While many still seek goldilocks

The problem is we’ve seen some shocks

Inflation won’t fall

And oil’s in thrall

To US and UK war hawks

But if we adhere to the data

It’s really not looking that great-a

For those who think Jay

Will soon lead the way

By cutting the Fed’s funding rate-a

We are back to being inundated with new information from both economic data and global events, both of which are driving markets for now. Interestingly, depending on the asset class, it seems that some are studiously ignoring what this new information means, at least what it has historically meant.

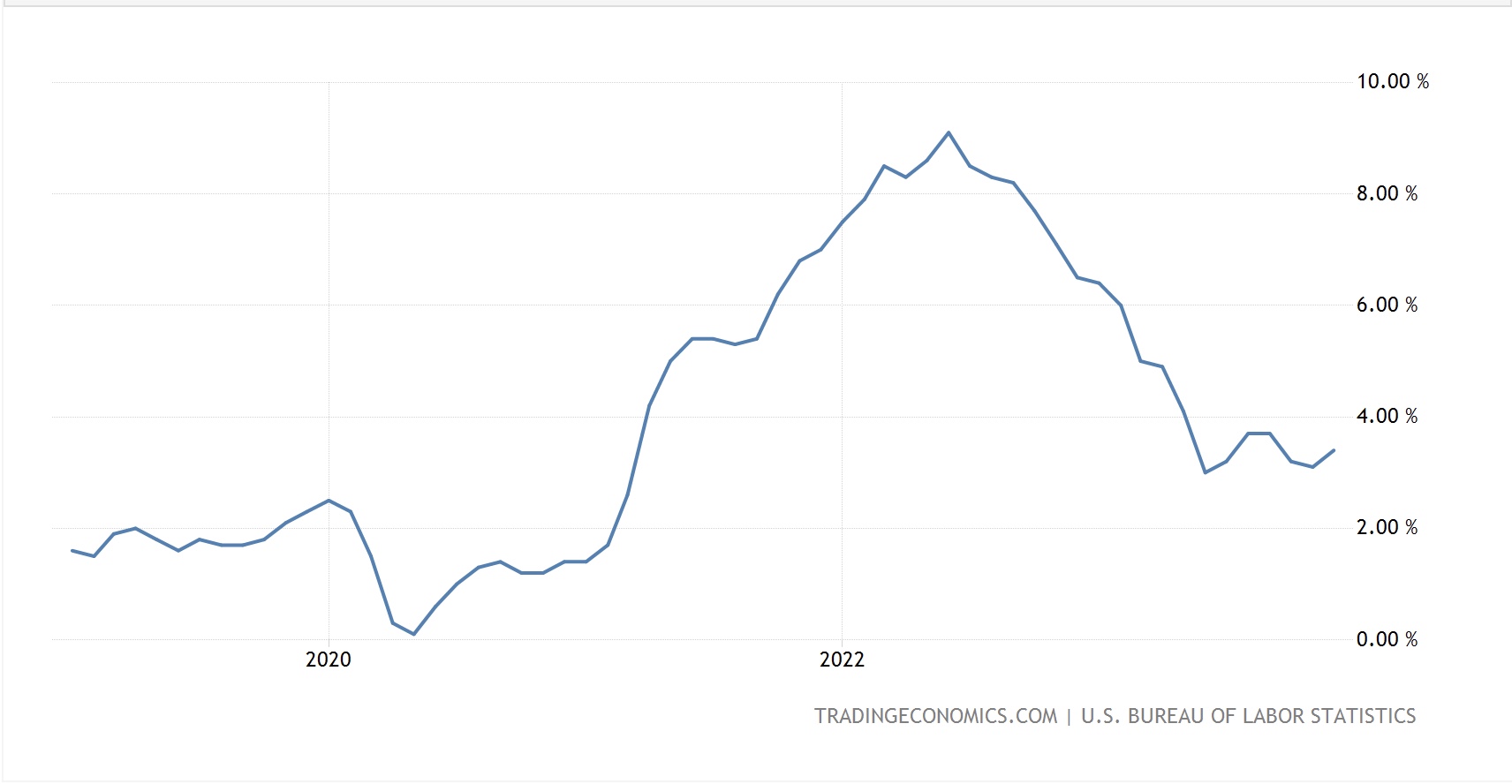

Let’s start with yesterday’s CPI data, which printed higher than forecast on both the headline (3.4%) and core (3.9%) measures. One needn’t be a market technician to look at the chart below of annualized CPI over the past five years and consider the possibility that the downtrend has ended, and we are reversing higher.

Source: tradingeconomics.com

To the extent that financial data has trends, and I think that is a very realistic estimate of how things work, the Fed may have a much tougher time squeezing the last 1.0% – 1.5% out of the inflationary process than many seem to believe. At least many in the bond market seem to believe that as despite the hotter than expected CPI data, bond yields actually declined yesterday. As well, there is no indication from the Fed funds futures market that they have changed their view on the number of rate cuts coming in 2024 with an even higher probability of a March cut, > 70% this morning, and still 6 cuts priced in for the entire year.

Regarding this seeming dichotomy, it is almost as if the market is trying to force the Fed’s hand. Historically, the Fed has tried not to ‘surprise’ markets when it comes to decisions, keeping a close eye on market pricing on the day of each meeting. As such, if the market is pricing in a cut or a hike, the Fed has been highly likely to follow through in the past. When there have been disagreements, the Fed will typically roll out lots of speakers to get their view across before the meeting in order to prevent that surprise on meeting day. As well, it is very clear that there is virtually no expectation of a rate adjustment at the FOMC meeting on January 31st, so perhaps the Fed doesn’t feel it is warranted to be that concerned yet. And of course, the data may turn in the direction of much softer inflation and even modestly worse employment so a cut will become the de facto norm. But my point is, the March 20th meeting is just 67 days away. For an economy whose trends move very slowly, it seems like the market may be a bit ahead of itself in this case.

We did hear from three Fed speakers yesterday, Mester, Barkin and Goolsbee, all of whom indicated that while the broad direction of things seemed pretty good, a rate cut in March is very premature. In fact, that has been the consistent theme from every Fed speaker and the market just doesn’t seem to care. We will see two PCE reports, two more CPI reports and two more NFP reports before the March FOMC meeting. And they will all be part of Q1 data, not Q4 data, so will at least have more relevance to the current situation. Maybe the market is correct, and inflation is going to turn back lower, and the first signs of economic weakness will convince Powell and friends it’s time to preemptively cut rates. However, even if that turns out to be the case, it is hard for me to see that as a > 70% probable outcome. Of course, I am just an FX poet, so maybe I just don’t get it.

The other topic that is making an impact is the Middle East. You may recall that oil prices had been on the soft side as the market saw weakening demand due to an impending recession with massive supply gains coming from better and better producer efficiency. In fact, I wrote about the latter this past Sunday in Oil’s Price is not Rising. However, all that efficiency is unimportant when compared to the escalation that we saw last evening in the Middle East, where US and UK forces attacked Houthi positions in Yemen in retaliation for the Houthi attacks on shipping in the Red Sea. This morning, oil is higher by 3.5% and since Monday, the rise has been 6.6%.

This poses several problems overall. First, of course, is the widening of the Middle East conflict being a problem in and of itself. The US military is already straining with its mission given the number of different places US troops are in harm’s way throughout the Middle East and Asia. The one thing we have learned throughout history is that war is inflationary. So, escalations in fighting will ultimately lead to escalations in prices of many things. Oil is merely the first casualty.

If you are Jay Powell whose current mission is to reduce inflationary pressures, a widening military conflict is not going to help the situation. In fact, it is likely that he will be called upon to support the military by ensuring the Treasury can issue as much debt as necessary at reasonable prices. This means the end of QT and a restarting of QE. If that were to be the case, and that is a big if, inflation would start another strong leg higher, and markets will be greatly impacted. Commodity prices will rise, the dollar will likely weaken, a bear steepening for bond yields would be in the cards and equity markets would rally, at least initially. But it would throw out any ideas of low inflation. I am not saying this is the current expectation, just that it is something that needs to be considered as events unfold going forward.

A quick look at the impact on markets today shows that equity markets are non-plussed by the escalation as yesterday’s benign US performance was followed by another rally in Japan although Chinese shares continue to lag after a big data dump showed economic activity there remains export oriented into a slowing global growth situation. Inflation remains moribund there, the Trade Surplus grew, and domestic funding continues to grow at a slower and slower pace. In Europe, though, there does not seem to be much concern as equity indices are all higher by about 0.5% although US futures are suffering a bit, -0.35%, at this hour (7:45).

In the bond market, Treasury yields are 3bps higher this morning than yesterday’s close, although they remain right at 4.00%, so are not really moving very much right now. Meanwhile, European sovereign yields, which closed before the US yields declined late, are all down about 3bps this morning, helped by confirmation that final inflation readings in Europe remained at recent lows. In the UK, the net data dump showed slightly weaker than forecast IP and GDP data which has helped drive the bid in Gilts. A quick JGB look, where yields fell 2bps, revolves around a story that the BOJ is going to reduce its end of year inflation forecast thus reducing the probability of any policy change anytime soon. This is one of the things helping the Nikkei and also a key driver of USDJPY higher.

Aside from oil prices rising, we are seeing gold (+1.0%) on the move today on the back of the Middle East escalation although the base metals are mixed. One other commodity note is uranium, a market which has been getting a lot more love lately given the recent acceptance by a portion of the eco community that its ability to generate electricity without producing CO2 is a net benefit. 40 nations have promised to increase their nuclear power use and demand for uranium has been rising amid a market where there is very limited supply and annual production does not meet current annual demand, let alone projected future demand. I simply wanted to highlight that there are price movements all over the place and while uranium may not be a major contribution to inflation, the fact that its price is rising so rapidly (100% in the past year) is not going to push inflation lower.

Finally, the dollar is firming up this morning as risk assets come under pressure. This is a typical war footing, where investors flee to the dollar in times of stress, just like they flee to gold. While the movement thus far has not been substantial, just 0.3% on average, it definitely has room to move further if things deteriorate in the Red Sea.

On the data front, we see PPI this morning, expected 0.9% headline, 2.0% ex food & energy, although given CPI was released yesterday, I doubt it will matter very much. As well, we hear from Minneapolis Fed president Kashkari, so it will be interesting to see if he has a different take than March is too soon, but things seem to be going well.

As we head into the weekend, the Middle East is the wild card. If things heat up, look for oil prices to continue to rise and risk to be discarded. That will probably help the bond market for now, and the dollar, but stocks will suffer.

Good luck and good weekend

Adf