This morning, the question on lips

Is where did DeepSeek get their chips

As well, there’s concern

That China will learn

Our secrets, and so, us, eclipse

Narratives are funny things. They seemingly evolve from nowhere, with no centralization, but somehow, they quickly become the only thing people discuss. I’ve always been partial to the below comic as a perfect representation of how narratives evolve for no apparent reason.

Of course, yesterday’s narrative was that the Chinese LLM, DeepSeek, was built by a hedge fund manager with older NVDA chips and for far less money than the other announced models from OpenAI or Google and performed just as well if not better. While equity traders were not going to wait around to determine if this was true or not, hence the remarkable selling on the open of all things AI, a little time has resulted in some very interesting questions being raised about the veracity of how DeepSeek was built, what type of chips they use and who actually built it.

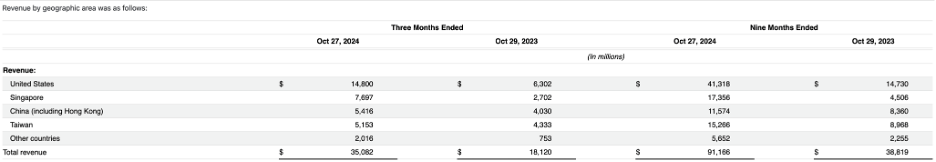

For instance, a quick look at NVDA’s 10Q shows that, remarkably, Singapore is a major source of revenue, and it has been growing dramatically.

Source: SEC.gov

Now, it is entirely possible that Singapore is a hotbed of AI development, but from what I have read, that is not the case. In fact, there is basically one lab there that has resources on the order of just $70mm. But despite that lack of local investment, at least reported local investment, Nvidia shows that chip sales in Singapore nearly quadrupled in the last year. Far be it from me to suggest that the narrative may change again, but who is buying those chips, more than $17 billion worth? The idea that they have been trans shipped to China is quite plausible and they may well be what underpins DeepSeek.

Again, I have no first-hand knowledge of the situation but it is not beyond the pale to make the connection that China has been effectively circumventing US export controls through Singapore, have built their own LLM model using the exact same chips as OpenAI and others, but propagated a narrative that they have built something better for much less in order to undermine the US tech sector equity performance and call into question some underlying beliefs in the US market and economy. Now, maybe this Chinese hedge fund manager did what he said. But the one thing we know about China is, it is opaque in everything it does, so perhaps we need to take this story and dig deeper. I am sure others will do so, and more information will be forthcoming, but it highlights that narratives continue to drive markets, but can also, at times, be constructed rather than simply evolve.

The thing is, this is still the only story of note in the market. Scott Bessent was confirmed as Treasury Secretary yesterday, and indicated he was a fan of gradual tariff increases, perhaps 2.5% per month, rather than large initial tariffs, but that does not seem all that exciting. And while Trump has not slowed down one iota, his focus has been on things like browbeating California into allowing reconstruction of LA rather than international issues, at least for the past twenty-four hours. The upshot is that markets, which even yesterday closed far above their worst levels from the opening, are rebounding further today with many of yesterday’s moves reversing, at least to some extent.

Starting in the equity markets, despite the weakness in the tech sector, US market closes were far higher than the opens with the DJIA actually gaining 0.65% on the session. However, while Japanese shares (-1.4%) definitely felt the pain of the tech sector, the rest of Asia saw some decent performance (Korea +0.85%, India +0.7%, Taiwan +1.0%) although Chinese shares (-0.4%) struggled. Of course, one reason for that may be that the largest Chinese property company, Vanke, reported humongous losses and both the Chairman and CEO stepped down.

In Europe, though, all is well with every major exchange in the green led by Spain’s IBEX (+1.0%) although gains of 0.5% – 0.7% are the norm. Now, remember, there is effectively no tech sector in Europe to be negatively impacted by the AI story, and it should be no surprise that these shares have followed the DJIA higher. And this morning in the US futures market, at this hour (6:50), we are seeing gains on the order of 0.4% across the board.

In the bond market, yesterday’s early rally in prices (decline in yields) backed off as stocks bounced from their lows although Treasury yields still fell 10bps on the day. This morning, the bounce in yields continues with Treasury yields higher by another 3bps and European sovereign yields rising between 1bp and 2bps on the session. It will be very interesting to watch the bond market now that Bessent has been confirmed as Treasury Secretary given his goal to extend the maturity of the US debt outstanding. Arguably, that should push up back-end yields, so we will see how effective he can be in reaching that goal.

Turning to commodities, yesterday saw a rout there as well with both oil and the metals markets suffering greatly. However, this morning, like many other markets, things are reversing course. Oil (+0.75%) has bounced off its lows from yesterday, and despite a pretty rough past two weeks, is still higher than it was at the beginning of the year. Gold and silver are unchanged from yesterday’s closing levels, and while off their recent highs, remain much higher in the past month. Copper, too, is bouncing slightly and still much higher this month. Perhaps yesterday’s price action was a catalyst for lightening up positions rather than changing views.

Finally, the dollar has rebounded vs. the G10 this morning, rising alongside US yields with the euro (-0.7%) and AUD (-0.8%) lagging the field, although dollar gains of 0.5% are the norm across the entire G10 this morning. In the EMG bloc, the CE4 are all tracking the euro lower, with all down around -0.6% to -0.8%, but yesterday’s biggest laggards, MXN, COP and BRL are little changed this morning, not rebounding, but not falling further. With the Fed expected to remain on hold while both the BOC tomorrow and ECB on Thursday are set to cut rates, perhaps the FX market is reverting to its more fundamental interest rate drivers than the hysteria of AI models. If that is the case, then we are likely to turn our attention to Chairman Powell’s press conference as the next critical piece of news.

On the data front this morning, we see Durable Goods (exp 0.8%, 0.4% -ex Transport), Case Shiller Home Prices (+4.3%) and Consumer Confidence (105.6). Yesterday saw New Home Sales rise more than expected but still resulted in the smallest number of sales for the year since 1995 when the population was far smaller.

Once again, depending on where you look, you can find data that supports either economic strength or weakness. It strikes me that today’s data will be of little consequence as traders will be focused on the equity market to see if the rebound has legs, as well as further news regarding DeepSeek. Tomorrow, however, the Fed will take center stage.

Good luckAdf