The ‘conomy just keeps on humming

So, confidence, not yet is coming

How long will rates stay

Where they are today?

And will stocks keep getting a drumming?

The problem remains that inflation

Is causing Chair Powell vexation

It’s sticky and hot

Which really is not

What he needs to get his ovation

Boy, I go away for a few days and look what you’ve done to the markets! When last I wrote, while there was a sense of shakiness in risk assets, it hardly appeared terminal. But now…. The bears are out in force it seems, fear is rising rapidly amid investors while greed is running for its life.

I tried to ignore market goings on while I was away for the back half of last week, but the news was overwhelming. My brief recap is simply, lots more Fed speakers have figured out that measured inflation is not heading lower, and that the decline during the second half of last year is turning into the aberration, not the rebound so far in 2024. This week we will see the PCE report on Friday, and while that is typically between 0.5% and 1.0% lower than CPI, it is not going to come close to their target.

As I wrote several weeks ago, following Powell’s press conference and subsequent speeches, regardless of the fact that there is no indication price pressures are abating, he is still keen to cut rates. However, the weight of the recent data has caused many of his colleagues on the FOMC to change their tune. The most recent was NY Fed President Williams who also indicated that a rate hike in the future cannot be ruled out. Remember, Governor Bowman discussed that idea the week before last. Going back to my prognostications at the beginning of the year, I had anticipated one cut at most during the first half of the year, but that rates, and bond yields, would be higher by Christmas. I still like that call, although I am losing my enthusiasm for the cut. And so is everybody else!

If rates simply stay where they are, I suspect that the recent equity selloff will moderate as it is clearly more fully priced into markets given the consistency with which we have heard that story in the past several weeks. However, beware if the next step is higher.

Meanwhile, the week is off to quite a slow start with most equity markets rebounding from last week’s declines as fears of further escalation in the middle east abate. The Israeli response to the Iranian response was muted and market participants have turned their attention elsewhere. This can best be seen in the commodities markets as both oil (-0.5% today, -4.2% in the past week) and gold (-1.3% today, -1.0% in the past week) are retreating from their recent highs. However, all is not completely well as we continue to see US Treasury yields on the high side and climbing (10yr +3bps) as more and more investors demonstrate concerns over inflation’s stickiness.

There was virtually no economic news overnight and a remarkably, though welcome, minimum of central bank speakers. Remember, the Fed is in their quiet period this week up until their meeting next Wednesday, so everyone needs to make up their mind on their own. With that in mind, here’s what we saw last night.

Equity markets in Asia rebounded nicely with the Nikkei (+1.0%) and Hang Seng (+1.75%) both performing well although shares on the mainland (CSI 300 -0.3%) didn’t join the party. Elsewhere in the region, only Taiwan was in the red with every other nation enjoying the bounce. As to Europe, this morning, the screen is green with gains ranging from the CAC (+0.35%) to the FTSE 100 (+1.45%) and everything in between. Again, this certainly feels like a relief rally given the absence of new information. Finally, the US futures markets are all higher this morning on the order of 0.5%, something I’m sure we are all happy to see.

In the bond markets, Treasury yields are leading the way with European sovereigns also higher by between 2bps and 4bps, clearly being dragged by Treasuries. We did hear from Banque de France president, and ECB member, Villeroy, that he felt a June cut was certain and he was looking for more afterwards. Interestingly, he made the argument that the ECB’s job was to ensure economic activity was helped as much as possible while targeting inflation. That is a different take than I’ve heard any ECB member discuss before, although I am sure it is what many are thinking.

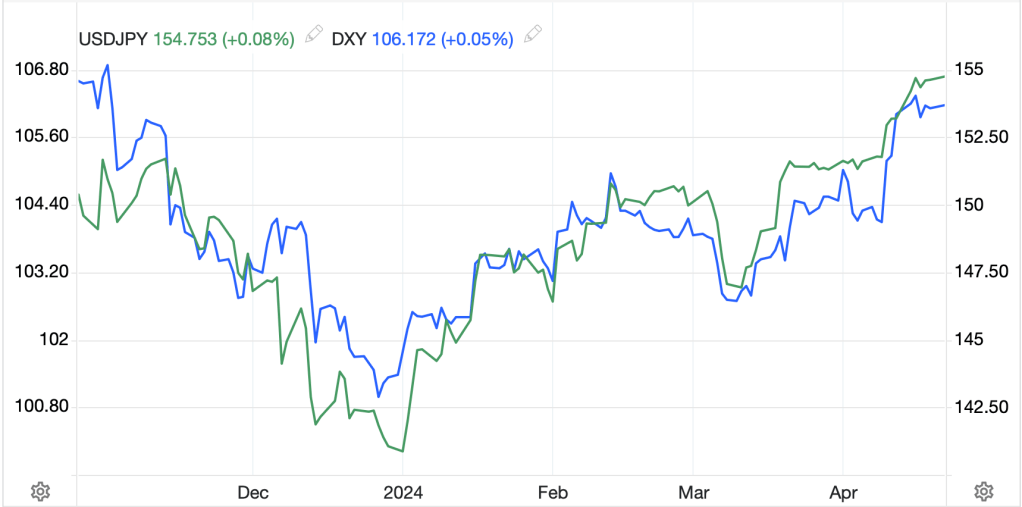

Perhaps the most interesting move last night was JGB yields climbing 4bps and moving up to 0.88%. This is their highest level since November when they flirted with the 1.0% “cap” that required a massive bond buying exercise by the BOJ. With USDJPY grinding ever so slowly toward 155.00, there is a school of thought that the BOJ will seek higher yields to defend the yen. However, my take is any yen defense will be in the form of intervention and be described as a smoothing activity. The current Mr Yen, Masato Kanda, has discussed the idea of a rise in USDJPY of 10 yen in a month as being too quick and worthy of a response. Granted, since its recent nadir of 146.85 on March 11, that milestone has almost been reached, but that low was a very short-term dip and while the yen has declined consistently all year, as you can see from the chart below, the pace has not nearly been that quick. In fact, I would argue the pace has been steady all year, and virtually identical to that of the dollar index which indicates this is not a yen problem, it is a dollar problem.

Source: tradingeconomics.com

Turning to the dollar, it is modestly higher overall this morning with the noteworthy mover the pound (-0.5%) after we heard from BOE member Ramsden explaining that he saw the risks of inflation remaining high were diminishing and that rate cuts were coming soon. While one of his colleagues, Megan Greene, gave the opposite spin, apparently in a misogynistic response, the market took Mr Ramsden as the more important voice on the matter. As well as the pound, we have seen the euro (-0.2%) and its EEMEA acolytes (PLN -0.5%, CZK -0.6%) slide. Otherwise, there is a mixture of lesser movements with a few currencies managing to gain strength, notably AUD (+0.3%), NZD (+0.3%) and CAD (+0.2%). Summing up the currency markets, for the time being, with the Fed sounding increasingly hawkish and other central banks turning dovish, it seems like it is hard to bet against the greenback. That doesn’t mean we will not see a short-term selloff, just that the trend, as you can see in the chart above, remains firmly higher for the buck.

On the data front, there is not a great volume of information, but PCE will certainly keep us all riveted to the screen Friday morning.

| Today | Chicago Fed Nat’l Activity | 0.09 |

| Tuesday | Flash Manufacturing PMI | 52.0 |

| Flash Services PMI | 52.0 | |

| New Home Sales | 668K | |

| Wednesday | Durable Goods | 2.5% |

| -ex Transport | 0.3% | |

| Thursday | Initial Claims | 215K |

| Continuing Claims | 1814K | |

| Q1 GDP | 2.5% | |

| Q1 Real Consumer Spending | 2.8% | |

| Friday | PCE | 0.3% (2.6% Y/Y) |

| -ex food & energy | 0.3% (2.6% Y/Y) | |

| Michigan Sentiment | 77.8 |

Source: tradingeconomics.com

With the absence of Fed speakers, a blessing in my view, market participants will likely be taking their cues from earnings as well as activities elsewhere. In the end, nothing has changed my view on the dollar where higher for longer suits both the rate and dollar outcome.

Good luck

Adf