Seems everyone just wants to sell

Their equities and bonds as well

But what will they do

With funds they accrue

If everything’s all gone to hell?

I guess it’s why gold still has luster

And Bitcoin’s become a blockbuster

The future’s unclear

And there’s growing fear

That this is a true f’ing cluster

It is difficult to highlight any particular driver of any market movement this morning. I imagine yesterday’s US equity selloff left a sour taste in the mouths of investors around the world which may help explain why virtually every equity market in Asia (Nikkei -0.85%, Hang Seng -1.2%, Korea -1.2%, India -0.8%) was lower last night or is so (CAC -1.0%, DAX -0.9%, IBEX -0.9%, FTSE 100 -0.65%) this morning. But bonds are hardly the destination of those funds with yields essentially unchanged this morning after yesterday’s bond sell-off (yield rally). In fact, in Japan, the long end of the curve, 30-year and 40-year, yields have each traded to new record highs.

Source: tradingeconomics.com

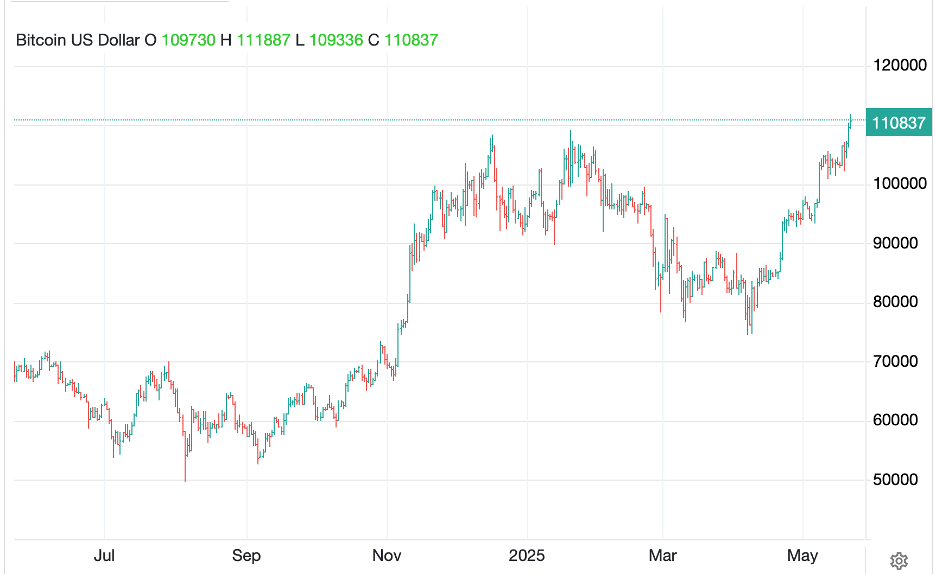

So, if investors are selling stocks and not buying bonds, exactly what are they doing with the funds? Gold, (-0.5%) which has had a nice run in the past week, is lower this morning, so it doesn’t appear money is heading there. Too, platinum (-0.3%) is softer this morning after a massive rally this week. Oil (-1.6%) is lower, NatGas (-1.1%) is lower, and in truth, it is difficult to find anything doing well. Except perhaps Bitcoin (+1.0%), which has rallied nearly 7% this week and more than 18% in the past month and is trading at new all-time highs.

Source: tradingeconomics.com

It appears that we have reached a point where the market narrative on virtually every asset class (crypto excepted) is that the future is bleak. There is a bull market in the number of analysts forecasting stagflation because of the US tariff policy and a nascent bull market in the number of analysts calling for much higher US (and by extension other national) yields given the fiscal follies that continue to be evidenced every day. As much press as the US gets for its massive, peacetime fiscal deficit, in a quieter voice, the IMF just warned France that its fiscal deficits were unsustainable as they, too, are above 7% of GDP.

Our concern should be that central bankers around the world are all going to respond in unison and that response is going to be debt monetization. Inflation targets are fine as far as they go, but they are not the raison d’etre of central banks. On a deeper level, central banks, whether independent or not, exist to assure that their respective governments can continue to borrow and fund their expenditures. Absent a massive fiscal tightening wave around the world, something that seems highly unlikely in our lifetimes, central banks will always be the lender of last resort to their governments.

Now, we already know that fiscal tightening can be accomplished as President Javier Milei in Argentina has accomplished an extraordinary feat down there. My concern is that it took decades of irresponsible fiscal policy and an almost complete absence of available financing to get the people to vote for change. Folks, no matter your views about how bad things are in the US or Europe or Japan, we are not even close to the situation there. So, we know what the future roadmap looks like, Argentina has paved the way, but we are just getting started, I fear. And in the US, given the advantage of having the global reserve currency, we are much further from a denouement than other Western nations.

In sum, if you want to know why gold and bitcoin are doing well, I believe they are pointing to the inevitable outcome of global debt monetization, or perhaps debt jubilees. Owning assets that are a liability of a government that can change the rules if they so desire is not a safe place to be, especially in a fourth turning. I think this is the message we need to start to understand. This is not to say things are going to fall apart tomorrow, just that I believe this is the direction of travel.

Well, that was darker than I expected when I started writing this morning, but alas, that is where things lead. The one thing I haven’t discussed is the dollar and FX markets. But unlike other markets, FX is a truly relative game, where the dollar’s strength (or weakness) is also manifest as another currency’s weakness (or strength). A broad-based dollar move, may be a harbinger of other market movements being seen as either better or worse than the US in a macro context, but let’s face it, despite all the angst recently of the dollar’s weakness, the euro is higher by just 4.5% in the past year! Similarly, the pound (+5.5%) has not moved that far although the yen (+8.5%) has shown more life, albeit from a starting point that was at multi decade lows. The fact that the dollar is modestly higher this morning, on the order of 0.3%ish across most currencies does not really tell us much.

Let’s take a look at the data we’ve seen so far in the session, with today being Flash PMI day. In Japan, while Manufacturing edged slightly higher to 49.0, it is still sub-50, and the Services number was weaker taking the Composite below 50.0. In Europe, France was little changed from last month with all three readings below 50, Germany was much softer than last month with all three readings below 49 and the Eurozone softened, as you would expect, with readings around 49.5. In fact, as we await US data, India is the only economy showing vibrancy with readings above 60! (I neglected the UK but alas, they are quickly making themselves irrelevant anyway. But for good order’s sake, they did manage to tick up from last month, although the Composite is still below 50.)

In the US this morning we get the weekly Initial (exp 230K) and Continuing (1890K) Claims data as well as the Chicago Fed National Activity Index (-0.2) at 8:30. Then the Flash PMI data (Mfg 50.1, Services 50.8) comes at 9:45 and Existing Home Sales (4.1M) at 10:00. We also hear from NY Fed President Williams, but is he really going to tell us something new? I don’t think so.

Sorry to have been so bleak this morning, perhaps the weather has contributed to the mood, but it is hard to find financial positives in the short run. I was truly excited by the concept of the US cutting spending, but I fear that ship has sailed for now. If DOGE did nothing else, it opened our eyes to the very specific ways in which government money is being spent on things that had no net benefit for the nation, although obviously the recipients were happy. Perhaps someday these things will be addressed, but if Argentina is any example, it could still take decades.

Good luck

adf