The doves are in flight

Alongside Dollar / Yen. NIRP

Just a memory

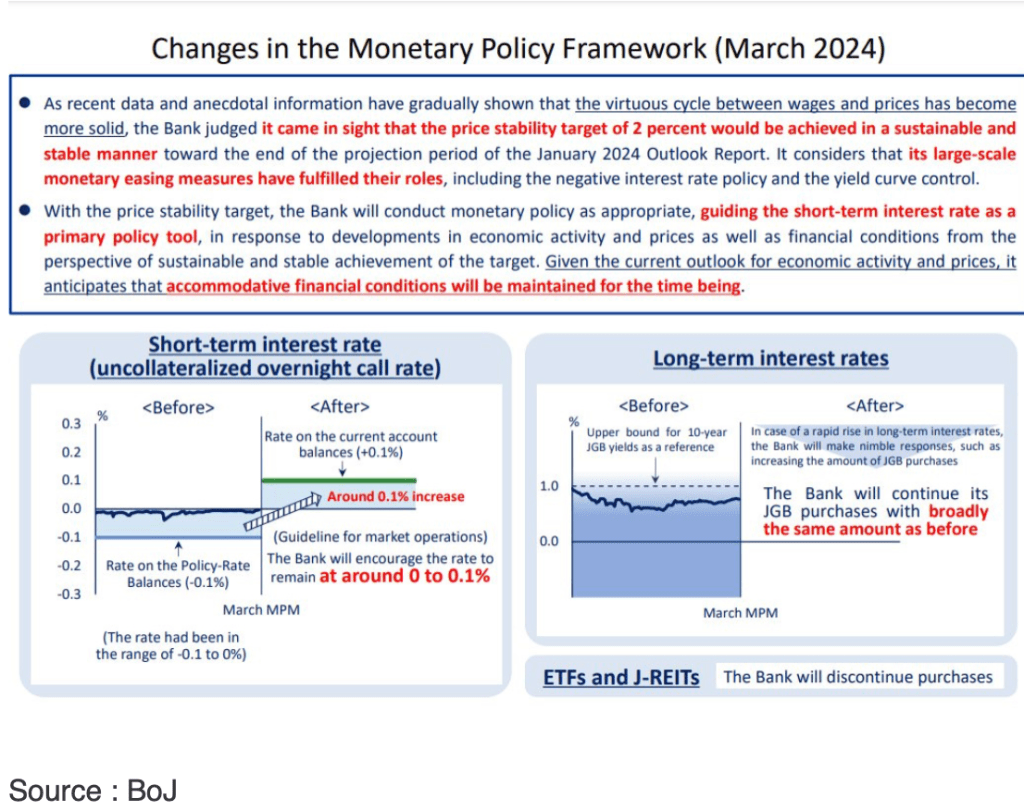

As many had been forecasting, notably the Nikkei News who as I mentioned yesterday have a perfect forecasting record, the BOJ ended NIRP by raising their overnight call rate to a range of 0.00% – 0.10%. Thus ends one of the longest policy experiments in history. I continue to believe when future historians look back at this time they will ask, what were they thinking? At any rate, here is what they offered up to the world:

Summarizing the key changes, there is now a range for the short-term rate, like the Fed’s range, which is a new feature, although they maintain they will seek to keep the rate close to the ceiling. As well, YCC is gone for good with no targets of any sort. However, they committed to continuing to purchase JGBs in roughly the current amounts and retain the flexibility to increase that amount at any time as they see fit. Regarding equities, REITs, and corporate bonds, they have officially declared those programs to be over, although in practice that has been the case for the past several months.

The market response was a classic ‘sell the news’. The yen has fallen 0.9% and is firmly back above 150 this morning while JGB yields edged lower yet again, down 3bps and trading at 0.73%. In the press conference, Ueda-san explained, “We judged that achieving the goal of sustainable 2% inflation has come within view. The large-scale monetary easing policy served its purpose.” However, he was clear that this was not the beginning of a massive tightening of policy a la the Fed or other G10 central banks. At the same time, PM Kishida said, “[The government] believes it is appropriate that the accommodative financial environment will be maintained from the perspective of taking a new step forward in light of the current situation and further ensuring positive economic developments.”

Summing everything up I would say that while this policy is marginally tighter than previous policy, there is no evidence that the BOJ is hawkish in any sense of the word. They will still be buying JGBs regularly, ergo monetizing government debt, and they will respond ‘nimbly’ as they see fit if something changes. My take on the impact is that the yen will be beholden to the Fed now and if the recent more hawkish narrative continues to evolve, look for USDJPY to continue to rise. JGB yields are likely to drift higher alongside yields elsewhere is the world while the Nikkei has room to run.

It’s time now to turn to the Fed

With pundits now starting to dread

The idea rate cuts

Are now seeming nuts

An idea to which they were wed

So, while we know rates will remain

Unchanged, we’ve got dots on the brain

Are three cuts in store?

Or fewer called for?

That outcome is what’s most germane

Interestingly, given how much has been written by analysts and pundits, as well as this poet, already on the topic of the FOMC meeting that starts at 9:00 this morning and culminates in their statement at 2:00pm tomorrow, I feel like all that is necessary here is a recap.

As I type this morning, the Fed funds futures market is now pricing just 72bps of rate cuts for all of 2024 and 139bps of cuts through September of 2025. While I had started discussing the concept of the dot plot pointing to a median of only two cuts this year several weeks ago, before the quiet period began and we started hearing more hawkish language from several FOMC members, that has become a mainstream discussion now. In fact, I suspect that is the default setting for most analysts, although the dovish acolytes will still be arguing for at least three cuts. Perhaps of more interest will be where the longer-term dots are printed.

Remember, the dot plot shows each members forecasts for the next three years individually as well as the ‘Longer Run’. In December, the Longer Run had a median of 2.50% and that has been the case for a very long time. The implication is that the Fed’s broad view of their policy is that the infamous r*, or neutral interest rate, is 2.5% which consists of a 2% inflation target and a 0.5% real interest rate. However, there has been a significant increase in the discussion amongst the analyst community about how that might change. If we consider that the nature of the economy post-pandemic, has changed in two key areas, the size of the workforce has shrunk and the efforts at reshoring or nearshoring productive capacity has expanded greatly, both of those things would lead one to expect a higher level of inflation and correspondingly higher interest rates. So, while a change in the Fed’s target rate is not likely anytime soon, a change in the Fed’s thinking of the appropriate r* is very possible.

Do not be surprised to see that median rise to 2.75% as members increasingly accept that the current state no longer resembles the previous, pre-pandemic, state. And that, I believe, is where there is more potential for market reaction than anywhere else. A rise in the longer run median forecast implies that Treasury yields, and in fact, the entire yield curve, should be permanently higher. While there has been some discussion of this idea, I would contend that is nowhere near the consensus view, and certainly not the current market narrative. But that would imply a pretty sharp sell-off in bonds with a corresponding rise in yields. Initially, I do not believe that would be a net positive for risk assets, although ultimately, I believe equity markets will absorb the news as companies adjust to the change. But it could get messy during that adjustment. This is where my eyes will be tomorrow.

Ok, let’s recap the overnight session. After a solid day in the States yesterday to start the week, the Nikkei (+0.65%) managed to recapture the 40K level amid a weaker yen and the new understanding that policy is not going to ratchet much tighter. China, on the other hand saw equity weakness in both Hong Kong (-1.25%) and on the mainland (-0.7%) as traders await the news tonight as to whether the PBOC is going to reduce the Loan Prime Rate again as they did last month. Clearly, there is not much hope right now! In Europe, markets are mostly a touch higher, but movement is very modest, +/-0.2% basically, as all eyes there are also on the FOMC tomorrow. As to US futures, they are modestly weaker this morning at this hour (7:30), down -0.4% on average.

In the bond market, Treasury yields are unchanged this morning after having drifted another 2bps higher yesterday. In Europe, it is a mixed picture with UK Gilt yields sliding 3bps, while the continent is seeing either no movement or a 1bp rise. The only data of note was German ZEW sentiment which rose significantly, to 31.7, back to its highest level in two years. We also continue to hear from ECB speakers that they are not yet ready to cut rates and remain data, not Fed, dependent!

Oil (+0.1%) continues to power higher on the back of softer supply data, increased success by Ukraine in attacking Russian refineries and a new situation, Iraq promising to abide by the OPEC+ production cuts. WTI is firmly above the $80/bbl level and looks like it wants to try for a move toward $90/bbl, at least on a technical basis. That cannot be helping central bank efforts at reducing inflation. As to the metals markets, they are softer this morning with gold (-0.2%) still holding up quite well given the dollar’s rebound, and copper (-1.1%) also under pressure today, but also holding the bulk of its recent gains.

Finally, the dollar is in the ascendancy today as not only is the yen under pressure, but too, the Aussie dollar (-0.6%) and its little brother NZD (-0.5%) after the RBA left rates on hold last night, as universally anticipated, but adopted modestly more dovish language in their statement and Governor Bullock was unable to convince the market in her press conference that they could still raise rates if inflation reappeared. But the dollar is higher vs. essentially all its counterparts, both G10 and EMG, with the CHF (0.0%) the best performer of the bunch. There is no need to seek other idiosyncratic stories for this move.

As to the data today, Housing Starts (exp 1.425M) and Building Permits (1.495M) are all we’ve got. Keep an eye on Canadian CPI (exp 3.1%) as that would represent an uptick from last month akin to what we are seeing elsewhere in the G10. Inflation is not dead my friends.

And that’s really it for today. It is hard to see the data having a substantive impact and that means that traders will spend the day adjusting their positions to prepare for tomorrow afternoon’s excitement. I imagine we could see the dollar drift off a bit today given how far it’s come, but nothing of note seems likely.

Good luck

Adf