On Friday, the NFP showed

That job growth has not really slowed

And wages were hot

So, pundits all thought

That ‘flation just might well explode

But under the NFP’s hood

Some things didn’t look quite so good

The joblessness rate

Itself did inflate

Though household jobs fell, understood?

Meanwhile across Europe the vote

For Parliament seems to denote

Incumbents were crushed

And governments flushed

While media seeks a scapegoat

Remember the narrative that had everyone feeling so good? Inflation was drifting lower, albeit not in a straight line, but central bankers around the world were quite confident that their collective 2.0% targets were coming into view, and pretty soon at that. This would lead to lower bond yields, continued strong performance in risk assets and slowing, but still solid economic activity. In other words, many were invested in the Goldilocks thesis of a soft landing.

Now, the data that we had seen last week seemed to indicate that was a viable process as the ADP Employment number was a touch soft, the JOLTS Job Openings number was definitely soft and although the ISM Services data was a lot stronger than anticipated, the ISM Manufacturing number was soft as well. In addition, if we go back to the previous week, the Chicago PMI print was abysmal at 35.4.

This was all a prelude to Friday’s NFP data which confirmed confused everything. While the headline number was much stronger than expected at 272K, the Unemployment Rate rose to 4.0% for the first time in more than two years, and Average Hourly Earnings rose 0.4% with an annual increase of 4.1%. But even more confusing was the fact that looking at the Household survey, the survey that is used to calculate the Unemployment Rate, showed the number of jobs FELL by 408K while 250K people exited the workforce. Now, if things were truly running smoothly, as the NFP number indicated, we would expect to see that household number of jobs rise, not fall. Something is amiss.

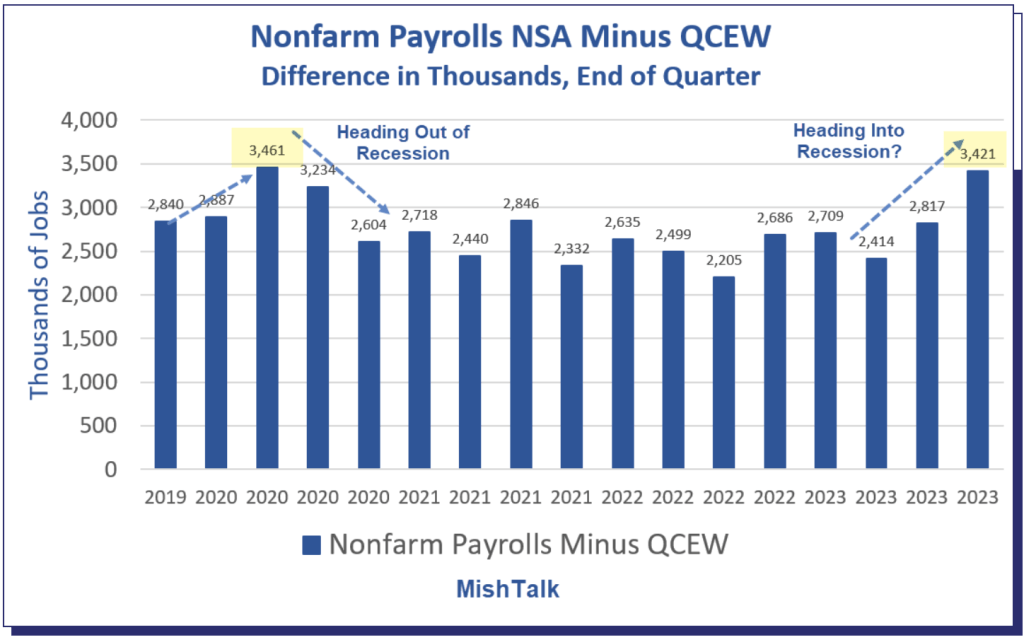

Having read far too much about this over the weekend, it appears that the BLS data and its models are not a very accurate representation of the current reality, at least for the monthly data. The BLS also produces a quarterly survey called the Quarterly Census of Employment and Wages (QCEW) which is a census of 11 odd million businesses in the US, rather than a survey of some 600k businesses for the NFP. If one looks at the growing discrepancy between the number of jobs shown in that data vs. the NFP data, the NFP data has been rising far faster with the gap widening severely. This can be seen in the below graph from the mishtalk.com website (from Mike Shedlock, an excellent economist/analyst).

The upshot is that while that headline NFP number has looked very good, there appears to be something else happening in the underlying data. Early next year, the BLS will revise its NFP data, and you cannot be surprised if they reduce the readings significantly. But revisions don’t have the same cachet as headlines, and so this is our current world.

The market response was as you would expect; bonds got crushed with the entire yield curve jumping 15bps, the dollar rallied sharply, up nearly 1% on the DXY with several currencies falling farther than that (e.g., MXN -2.85%, NOK -1.5%, BRL -1.6%), and equity markets falling although not nearly as much as you might expect, only about -0.15% on average across the big indices. But the notable moves were in commodities with gold (-2.2%), silver (-3.9%) and copper (-3.0%) just in the wake of the NFP data, with larger declines overall on the day. Energy was the only space that held in on the day, but of course, it has been under pressure for several weeks.

What’s next? Well, this week brings a great deal of new information including CPI, PPI, the FOMC Meeting and the BOJ meeting. My take is many traders are licking their wounds right now, so given today’s calendar is quite benign, I imagine things will be a bit choppy as positions get adjusted, but direction will be hard to discern. Except…

The European Parliament elections were held starting last Thursday but running through Sunday, with all 27 nations in the EU voting for their parliamentary representatives. The story is, as you will clearly have heard by now, that the left wing, center-left and centrist parties got decimated while everyone on the right side of the aisle massively outperformed. The Belgian PM resigned and there will be elections there. French President Macron dissolved parliament for a snap election as his party won just 15% of the vote while Marine Le Pen, the conservative candidate leading the National Rally, won more than 31% of the votes. As well, German Chancellor Olaf Sholz has been decimated as have the Green parties across the continent. Times, they are a-changin’. It is no surprise that the euro continues to falter after Friday’s declines as the European part of the equation just added to the woes from the US implication of higher interest rates.

What will these elections mean for markets? The clearest message that I see is that the climate agenda is likely to be altered such that demand for oil and gas may well increase. Do not be surprised to see more European nations abandon the Net Zero concept, at least reaching it by 2050. Ironically, while the first move was seen as a negative for the euro, this may well be a harbinger of future euro strength if the Eurozone economies waste less money on impossible dreams and spend more on actual economic activity that generates benefits and income for its citizens without government subsidies. But that will take a bit more time.

Perhaps the most important thing is that this election may well be a harbinger of the US election in November as the European people have clearly rejected the current themes and are looking for a change. Far left Green policies that have been promulgated by the Biden administration have found no favor in Europe and certainly the current polling indicates it is equally unpopular in the US.

OK, a quick tour of the overnight session shows that Japanese equity markets performed well after GDP data there last night showed a less negative outcome in Q1 than originally reported, while most of the rest of Asia was closed for various holidays. European bourses, however, are under pressure across the board led by France (-2.2%) although most of the rest of the continent has seen declines on the order of -1.0%. As to the US futures markets, at this hour (6:15), they are lower by -0.3%.

Bond yields continue to climb with Treasuries up another 2bps and European sovereigns rising between 2bps (Germany) and 8bps (France and Italy) as the combination of higher US yields and some concerns over the future direction in Europe have come to the fore. Overnight, JGB yields also jumped 7bps and are back above 1.00%, with the Japanese data and US data the drivers. The BOJ meets Friday this week, so there is much speculation as to the outcome, although a rate hike is not forecast.

In the commodity markets, after Friday’s rout in the metals space, the big ones are all firmer this morning, although this looks like a trading bounce rather than a change of views. Oil markets are little changed this morning, trading at the lower end of their recent ranges but NatGas, something I haven’t discussed in a while, is rallying again. It is higher by 3% this morning and 26% in the past month, rising to $3.00/MMBtu, its highest price since November and double the lows seen in March. Consider that if there is continued pushback against the Green agenda, as evidenced by the European elections, demand for NatGas is likely to grow quite strongly.

Finally, the dollar is continuing to gain strength this morning, with the euro down -0.6% following Friday’s declines and the EEMEA currencies all falling more than that. Given the holidays in Asia, there was limited trading in the onshore markets there, and other than MXN, which is unchanged this morning, the rest of LATAM hasn’t opened yet. However, remember that the peso has fallen 10% in the past week, so there is likely going to be some more movement in that space going forward. Markets typically don’t dislocate by 10% and then just stop.

As if last week didn’t bring enough surprises between the NFP and election results in India, Mexico and Europe, this week we have a lot more to look for, although today is a blank slate.

| Tuesday | NFIB Small Biz Optimism | 89.8 |

| Wednesday | CPI | 0.1% (3.4% Y/Y) |

| -ex food & energy | 0.3% (3.5% Y/Y) | |

| FOMC Rate Decision | 5.5% (unchanged) | |

| Thursday | Initial Claims | 224K |

| Continuing Claims | 1800K | |

| PPI | 0.1% (2.5% Y/Y) | |

| -ex food & energy | 0.3% (2.5% Y/Y) | |

| Friday | BOJ Rate Decision | 0.10% (unchanged) |

| Michigan Sentiment | 72.0 |

As this is a quarterly meeting of the FOMC, we will get new projections and a new dot plot, and of course, Chairman Powell will be speaking afterwards. As of now, the market is pricing about a 50:50 chance of the first cut coming in September and a total of one and one-half cuts for the rest of the year. It remains very difficult to discern what is really happening in the economy with all the conflicting data. However, whatever the growth stories, nothing has indicated that inflation is going to decline very far. I maintain the Fed is going to be higher for longer for even longer. It continues to be difficult to see the benefits of many other currencies, although I would not be surprised to see MXN regain much of its lost ground as I doubt Banxico will be easing policy anytime soon, and president-elect Sheinbaum is not going to change things there that much and doesn’t take office until October.

Good luck

Adf