It seems that prices

In Japan are not soaring

Like the hawks would want

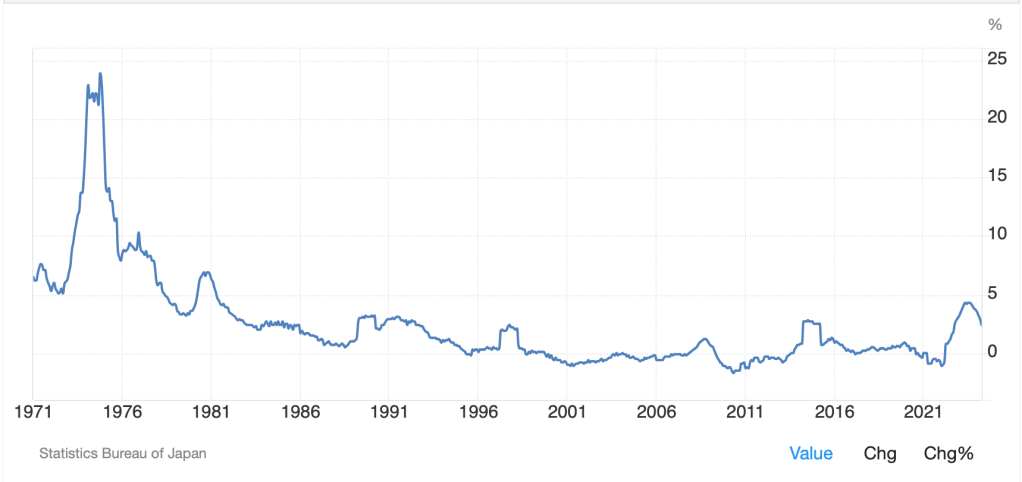

Japanese inflation data last night showed a continued decline as the Core rate fell to 2.2%, and the so-called super core rate slipped to 2.4%, its lowest level since October 2022. As you can see in the super core chart below, the trend seems clearly to be downward although the current level remains far above inflation rates for most of the past 30 years.

Source: tradingeconomics.com

The irony here is that were this the chart of the inflation rate in any other G7 nation, the central bank would be crowing about how successful they had been at slaying the inflation dragon. Alas, as the chart demonstrates, Japan’s dragon was a different species, and one that I’m pretty sure the 122 odd million people there were very comfortable having as a “pet”. After all, I have never met a consumer who was seeking prices to rise before they bought something, have you?

From a market perspective, the continued decline in inflation rates calls into question just how much further Japanese interest rates need to rise in order to achieve the BOJ’s goals. Again, remember the BOJ’s goals for the past decade has been to RAISE the inflation rate to 2% and their tactic has been to create the largest QE program in the world such that they now own more than 50% of the outstanding Japanese government debt across all maturities. If inflation continues to decline back to, and below, 2%, while I’m confident the general population there will have no objections, Ueda-san may find himself in a difficult position.

Arguably, if higher inflation is the goal (and politically that seems nuts) then the most effective tool the nation has is to allow the yen to continue to weaken and import inflation. I continue to believe that this will be the process going forward, and while very sharp and quick declines will be addressed, a slow erosion will be just fine. Absent a major change in US monetary policy to something much easier, I still don’t see a case for a much stronger yen. However, as a hedger, I would continue to consider options to manage the risk of any further bouts of intervention.

While many are still of the view

That rate cuts are long overdue

What yesterday showed

Is growth hasn’t slowed

So, Jay and his friends won’t come through

Back home in the US, yesterday’s data releases did nothing to encourage the large contingent of people who are desperate looking for a rate cut before too long. While New Home Sales were certainly lousy, falling from the previous month’s downwardly revised level, and the Chicago Fed’s National Activity Index was also quite soft, indicating economic activity had slowed last month, the Flash PMI data got all the attention with both Manufacturing (50.9) and Services (54.8) rising sharply, an indicator that there is still life in the economy yet. The result was that we saw US yields rise (10yr +7bps), the dollar strengthen, and equity markets give back their early, Nvidia inspired, gains to close lower on the day. While equity futures are rebounding slightly this morning, confidence that a rate cut is coming soon has clearly been shaken.

Adding to the gloom was a reiteration by Atlanta Fed president Bostic that it is going to take a lot longer for rates to impact inflation than in the past. In a discussion with Stanford Business School students, he focused on the fact that so many people locked in low mortgage rates during the pandemic and recognized, “the sensitivity to our policy rate — the constraint and the degree of constraint that we’re going to put on is going to be a lot less.” For those reasons, Bostic said, “I would expect this to last a lot longer than you might expect.” This discussion has been gaining more adherents as the punditry is grudgingly beginning to understand that their previous models are not necessarily relevant given all the changes the pandemic wrought. Summing up, there continues to be no indication, especially in the wake of the more hawkish tone of the Minutes on Wednesday, that the Fed is going to cut rates soon.

So, with the new slightly less perfect world now coming into view, let’s take a look at market behavior overnight. Yesterday’s US equity slide was continued everywhere else around the globe with Asian markets (Nikkei -1.2%, Hang Seng -1.4%, CSI 300 -1.1%) under uniform pressure and European bourses, this morning, also in the red, but by a lesser -0.4% or so across the board. For many of these markets (China excepted) they have recently run to all-time highs, or at least very long-term highs, so it should be no surprise that there is some consolidation. There is a G7 FinMin meeting this weekend and the comments we have heard so far indicate that the ECB is on track to cut rates next month, but there are no promises for further cuts. Net, it seems clear that as much as most central banks want to cut interest rates, they are still terrified that inflation will return and then they have an even bigger problem.

In the bond market, it has been a very quiet session after yesterday’s yield rally with Treasury yields unchanged this morning and European sovereign yields similarly unmoved. Even JGB yields are flat on the day as it appears bond traders and investors started their long weekend a day early. Remember, not only Is Monday a US holiday, but it is a UK holiday as well, so there will be very little activity then.

In the commodity markets, oil prices remain under pressure and are drifting back toward the low end of their recent trading range. One story I saw was that there is a renewed effort to get the ceasefire talks in Gaza back on track, but that seems tenuous at best. Given the strength seen in the PMI data across Europe and the US, it would seem the demand side of the story would improve things here, but not yet. As to the metals markets, after a serious two-day correction, this morning is bringing a respite with both gold and silver prices bouncing while copper prices remain unchanged. I remain of the view that the longer-term picture for metals is still intact, so day-to-day trading activity should be taken with a grain of salt. Ultimately, I continue to believe that the central banking community is going to cut rates before inflation is controlled and that will lead to much bigger problems going forward along with much higher commodity prices.

Finally, the dollar, which rallied alongside yields yesterday, is giving back some of those gains, albeit not very many of them. The commodity currencies (AUD +0.2%, NZD +0.2%, ZAR +0.4%, NOK +0.6%) are the leading gainers this morning although the euro is also firmer as is the pound despite much weaker than expected UK Retail Sales data. Alas, the poor yen can find no support and continues to drift a bit lower, with the dollar back above 157 this morning and keep an eye on CNY, which is now back above 7.25 for the first time in a month after Chinese FDI data showed larger than expected -27.9% decline. It seems that President Xi has successfully scared off most foreign investment which is very likely a long-term problem for the nation. While it has been very gradual, the fixing rate continues to weaken each day as it appears the PBOC is finally accepting the need for a weaker yuan.

On the data front, we see Durable Goods (exp -0.8%, +0.1% ex-Transports) and then Michigan Confidence (67.5) which continues to be a problem for President Biden’s reelection campaign as the people in this country are just not happy. We also hear from Governor Waller this morning. It will be very interesting to hear him as my anecdotal take is that the regional presidents have been much more hawkish than the governors and Chairman Powell, so if he leans dovish, it may demonstrate a bigger split between factions on the board than we have been led to believe. We shall see.

Net, it remains very difficult for me to make a case for the dollar to weaken substantially at this time. While it may not power ahead, a decline seems unlikely for as long as higher for longer remains the mantra.

Good luck and good long weekend

Adf

There will be no poetry on Monday due to the holiday.