A shift in the narrative view

On AI has started to brew

What folks had thought certain

From behind the curtain

Seems like, now, some cracks have shown through

For stock markets, this is bad news

‘Cause AI has been the true fuse

Of recent price action

And any distraction

Could well, bullish thoughts, disabuse

While equity markets around the world continue to trade near record highs which were set just weeks ago, there has been a subtle change in the narrative, at least based on my perusal of FinX. Although there are still many in the ‘buy the dip’ camp who strongly believe that it is different this time and AI is the future, there has been an increase in the number of voices willing to say that things have gone too far. One of the stories getting a lot of press is the fact that Tesla’s shareholders voted to give Elon Musk a pay package that could amount to $1 trillion if the company meets its milestones over the next 10 years, including having the company’s market cap rise to $8.5 trillion from the current $1.5 trillion. This certainly has a touch of excess attached to it.

But more broadly, I couldn’t help but notice this graph, originally created by the Dallas Fed, but more widely disseminated by the FT showing the potential future of AI’s impact on humanity. Under the standard of a picture is worth a thousand words, I might argue the information in this picture falls some 985 words short. Rather, they simply could have said, ‘AI could be amazing, it could be catastrophic, or it might not matter at all.’

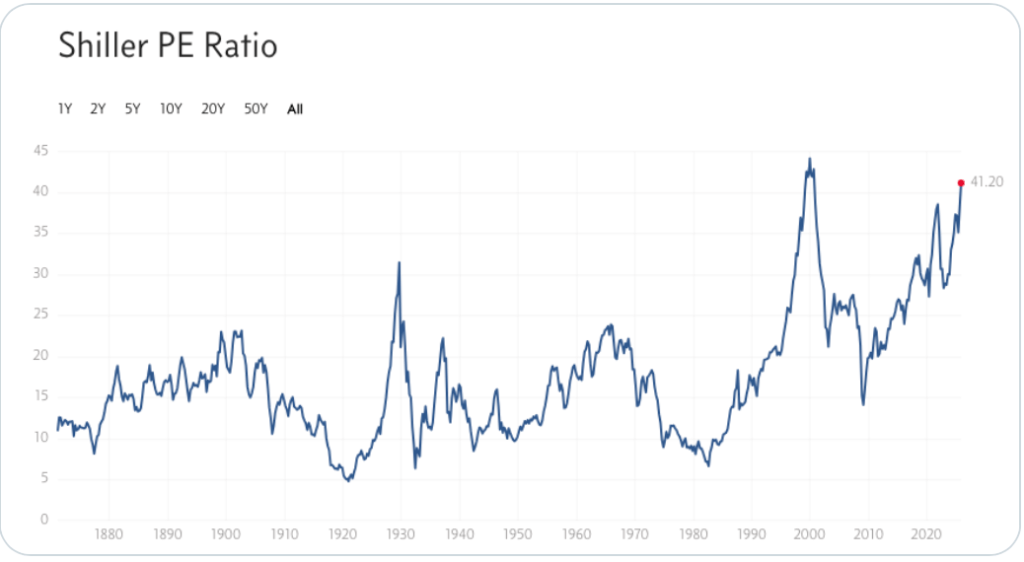

However, aside from the inanity of this chart, and more importantly for those paying attention to markets and their portfolios, things look a bit different. There has been a lot of discussion regarding the everything bubble which has been led by the massive increase in value of the Mag7 stocks. Recently, it set some new valuation records with the Shiller CAPE (Cyclically Adjusted Price Earnings) ratio now trading at its second highest level of all time, at 41.2, exceeded only during the dotcom bubble of 2000.

Source: @DavidBCollum on X

Added to this is the fact that only about half the companies in the S&P 500 are trading above their 200 day moving averages, a key trend indicator, which implies that the uptrend may be slowing, and the fact that we have had seven down days in the past eight sessions (and US futures are lower this morning by -0.2% as I type at 7:15) indicates that perhaps, a correction of some substance is starting to take shape.

Source: tradingeconomics.com

As of this morning, the S%P 500 is merely 3% below the highs seen on October 29th, so just a week ago. The conventional description of a correction is a 10% decline, and a bear market is a 20% decline. I am not saying this is what is going to happen, but my spidey sense is really starting to tingle.

Source: giphy.com

Remember, I’m just a poet, and an FX one at that, so my takes on markets are just one poet’s views based on too many years in markets. This is not trading advice in any way, shape or form. But what I can say is, be careful with your investments, things are changing.

So, let’s move on to the overnight session to see how things played out following the selloff yesterday in the US. Let me say this, it wasn’t pretty. Pretty much all Asian markets were lower to end the week led by Korea (-1.8%) which has seen its market race higher than the NASDAQ this year, but there was weakness in Japan (-1.2%), China (-0.3%), HK (-0.9%), Taiwan (-0.9%) and Australia (-0.7%) with most other regional exchanges flattish to lower by -0.5%. Given the tech story is critical to Asia overall, if that is starting to falter, we can expect these markets to slip as well. Too, there was news from China showing its Trade Surplus shrank slightly, to $90.7 billion, but more ominously, exports actually declined -1.1% while imports rose only 1.0%. Arguably, the reason President Xi was willing to make a deal with President Trump is because the domestic economic situation in China is troublesome and he knows that more trade problems will be a domestic nightmare for him.

In Europe, red is the dominant color on screens as well with the IBEX (-0.9%) leading the way lower, but the DAX (-0.9%), FTSE 100 and (-0.7%) and CAC (-0.5%) all fading as well and losses the universal story on the continent. Now, we know that it is not a tech story since, arguably, Europe has no tech presence. So the problems here are more likely a combination of following the global trend lower and ongoing soft Eurozone data implying that economic growth, and hence corporate profits, are going to continue to be weak. With the ECB taking themselves out of the equation for now, claiming rates are at the correct level and turning their focus to the idea of a digital euro (which will never be important), if we continue to see the US market slip, you can be certain that European bourses will follow.

In the bond market, it is hard to get excited about anything right now as Treasury yields, which slipped a basis point yesterday, are higher by 1bp this morning. We remain right at the level from the immediate aftermath of the FOMC meeting, which tells me that traders are awaiting the next major piece of news. European sovereign yields are also higher by 1bp across the board with only the UK (+3bps) the outlier here today while JGBs overnight slipped -1bp following yesterday’s Treasury price action.

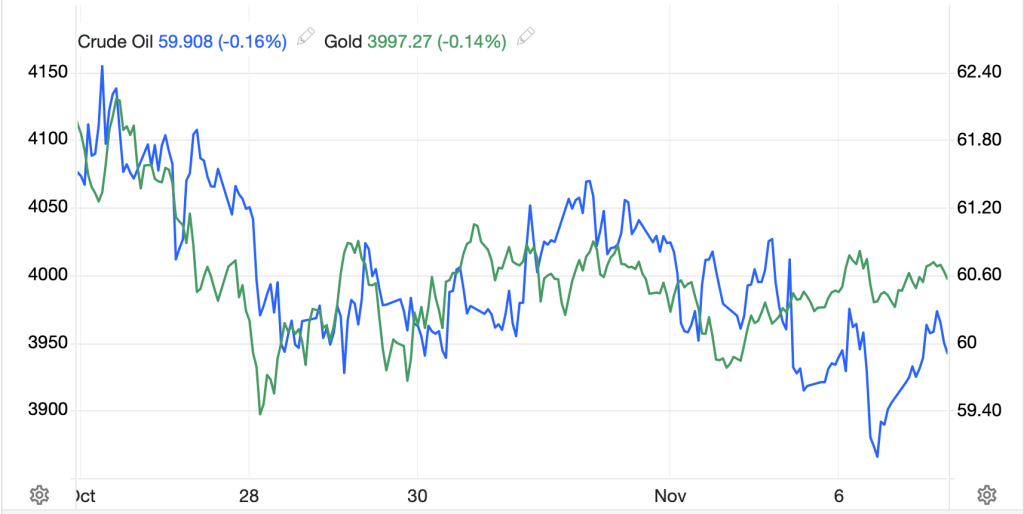

In the commodity space, both oil (+0.8%, but below $60/bbl) and gold (+0.5% but below $4000/oz) continue to trade in a range and basically have not moved anywhere of note over the past 2+ weeks as you can see in the chart below.

Source: tradingeconomics.com

There have certainly been some choppy moves, but net, nothing! Silver (+1.0%) however, has gotten a boost after the US designated it a critical mineral implying government support. It would not be surprising to see silver outperform gold for a while going forward.

Finally, the dollar remains an afterthought to markets. The DXY rallied to above 100 briefly, but has now slipped back below that level into its multi-month trading range as per the below chart.

Source: tradingeconomics.com

Looking at the major currencies today, +/-0.2% describes the price action, which means nothing is happening. The only notable difference is KRW (-0.7%, which has continued to decline on the back of growing outflows of capital, perhaps anticipating the flows that will come with Korea’s promises for investing in US shipbuilding and semiconductor manufacturing. But the won has been tumbling since early July, down 8% in that period.

Source: tradingeconomics.com

And that’s really it this morning. Looking at the KRW, though, we must really consider what I mentioned yesterday about the Supreme Court’s tariff ruling, whenever that comes. If the tariffs are overturned, it’s not the repayment of those collected that is the issue, it is the change in the investment flows, and that will be a very good reason to turn negative on the dollar. But until such time, while risk managers need to stay hedged, traders have carte blanche. If tech stocks really do correct, a risk off scenario is likely to support the dollar, at least for a while. Hopefully, that won’t be today’s outcome.

Good luck and good weekend

Adf