There once was a fellow named Jay

Whose job, as it works out today

Is managing prices

And ‘voiding a crisis

A mandate from which he can’t stray

The problem he has, as it stands

Is others are tying his hands

So, prices keep rising

And he’s now realizing

He’s no longer giving commands

Friday’s PCE data was not as hot as some had feared, but certainly showed no signs of cooling. To recap, the M/M numbers for both headline and core were 0.3%, as expected, although at the second decimal they must have been higher because both Y/Y numbers were higher than expected at 2.7% headline and 2.8% core. As can be seen in the chart below from tradingeconomics.com, both the core (blue line) and headline (gray line) have the appearance of having bottomed.

While things certainly could have been worse, especially based on the price deflator data we saw in the GDP report, this cannot have helped Chair Powell’s attitude. Remember, too, that 0.3% rises annualize to a bit more than 3.6%, far higher than the ostensible target. The inflation fight has not yet been won by the Fed although I expect that we are going to hear a lot of commentary going forward that it has. Wednesday brings the FOMC meeting, something on which we will touch tomorrow, and obviously a critical aspect of the discussion. One other thing, given the data was not as hot as feared, it took until yesterday for the Fed whisperer to write his article, which was focused on the long-term neutral rate rather than inflation per se.

Did they sell or not?

Looking at charts, possibly

But they’ll never say

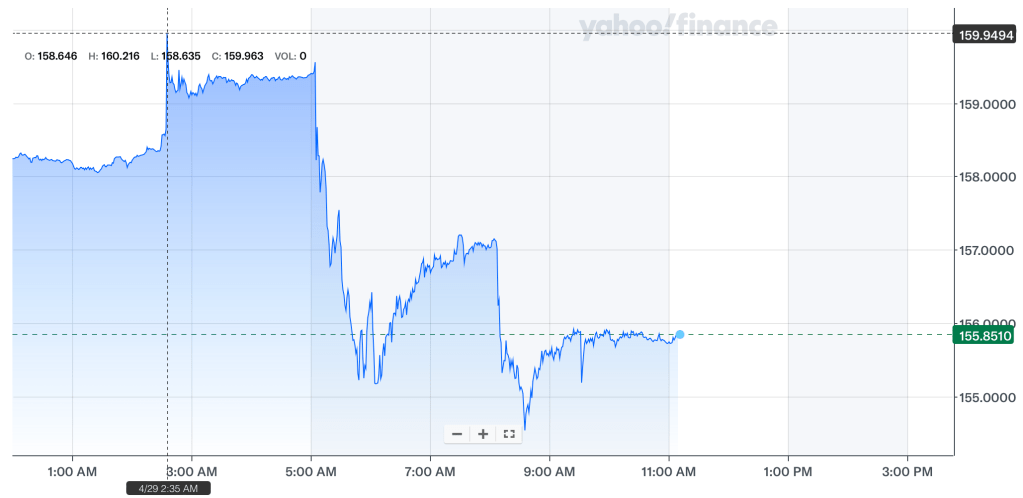

The next story of note was the fact that USDJPY trade above 160 last night, during the early hours of the session. As can be seen from the below chart from yahoo finance, it seemed to have touched 160.216 before slipping back to the mid-159’s and then collapsing a few hours later, back to its current state just below 156.

Something to remember is that it is golden week in Japan, with the nation on holiday yesterday so banks were, at most, running skeleton staffs of junior traders and market liquidity was significantly impaired. But the question today is, did the BOJ intervene on behalf of the MOF. From what I have been able to glean, there was significant selling by the big three Japanese banks, certainly a sign that intervention was possible. Of course, the chart shows how sudden the decline was, also an indication that it could have been intervention. The best explanation I have heard for the initial move above 160 was it was some bank(s) running stop-losses at the level, as well as triggering barriers there in the options market. At this hour (6:15), the yen has appreciated by 1.6% from Friday’s closing levels. However, I sincerely doubt that we have seen the end of the weakness in the yen. This is especially true if Chair Powell comes across as more hawkish on Wednesday, something that is clearly quite possible.

The last thing to note for today

Is Yellen and her QRA

How much will she borrow?

And Wednesday, not ’morrow

We’ll learn if more bonds are in play

This brings us to the Quarterly Refunding Announcement (QRA) to be released at 3:00 this afternoon. While historically, the only people who cared about this report were bond market geeks, it has gained a significant amount of status since the October 31st announcement where the Treasury indicated it would be issuing less debt than had been expected. That led directly to the massive bond market rally at the end of last year as well as the concomitant stock market rally. Looking at the below chart from tradingeconomics.com, it is pretty clear when things turned around, and it was right when the QRA came about.

Once we know the borrowing plans from this afternoon, we will learn on Wednesday the mix of borrowing that will be coming, and whether Secretary Yellen will continue to issue a more significant amount of debt in T-bills, or if she will try her hand at notes and bonds again. Given that yields have been climbing lately, I suspect there will be more T-Bill issuance than is the historic norm, which has been about 20% of total borrowing, but perhaps not the 80% she issued last quarter. Ultimately, the real concern today is that the estimated borrowing numbers could be larger than current forecasts, and perhaps just as importantly, the question of just how much was borrowed last quarter. The sustainability of this process is starting to be called into question although I don’t expect anything to happen quite yet.

Ok, that’s enough for one day! A quick recap of the overnight session shows that Chinese shares rallied on the back of news from Beijing that the government was relaxing some regulations in the property sector. In fact, that was sufficient to help all Asian equity markets higher on the order of 0.5% – 1.0%. Meanwhile, European bourses are mixed this morning with both the DAX and CAC little changed, the FTSE 100 edging higher by 0.5%, but other continental exchanges under pressure. As to US futures, they are very modestly higher this morning after Friday’s rally.

In the bond market, after modestly higher yields on Friday, this morning is seeing Treasury yields slip 4bps and European sovereigns fall between 5bps and 7bps. Clearly, there is not much concern that the QRA is going to indicate massive new borrowing, but I guess we will know this afternoon.

Commodity prices are on the quiet side this morning with oil basically unchanged, as is gold as both hold onto last week’s gains. However, copper (+0.5%) continues to rally and is now just $0.30/pound below its all-time highs of $4.89. There are many stories regarding the copper market with some discussing hoarding by the Chinese and others focused on the needs of the ongoing ‘energy transition’ which will need significant amounts of the red metal to electrify everything. While it has run up quite quickly of late, I must admit the long-term view remains positive in my mind between the absence of new mines and the needs of the transition although a pullback would not be a surprise.

Finally, the dollar, aside from vs. the yen, is generally lower across the board. While it remains in the upper end of its recent trading range, it appears the sharp decline in USDJPY has had knock-on effects elsewhere. The financial currencies, like EUR (+0.3%), GBP (+0.4%) and CHF (+0.3%) are all firmer as are the commodity bloc (NOK +0.3%, ZAR +0.45%, AUD+0.5%). In fact, I am hard-pressed to find a currency that is underperforming the greenback. Positioning in dollars has been quite long lately so ahead of this week’s FOMC meeting as well as the NFP on Friday, it is quite likely that we are seeing a little reduction in those positions. However, we will need to see a change in the data to change the longer-term view.

Obviously, there is a ton of stuff coming out this week.

| Today | QRA | |

| Tuesday | Employment Cost Index | 1.0% |

| Case Shiller Home Prices | 6.7% | |

| Chicago PMI | 44.9 | |

| Consumer Confidence | 104.0 | |

| Wednesday | ADP Employment | 179K |

| ISM Manufacturing | 50.1 | |

| JOLTS Job Openings | 8.68M | |

| FOMC Rate Decision | 5.50% (unchanged) | |

| Thursday | Initial Claims | 212K |

| Continuing Claims | 1782K | |

| Nonfarm Productivity | 0.8% | |

| Unit Labor Costs | 3.2% | |

| Factory Orders | 1.6% | |

| Friday | Nonfarm Payrolls | 243K |

| Private Payrolls | 180K | |

| Manufacturing Payrolls | 7K | |

| Unemployment Rate | 3.8% | |

| Average Hourly Earnings | 0.3% (4.1% Y/Y) | |

| Average Weekly Hours | 34.4 | |

| Participation Rate | 62.7% | |

| ISM Services | 52.0 |

Source: tradingeconomics.com

In addition to all this, on Friday we will hear from two Fed speakers, Williams and Goolsbee, and I imagine if they are unhappy with the market response to their messaging on Wednesday, we will hear from more.

Ultimately, this is an important week to help us understand how things are going in the economy and how the Fed is thinking about everything. As long as payrolls continue to hang in there, any chance of Fed dovishness seems to diminish by the day. But stranger things have happened. As to the dollar, today’s position adjustments make sense and I suspect there will be a few more before the big news hits on Wednesday and Friday. Til then, I think all we can do is watch and wait.

Good luck

Adf