The rest of the world is amazed

And frankly, I think, somewhat dazed

The vote in the States

Deteriorates

Each cycle, as folks turn half-crazed

But still, everyone cannot wait

To find out if we will be great (again)

Or if we will turn

The page and thus spurn

The chance to encourage debate

By now, I imagine most of you have figured out my preference for the election outcome and whatever your view, I sincerely hope you don’t hold it against me. However, if that is the case, so be it. In the meantime, whatever happened in markets yesterday and overnight just doesn’t matter at all as the opportunity for a major revision of perceptions is so large as to make any price information completely useless, at least in the US markets.

I have seen numerous studies showing the history of how markets behave in presidential election cycles, but I think it is a fair assessment that the current cycle is unlike any previous cycle that we have seen since, perhaps, just before the Great Depression. Simply consider the massive amount of information that is available to the average person from numerous sources these days compared to anytime in the past. As such, I don’t put much faith in any of those studies.

Which takes us to this morning. Do we truly have any idea what the outcome will be? I would argue not although we all have our favored outcomes. And that bias, I believe, is deeply embedded in virtually every analysis. As such, I will not try to analyze. Rather, I will observe.

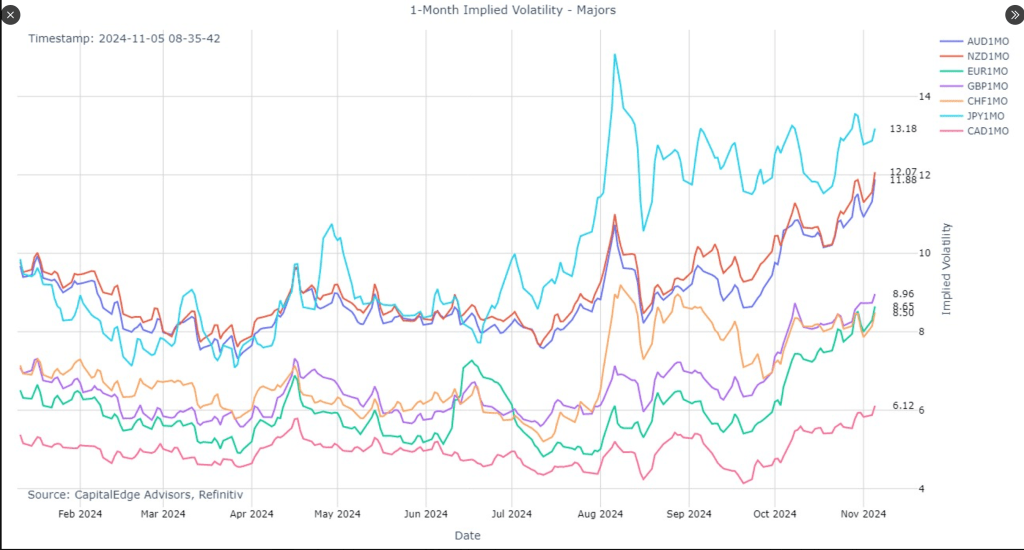

The first observation is that market implied volatility has been rising for the past weeks as the seemingly dramatic differences in policy outcomes depending on the ultimate winner mean market dislocations in either direction are quite possible.

For example, let’s look at 1-month implied volatility in the major USD currency pairs this year as per the below:

Source: Capital Edge Corner via X

They have been rising steadily since early October as a combination of corporate hedgers trying to protect themselves and hedge funds and traders trying to profit from the dislocation have increased demand steadily. The one truism here is that upon confirmation of a winner, regardless of the underlying move in the dollar, implied volatility is going to decline.

Much has been made of the ‘Trump trade’ which appears to mean that if Trump wins, the prospects for higher growth and inflation will steepen the yield curve, driving yields higher, while supporting the dollar (much to Trump’s chagrin) as foreign investors flock to US equities. In fact, the most common explanation for the dollar’s decline over the past several sessions has been that Harris has improved in the polls.

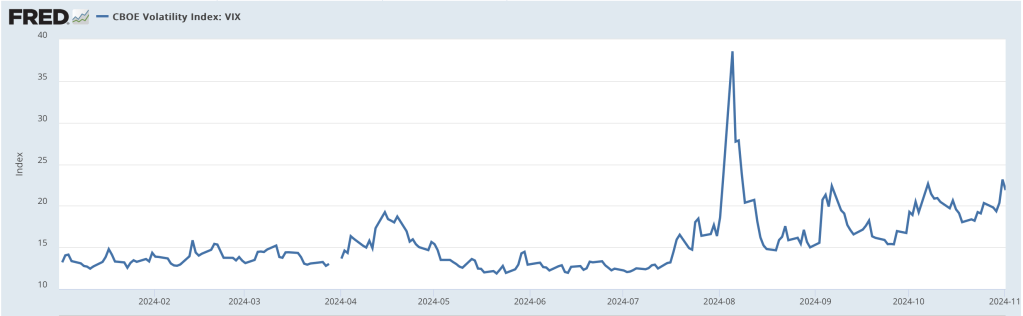

But it is not just the FX markets where implied volatility is rising, look at the VIX below, which is also showing a steady climb over the past two months.

Source: Fred.gov

That spike in August was the almost forgotten market response to the BOJ tightening policy and the -12% decline in the Nikkei just days after the Fed didn’t cut interest rates as many had hoped. But if you eliminate that event, the trend higher remains intact.

Finally, the MOVE Index, which is the bond market volatility index shows very similar behavior, a steady climb over the past month especially, but truly trending higher since the summer as seen below:

Source: Yahoo Finance

My point is that given the growing uncertainty across all markets as well as the complete inability to, ex ante, determine who is going to win the election, the signal to noise ratio of price movement right now is approximately 100% noise, at least in financial markets. Commodity markets have a bit of a life away from the election, so price action there is far more representative of true supply and demand issues. Arguably, this is merely another consequence of the financialization of most things, the loss of market signals as they have been overwhelmed by the flood of liquidity provided by central banks around the world.

At any rate, until we know who wins, it will be difficult to establish a view of the near-term or long-term future of market activity. So, let’s recap the overnight session as its all we have left.

After yesterday’s equity selloff in the US, most Asian exchanges posted gains led by China (+2.5%) and Hong Kong (+2.1%) which responded to comments from Chinese Premier Li Qiang’s comments that, “The Chinese government has the ability to drive sustained economic improvement.” And perhaps they do, although there are clearly issues regarding the local entities that are willing to gain at the expense of each other in order to demonstrate their own progress. But Japanese shares (+1.1%) also rallied along with most of the region, perhaps a direct analogy to the US decline as the ‘Trump trade’ has included weakness in markets likely subject to Trump’s promised tariffs. Meanwhile, in Europe, bourses have edged slightly higher this morning, between 0.1% and 0.2%, with no new data or news of note. Interestingly, US futures are starting to trade higher at this hour (6:50), perhaps an indication of market beliefs, although just as likely part of the random walk down Wall Street.

In the bond market, Treasury yields (+3bps) are creeping higher again, also in line with the Trump trade, and that seems to be dragging European sovereign yields along for the ride as all those markets have seen yields climb between 4bps and 5bps. Again, given the lack of new data, and the history of these yields following Treasuries, I see no other strong explanation.

In the commodity markets, oil (+0.3%) continues its rebound and has now gained more than 6.5% in the past week. The combination of OPEC+ delaying their planned production increases and seeming hopes for a pickup in Chinese demand on the back of the coming details of the stimulus package seems to have traders in a better mood these days. As to the metals markets, they are all firmer this morning with gold (+0.2%) mostly biding its time ahead of the election, but both silver (+0.8%) and copper (+0.9%) starting to accelerate a bit. Nothing has changed my view that regardless of the election outcome, this space is far more dependent on continued central bank policy easing and there is no indication that is going to end soon.

Finally, the dollar is softer again this morning, but in a more muted fashion than the past several sessions. Although, with that in mind, we still see the euro and pound both climbing a further 0.25% and AUD (+0.6%) today’s leader after the RBA left rates on hold with a more hawkish statement than anticipated. But the weakness is widespread with NOK (+0.4%) continuing to benefit from oil’s rise while ZAR (+0.6%) gains on the back of the rise in metals. Of course, the currency that has seen the most discussion ahead of the election is MXN. It is basically unchanged this morning, a perfect description of the narrative that the election will be extremely close. However, a quick look at its price movement over the past week shows that it follows every bump in the polls.

Source: tradingeconomics.com

And that’s really it this morning. We see the Trade Balance (exp -$84.1B) and ISM Services (53.8) but honestly, nobody is going to respond to that data. Instead, all eyes will be on the early exit polls and the reporting of how the election is going. No matter what, it seems hard to believe we will really have an idea before 10:00pm this evening, and then only if it is a blowout in either direction, seemingly a low probability. So, today is a day to watch and wait if you don’t already have hedges in place because honestly, it’s probably too late to do anything now.

Good luck and go vote

Adf