The answer to yesterday’s question

Is CPI’s seem some regression

Both stocks and bonds soared

The dollar was floored

But Powell now has indigestion

To no one’s surprise he left rates

Unchanged, while the dot plot translates

To higher for longer

Though pressure’s grown stronger

To cut to achieve his mandates

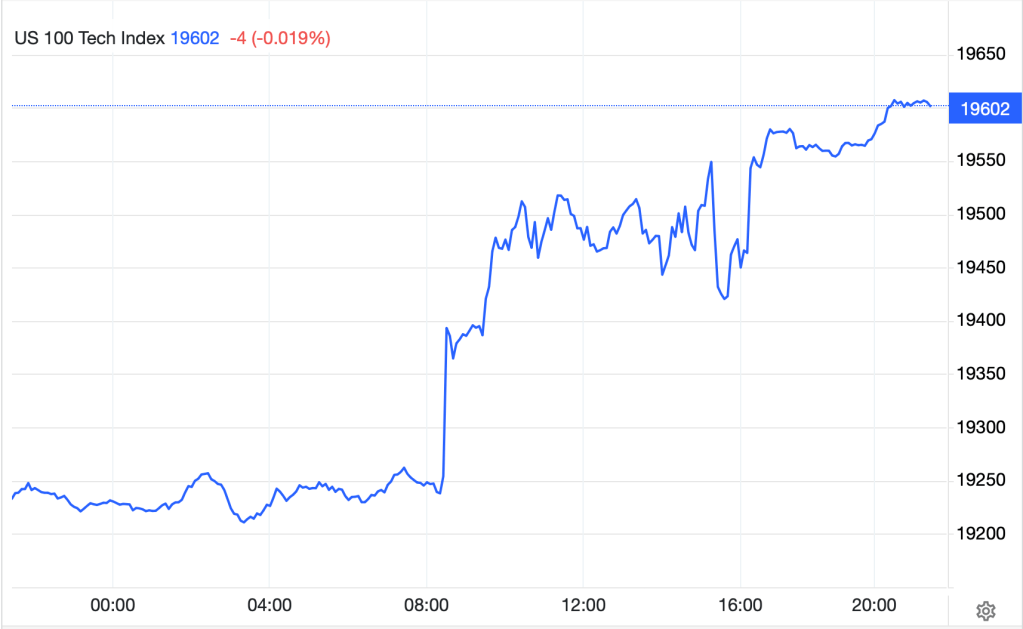

Unequivocally, the CPI data was cooler than market forecasts. Month over month prices were unchanged at the headline level and grew only 0.16% on a core basis, with the year-on-year numbers each coming in one tick below expectations. It took absolutely no time for markets to run with this data as the following charts from tradingeconomics.com for the NASDAQ 100, 10-year Treasury yields and EURUSD demonstrate. See if you can determine when the CPI data was released.

Now, as I explained, and has become abundantly clear to anyone watching, the equity market is in a world of its own. While yields backed up and the dollar rebounded (euro fell) after the somewhat more hawkish than expected FOMC statement, dot plot and Powell press conference, the NASDAQ ignored everything and kept on rallying. While that is remarkably impressive, I remain of the opinion that trees still don’t grow to the sky, although apparently, they can get really tall!

At any rate, a quick look under the hood at the CPI shows that core goods prices continue to fall, which was largely why today’s data looked so good, but primary rents and OER continue to climb at about 0.4% monthly despite many assurances by many pundits, analysts and economists that rental inflation was sure to begin declining soon. It has been rising at this pace or faster for more than two years, and while the actual pace has backed off from the rate a year ago, if you annualize 0.4% you come up with just under 5.0% inflation. It remains hard to believe that shelter costs can rise at that pace and the general price level is going to get back to 2.0%. Yesterday’s data was good, but we are not out of the woods yet.

Turning to the FOMC, the statement was virtually unchanged from the May statement, which makes sense since the mix of data that we have seen in the interim shows some hot and some cold numbers and no clear line of sight to the end game. As such, it is not surprising that Chairman Powell tried to veer hawkish at the press conference in what appears to have been an attempt to offset the (over)reaction to the CPI data. In fact, a look at the dot plot shows that, as I suggested, the median expectation for rate moves in 2024 is down to a single cut, although they are more confident that inflation will continue to fall next year with the median expectation for an additional 4 cuts. However, as I also suggested, the longer-term outlook continues to rise with the median there now up to 2.80% from 2.60% in March, and 2.5% or below for the 3 years prior to that.

Interestingly, in their Summary of Economic Projections they expect PCE inflation to be 2.6% this year, up from 2.4% in March, with core PCE to be at 2.8% this year, up from 2.6% in March. They did, however, maintain their views of GDP growth (2.1%) and Unemployment (4.0%). At least, unlike Madame Lagarde who cut rates despite raising inflation forecasts, the Fed’s inaction made far more sense.

But pressure is building on Powell and the Fed to cut rates. Today, several senators wrote (and released) a letter to Powell exhorting him to cut rates because everybody else is doing it. They claim that his intransigence is hurting the economy, although the whole point of higher for longer is that there is scant evidence that the economy, as a whole, is in trouble despite rates where they are, although certainly some sectors are feeling a pinch. As an aside, given the extreme degree of financial and economic ignorance that is routinely demonstrated by virtually every member of the House and Senate, this letter is simply political grandstanding. But pressure is pressure, and Powell will certainly feel it, although I don’t think he is too concerned by this group overall.

While this morning brings PPI (exp 0.1%/2.5% headline and 0.3%/2.4% Core) as well as the weekly Initial (225K) and Continuing (1800K) Claims data, it is hard to believe that either of those data points are going to have any substantive impact given everything we learned yesterday. So, let’s look elsewhere to see what is happening.

One of the interesting stories right now is the ongoing situation in France with the snap elections called by President Macron. Apparently, the quick timing has resulted in significant confusion on both the left and right of the spectrum as to who will be allying with whom, and what they stand for. While this is amusing in its own right (see this Twitter thread), the ramifications are greater for the impact on the French OAT market and the euro.

Briefly, the issue is that France has been slowly sliding from the figurative north of Europe to the South, meaning that it used to be considered a country with almost Germanic fiscal sensibilities and now it is much more akin to the PIGS than Germany. The WSJ had an interesting article this morning describing the situation. Ultimately, the market response has been for French yields to rise compared to German yields, adding pressure to the country as it needs to continue to finance its 5%+ budget deficit. Now add to that the absolute trainwreck that is the current government leadership (as evidenced by that Twitter thread) and investors have decided that there are better places to invest with less credit risk. After all, S&P Global downgraded French debt last month due to their profligate spending and I assure you, whatever the election outcome, there will be more spending not less.

If we view this through a FX lens, the combination of clear dysfunction in Europe, lower interest rates in Europe and a Fed still committed to seeing the whites of 2%’s eyes before cutting rates here, it is very easy to anticipate the euro will be biased downwards over time. While I know there are many who continue to write the dollar’s obituary, the fact remains that it is still standing with no competitors of note. In fact, part of the raison d’etre of the euro was to be able to replace the dollar as a reserve currency. It seems that hasn’t worked out all that well.

Ok, let’s see how global markets responded to the US data yesterday. Perhaps the most interesting thing was that even in the US, the DJIA fell slightly, despite the conviction that rates are heading lower. In Asia, the picture was mixed with Japan (-0.4%) and China (-0.5%) sliding while Hong Kong (+1.0%) rallied on the tech rally. Many consider the Hang Seng to be China’s NASDAQ with respect to the weight of tech companies in the index. As to European bourses, they are all in the red this morning by more than -1.0% with France (-1.4%) leading the way lower. Of course, based on the above discussion, that can be no surprise. Lastly, in the US, futures at this hour (6:45) are mixed with NASDAQ higher by 0.6% while DJIA futures are -0.4%. Apparently, the prospect of lower rates doesn’t help more mature companies.

In the bond market, after yesterday’s wild ride (see above chart), Treasury yields have edged lower by -1bp, but in Europe, yields are continuing higher from their closing levels, catching up to the Treasury yield rebound in the wake of the FOMC meeting. Not surprisingly, French OATs are leading the way with yields higher by 4bps while Germany has seen only a 2bp rise.

This morning, commodities are uniformly under pressure with oil (-0.8%) sliding after a solid weekly performance while metals markets are also slipping (Au -0.1%, Ag -0.8%, Cu -0.6%) as traders try to come to grips with the next interest rate moves and adjust their positions. An interesting story this morning is that a shipment of copper from Russia to China for 2000 tons apparently never arrived in China. This is simply the latest quirk in the metals markets where confirmation of what is being traded is limited. You may recall the story last year about nickel inventories at the LME actually being bags of painted rocks. In this space, the broad trend remains that there is excess demand for metals, especially copper, silver and aluminum, as all three are critical to electrification of systems and grids, but it is going to be a bumpy ride higher!

Finally, the dollar, which was decimated in the immediate wake of the CPI data yesterday, managed to claw back some of those losses in the afternoon thanks to the more hawkish Fed and this morning, that slow rebound continues with the greenback higher vs. almost all its counterparts in both the G10 and EMG blocs. However, nothing really stands out as having moved significantly, with a general trend of about 0.2% or so across the board.

And that is really all we have today. The first post-FOMC speaker is NY Fed president Williams at noon, although I suspect his message will be identical to Powell’s yesterday. As to the rest of things, the BOJ meets tonight and while there is no expectation of a policy change, Ueda-san’s comments will be carefully parsed for any clues to when a change may be coming.

Since nothing seems to matter to the NASDAQ and everyone wants to own it, I suspect that the dollar will maintain its gradual strength until further notice.

Good luck

Adf