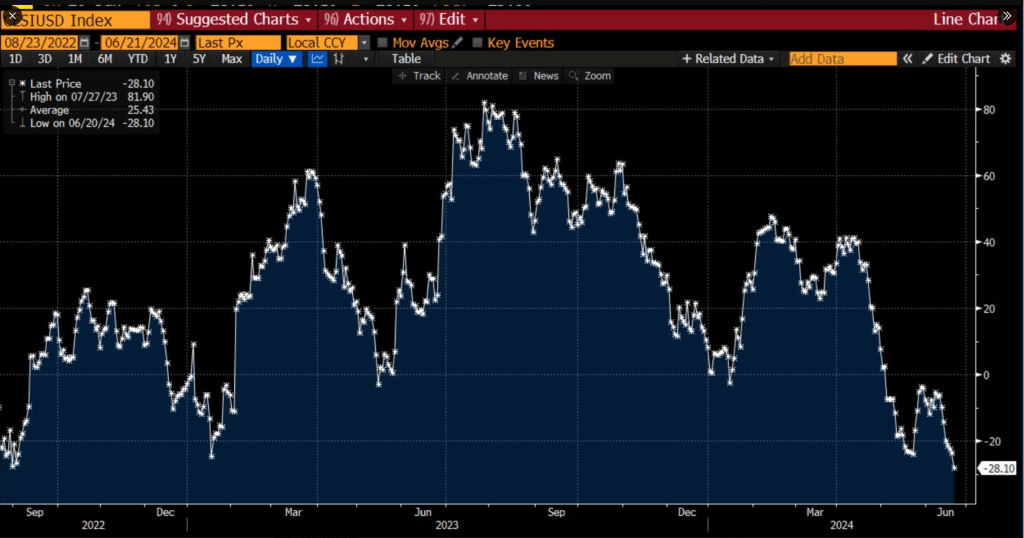

The data of late have not been positive. Interestingly, this is not simply a US phenomenon, but appears to be spreading elsewhere in the world as evidenced by this morning’s much weaker than expected Flash PMI data out of Australia (Mfg 47.5 vs. 49.7), Japan (50.1 vs. 50.6) and Europe (Germany 43.4/46.4, France 45.3/46.8, Eurozone 45.6/47.9). This follows the US trend where yesterday we saw the weakest Building Permits and Housing Starts data since the pandemic in June 2020 as well as a weaker than forecast Philly Fed result and higher than forecast Initial Claims data. Prior to the Juneteenth holiday, Retail Sales were also quite soft, and another harbinger is the Citi Surprise Index, which Citibank created to measure actual data vs. the forecasts ahead of the release. Typically, as it declines, it indicates weakening growth and vice versa. As you can see from the below chart, this indicator has fallen to its lowest level in two years.

Source: Bloomberg

Summing it up, the strength of the economy is clearly being called into question by the data releases. However, as we have seen for the past several years, this is not a universal phenomenon. For instance, who can forget the recent NFP print which beat expectations handily. As well, the Atlanta Fed’s GDPNow indicator remains at 3.0% after yesterday’s housing data, still far above the forecasts by most economists, and an outcome that would be welcomed by almost everyone.

(As an aside and related to yesterday’s discussion about how politics intrudes on, or at least colors, so much of the financial market commentary, there have been numerous articles ‘blaming’ the weak PMI data on the results of the European Parliament elections and the ensuing call by French President Macron for next week’s snap election. While one can make the case that is the situation in France, given the inherent uncertainty of the outcome, it seems a stretch to say that is why Germany’s data suffered. After all, it is possible that all the talk of Eurozone tariffs on Chinese goods and the demonstrated incompetence of the current German government are sufficient to dissuade businesses there from investment and growth.)

So, what are we to believe? The first thing I would highlight is that the idea of two separate economies seems to gain validity by the day. For the haves, however you want to describe them but arguably the top 10% of income and wealth, the current situation has been fine. While inflation is annoying, they can afford the higher prices given their asset portfolios, whether real estate or equities, have risen so dramatically. The wealth effect for them is quite real.

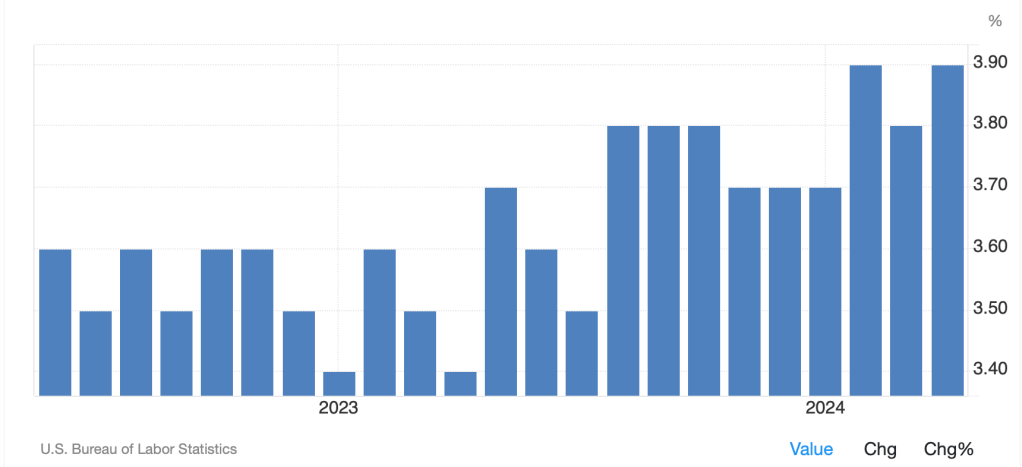

However, for the rest of the nation, things are far less positive. The Retail Sales data tell a tale of reduced purchases of stuff (remember, that data is not inflation adjusted, so higher sales and higher inflation could well indicate less stuff sold but more money paid for it). Additionally, the employment data is also a mixed bag as although NFP was strong, the household survey indicated less people were working and the trend in the Unemployment Rate is clearly up and to the right as per the chart below.

Source: tradingeconomics.com

Adding to this mix we have the Fed, who continue to look at the inflation data, and while they were pleasantly surprised by the slightly softer tone of the CPI data earlier this month as well as the PCE data last month, are still not prepared to address potential weakness in the economy. This was made evident again yesterday when Richmond Fed President Barkin said, “my personal view is let’s get more conviction before moving.” In other words, as we have heard consistently, patience remains a virtue at the Eccles Building.

If pressed, my personal view is that the economy has peaked for this cycle and we are going to start to see more data show weakness going forward, not strength. The bigger problem with this is that while inflation has ebbed from its highest levels, it appears to me that the idea it will reach, and remain at, the 2.0% target is extremely unlikely. Rather, I remain in the camp that the new level of inflation is somewhere between 3% and 4% as defined by CPI, and that over time, the Fed is going to bless that as an appropriate description of stable prices. Given the Fed’s clear desire to cut rates, I fear that they are going to act earlier than would otherwise be prudent and that while economic activity will decline, prices will rebound. Absent a massive recession, something like we saw in 2008-09, I do not see prices falling back to the current target.

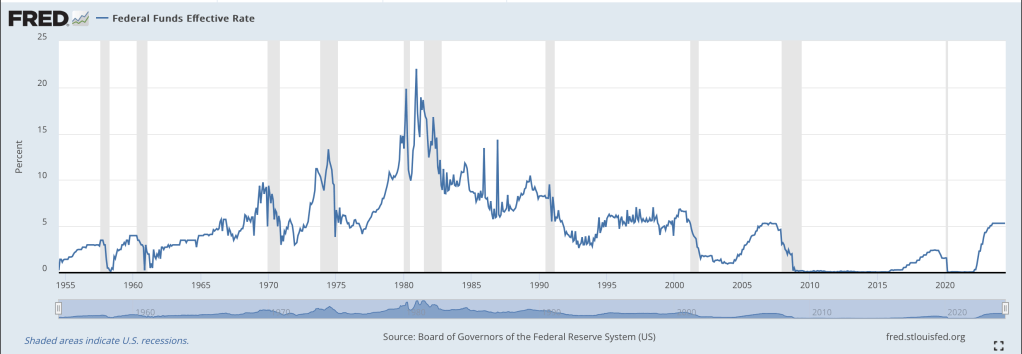

And here’s the problem with that view from a market’s perspective, if the recession comes, the Fed will cut rates and cut them relatively quickly. This can be seen in the chart below showing Fed funds behavior relative to recessions.

Source FRED data base

Alas, for equity markets, during a recession, equity markets tend to fall, with declines of 30%-50% quite common and much greater as well (NASDAQ fell 88% during 2001-02 recession). The road ahead appears to be filled with difficulty, so keep that in mind as you go forward.

Ok, sorry that ran on so long, but sometimes it is important to dig a little deeper I feel. Let’s do a really quick turn of the overnight session. Japanese equities were little changed but Hong Kong fell sharply (-1.7%) and the mainland drifted lower. The rest of Asia was broadly under pressure although Australia (+0.35%) managed to eke out small gains. In Europe, following the weak PMI data red is the color of the day with every market lower on the session, including the UK which released surprisingly positive Retail Sales data, although their PMI data was also soft. At this hour, US futures are little changed awaiting the Triple Witching Day of expiries of futures, options and options on futures.

In the bond market, yields are lower across the board led by Treasuries (-3bps) and all of Europe as those PMI data are a harbinger of slower growth and will likely be an encouragement for more rate cuts by the ECB. In fact, Klaas Knot, one of the more hawkish ECB members indicated he could see three more cuts this year, which is even more dovish than the market is pricing.

In the commodity markets, oil is essentially unchanged this morning, maintaining its recent gains as inventory data showed more draws than expected. In the metals markets, gold (+0.2%) is holding onto its recent rebound, but given the weaker economic data story, both silver and copper are under pressure.

Finally, the dollar is gaining this morning as European currencies suffer from weak data and rate cut dreams, although there are two real outliers, MXN (+0.45%) on the back of surprising strength in recent economic data (Retail Sales and IP) and ZAR (+0.55%) as it appears more investors are turning to the rand as the pre-eminent carry trade earner vs. the yen and reducing their MXN exposures after the recent elections.

On the data front, the Flash PMI’s are due at 9:45 (exp 51.0 Mfg, 53.7 Services) and then at 10:00 we see both Existing Home Sales (4.10M) and Leading Indicators (-0.3%). While there are no Fed speakers on the calendar, I fully expect to hear from someone before the end of the day as they simply cannot shut up.

Overall, risk is off, and I suspect that we could see some equity selling during today’s session, following yesterday’s moves. With that, bonds are likely to perform as well as the dollar, and I think gold holds on, though the rest of the commodity complex is likely to suffer further losses.

Good luck and good weekend

Adf