The year is now halfway completed

While narrative writers repeated

The story, same old,

The dollar’s been sold

‘Cause global investors retreated

As well, they continue to scream

Trump’s policies are too extreme

His tariffs will drive

Inflation to thrive

While growth will soon start to lose steam

I don’t know about you, but this poet is tired of reading the same stories over and over from different pundits when it comes to the current macroeconomic situation. And so, I thought I might take a look at what the current narrative seems to be and, perhaps, analyze some of the reasons it will be wrong. I have full confidence it will be wrong because…it always is. Add to that the fact that the narratives continue to try to build on expectations of what President Trump wants to do and let’s face it, there is no more unpredictable political leader on the planet right now.

In fact, we can look at one of the key narratives that had been making the rounds right up until Thursday night when the House and Senate agreed the terms of the BBB which has since been signed into law. Serious pundits were convinced that the president could never get this done and yet there it is.

But let’s discuss another popular narrative, the end of American exceptionalism. First, I’d like to define the term American exceptionalism because I believe that the equity analysts borrowed the term from the Ronald Reagan. For the longest time, I would contend the term referred to the American experiment, writ large, with the dynamic market economy that was created by the legal framework in the US. After all, no other nation, certainly not these days, has anything like this framework. The combination of the 1st and 2nd Amendments to the Constitution have been critical in not only creating this framework but keeping it from getting too far out of hand.

However, in the market context, American exceptionalism refers to the fact that the relative strength of the US economy drew investors from around the world into US equity markets, driving the value of US equities relative to both total global equities and the US proportion of global GDP to extreme heights. While the chart below shows a peak just above 50% of global market cap and that number is declining right now, I have seen estimates that the number could be as high as 70% of global market cap. I suppose it depends on how you define global market cap, but MSCI’s readings tend to be well respected.

In addition to the significant portion of equity market capitalization compared to the rest of the world is the fact that US GDP is a significantly smaller percentage, somewhere in the 23% – 26% range depending on how one calculates things with FX rates.

The upshot is that heading into 2025, US equity valuation was at least twice the size of the US economy compared to the entire world. Certainly, that is exceptional, and the term American exceptionalism seemed warranted. But as you can see from the first chart, other markets have been outperforming the US thus far this year with the result that the US no longer represents quite as large a percentage of the world’s equity market capitalization. So, is this the end of that form of American exceptionalism? The pundits are nearly unanimous this is the case.

A knock-on effect of this is that the dollar has been under pressure all year, having declined more than 10% vs. the DXY and 13% vs. the euro. In fact, a key factor in the weaker dollar thesis is that international investors are either selling their US stocks or hedging the FX exposure with either of those weighing on the dollar.

Source: tradingeconomics.com

Now, so far, that seems a logical conclusion and I cannot argue with it. However, as we look forward, is it reasonable to expect that to continue? In this instance, I think we need to head back to the BBB, which is undoubtedly going to provide significant economic stimulus to many parts of the economy (sorry green tech), and seems likely to help energy, tech and industrial companies continue to perform well. Much has been made of the idea that American exceptionalism has peaked but I wouldn’t be so sure. Net, I am not convinced the US ride is over, at least not for the economy, although segments of the equity market could well be in for a fall.

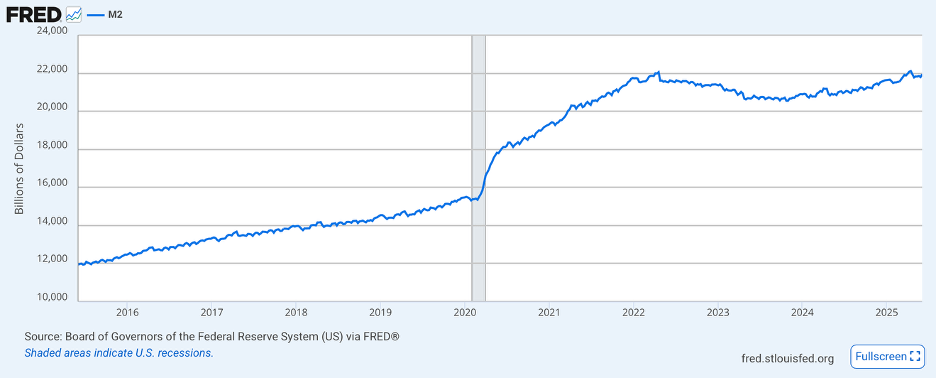

The other narrative that I continue to hear is that Trump’s policy mix, of tariffs and deportations is going to drive inflation much higher. In fact, Dr Torsten Sløk, who does excellent work, explained this weekend that tariffs would raise US CPI a very precise 0.3% this year. Of course, the problem with this story is that, thus far, inflation readings have been quite tame, falling since Liberation Day. It is certainly early in the game, but it is not at all clear to me that tariffs are going to be a major driver of inflation. First, many companies have decided to eat the cost themselves, notably Japanese car manufacturers. Second, M2 in the US has basically flatlined since April 2022 (see chart below), and if money supply is not growing, inflation will be hard-pressed to rise too quickly.

Now, it is certainly possible that the Fed increases the supply of money, although given the antagonism between Powell and Trump, I sense that the Fed will remain tighter for longer as they will make no effort to help the president if the economy starts to visibly slow down.

But, if I were to try to estimate what Trump’s end game is, I think the following chart is the most important.

This chart is the reason Donald Trump is our president, and it is one that the punditry does not understand. It is also the reason that US equities have performed so well. Corporate profit margins in the US have grown unabated since Covid.

Now, let’s put these two thoughts together. Corporate profit margins have exploded higher, currently at an all-time high of 10.23%. Meanwhile, the share of GDP that has gone toward labor has fallen dramatically since China entered the WTO. The result has been workers in the US have seen their incomes decline relative to corporate income. While it is true that, technically, the punditry is part of the work force, they are asset owners as opposed to Main Street who have far less invested in the equity markets. Ask yourself, how did corporates improve their margins so significantly? The combination of immigrant labor and moving production offshore weighed heavily on US wage growth. If you want to understand why President Trump is speaking to Main Street and using tariffs with reckless abandon it is because he is trying to adjust this process.

If he is successful, I expect that equity markets will lag other investments as those profit margins are likely to decline. If they just go back to pre-Covid levels of 6%, that represents a huge amount of money in the pockets of consumers. Do not be surprised if the result is solid economic growth with lagging profits and lagging equity prices. Too, a weaker dollar plays right into this game as it helps the competitiveness of US manufacturers both for domestic consumption and exports.

This is not the narrative, however. The narrative continues to be that Trump’s tariffs are going to generate significant inflation and drive the economy into a recession. In fact, just this morning I read that Professor Steven Hanke (a very smart fellow) now has a recession estimated at 80% to 90% probability. All the uncertainty is preventing activity as corporate managers hold back on making decisions, allegedly. Of course, now that the BBB is law, the tax situation is settled, and I will not be surprised to see investment return with clarity on that issue.

The narratives have been uniformly negative for a while. Part of that is because many of the narrative writers objectively despise President Trump and cannot abide anything he does. But part of that is because I believe the president is not focusing on the issues that market pundits have done for many years and instead is focusing on helping Main Street, not Wall Street. Perhaps that is why Wall Street political donations were heavily biased toward VP Harris and every other Democrat.

I hope this made some sense to you all, as I try to keep things in context. In addition, as it is Sunday evening, I expect tomorrow morning’s note to be quite brief. Love him or hate him, President Trump clearly hears the sounds of a different drummer than the rest of the political class and has proven that he can get what he wants. Do not ignore that fact.

Good luck

adf