As the yen declines

Pressure on the BOJ

Climbs up towards the stars

Intervention in the currency markets has a long and undistinguished history. At least that is true for nations that have open capital accounts. In fact, a key reason that countries impose and maintain capital account restrictions is to avoid the situation of having their currency collapse when the locals fear future loss of purchasing power, i.e. inflation is rising. While there have been situations where a central bank has been able to prevent a significant movement in the past, it has almost always been in an effort to prevent too much currency strength, never weakness.

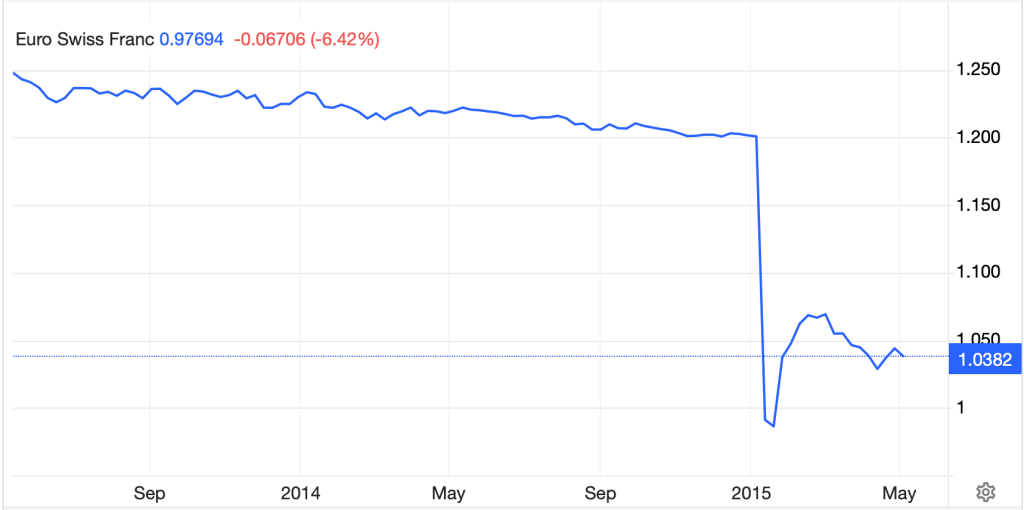

A great example is Switzerland in January 2015. As you can see from the chart below of the EURCHF cross, Switzerland was explicitly targeting a level, 1.20, in the cross as the strongest the Swiss franc could trade (lower numbers indicate a stronger CHF). This was in an effort to support the export sectors of the economy during a period shortly after the Eurozone crisis when Europeans were quite keen to convert their funds to Swiss francs as a more effective store of value.

Source: tradingeconommics.com

The upshot was that the Swiss National Bank wound up effectively printing and selling hundreds of billions of francs, receiving dollars and euros and then investing those proceeds into the US stock market. At one point, they were the largest shareholder in Apple! But even in this case, where you would expect a nation could prevent their currency from rising too far or too fast, the process overwhelmed the SNB and one day in January 2015 they simply said, enough. That 25% appreciation in the franc took about 15 minutes to accomplish and as evidenced by today’s exchange rate of 0.9768, it has never been unwound.

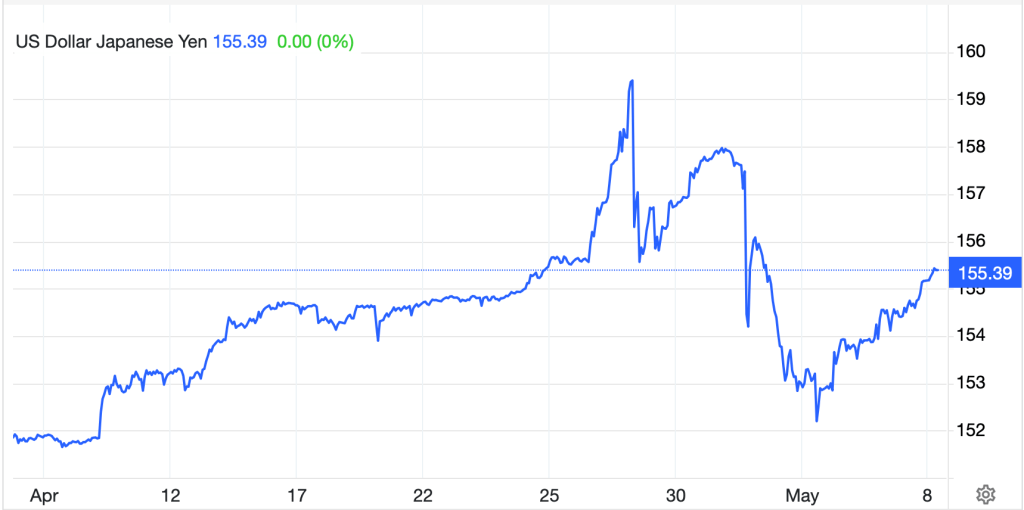

And that’s what happened to a central bank that is trying to prevent its own currency from strengthening. For central banks to prevent weakness is an entirely different story and a MUCH harder task. As I have repeatedly explained, the only way to change the trajectory of a currency is to alter monetary policy. At this time, given the Fed’s commitment to higher for even longer, the only way Japan can prevent more substantial yen weakness is for the BOJ to tighten policy even further. This is made evident in the below chart of the price action in USDJPY for the past month. In it, you can see when it spiked above 160 on April 28th, and the subsequent intervention that day and then two days later.

Source: tradingeconomics.com

However, in both cases, despite spending upwards of $60 billion intervening, the yen immediately resumed its downtrend (dollar uptrend) and this morning it is back above 155. It is this price action that appears to have finally awoken Ueda-san as last night, in an appearance at the Japanese parliament, he explained the following, “Foreign exchange rates make a significant impact on the economy and inflation. Depending on those moves, a monetary policy response might be needed.” Ya think! Ueda-san was followed in parliament by FinMin Suzuki who repeated something he said last week, “Since Japan relies on overseas markets for food and energy, and a large portion of its transactions are denominated in dollars, a weaker yen could raise prices of imported goods.” While those comments are self-evident, the fact that he needed to repeat them is indicative of the idea that Japan is getting increasingly uncomfortable with the current yen exchange rate.

So, will Ueda-san raise rates at the next meeting in June? Will he alter their QQE policy and explicitly explain they will no longer be buying JGBs? Certainly, the market is on edge right now given the two bouts of intervention from last week, but not so on edge that it isn’t continuing to sell the currency and capture the carry. At this point, you cannot rule out a third wave of intervention, and certainly we should expect more jawboning. But in the end, if they are serious about the yen being too weak, Ueda-san will have to move. At this point, I am not convinced, but the meeting is on June 14th, so there is plenty of time for things to become clearer.

And other than that, quite frankly, not much is going on. So, let’s take a tour of markets to see how things stand this morning.

Yesterday’s equity markets in the US were tantamount to being unchanged across the board, at least that is true of the major indices. There were certainly individual equities that moved. In Asia, it was a mixed picture with both Japanese (Nikkei -1.6%) and Chinese (CSI 300 -0.8%) shares in the red, which dragged down HK shares. But elsewhere in the region, we saw more gains than losses, albeit none of the movement was that large overall. Meanwhile, in Europe, all the markets are looking robust this morning with gains ranging from 0.5% (DAX, FTSE 100) to 1.0% (CAC) and everywhere in between. The Swedish Riksbank cut rates by 25bps, as anticipated this morning, and perhaps that has encouraged investors to believe the ECB is going to embark on a more significant easing campaign starting next month. Certainly, the limited data we saw this morning, (German IP -0.4%, Spanish IP -1.2%, Italian Retail Sales 0.0%) are not indicative of an economy that is growing strongly. Finally, US futures are just a touch lower, -0.2%, at this hour (7:15).

Despite the weakness in Eurozone data, and the absence of US data, yields are rebounding a bit this morning with Treasuries higher by 3bps and the entire European sovereign spectrum seeing yields rise by 3bps to 4bps. It seems unlikely that the weak Eurozone data is the driver and I suspect that this movement is more a trading reaction based on the recent decline in yields. After all, just one week ago, yields were more than 20 basis points higher, so a little rebound can be no surprise.

In the commodity markets, oil (-1.1%) is under pressure as rising inventories outweigh ongoing concerns over Israel’s Rafah initiative. While the EIA data is generally considered the most important, yesterday’s API data showed a build of more than 500K barrels vs. expectations of a 1.4M barrel draw. At the end of the day, this is still a supply/demand driven price, and if supply is more ample, prices will fall. In the metals markets, precious metals continue to trade choppily around recent levels, but we are starting to see some weakness in the industrial space with both copper (-1.25%) and aluminum (-1.6%) under pressure this morning. Certainly, if economic activity is starting to wane, these metals are likely to suffer.

Finally, in the FX markets, the dollar is continuing to rebound from its recent selloff, gaining against virtually all its counterparts, both EMG and G10. SEK (-0.5%) is the biggest mover in the G10 after the rate cut, but JPY (-0.45%) is not far behind. We are also seeing weakness in AUD (-0.4%) on the back of those metal declines. As to the EMG bloc, ZAR (-0.7%) is the laggard there, also on the metals weakness, but we saw KRW (-0.5%) suffer overnight as well amidst the general dollar strength.

Once again, there is no US data on the calendar although we hear from three more Fed speakers, Boston’s Collins as well as governor’s Cook and Jefferson. Yesterday, Mr Kashkari did not give us any new information, indicating that higher for longer still makes the most sense and even questioning the level of the neutral rate, implying it may be higher than previously thought. But there have been no cracks in the current story that the Fed is not going to alter policy soon.

While day-to-day movements remain subject to many vagaries, the reality is that the trend in the dollar has been higher all year and as long as monetary policies around the world remain as currently priced, with the Fed the most hawkish of all, the dollar should grind higher over time.

Good luck

Adf