On Monday, the market did naught As traders were giving much thought To how Jay explains The work that remains For him to achieve what he’s sought And so, while no change is expected In rates, look at what is projected The June dot plot showed The Fed’s preferred road Was four cuts will soon be effected

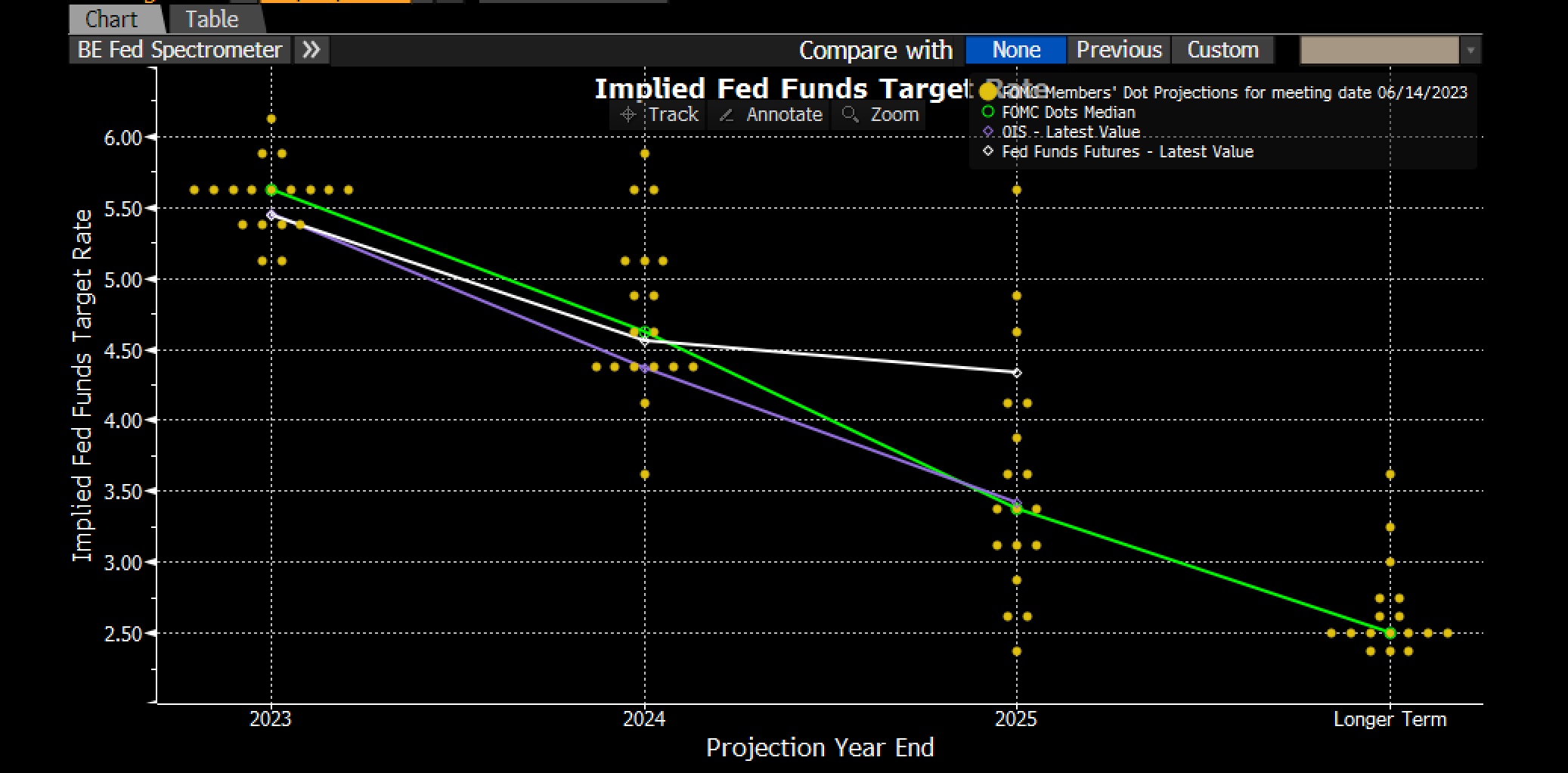

Once again, the overnight activity remains fairly dull as traders and investors around the world await the results of tomorrow’s FOMC meeting. At this point, it seems quite clear the Fed will remain on hold tomorrow leaving Fed funds in a 5.25%-5.50% range while continuing their QT program. With this in mind, all the excitement will come from the new Summary of Economic Projections (SEP) which includes the dot plot. The dot plot is the graphical representation of the FOMC members’ expectations for the path of Fed funds going forward. Below is the most recent release from the June meeting (chart from Bloomberg).

The chart shows each of the FOMC members’ forecasts for where Fed funds will be at the end of 2023, 2024, 2025 and over the long term. The green line shows the median forecast which in June indicated a belief there will be one more rate hike in 2023 and then four rate cuts in 2024 with another five cuts in 2025 before eventually seeing Fed funds move back to the perceived ‘neutral’ rate of 2.5%.

However, let us consider how some alternative scenarios might evolve. For instance, I continue to wonder why the Fed will be cutting rates by 100bps in 2024 if they no longer forecast a recession in the US. After all, if the economy continues to chug along with rates at 5.5%, what purpose would be served by cutting rates? And if the economy does enter a recession next year, something which seems realistic, then the Fed will be cutting far more than 100bps. It’s funny, if you look at the dispersion of expectations for 2024, there is one member who feels certain a recession is coming, with an expected rate of 3.625%, and another one who sees higher for longer as lasting the entire year. At least those two members are making some sense. However, the idea that the Fed will cut just because, without a more severe economic shock, seems quite unlikely. After all, Chairman Powell has invoked the ghost of Paul Volcker numerous times and explained they will not be fooled by a temporary decline in inflation. Rather, they are in this for the long haul and will win the battle.

There are those who would argue that the Fed will cut rates, regardless of the economic situation, because the US cannot afford to continue to pay interest at the current level on their >$32 trillion in debt. As such, Powell will feel enormous pressure from the administration to reduce rates to help the government. Now, that is the exact opposite of central bank independence, but certainly not an impossible outcome. But absent that type of situation, it strikes me that we remain a very long way from the Fed achieving their target inflation rate of 2.0%. At this point, the one thing Powell has made abundantly clear is that he will not stop until they achieve that goal.

Another fly in the rate cutting ointment is the price of oil. Again, this morning it is higher, +0.8%, and now above $92/bbl and seemingly approaching the magical $100/bbl level. In the wake of the Russian invasion of Ukraine, the Biden administration released some 300 million barrels from the US’s Strategic Petroleum Reserve (SPR) which helped moderate price increases at the time. However, the ability to repeat that exercise does not exist as currently, the SPR only holds about 350 million barrels and there are actual physical constraints regarding the integrity of the salt domes in which the SPR is kept. If too much is released, the domes could cave in. When considering this alongside the ongoing production cuts from OPEC+ as well as the administration’s effective war on domestic oil production, it is reasonable to conclude that oil prices have higher to climb. Working our way back to the Fed, the problem is that high energy prices ultimately become embedded in all prices, as even services require energy to be accomplished. This underlying cost pressure is going to prevent any significant decline in the rate of inflation and, in turn, support the Fed’s higher for longer narrative for even longer.

Wrapping up the discussion, I would contend that absent a sharp recession, the Fed is not going to be pressured into cutting the Fed funds rate anytime soon. Instead, I expect that we will continue to see longer end rates rise slowly as the combination of massive new issuance of Treasury debt and lingering inflation will require higher yields to find buyers. Currently, the two largest non-Fed holders of Treasury securities are China and Japan, and both of them have been slowly liquidating their portfolios as they need dollars to sell in the FX markets in order to support their own currencies. When push comes to shove, I expect that we will see US rates retain their advantage over other G10 currencies and that it will continue for a while to come. As such, I continue to expect the dollar to outperform, at least until something really breaks. However, what that something is remains open to debate.

Turning to the overnight session, which was quite uninteresting as mentioned above, we saw mixed to weaker performance in Asian equities, with only the Hang Seng managing to eke out any gains at all, while European bourses are mixed with the major exchanges all within 0.2% of yesterday’s closing levels. Yesterday’s US performance was as close to unchanged as it could get while being open, and this morning’s futures market is showing tiny gains (<0.1%) at this hour (8:00).

Bond markets are somewhat mixed on the day, with Treasury yields backing up 2bps, while UK gilt yields are lower by 4bps and everything else is in between. Eurozone final CPI for August was released with the headline ticking down 0.1% to 5.2%, but core unchanged at 5.3%, with both, obviously, still well above the ECB target. Madame Lagarde must be praying quite hard for inflation to fall further as she made it clear she does not want to raise rates again. In the end, the Eurozone has myriad problems with sticky high prices and slowing growth, an unenviable position.

Aside from oil’s gains, gold has been performing relatively well lately, which given the dollar’s resilience and higher interest rates seems somewhat odd. One possible explanation is that there continues to be significant demand in Asia, where, for example, the Shanghai Gold exchange price is currently some $30/oz higher than on the COMEX, and this spread has been growing. We have heard much about the record amount of gold buying by central banks this year, and this seems of a piece with that outcome. However, looking at industrial metals, both copper and aluminum are softer this morning as the prospects for Chinese growth diminish and with them so do prospects for demand for those metals.

Finally, the dollar is a bit softer this morning vs. most of its G10 counterparts with NOK (+0.75%) leading the way higher on the back of oil’s continuing rally. In fact, the entire commodity bloc is at the top of the charts today. However, in the EMG bloc, we are seeing more of a mixed picture with an equal number of gainers and laggards and none showing exuberance in either direction.

On the data front today, we see Housing Starts (exp 1439K) and Building Permits (1440K) as well as Canadian CPI (3.8% headline, 3.7% core), with both measures rising and keeping pressure on the BOC. There are still no speakers, so my take is that things will be dull until tomorrow’s FOMC announcement at 2:00pm.

Good luck

Adf