On one hand, the chorus is growing

That US debt is so mind-blowing

The ‘conomy will

Slow down, then stand still

As ‘flation continues its slowing

But others remind us the data

Does not show a slowing growth rate-a

And their main concerns

Are Powell still yearns

For rate cuts to help market beta

As many of us enjoyed the long weekend, it appears it is time to put our noses back to the proverbial grindstone. I know that as I age, I find the meaning of the Memorial Day holiday to grow in importance, although I have personally been very fortunate having never lost a loved one in service of the nation. However, as the ructions in the nation are so evident each day, I remain quite thankful for all those that “…gave the(ir) last full measure of devotion” as President Lincoln so eloquently remarked all those years ago.

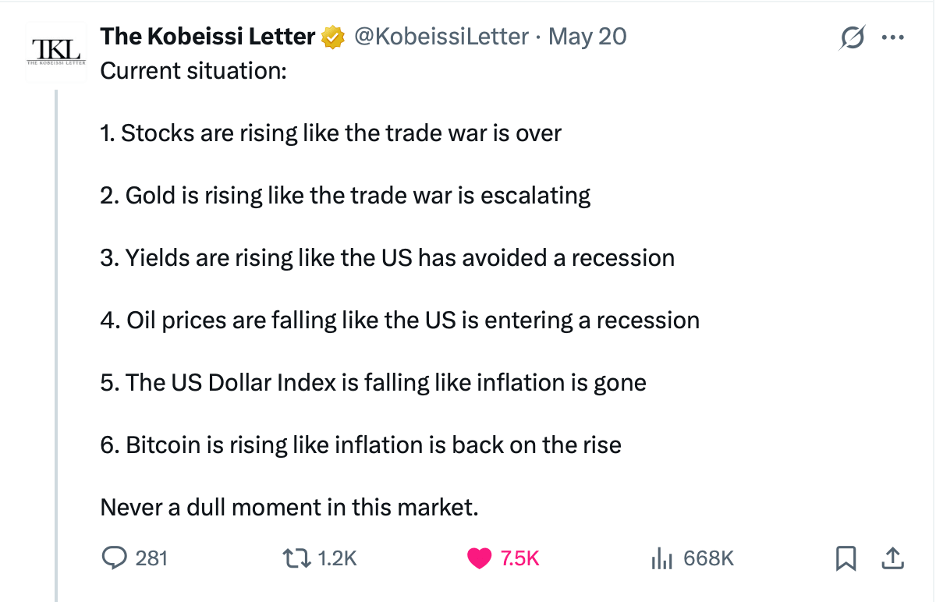

But on to less important, but more topical things. A week ago, an X account I follow, The Kobeissi Letter, posted the following which I think is such an excellent description of why we are all so confused by the current market gyrations.

Prior to President Trump’s second term, I would contend that the broad narrative had some internal consistency to it, so risk-on days saw equity markets rally along with commodities while bond prices would fall (yields rise) and the dollar would sink as well. Similarly, risk-off days would see pretty much the opposite. And it was not hard to understand the logic attached to the process.

But here we are, some four plus months into President Trump’s term and pretty much every old narrative has broken into pieces. I think part of that stems from the fact that the mainstream media, who were purveyors of that narrative, have been shown to be less than trustworthy in much of what they reported during the Biden Administration, and so there is a great deal of skepticism now regarding all that they say, whether political or financial.

However, I think a bigger part of the problem is that different markets have seen participants focusing on different idiosyncratic issues rather than on the bigger picture, and so there are many mini narratives that are frequently at odds. Add to this the fact that there continues to be a significant dichotomy between the soft, survey data and the hard, calculated data, with the former pointing toward recession or stagflation while the latter seems to be pointing to stronger economic activity, and the fact that if you ask twenty market participants about the impact of President Trump’s tariff policies, you will receive twenty-five different explanations for why markets are behaving in a given manner and what those policies will mean for the economy going forward.

It is at times like these, when there are persuasive short-term arguments on both sides that I step back and try to look at bigger picture events. In this category I place two things, energy and debt. Energy is life. Economic activity is simply energy transformed and the more energy a nation has and the cheaper it is, the better off that economy will be. President Trump has made no bones about his desire to cement the US as the number one energy producer on the planet and to allow affordable energy to power the economy forward. As that occurs, that is a medium- and long-term bullish backdrop.

On the other hand, we cannot forget the debt situation, which is an undeniable drag on economic activity. Forgetting the numbers per se, the fact that the US debt/GDP ratio is at wartime levels during peacetime (well, US peacetime) with no obvious end to the spending is a key concern. But it is not just the US with a growing debt/GDP ratio. Here is a listing from tradingeconomics.com of the G20’s ratios. (Russia is the bottom of the list but not relevant for this discussion.)

And remember what has been promised by Germany and the Eurozone with respect to defense spending? More than €1 trillion for Germany and it sounds, if my addition is correct, like upwards of €1.7 trillion across the continent. And all of that will be borrowed, so that is another 22% in Germany alone. The point is the global debt/GDP ratio remains above 300% for public and private debt. As government debt grows above 100%, at some point, we are going to see central banks, in sync, clamp down on longer-term yields.

However they couch it, and however they do it, whether actual yield curve control, through regulations requiring banks and insurance companies to hold more government bonds on their balance sheets with no capital charges, or through adjustments to tax driven accounts like IRA’s and 401K’s, requiring a certain amount of government debt in the portfolio to maintain the tax deferred status, I expect that is what we are going to see. And even with oil prices declining, which I think remains the trend, inflation is going to be with us for a long time to come as debt will be monetized. It is the only solution absent a depression. And every central bank will be in on the joke. Which takes us to this morning…

As yields were soaring

The BOJ kept quiet

Until yesterday

Apparently, the bond vigilantes have spent the past decades learning Japanese. At least that is what I conclude from the price action, and more importantly, the BOJ’s recent response in the JGB market. As you can see in the chart below, there has been a significant reversal in 30-year JGB yields with similar price action in both the 20-year and 40-year varieties.

Source: tradingeconomics.com

You may recall that last week, the Japanese government issued 20-year bonds, and the auction went quite poorly, with yields rising sharply (that was the large green candle six sessions ago). Well, it seems that the BOJ (along with the Ministry of Finance) have figured out that the bond situation in Japan is reaching its limits. After all, in less than two months, 30-year JGB yields rose 100 basis points from a starting point of about 2.2%. That is an enormous move. Now, if we look at the table above, we are reminded that Japan’s debt/GDP ratio is the highest in the developed world at well over 200%. In addition, the BOJ owns more than 53% of all JGBs outstanding. Quite frankly, it is easy to make the case that the BOJ has been monetizing Japanese debt for years.

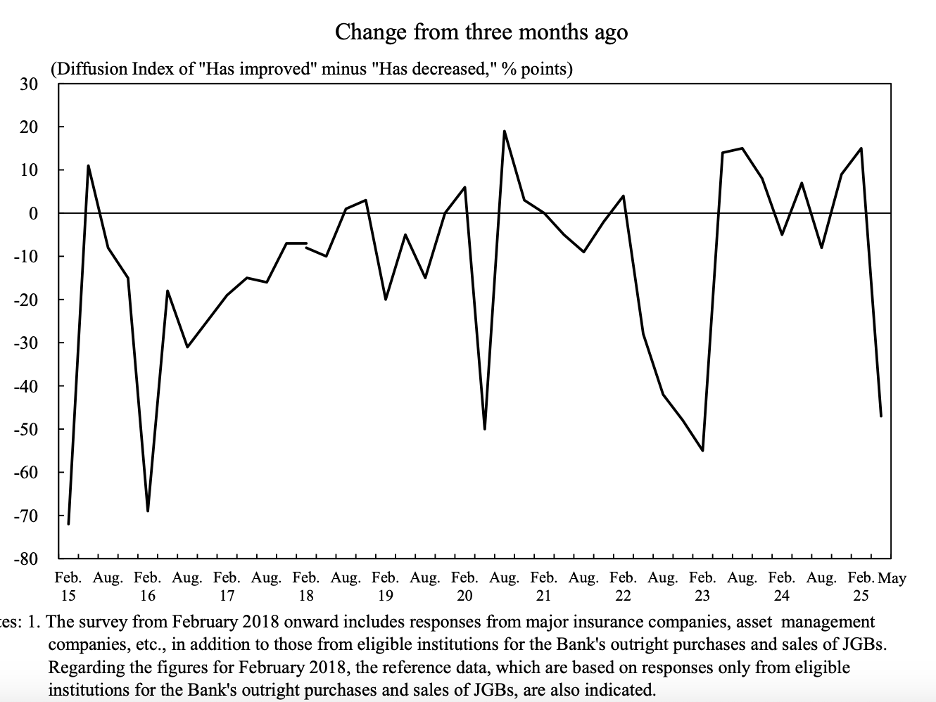

As it happens, last week the BOJ held one of their periodic (actually, the 22nd) “Bond Market Group” meetings in which they discuss with various groups of market participants the situation in the JGB market regarding liquidity and trading capabilities and the general functioning of the market. The two charts below, taken from the BOJ’s website (H/T Weston Nakamura) demonstrate that there is growing concern in the market as to its ability to continue along its current path.

The concern demonstrated by market participants is a clear signal, at least to me, that we are entering the end game. For all the angst about the situation in the US, with excessive fiscal expenditures and too much debt, Japan has that on steroids. And while Japan has the benefit of being a net creditor country, the US has the advantage of having both the strongest military in the world and issuing the world’s reserve currency. As well, the US neighborhood is far less troublesome than Japan’s in East Asia with two potential protagonists, China and North Korea. All I’m saying is that after decades of kicking the can down the road, it appears that the road may be ending for Japan and difficult policy decisions regarding spending, deficits and by extension JGB issuance are coming soon.

It’s funny, many economists have, in the past, described the US situation as Japanification, with rising debt and slowing growth. But perhaps Japanification will really be the road map for how to respond to the first true limits on the issuance of government debt for a major economy. Last night, JGB yields fell across the board, dragging global yields down with them. The yen (-0.8%) weakened sharply, reversing its trend of the past two weeks, while the Nikkei (+0.5%) rallied. Perhaps market participants are feeling comforted by the fact the Japanese government seems finally ready to recognize that things must change. But this is the beginning of that process, not the end, and there will be many twists and turns along the way. Stay tuned.

Ok, I really ran on, but I feel it is critical for us all to recognize the debt situation and that there are going to be changes coming. As to other markets overnight, this is what we’ve seen. Asia was mixed with gainers (Hong Kong, Australia, Singapore) and laggards (China, Korea, India, Taiwan) but nothing moving more than 0.5% in either direction. Europe, on the other hand, has been the beneficiary of President Trump delaying the tariffs on the EU until July 9th, with all the major indices higher led by the DAX (+0.8%) which also rallied more than 1% yesterday. Say what you will about President Trump, he has gotten trade discussions moving FAR faster than ever before in history. US futures, at this hour (6:15) are also pointing nicely higher, more than 1.3% across the board.

We’ve already discussed bond yields where 10yr Treasury yields have backed off by 5bps this morning although European sovereign yields have not benefitted quite the same way with declines of only 2bps on average. But the trend in all cases is for lower yields right now. Hope springs eternal, I guess.

In the commodity space, with the new view on tariffs, risk is abating and gold (-1.5%) is being sold off aggressively. Not surprisingly, this has taken the whole metals complex with it. As to oil (+0.1%) it continues to trade in its recent $60 – $65 range and while the trend remains lower, it is a very slow trend.

Source: tradingeconomics.com

Finally, the dollar is perking up this morning, not only against the yen, but across the board. On the haven front, CHF (-0.6%) is sinking and the commodity currencies (AUD -0.6%, NZD -0.8%, SEK -0.6%) are also under pressure. But the euro (-0.4%) is lower and taking the CE4 with it. In fact, every major counterpart currency is lower vs. the dollar this morning.

On the data front, this morning brings Durable Goods (exp -7.8%, -0.1% ex-transport), Case Shiller Home Prices (4.5%), and Consumer Confidence (87.0). We also hear from NY Fed President Williams this evening. Chairman Powell spoke at the Princeton graduation ceremony but said nothing about policy. I will review the rest of the week’s data tomorrow.

Bonds are the thing to watch for now, especially if we are going to see more active policy adjustments to address what has long been considered an unsustainable path. The question is, will there be fiscal adjustments that help? Or will central banks simply soak up the bonds? While I hope it is the former, I fear it is the latter. Be prepared.

Good luck

Adf