Even in Japan

Incumbency is questioned

It’s a brand-new world

Yesterday’s elections in Japan brought about the downfall of yet another incumbent government as people around the world continue to demonstrate they are tired of the status quo. Recently appointed PM, Shigeru Ishiba called for a snap election within days of his appointment following the resignation of previous PM Kishida on the heels of a funding scandal. Ishiba’s idea was to receive a fresh mandate from the electorate so he could implement his vision. Oops! It turns out that his vision was not in sync with the majority of the population. Ultimately, the LDP and its key ally, Komeito, won only 215 seats in the Diet (Japan’s more powerful Lower House), well below the 233 necessary for a majority and even further from the 293 seats they held prior to the election. The very fact that this occurred in Japan, the most homogenous of G10 nations, is indicative of just how strong the anti-incumbent bias has grown and just how tired people are of current leadership (keep that in mind for the US election).

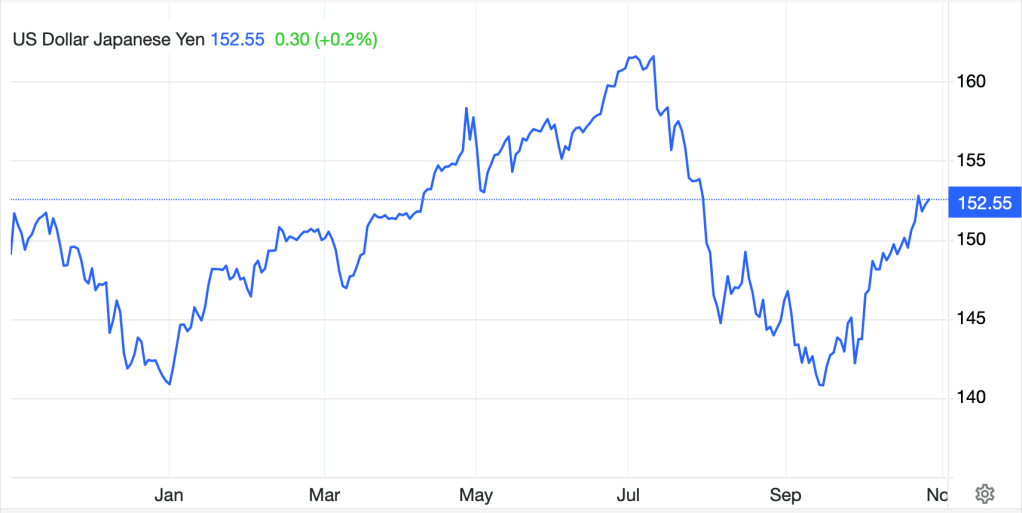

Now, turning to the market impact, the tenuous hold any government formed from these disparate results means that Japan seems unlikely to have a clear, coherent vision going forward. One of the key issues was the ongoing buildup in defense expenditures as the neighborhood there increasingly becomes more dangerous. But now spending priorities may shift. Ultimately, as the government loses its luster and ability to drive decisions, more power will accrue to Ueda-san and the BOJ. This begs the question of whether the gradual tightening of monetary policy will continue, or if Ueda-san will see the need for more support by living with more inflation and potentially faster economic growth.The yen’s recent decline (-0.25% today, -8.5% since the Fed rate cut in September) shows no signs of slowing down as can be seen from the chart below. As the burden of policy activity falls to the BOJ, I expect that we could see further yen weakness, especially when if the Fed’s rate cutting cycle slows or stops as December approaches. If this process accelerates, I suspect the MOF will want to intervene, but that will only provide temporary respite. Be prepared for further weakness in the yen.

Source: tradingeconomics.com

This weekend’s Israeli response

To missile attacks from Iran-ce

Left bulls long of oil

In massive turmoil

As prices collapsed at the nonce

The other major market story this morning was the oil market’s response to Israel’s much anticipated retaliation to the Iranian missile barrage from several weeks ago. The precision attacks on military assets left the energy sector untouched and may have the potential to de-escalate the overall situation. With this information, it cannot be surprising that more risk premium has been removed from the price of oil and this morning the black, sticky stuff has fallen by nearly 6% and is well below $70/bbl. This has led the entire commodity sector lower in price with not only the entire energy sector falling, but also the entire metals sector where both precious (Au -0.6%, Ag -0.9%) and base (Cu -0.2%, Al -1.1%) have given back some of their recent gains. While declining oil prices will certainly help reduce inflationary readings over time, at least at the headline level, I do not believe that the underlying fundamentals have changed, and we are likely to continue to see inflation climb slowly. In fact, Treasury yields (+3bps) continue to signal concern on that very issue.

Which takes us to the rest of the overnight activity. Friday’s mixed session in NY equity markets was followed by a lot more green than red in Asia with the Nikkei (+1.8%) leading the way on the back of both lower energy prices and the weaker yen, while Chinese stocks (+0.2%) managed a small gain along with Korea (+1.1%) and India (+0.8%). However, most of the other regional markets wound up with modest declines. In Europe, mixed is the description as well, with the CAC (+0.25%) and IBEX (+0.4%) in good spirits while both the DAX and FTSE 100 (-0.1%) are lagging. Given the complete lack of data, the European markets appear to be responding to ECB chatter, which is showing huge variety on members’ views of the size of the next move, and questions about the results of the US election, with President Trump seeming to gain momentum and traders trying to figure out the best way to play that outcome. As to US futures, this morning they are firmer by 0.5% at this hour (7:20).

Although Treasury yields have continued their recent climb, European sovereign yields are a touch softer this morning, although only by 1bp to 2bps, as clarity is missing with respect to ECB actions, Fed actions and the US elections. My sense is that we will need to see some substantial new news to change the current trend of rising yields for more than a day.

Finally, the dollar is net, a little softer today although several currencies are suffering. We have already discussed the yen, and we cannot be surprised that NOK (-0.4%) is weaker given oil’s decline, but we are also seeing MXN (-0.3% and back above 20.00 for the first time since July) under pressure as that appears to be a response to a potential Trump electoral victory. But elsewhere, the dollar is under modest pressure with gains on the order of 0.1% – 0.3% across most of the rest of the G10 as well as many EMG currencies. There are precious few other stories of note this morning.

On the data front, it is a very big week as we see not only NFP data but also PCE data.

| Tuesday | Case-Shiller Home Prices | 5.4% |

| JOLTS Job Openings | 7.99M | |

| Consumer Confidence | 99.3 | |

| Wednesday | ADP Employment | 115K |

| Q3 GDP | 3.0% | |

| Thursday | Initial Claims | 233K |

| Continuing Claims | 1880K | |

| Personal Income | 0.2% | |

| Personal Spending | 0.4% | |

| PCE | 0.1% (2.1% Y/Y) | |

| Core PCE | 0.1% (2.7% Y/Y) | |

| Chicago PMI | 47.5 | |

| Friday | Nonfarm Payrolls | 180K |

| Private Payrolls | 160K | |

| Manufacturing Payrolls | -35K | |

| Unemployment Rate | 4.2% | |

| Average Hourly Earnings | 0.3% (4.0% Y/Y) | |

| Average Weekly Hours | 34.2 | |

| Participation Rate | 62.5% | |

| ISM Manufacturing | 47.5 | |

| ISM Prices Paid | 48.2 |

Source: tradingeconomics.com

Of course, with the FOMC meeting next week, we are now in the Fed’s quiet period, so there will be no more official commentary. The one thing to watch is if something unexpected occurs, then look for an article from the Fed whisperer, Nick Timiraos of the WSJ. But otherwise, this is shaping up as a week that starts slowly and builds to the back half when the data comes.

Regardless of the election outcome, I expect that the budget situation will only devolve into greater deficits. I believe that will weigh on the bond market, driving yields higher and for now, I think that will likely help the dollar overall, but not too much. It remains difficult for me to see the dollar reverse course lower absent a much more aggressive FOMC, and that just doesn’t seem to be on the cards.

Good luck

Adf