In Europe, the corporate elite

Have started, their worries, to bleat

They’re now quite concerned

That they will get burned

If dollar sales start to retreat

For years, when the dollar was rising

Weak unit sales, it was disguising

But now the buck’s falling

Which they find appalling

As earnings forecasts, they’re downsizing

Markets are very interesting constructs. Not only do they help find a clearing price for supply and demand of something, but they also tend to take on anthropomorphic characteristics in many eyes as some type of creature beyond anyone’s control, but with a tinge of malevolence. Part of that latter feeling comes from markets’ ability to make every pundit seem like a fool. After all, it was just 3 days ago when I was reliably informed by the punditry that equity values were set to collapse as the US economy entered a depression. It seems we may have to wait a few more days for that situation to play out. And, in fact, they have now changed their tune. While ascribing the rebound to President Trump’s reversal on some issues, the overall doom and gloom story has moved to the background. But if there is one thing I have continuously discussed since Trump’s election is that volatility was very likely to increase, and that has certainly been the case.

Shifting our focus to the FX markets, though, I couldn’t help but chuckle at a Bloomberg article this morning titled, The Dollar’s Slide is Raising Red Flags for Corporate Earnings. As I am based in the US, the fact that this was a front-page article had me somewhat confused. A long career in speaking with corporate accounts on FX made it clear that a weak dollar was the best thing for earnings of US multinationals. Generally, when the dollar was strong, CFOs would ascribe any earnings problems to that issue as a catch-all excuse, but when the dollar declined, outperformance by a company was the result of brilliant execution.

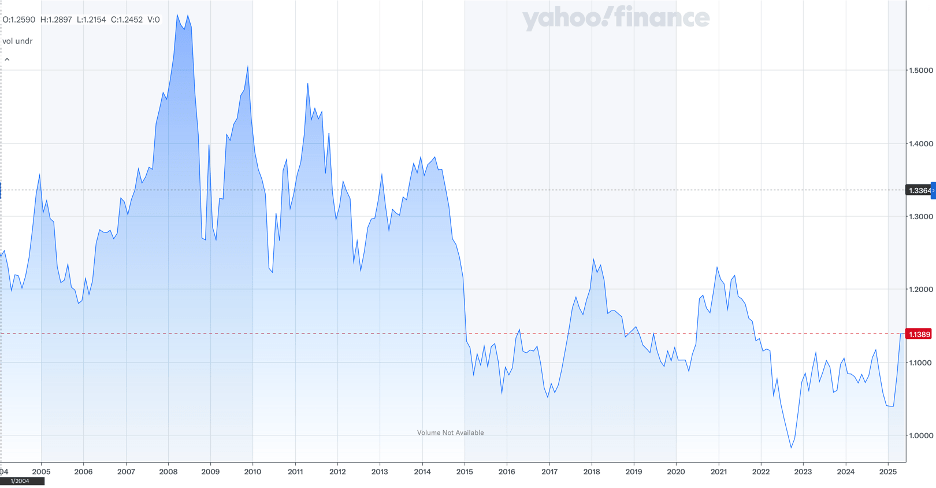

So, you can understand my initial confusion. But upon reading the article, it turns out they were talking about European corporates, who for the first time in three years find that hedging their US dollar sales is critical. Not only that, but they have also been quick to highlight that all new hedges will be at worse rates and therefore future earnings are already sure to be impacted. Now, a quick look at the chart below does show that the euro has risen to its highest level in three years. But it also shows that compared to the past 20 years, the euro is nowhere near high levels. In fact, it sits well below the median price (somewhere in the 40th percentile actually). Perhaps European corporate Treasurers have simply forgotten their history. Or more likely, just like US corporate Treasurers when the dollar is rising, they are seeking a scapegoat.

I cannot emphasize enough that the FX rate is not the driver, but the release valve for all the things that happen in the global economy. Other actions take place, whether interest rate changes, policy or market, economic adjustments, policy or market, or exogenous events, and the FX rate is the place where equilibria are found. In fact, arguably, that is the biggest flaw in the Trump administration’s idea that if they weaken the dollar, it will solve policy problems. The dollar is the tail to the economy’s dog.

In the meantime, the reason one runs a hedge program with consistency is to mitigate the big moves in FX and their impacts on earnings. But remember, even the best hedge programs lag large secular moves.

Ok, I’ll step down off my high horse and let’s look at how markets behaved overnight. After yesterday’s second consecutive rally in the US, the picture elsewhere in the world is more mixed. In Asia, the Nikkei (+0.5%) continued its rebound but the Hang Seng (-0.75%) and CSI 300 (-0.1%) saw no benefit overnight. Elsewhere in the region winners and losers were pretty evenly split and nobody saw a movement of more than 0.8% in either direction. In Europe, red is today’s color, but it’s a pale red with losses across the board of the 0.1% to 0.25% variety. The only news overnight was German Ifo data, which showed a bit of a surprising uptick in the current business climate as well as expectations. Perhaps the promise of more German fiscal largesse is outweighing concerns over tariffs. As to US futures, they, too, are lower by about -0.15% at this hour (7:20).

In the bond market, yields are sliding around the world with Treasuries (-3bps) continuing to back away from their recent highs while European sovereigns see yields decline between -3bps and -4bps. Even JGB yields slipped -1bp overnight. My take is some of the fear has ebbed away from the market.

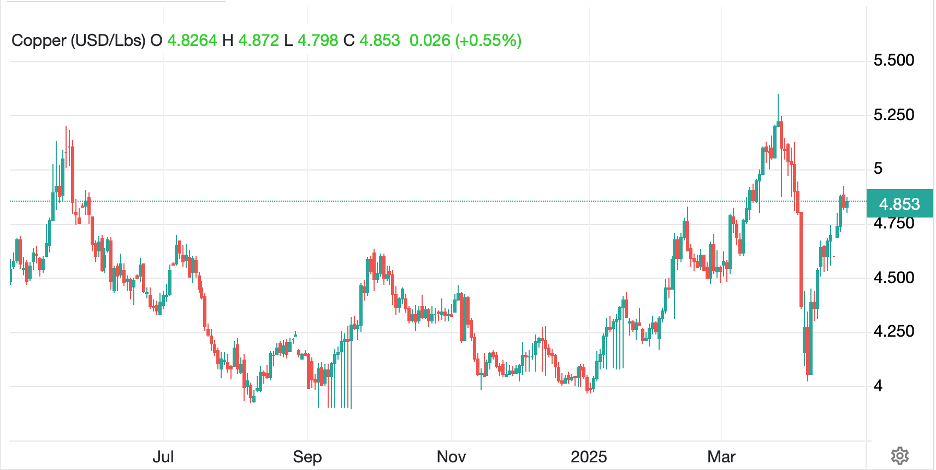

In the commodity markets, oil (+1.1%) remains in its recent trading range, with a still very large gap above the market in price terms. The demand story seems fixed at weakening demand because of either slowing growth, or the electrification of everything or something like that, while the supply story is starting to see hints that oil companies are going to back off production with prices at current levels. The latter feels like the larger short-term risk, although nothing has changed my longer-term view of lower prices here. In the metals markets, gold (+0.7%) is rebounding after a difficult two days, arguably some real profit taking was seen. Meanwhile silver (-0.5%) which actually outperformed gold for the past two sessions is giving some of those gains back and copper (+0.8%) is continuing its rebound after a dramatic decline from the all-time highs seen just one month ago. Talk about a V-shaped recovery!

Source: tradingeconomics.com

Finally, the dollar is softer this morning, giving back about half of yesterday’s 1% gains. In the G10, SEK and NOK (both +1.1%) are leading the way although the euro (+0.6%) is having a good day, as is the yen (+0.75%). The pound (+0.5%) is a bit of a laggard but after seeing this interview of Ed Miliband (UK Secretary of Energy and Climate Change), and his either inability to understand the implications of his policy, or his willingness to lie about it, I cannot believe the pound will continue to track the euro. The UK’s energy policy appears designed to destroy the UK economy. Consider that solar power is a key pillar of their future efforts to achieve net zero carbon emissions, and the UK is the nation that gets the least solar coverage in the world. After all, it rains there half the time. Meanwhile, the government is keen to end all other sources of energy. No matter what you think of President Trump’s policies, they are not nationally suicidal like the UK’s.

Turning to the EMG bloc, gains are the norm, but not universal. The CE4 are doing well but ZAR (-0.2%) and KRW (-0.6%) with the latter suffering from weaker than expected GDP growth in Q1 while the former, after a strong run since early in April, appears to merely be taking a breather.

We finally see some notable data this morning with Initial (exp 222K) and Continuing (1880K) Claims, Durable Goods (2.0%, 0.3% ex-Transport) and the Chicago Fed National Activity Index (0.11) all at 8:30, then at 10:00 we get Existing Home Sales (4.13M). Yesterday saw New Home Sales pick up more than expected and the Beige Book indicate that economic activity was unchanged from the past, but uncertainty had risen.

Here’s what we know; the world is not ending but it is continuing to change from the structures created in the post WWII period. This process is just beginning and anybody who claims to know where things are headed is lying. I continue to believe in my bigger picture views, but day to day, there is no rhyme or reason, especially given the importance of headline bingo.

Good luck

Adf